Security challenges and innovations in digital onboarding solutions for banks

The digital transformation trend in the banking sector has brought immense changes to how financial institutions engage with customers. Among the most impactful developments is digital onboarding: an efficient, remote process allowing banks to welcome new customers without the need for in-branch visits. This not only enhances the customer experience but also aligns with user expectations in a world where convenience and speed are of the utmost importance. However, with these conveniences come critical security challenges. In a time when cyber threats are on the rise, the digital onboarding experience must be not only seamless but also secure.

In this article, we will explore the significance of security in the digital customer onboarding process, identify the key challenges financial companies face, and discuss innovative approaches to mitigate risks. From fraud prevention and data protection to regulatory compliance, we’ll cover the necessary steps banks can take to protect customer data and foster trust while leveraging cutting-edge solutions that enhance the customer journey.

Table of contents

Digital onboarding in banks explained

Digital onboarding refers to the online, remote process of bringing new customers into a financial institution’s ecosystem, enabling them to open accounts and access banking services quickly and efficiently. This method has replaced traditional onboarding methods, which required visiting a physical branch and interacting with a bank employee. Now, the account opening journey is a set of streamlined processes performed entirely online. This way, financial organisations are not only meeting evolving user expectations but also improving operational efficiency, as manual labour becomes less necessary thanks to automated verification and well-structured steps.

This approach empowers banks to redefine customer acquisition. However, with ease of access and fast account-opening processes, financial institutions must prioritise consumer safety. Breaches, fraudulent accounts, and identity theft are serious threats in the digital space, making it essential to provide advanced security measures and compliance protocols.

The importance of security in digital onboarding for banks

Security is fundamental in digital customer onboarding. Without adequate security, a bank’s processes become vulnerable, opening doors to regulatory non-compliance, fraud, and data breaches. Recent statistics show a significant rise in cybercrime targeting the financial sector. According to Statista, “(…) the global cost of cybercrime is expected to surge in the next four years, rising from $9.22 trillion in 2024 to $13.82 trillion by 2028.” For money-related brands, protecting customers’ data is a non-negotiable responsibility, especially with increasing regulatory requirements.

A secure onboarding process builds customer trust and loyalty, enhancing banking satisfaction and making users more likely to engage with additional services. At the same time, banks must focus on regulatory requirements that demand secure handling of customer details. Safety is not just beneficial but mandatory. Compliance with standards such as KYC, AML, and GDPR is crucial for maintaining credibility and operational legitimacy.

Key security challenges in digital customer solutions

Digital onboarding processes introduce several challenges regarding safety for banks and other financial institutions. The main problems include:

Fraud detection and prevention

In digital customer onboarding, identity verification is critical, as fake or stolen identities can be used to open fraudulent accounts. Synthetic identity theft, deepfakes, and spoofing techniques are increasingly sophisticated. Banks must leverage real-time document verification systems and fraud detection tools to identify anomalies in customer profiles and prevent fraud effectively.

Privacy and data protection

The banking industry must ensure the secure handling of personally identifiable information (PII) and sensitive financial data. Encryption, secure storage, and careful sharing of customer data with third parties are essential. Any lapse in data protection not only affects customer trust but also breaches compliance requirements.

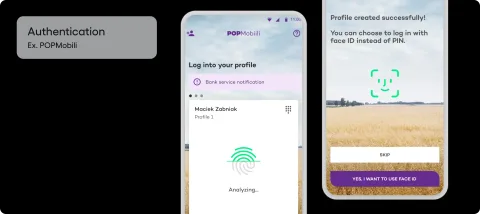

Mobile device security

With a growing number of users opting for mobile banking, device security is crucial. Mobile-based attacks, such as phishing, smishing (phishing through SMS), and device hijacking, pose significant risks. Biometric authentication, such as fingerprint or facial recognition, while convenient, must be implemented securely to prevent misuse and ensure an efficient experience.

Regulatory compliance

Compliance is mandatory in digital banking, with standards such as GDPR, KYC, AML, CTF (Counter-Terrorism Financing), and PSD2 dictating how banks should handle information and prevent money laundering. Failing to meet these standards can lead to severe penalties and reputational damage.

Integration with legacy systems

Many financial institutions still operate with legacy systems, making it challenging to integrate any new solutions smoothly. Ensuring compatibility and maintaining secure connections between old and new systems are essential to avoid potential security gaps in customer onboarding services.

Social engineering attacks

Social engineering is a major threat to the banking industry as attackers manipulate users or employees into revealing sensitive information. Employees involved in the customer onboarding process should be trained to recognise social engineering techniques to mitigate this risk.

Insider threats

Insider threats can stem from current or former employees misusing access to consumer data. Protection against insider threats involves implementing strict account access controls and regularly monitoring employee activity within sensitive systems.

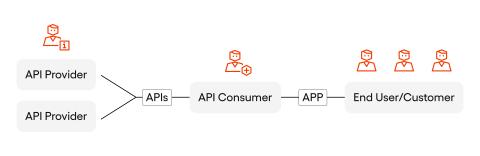

API and cloud security

As banks adopt cloud-based technologies and expose systems through APIs for streamlined process automation and third-party integration, ensuring the safety of these solutions is essential. APIs must be securely coded and protected against unauthorised access, and cloud environments must comply with protection standards.

Emerging threats

The threat landscape in digital banking is continuously evolving, with new vulnerabilities and attack vectors frequently emerging. Banks need to stay vigilant against emerging threats such as ransomware, advanced persistent threats (APTs), and sophisticated malware attacks that could compromise customer data. By actively monitoring these trends, banking companies can implement preventative measures and adapt their online customer onboarding services to maintain a high level of security.

How banks can assess risks in digital onboarding

To effectively mitigate security concerns, banks should implement a thorough risk assessment approach tailored to the digital onboarding process. Key elements include:

- KYC, CDD, and AML Procedures: Conducting Know Your Customer (KYC), Customer Due Diligence (CDD), and Anti-Money Laundering (AML) checks is essential for verifying customer identity, reducing fraud, and ensuring compliance with regulatory standards.

- Enhanced Due Diligence: For high-risk customers, performing deeper background checks enables banks to identify potential threats early in the onboarding journey, reducing exposure to risks.

- Streamlining the Onboarding Process: Integrating features such as e-signatures and process automation improves the customer experience while maintaining security and compliance.

- Behavioural Analytics and Risk Scoring: By applying behavioural analytics, banks can identify abnormal user behaviour during onboarding. Risk scoring helps detect potential fraud, enabling proactive intervention.

- Fraud Prevention Tools: Advanced fraud detection solutions, such as real-time monitoring systems, allow banks to actively prevent fraud during customer onboarding.

- Zero-Knowledge Proof: This cryptographic approach verifies a customer’s identity without disclosing sensitive information, addressing both security needs and user privacy expectations.

- Automation with RegTech, AI, and ML: Automation powered by algorithms streamlines identity verification and compliance checks, allowing customers to quickly open an account while enhancing security.

- Credit Risk and Financial Profiling: Assessing a customer’s credit and financial profile early in the process enables banks to evaluate risk and make more informed onboarding decisions.

- Continuous Monitoring and Risk Reassessment: Post-onboarding, regular assessments help identify emerging risks, ensuring the digital onboarding solution remains compliant and responsive to evolving security challenges.

Risk mitigation strategies in digital customer onboarding

Effective risk management in a digital onboarding solution is essential to maintain a balance between user convenience and robust security measures. One widely accepted model, the “Management of Risk” framework, advocates for a structured approach to identifying, assessing, and mitigating risks. Here are a few core strategies that the banking industry can adopt:

- Implementing Multi-Factor Authentication (MFA): Adding layers of verification beyond a simple password — such as a code sent to a mobile device or a biometric scan — makes it more challenging for unauthorised users to gain access.

- Real-Time Fraud Detection: With AI-powered tools, banks can detect and prevent fraudulent activities instantly, enabling real-time intervention. This technology is crucial in preventing complex schemes like synthetic identity fraud, which are difficult to detect through traditional means.

- Tokenisation and Data Masking: These techniques convert sensitive information into a secure format before it’s processed or stored, reducing the risk of exposure in case of a breach.

- Zero-Knowledge Encryption: By verifying customer identity without storing any of their sensitive information, zero-knowledge proof adds an extra layer of security, maintaining customer trust without compromising privacy.

- Continuous Security Training: Training bank employees on best practices and potential security threats helps mitigate risks associated with insider threats and social engineering. An informed team can act as the first line of defence, reducing the likelihood of human error that could lead to data exposure.

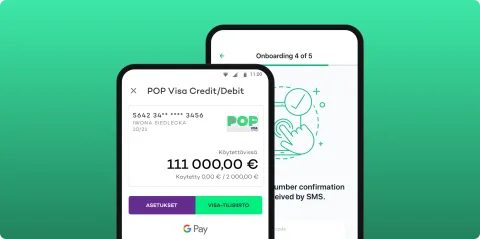

Innovations in customer journey and user experience

Banks today must balance security with a high-quality experience provided to customers. Advancements in digital onboarding have allowed financial institutions to enhance customer satisfaction while minimising account opening and onboarding time, as well as reducing the need for manual checks. Features such as electronic signatures and real-time verification make the process more seamless, allowing more customers to access digital banking services quickly and efficiently.

Behavioural analytics plays a key role in this streamlined experience, offering banks insights into each customer’s digital journey — insights that were never possible with in-person onboarding. By identifying and understanding behavioural patterns, financial institutions can create a more personalised account-opening process that meets modern user expectations, potentially leading to higher acquisition and retention rates.

Another significant innovation is credit risk profiling, which allows banks to quickly evaluate a customer’s financial profile, facilitating faster approvals and improving the overall efficiency of the account-opening process. Integrating tools for real-time financial profiling during onboarding gives banks a more holistic view of potential risks and strengthens deposit growth by enabling the institution to offer tailored services that align with the customer’s financial history.

Conclusions

Digital onboarding solutions have transformed the way banks operate and engage with new customers, meeting the demands of a digital-first society. However, to maintain trust, it is crucial for financial institutions to prioritise security throughout the customer onboarding journey. By implementing robust security measures and keeping up with regulatory compliance requirements, banks can create a streamlined, secure, and efficient onboarding experience, enhancing customer satisfaction and reinforcing operational security.

For organisations looking to further secure their digital onboarding processes, our AI governance solutions provide a comprehensive approach to ensuring compliance with the latest AI regulations. By incorporating advanced verification, privacy protections, and innovative security features, we empower financial firms to maintain the highest standards of compliance management and data security, building a trusted foundation for every customer relationship.