A strategic analysis of biometrics in modern banking

The numbers paint a very clear picture. Banks that get digital trust right see their annual growth rocket up by 7.8 times compared to rivals. This shows just how much customers value knowing their details are safe online.

But there is a flip side. The rise of AI has also armed fraudsters, with potential losses from these scams expected to hit $40 billion a year by 2027. At the same time, the quality of a bank’s digital service can swing customer loyalty scores by as much as 103 points on the NPS scale.

In this high-stakes environment, biometrics is becoming the key tool for managing risk and building customer relationships. Moving away from old-fashioned passwords is no longer just a nice idea. It is a business necessity that will define a bank’s ability to protect its assets and grow in the long run.

Table of contents

Digital trust: an asset more valuable than money

Biometric technology has become a central part of how modern banks plan for the future. It has grown from a simple security feature into a foundation for building “Digital Trust“.

This idea, defined by McKinsey & Company as a bank’s ability to handle online and technological risks well, has a direct and measurable link to a bank’s financial performance.

The financial impact of digital trust

One analysis showed that financial firms with high levels of digital trust grew 7.8 times faster between 2017 and 2024 than those without it.

Trust is also the bedrock of customer loyalty. Only 18% of consumers would think about leaving a bank they trust. With figures like these, spending money on technology that builds trust is not a cost, but a key investment in long-term growth.

Overcoming customer privacy concerns

Getting this right is not straightforward, though. A study from Accenture found that many customers are worried. 53% are concerned about the privacy of their data, while 58% fear the risks of hacking as AI becomes more common.

This tells us that just having advanced technology is not enough. The real challenge is to communicate openly and make customers feel genuinely safe.

Biometrics sits at the heart of this issue, being the most personal way to identify someone. The future, as Accenture sees it, is about moving from artificial intelligence to “trusted intelligence“.

Banks have to prove that the data they collect is not only safe but also genuinely useful for the customer. How they introduce and manage biometric systems becomes a vital part of building that valuable digital trust. This makes biometrics a core part of customer relations and business strategy, not just an IT security matter.

The end of passwords? A quiet revolution in logging in

The way we prove who we are to banks is changing in a big way. We are seeing a move away from old methods like passwords and PINs towards systems that are smoother and safer. A look at forecasts from firms like Gartner helps to identify the key trends that will shape banking technology.

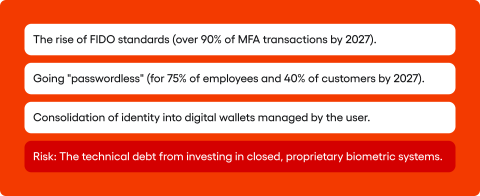

The rise of FIDO and passwordless standards

Gartner’s predictions point to two main developments. First, by 2027, over 90% of multi-factor authentication transactions will be based on FIDO protocols, such as passkeys.

This signals a clear and inevitable shift away from closed, company-specific systems. In this model, the biometrics built into a customer’s device, like a fingerprint reader or Face ID, plays a key part. It acts as a local verifier to unlock their private cryptographic key.

Second, going “passwordless” is becoming a market reality. Gartner expects that by 2027, over 75% of employee authentications and over 40% of customer authentications will happen without a password. This change is driven by the need to improve both security and user experience.

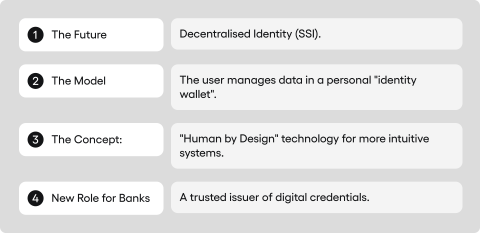

The shift towards identity ecosystems

A third powerful trend is taking shape: the consolidation of identity into digital wallets. This vision, outlined in Accenture’s reports on decentralised identity, suggests that people will manage their own digital credentials in a personal “identity wallet”. Banks and other organisations will then ask for cryptographic proof of identity from this wallet, rather than storing the data themselves.

These three trends all point to the same conclusion. The future of authentication in banking is not about picking one biometric method. It is about strategically connecting bank processes with global, standardised identity systems.

The challenge for banks is no longer “which biometrics should we use?”. It is now “how do we prepare our systems to connect with upcoming platforms where biometrics is a built-in, invisible part?”.

Ignoring this fundamental change is a serious strategic risk. Continuing to invest in closed, proprietary biometric systems could lead to expensive technical debt. As soon as standardised identity wallets become widely used, customers will start to see separate banking systems as old-fashioned and inconvenient.

They will naturally ask, “Why do I have to register my face separately for this banking app when I log into everything else with one click?”. This situation would force a bank into a costly, urgent migration. The money previously spent on a closed system would be largely wasted.

The winners in this transformation will be the institutions that build their systems from the start to be modular and ready to connect with external, standard-based identity providers.

The arms race 2.0: how banks are fighting AI-powered fraudsters

The landscape of cybersecurity threats has changed dramatically. The rise of easy-to-use generative AI tools has made it possible to create highly convincing scams on an unprecedented scale. This makes many traditional security methods insufficient.

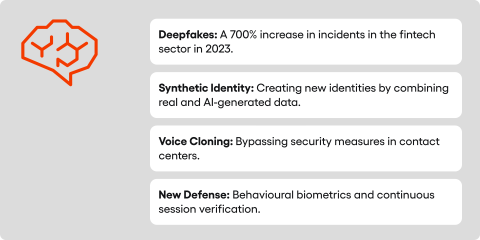

The new threats from artificial intelligence

The financial loss forecasts are alarming. Losses from GenAI-powered fraud in the United States alone could grow from $12.3 billion in 2023 to a staggering $40 billion a year by 2027, according to Deloitte. This represents a compound annual growth rate of 32%.

Another Deloitte analysis focuses on synthetic identity fraud. It predicts this type of attack will generate at least $23 billion in losses by 2030.

New attack methods include deepfakes. Reports show a 700% increase in deepfake incidents in the fintech sector in 2023. GenAI allows for the creation of very realistic fake video and audio recordings to bypass identity verification.

Another threat is synthetic identity. Here, fraudsters combine real data with fake, AI-generated data to create a new, fictional identity. These “synthetic” people are very hard for traditional systems to detect.

Voice cloning is also on the rise. A fraudster using a cloned customer voice can convince a call centre agent to perform an unauthorised transaction. This makes voice alone a high-risk authentication factor.

The role of biometric technology in fraud prevention

The security industry is developing a new generation of biometric solutions to fight these threats. Leading providers like Experian and FICO offer integrated anti-fraud platforms, as noted in the IDC MarketScape: Worldwide Enterprise Fraud Solutions 2024 report.

These platforms combine technologies like physical and behavioural biometrics with device intelligence. Together, they create a multi-layered defence system.

Deloitte states in its analysis that “biometrics and behavioural cues can be a powerful weapon in the fraud-fighting arsenal”. This is no longer an option. It’s a strategic necessity.

To counter voice cloning, innovative behavioural biometrics solutions are emerging. These systems, as Accenture points out, analyse unique interaction patterns like typing rhythm. This provides a continuous, passive layer of identity verification.

This evolution of threats forces a rethink of “strong authentication”. The security model is shifting from a one-time check at login to continuous verification throughout a user’s session. It is much harder to imitate a user’s unique behaviour over a longer period than to fool a single checkpoint.

The system is no longer just asking, “Are you who you say you are at login?”. It is constantly monitoring, asking, “Are you still the same person?”. This requires banks to invest in platforms that can analyse behavioural data in real-time.

Ultimately, the fight against GenAI-based fraud is an arms race. A bank’s competitive edge will not come from simply having AI. It will come from the quality of the data used to train its anti-fraud models. An AI model trained on millions of genuine customer interactions will be far more effective at spotting anomalies.

This increases the strategic importance of a bank holding integrated customer data. It creates a powerful feedback loop. More customers mean more data, which leads to better AI, which leads to higher security, which builds greater trust and attracts more customers.

Beyond security: biometrics means real profit and loyal customers

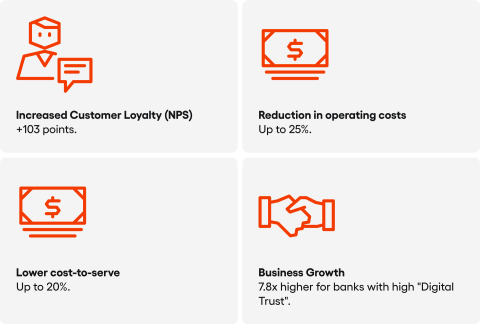

Spending on advanced biometric technologies must be justified by measurable business benefits. Data from leading consulting firms clearly shows that the return on investment in biometrics is multi-dimensional, covering fraud reduction, operational efficiency, and customer loyalty.

How biometrics deliver enhanced security and customer loyalty

One of the most powerful arguments for biometrics is its ability to remove friction from digital processes. A Bain & Company report identifies this friction as a major destroyer of customer loyalty.

The numbers are stark. There is a 103-point difference in Net Promoter Score (NPS) between customers who successfully opened an account digitally on their first try and those who failed. Biometrics simplifies these key interactions.

A smooth, one-click authentication has the potential to drastically improve NPS and customer retention, providing the enhanced security customers expect.

The measurable impact on operational efficiency

The benefits of biometrics also show up in hard operational data. Boston Consulting Group estimates that banks can reduce their operational costs by as much as 25% by fully implementing a mobile banking strategy with biometrics at its core.

Similar findings come from Accenture. Their research suggests that banks using coherent omnichannel strategies can lower their cost-to-serve by up to 20%, partly by reducing calls to contact centres about forgotten passwords.

The table below summarises the key performance indicators that show the wide-ranging benefits of biometrics in banking.

Key performance indicators of biometric rollouts in banking

| Benefit Category | Metric | Quantitative Value | Source and Context |

| Customer Loyalty | Difference in NPS | +103 points | Bain & Company: Difference between a smooth and a problematic digital onboarding. |

| Business Growth | CAGR Growth | “7.8x higher” | McKinsey & Company: Comparison of banks with high and low levels of “Digital Trust”. |

| Customer Retention | Likelihood to leave | Only 18% | McKinsey & Company: Percentage of customers willing to leave a bank they trust. |

| Operational Efficiency | Reduction in operating costs | Up to 25% | Boston Consulting Group: Potential of a full mobile banking implementation. |

| Operational Efficiency | Reduction in cost-to-serve | Up to 20% | Accenture: Potential of implementing an omnichannel strategy. |

| Risk Management | Losses from GenAI fraud (forecast) | Growth to $40bn by 2027 | Deloitte: Forecast for the US market, showing the urgent need for investment in defence. |

| Risk Management | Losses from synthetic identity (forecast) | At least $23bn by 2030 | Deloitte: Forecast for the US market, highlighting a specific threat. |

The benefits of biometrics work together. A single, well-planned investment in a modern authentication platform brings measurable returns in both security and customer experience at the same time. This creates a powerful, multiplied return on investment.

Your identity in your hands: are banks ready for the future?

Beyond the immediate benefits, reports from consulting firms point to a long-term shift in how digital identity is managed. To stay relevant, banks must prepare for an era where control over personal data returns to the user.

The future of digital banking: decentralised identity

Accenture highlights the rapid growth of the market for decentralised identity (SSI). A projected annual growth rate of 90% shows this is a dynamically forming market segment that will reshape digital banking.

This vision involves a fundamental change. Instead of storing customer data in centralised silos, companies will access data held in a customer’s personal “identity wallet”.

Banks will ask for consent to access specific credentials for a particular transaction. This model increases digital trust and reduces the risk of mass data breaches.

New business models and the “human by design” concept

At the same time, Accenture’s Technology Vision reports promote the concept of “Human by Design” technology. This is the idea of creating systems that are more intuitive.

Biometrics plays a key role in this. Technologies like voice analysis are seen as tools that allow systems to “understand” the user on a much deeper level.

For this to become a reality in an ethical way, however, it must be linked with decentralised identity. SSI is what will make sure that these advanced technologies do not become tools for surveillance. The user must keep full control over their biometric data.

This strategic shift has deep implications for banking. It requires a fundamental overhaul of IT architecture towards flexible, API-based systems. It also opens up new business models, where banks can become trusted issuers of digital credentials.

A bank’s long-term biometric strategy should not focus on “owning” customer data. The goal should be to build such deep trust that the bank becomes the preferred partner in an ecosystem where the customer manages their own identity.

This is a revolutionary change in thinking. In the future model, based on standards like FIDO, the bank will not store a fingerprint. It will ask the customer’s wallet for cryptographic proof that authentication was successful. In this new world, trust becomes the currency.

Advancement and trends in biometrics in british banking

The UK banking sector shows a much wider variety of implemented biometric technologies. It also has a higher level of maturity in their use.

NatWest was a pioneer. In April 2019, it launched a pilot for biometric payment cards for 200 customers, allowing transactions above the £30 limit without a PIN. The limit for credit cards was later raised to £100.

Barclays stands out with advanced technology. Since 2014, it has offered corporate clients finger vein scanners from Hitachi. An improved version with Bluetooth was introduced in 2024.

HSBC carried out the largest rollout of voice biometrics. It offered its Voice ID service to all 15 million retail customers by 2016. In 2019, Santander UK introduced a similar system based on voice and phone identification.

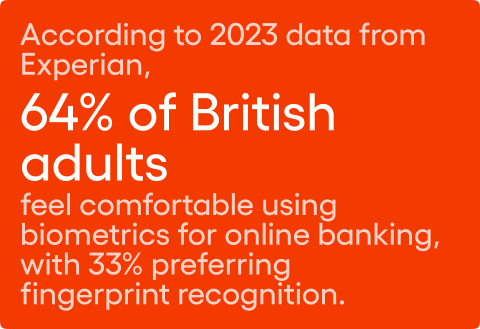

British consumers are open to biometrics. A YouGov survey showed that 33% prefer fingerprint recognition. According to 2023 data from Experian, 64% of British adults feel comfortable using it for online banking.

Despite this, adoption has sometimes been low. A 2016 study showed that only 13% of respondents used fingerprint recognition. Challenges in the UK market include a high level of regulation and data privacy needs, as highlighted in a 2024 parliamentary report.

Summary: strategic directions for the banking sector

The analysis of global trends leads to a clear conclusion. Biometrics in banking is no longer a technical issue. It is a strategic imperative. Faced with growing threats from generative AI and evolving consumer expectations, financial institutions must take a proactive and multi-layered approach.

Below are the key areas for action that should be a priority.

First is investment in flexible and multi-layered security systems. No single biometric method is a universal solution. The complexity of threats like deepfakes requires multimodal authentication, which might combine face analysis with behavioural biometrics and adjust security levels to the transaction risk. It is time to move away from a “one-size-fits-all” mentality.

Second is prioritising behavioural biometrics as a strategic line of defence. In an age of fraud that can bypass static verification, analysing how a user types or moves a mouse becomes essential. Its greatest advantage is that it works continuously and passively. This allows for the detection of anomalies throughout an entire session.

Third is actively building “Digital Trust” through transparency. Trust is a measurable financial asset. A lack of it, stemming from privacy concerns, is the main barrier to adopting new technologies. Banks must proactively manage these concerns by creating clear privacy centres that explain in simple terms what data is collected and for what purpose.

Finally, there must be strategic preparation for the identity management revolution. Full implementation of decentralised identity (SSI) models is a few years away. But the rapid growth of this market and forecasts for the dominance of open standards like FIDO indicate that ignoring this trend is strategically risky. Banks must prepare their systems for a future where the customer is the sovereign owner of their identity.

Taking these actions will allow financial institutions to not only manage risk effectively but, above all, to use biometrics as a tool to build a lasting competitive advantage.

FAQ – Biometrics in banking

1. What is biometrics in banking and how does it work?

Biometrics in banking refers to advanced biometric technology that uses your unique physical characteristics for identity verification. Instead of typing traditional passwords, you might use a fingerprint or your face. The biometric process involves a biometric sensor (like the camera or fingerprint scanner on your mobile phone) capturing your information, which is then compared to a pre-registered template. This form of biometric authentication is central to the secure banking promise from modern financial institutions.

2. How does biometric authentication work on a mobile phone?

Biometric authentication on mobile devices uses built-in hardware like the camera or fingerprint sensors. When you use your device for digital banking, the app may ask for your biometric approval for certain actions. Your phone then handles the verification locally, meaning your sensitive biometric data doesn’t need to be sent over the internet. This makes biometric authentication a very secure way to access your account, often on registered devices directly, without needing a separate device for codes.

3. Is facial recognition technology safe for online banking?

Facial recognition technology maps the unique geometry of your face by analysing various facial features. When you log in to your online banking app, the system performs a new facial recognition scan and compares it to your existing face biometric template. To ensure security, modern biometric systems often include “liveness” checks to make sure it’s a real person and not a photo, a key defence against deepfakes created with artificial intelligence. This form of facial recognition is one of the most widely adopted security methods.

4. What is a voice biometric and how is it used for voice authentication?

A voice biometric is a unique “voiceprint” created from over 100 different characteristics of your voice. It’s much more advanced than simple voice recognition that just understands commands. For voice authentication, the system analyses your vocal tract and cadence, meaning it isn’t fooled by a recording. For best results when using a voice biometric, you should speak in your usual speaking voice, and be aware that if microphone access denied is set on your device, the feature will not work.

5. How is my biometric data stored and is it secure?

This is a key concern, and modern security measures are designed to protect your information. In most cases, the biometric data stored on your mobile phone is encrypted and securely stored in a secure chip on the device itself. This means your biometric data never leaves your phone to be held on a central server. This decentralised approach is fundamental to biometric security and helps prevent criminals from being able to gain unauthorized access to your account.

6. What is “biometric approval” and how does it work for transactions?

The biometric approval feature lets you authorise payments or make changes to your bank account using your biometrics. When a biometric approval required message appears, for instance after you amend bill payee details, you will often get a notification if you have push notifications enabled. The biometric approval lets you act quickly; you simply click biometric approval to confirm the action with your face or fingerprint. This form of biometric approval is designed to be simple, and a fourth failed attempt will typically lock access for security.

7. Can I use biometrics for more than just logging in, like for account access or other banking services?

Yes, absolutely. While accessing online accounts is a common use, integrating biometrics allows you to do much more. A biometric approval can be used to authenticate transactions and manage your account securely. For example, a mobile app change such as updating your address might require it. You can often manage permissions in your biometric settings; to change them, you may need to select manage biometrics, and if you no longer want to use the feature, you can select manage biometrics again and choose not to use biometrics anymore.

8. What are the biggest challenges for the banking sector in adopting this technology?

The banking sector faces a few key challenges. One of the main ones is regulatory compliance, as rules around how biometric data is handled are very strict, and maintaining this regulatory compliance is essential. Another is ensuring systems are robust enough for effective fraud prevention. Finally, there is the ongoing need to educate banking customers to build trust and ensure they are comfortable using these new approval methods instead of visiting a bank branch.

9. What is the future of biometric security in online banking?

The future of biometrics in banking will likely involve more multi factor authentication, where your biometric identity is one of several layers of security. We can expect facial recognition and voice biometric technology to become standard for most online banking services. For future authentication attempts, the system might require further security checks or use different same approval methods depending on the risk level to prevent fraudulent transactions. The ultimate goal is to make the entire biometric approval process seamless.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.