The benefits of a core banking system in cloud

Core banking in cloud can be tricky. Why? While over half of financial leaders plan to move their operations to the cloud within five years, a surprising 40% of companies say their current cloud projects have brought them little real value. This mismatch shows that switching to cloud banking is more than just a technology update. It is a high-stakes strategic game. The potential savings are huge, with estimates suggesting banks could save up to US$311 billion in operational costs by 2030. Because of this, figuring out how to manage the change well is now a top priority for any financial institution that wants to stay competitive.

Table of contents

Key takeaways

- From hesitation to necessity: Cloud banking has moved from being a curious idea to a strategic must-have. Early worries about security and rules have mostly been solved, leading to more investment and wider use.

- Hybrid is the new normal: For most established banks, the best way forward is not to replace everything at once. Instead, they are mixing new cloud services with their existing systems, allowing them to modernise step-by-step and with less risk.

- Focus on innovation and customers: While saving money is a plus, the real prize is the ability to innovate faster. The cloud lets banks create new products quickly, offer personalised services, and use advanced tools like artificial intelligence.

- Cloud is the foundation for AI: You cannot get the full benefit of AI without the cloud. The cloud provides the flexible, powerful base needed to use AI for everything from spotting fraud to improving customer relations.

- A business change, not just an IT project: A successful move to the cloud needs the whole company to be on board. It requires support from the top, smart financial planning, and a focus on hiring the right people.

What is cloud core banking?

Core Banking is the system that manages a bank’s most basic operations. This includes everything from customer accounts and transactions to loans and payments. Gartner calls these the back-end systems that handle the daily work of a bank.

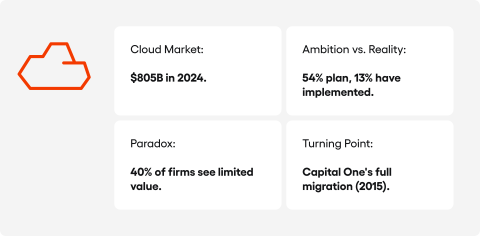

Cloud Computing is the model of delivering computer services over the internet. Instead of buying and running their own expensive servers, banks can rent resources from cloud providers. The market for this was expected to grow by 21% a year through 2024, showing how central it has become to business today.

The Cloud Core Banking Model is all about moving these vital banking systems to a cloud environment. This move allows a bank to scale its resources up or down as needed. It also frees them from the job of managing their own physical IT hardware.

Contrasts: traditional vs. hybrid banking

To understand the value of the cloud, it helps to compare it to other ways of working. Each model has its own place.

Traditional banking relies on a bank’s own servers and data centres. This old way of working is often held back by outdated applications that are difficult to update. This makes it hard to modernise.

Hybrid banking is a middle path, where some systems run in the cloud and others stay on the bank’s own servers. This allows for a slower, more controlled change. Research from Bain suggests that a bank’s own servers won’t disappear completely, so companies need to get good at managing these mixed environments.

The evolution and state of cloud adoption in the financial sector

The journey of cloud technology in finance has been one of moving from early doubt to seeing it as a strategic necessity. The attitude of the whole industry has shifted over the last decade.

Historical barriers and breakthroughs

For a long time, financial institutions were very cautious about using the public cloud for their main systems. Their main worries were about meeting strict regulations, keeping data secure, and making sure their services were always available. Because of this, they preferred to use private cloud environments for their most important work.

The story started to change around 2015. That’s when Capital One announced it was moving all its operations to Amazon Web Services, saying the public cloud was secure enough for them. This was a turning point that challenged the industry’s long-held fears.

By 2023, the world’s biggest banks and insurance companies were using the public cloud for many services. Strategic partnerships between big financial names and cloud providers became common.

The current adoption landscape

Today, the use of the cloud in finance is growing fast and has become strategically important. Spending on cloud services is on the rise.

In 2022, the average financial firm spent US$25 million a year on the cloud. IDC predicts that global spending on public cloud services will be doubled since 2024. The banking industry is one of the three biggest spenders, making up US$190 billion of that in 2024.

Even with this growth, a McKinsey study found that adoption is still in the early phases. Only 13% of financial leaders have more than half of their IT infrastructure in the cloud. But things are moving quickly, as 54% of them expect to reach that point in the next five years.

Strategies for modernising core banking systems

Updating a bank’s core systems is a big job. It needs a smart plan to move from old technology to modern, cloud-based setups.

From legacy systems to cloud architecture

The problem of old applications is very common in banking. Many banks have talked about needing to change for years, but they still run on “ancient” systems. This “technical debt” is a major barrier that stops them from innovating.

To deal with this, experts suggest using layered architectures and microservices. This allows banks to move away from their old, single-block systems step by step, which reduces the risk of things going wrong. It also lets them build flexible setups that mix cloud services with their own local systems, preparing them to work with modern API-based tools.

Strategic approaches to transformation

Banks can take a few different paths to modernise their technology. One idea is the “Digital Core” model, which Accenture describes as the key technology capability that drives a company’s growth. This includes a cloud-first foundation, a strong data and AI backbone, and digital platforms.

Another strategy is to create “digital attackers.” This approach, supported by firms like Bain with its NextEngine, involves building a separate, fully digital platform that isn’t held back by old systems. This lets the bank experiment with new business models without disrupting its established operations.

A third way, identified by Bain, is for banks to choose one of three paths to gain an edge: cutting costs by simplifying (like Santander), using digital tools and data to connect with customers (like JPMorgan Chase), or becoming a technology powerhouse (like Capital One).

Business benefits and value from cloud core banking

Moving to cloud core banking brings financial institutions big business benefits that go far beyond just optimising costs.

Cost optimisation and operational efficiency

Adopting the cloud can lead to big savings. McKinsey estimates that by 2030, global IT savings could reach US155billion,withoperationalsavingsofUS311 billion. An analysis by Bain shows that technology-leading banks have a cost-to-income ratio that is 10 percentage points lower.

A real-world example is Santander. By standardising its products and processes, the bank reduced its cost-to-income ratio by 6.5 percentage points.

Growth and innovation

The cloud shortens the time it takes to bring a new service to market. Through a partnership with McKinsey, a digital Islamic bank was launched in under nine months. Another digital bank for retail customers was up and running in 12 to 18 months.

Modern cloud platforms also allow for real-time personalised services. The cloud is also the foundation for advanced data analytics and AI, which are needed for hyper-personalised banking experiences. As part of its AI strategy, JPMorgan Chase built a team of over 900 data scientists.

Resilience and business continuity

Using the cloud also offers better disaster recovery and keeps the business running smoothly. Deloitte highlights that the cloud builds operational resilience by copying data and services across multiple geographic regions. This reduces the risk of a single data centre failure causing a major outage.

Challenges and considerations

Despite the many benefits, moving to the cloud comes with challenges that need careful planning and management.

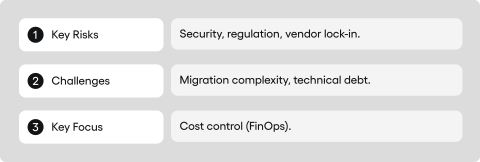

Regulation and security

Financial institutions operate under heavy regulatory pressure. Concerns about data privacy and security have long been a barrier to cloud adoption. For 80% of banks and insurers, a provider’s reputation for security is a top selection criterion.

Migration complexity and technical debt

The cost and effort of moving operations to the cloud remain a major concern. The banking industry will be working in hybrid and multi-cloud environments for years to come. Technical debt, often seen as a burden, is now being reframed as a strategic investment opportunity.

Instead of just maintaining outdated systems, banks are investing in migration to unlock future capabilities. This is especially true in the area of AI and data analytics.

Vendor management and avoiding lock-in

Financial institutions should avoid becoming dependent on a single provider, known as vendor lock-in, to stay flexible. A multi-cloud strategy, while more complex, allows for price negotiation and the choice of the best solutions from different providers. McKinsey advises turning traditional supplier relationships into true partnerships.

The situation in the UK

The British banking sector is moving slower on cloud adoption than one might expect from a leading financial market. An EY study found that 80% of UK banks have moved less than 10% of their business infrastructure to the public cloud.

The main barriers holding back the transformation are concerns about data security (cited by 87% of banks), regulatory risk (67%), and third-party risk (60%).

Despite this, there are signs of acceleration. Over a quarter (27%) of institutions migrated at least half of their business to the public cloud by 2022. Importantly, the UK is a European leader in Open Banking infrastructure, with 173 payment service providers compared to just 36 in Germany. This could provide a foundation for future growth.

Summary

Cloud core banking has evolved from a technological option to a strategic necessity for financial institutions. Early concerns about security and regulation have been largely addressed, which is now driving investment and adoption across the sector.

For most traditional banks, the way forward is not a complete overhaul of their systems at once. Instead, they are taking a strategic hybrid approach, blending cloud-native components with their existing legacy systems. This allows for gradual modernisation and reduces the risks involved in the transformation.

Although cost optimisation is still a factor, the real value of cloud banking lies in its ability to speed up innovation, enable rapid product development, and deliver hyper-personalised customer experiences. The cloud also provides the necessary foundation for advanced capabilities like AI and big data analytics, making it fundamental for future competitiveness.

A successful move to the cloud is not just an IT project but a comprehensive business transformation. It requires board-level commitment, sustainable funding models, new operating models, and a focus on attracting and retaining engineering talent.

FAQ

1. What exactly is a cloud core banking system and why is it so important today?

A core banking system in cloud architecture represents a fundamental shift in how financial institutions operate. Essentially, it involves moving the bank’s central processing unit—the core of its operations—from private, on premises servers to a scalable, third-party cloud environment. This is more than a simple IT upgrade; it’s a strategic overhaul of the entire banking system.

The importance of this transition cannot be overstated. Many established banks are held back by legacy core banking systems that are decades old, making innovation difficult and expensive. Adopting a modern core banking model allows these institutions to become more agile, efficient, and responsive. This change to the core banking system is the foundation upon which future growth and competitiveness are built, making it a critical step for any bank looking to thrive in the digital age.

2. What are the main benefits for banks migrating their core systems to the cloud?

The primary benefit of migrating core banking systems is the massive boost in operational efficiency. By moving away from costly and difficult-to-maintain legacy infrastructure, banks can significantly lower their operational overheads. This approach is highly cost effective, freeing up valuable resources that can be reinvested into developing new products and improving services for their customers.

Furthermore, a key advantage is scalability. A modern core banking platform can dynamically adjust to handle fluctuating transaction volumes, providing the scalability needed for growth without requiring massive upfront investment in hardware. This move also accelerates the pace of innovation, allowing a bank to deliver new services and features to customers much faster than a traditional banking system would ever allow.

3. Are cloud-based banking platforms only suitable for new digital banks?

While it’s true that a new digital bank will almost certainly be built on cloud based banking platforms from day one, the benefits are just as significant, if not more so, for established institutions. These solutions are not exclusive to market newcomers. For traditional banks, a cloud based architecture is a powerful tool to overcome the limitations of their existing infrastructure.

Embarking on this digital transformation allows them to compete on a level playing field with agile fintech companies. By adopting modern core banking solutions, they can enhance their service offerings, improve customer experiences, and streamline their operations. A successful core banking project can revitalise a traditional institution, enabling it to better serve its millions of customers.

4. What does “cloud-native core” mean and how does it differ from just moving old systems to the cloud?

This is a critical distinction. A cloud native core is fundamentally different from simply taking an old, existing banking system and hosting it on a cloud server (a “lift-and-shift” approach). Being cloud native means the core banking software has been designed and built from the ground up to take full advantage of cloud architecture. This involves using principles like microservices, where the banking system is broken down into smaller, independent services that can be updated separately.

This approach is the essence of core modernization. A cloud native core provides far greater flexibility, scalability, and resilience than a legacy application running on premises. It’s about rebuilding the core engine of the bank, not just changing its location. This cloud native design is what truly enables banks to innovate at speed and scale.

5. What are the biggest challenges when implementing new core banking solutions?

Implementing new core banking solutions is a major undertaking for any bank, filled with significant challenges. Firstly, meeting strict regulatory requirements is a top priority, and any new platform must be fully compliant. Secondly, ensuring the absolute security of sensitive customer data throughout the migration process is paramount. The complexity of moving decades of data and processes from an old banking system to a new one is a huge operational hurdle.

There is also the challenge of selecting the right core banking solutions from a crowded market of providers. Banks must also carefully manage the project’s scope and budget to avoid spiralling costs. This complex management task requires careful planning and a phased approach to minimise disruption for customers. These solutions form the new core of the institution, so the stakes are incredibly high.

6. How do modern core banking systems improve customer experiences?

Modern core banking systems are designed with the end-user in mind, leading to vastly improved customer experiences. Unlike rigid legacy platforms, a modern core banking platform is flexible, which enables banks to rapidly develop and deploy new features. This means customers get access to innovative products and services faster than ever before.

For example, a cloud native core can easily integrate with other financial apps, providing customers with a more holistic view of their finances through open banking. The ability to process data in real-time allows for hyper-personalisation, meaning banks can offer products and advice that are truly relevant to an individual’s needs. Ultimately, these advanced core banking systems deliver a smoother, faster, and more intuitive interaction for all customers.

7. What is the role of Open Banking and fintech companies in core banking’s evolution?

Open Banking and the rise of fintech companies have been huge catalysts for change in the financial services industry. They have forced traditional banks to re-evaluate their old, closed-off core banking systems. Open Banking relies on the secure sharing of financial data via APIs, which is almost impossible to achieve efficiently with a rigid, on premises banking system.

This is where a modern core comes in. A flexible core banking platform is needed to handle the complex integrations and high volume of API calls that make open banking work. This allows for the creation of new ecosystems where banks and fintechs can collaborate on new solutions, such as advanced payment services or tools for personal finance management.

8. Can banks maintain control over operations and data when using cloud providers?

This is a common concern, but the answer is yes. While the infrastructure is managed by cloud providers, the bank retains full ownership of and control over its data and operational rules. Modern cloud based banking platforms offer sophisticated tools that allow banks to configure products, set policies, and manage their own processes. The core banking software is designed to be highly configurable to meet specific business needs.

The relationship is one of partnership; the cloud provider supplies the secure and scalable resources, while the bank uses its own expertise for delivering banking services. The bank’s internal teams still deliver the strategy and oversee all operations; they are simply taking advantage of a more powerful and efficient underlying technology platform.

9. What is ‘composable banking’ and how does it relate to cloud-based services?

Composable banking is an approach where a bank builds its financial services by combining or “composing” various independent, best-in-class solutions. Instead of buying a single, monolithic core banking system that does everything, the bank can pick and choose the best components for different functions, such as payments, lending, or customer onboarding.

This is made possible by cloud based services and a cloud native core. A cloud native architecture, with its use of microservices and APIs, is inherently composable. It allows a bank to easily plug in new solutions or swap out old ones without disrupting the entire banking system. This modularity provides ultimate flexibility, allowing banks to deliver highly customised financial services and adapt quickly to market changes.

10. What does the future of core banking look like with platforms like Thought Machine?

The future of core banking, and the entire digital transformation journey, is defined by platforms that are truly cloud native. Pioneers like Thought Machine, with their Vault Core banking platform, are demonstrating what is possible. Their solutions are built on a fundamentally different architecture from the core banking software of the past. This new generation of core banking systems is built around a universal core that can be configured to run any type of retail banking product.

This approach enables banks to move beyond the constraints of their old on premises systems. They can design and deliver products with unprecedented speed and flexibility, handling all imaginable payment types and creating superior customer experiences. This represents the end-game for core banking: a powerful, flexible, and efficient engine that allows banks to provide truly next-generation financial services and banking services. This is the digital transformation in action.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.