Choosing the right partner for fintech development outsourcing

Working on digital initiatives with a seasoned partner is the best way to optimise IT budgets. Fintech development outsourcing can help brands accelerate time-to-market and achieve spectacular software quality. It is considered a proven approach to finding the right programming specialists. However, utilising such a strategy can be complicated without proper knowledge.

This article is dedicated to all financial institutions that want to work with external tech providers. It showcases potential challenges in that area. By eliminating them, fintech brands will be able to outsource development services to partners that match all their requirements.

Table of contents

Fintech Development Outsourcing Explained

The financial technology (fintech) industry is at the forefront of revolutionising financial services. By offering innovative solutions such as mobile apps for banks, investment systems, insurance platforms, and other advanced software products, they enhance efficiency, security, and user experience, while also disrupting the current status quo of the sector and leading to improvements demanded by modern consumers. Betting on digital offerings is imperative for money-related brands that want to stay afloat.

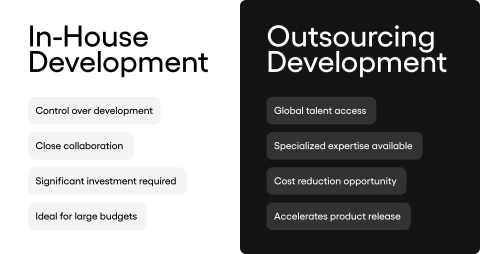

As fintech companies strive to maintain a competitive edge, they often face the critical decision of whether to develop their solutions in-house or outsource fintech software development to external experts. To establish which way to follow, we should begin by comparing these two options. It’s important to remember that each has its pros and cons, and the final decision should be based on the individual needs of the company.

In-house Team vs. Outsourcing Vendor

The decision to invest in fintech app development in-house or to outsource is pivotal for fintech businesses. Developing in-house provides direct control over the development process, fostering close collaboration and swift decision-making inside teams and between different departments. However, it demands significant investment in hiring skilled professionals, onboarding the team, setting up the necessary infrastructure, and continuous training to keep up with technological advancements.

Working with an internal team is the best choice for companies that are not in a hurry, have large budgets, want to keep their projects secret before release, or already have an entire IT department with the required skills in place.

Outsourcing, on the other hand, offers several compelling advantages. It allows fintech companies to tap into a global talent pool, access specialised expertise, and reduce operational costs. Moreover, outsourcing can accelerate production and speed up product release, which is a critical factor in the fast-paced financial and banking industry.

By leveraging the capabilities of experienced outsourcing partners, fintech brands can focus on their core business processes while ensuring high-quality development outcomes. However, to fully take advantage of outsourcing, it’s crucial to find a provider that matches the individual needs of the organisation.

The significance of selecting the ideal partner should not be underestimated. The success of any fintech software outsourcing project solely depends on this factor. A competent vendor brings not only technical expertise and regulatory knowledge but also ensures that the project aligns with business objectives, adheres to security standards, and provides robust support post-development. The provider that can transform a project from a conceptual idea to a market-ready solution drives innovation and growth for fintech industry players.

Criteria for Selecting an Ideal Outsourcing Partner for Fintech Companies

Choosing a fintech outsourcing company involves evaluating several critical points to ensure they align with particular business needs and project goals. We outlined the essential criteria to consider when selecting fintech developers.

Technical Expertise

The cornerstone of a successful fintech development project is the technical knowledge of the software developers. Look for partners who have a demonstrable track record of successful digital projects for financial institutions. They should have experience in developing complex money-related systems, payment gateways, and other fintech applications.

All that indicates their ability to handle the specific challenges and requirements of development for digital banking brands and fintech companies that have strict requirements.

Moreover, industry knowledge of emerging technologies (including financial technology trends) is a must for software agencies that want to offer their services for this rapidly evolving field.

An ideal partner for fintech startups and companies should be well-versed in the latest tech advancements such as artificial intelligence (AI), machine learning (ML), and data analytics, as well as the most recent programming languages. Their familiarity with these technologies can drive innovation and provide a competitive advantage in projects.

Compliance with Financial Regulations

Regulatory compliance is critical in fintech due to the sensitive nature of financial data and transactions. A reliable outsourcing partner must know key regulations designed to protect consumer data, ensure secure transactions, and prevent financial crimes such as the General Data Protection Regulation (GDPR), the Payment Services Directive 2 (PSD2), Anti-Money Laundering (AML), and Know Your Customer (KYC). They also have to be able to create fintech solutions that are compliant with all these legal requirements.

When picking the fintech outsourcing team, ask for case studies or testimonials demonstrating their ability to maintain compliance in past projects. This helps in avoiding legal pitfalls and ensures smooth business operations.

A partner with a proven track record in compliance can help navigate complex regulatory landscapes effectively. Also, they will be able to advise on what can be done in the digital product and which features should be avoided to not risk potential legal repercussions and reputational harm.

Security and Data Protection

Given the mentioned sensitivity of financial data, security should be a top priority. Every outsourcing partner considered for collaboration should implement robust security measures in their products, including:

- Data Encryption: Ensuring data is encrypted both in transit and at rest is a must in digital products dedicated to money. This approach prevents unauthorised access and ensures data integrity.

- Access Control: Systems made for financial companies should be able to limit access to sensitive data to authorised personnel only. Role-based access controls and multifactor authentication can enhance security.

- Regular Security Audits: Conducting security audits on schedule and assessing the vulnerability of the system and its features is essential to identify and mitigate potential security risks. A proactive approach to security helps in safeguarding data against emerging threats.

Experience

Experience is a key determinant of reliability and quality. When evaluating providers, consider all proofs that showcase the capabilities and successes of each vendor. First, review detailed case studies and client testimonials. They provide insights into the software company’s problem-solving capabilities, tech expertise, and customer satisfaction levels.

Real-world examples can highlight their ability to deliver successful fintech projects. Additionally, awards from industry bodies can indicate a high level of expertise and industry recognition. Such rewards often reflect the partner’s commitment to excellence and innovation

Fintech Software Development Team and Project Management

The quality of the development team can make or break a project. Important factors include not only the experience levels of professionals, but also their willingness to invest in obtaining new skills. It might be a controversial statement, but a great IT team consists of senior software developers and junior programmers. The former bring depth and insight, while the latter can provide fresh perspectives and enthusiasm.

It’s also worth noting that a good outsourcing partner invests in continuous training to keep their team updated with the latest market trends and technologies. This commitment to learning ensures that the staff can handle evolving project requirements and industry changes effectively.

Effective project management ensures timely delivery and high-quality output. Key methodologies used by IT companies are Agile and Scrum. However, other iterative approaches can also enhance flexibility and responsiveness. Such a style of work promotes collaboration, step-by-step development, and continuous improvement, which are crucial for complex fintech projects.

Many custom fintech outsourcing services agencies create their own, hybrid project management methods based on agile frameworks to achieve the best possible outcomes. Make sure to learn as much as possible about their approach and if it fits your company’s style of work.

Furthermore, frequent and open communication is an integral part of successful project management. It’s necessary for tracking progress and addressing issues promptly. Regular updates, status meetings, and collaborative tools can facilitate effective communication – check which ones are used by the fintech outsourcing provider of choice.

Clear visibility into project milestones, deadlines, and budgets helps in managing expectations and reducing risks. Transparency builds trust and ensures that all stakeholders are aligned throughout the project lifecycle.

Support and Maintenance

Post-development support is essential for the smooth functioning of fintech solutions. Seasoned partners offer well-defined SLAs (service-level agreements) that guarantee timely and effective help whenever it’s needed. This document sets clear expectations for response times, issue resolution, and overall service quality.

Many vendors also provide dedicated support teams that ensure issues are resolved promptly and efficiently. Continuous monitoring and proactive maintenance can prevent potential problems and guarantee system reliability.

Pricing Models

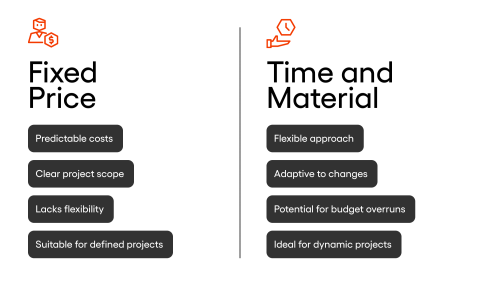

Understanding the various pricing models in fintech software development services is crucial for budgeting and financial planning. The two most common models include:

- Fixed Price: Suitable for well-defined projects with clear requirements. It offers predictability of costs but lacks flexibility. This model is ideal when project scope and deliverables are clearly outlined from the beginning.

- Time and Material: Ideal for projects where requirements may evolve over time. It provides flexibility but can lead to budget overruns if not managed properly. This model suits dynamic projects where adaptability is essential.

Innovation and Scalability

An ideal partner should not only meet current needs but also anticipate future requirements of their digital banking or fintech solution client. The ability to drive innovation into a company by investing in research and development, as well as staying abreast of industry trends, is necessary to create digital software solutions that are future-proof and scalable in the long term. A proactive approach to innovation can also drive competitive edge and business growth.

If fintech developers can accommodate future expansions, integrations, and evolving requirements, they can prepare brands to scale their projects up or down based on ongoing business needs.

Cultural Fit

Cultural alignment between the organisation and their fintech outsourcing team can significantly impact mutual relations and project success. Evaluate the following factors before you bet on a specific provider:

- Work Ethics and Values: Ensure that their approach to work, internal values, and culture align with yours. Shared ethics and views foster a collaborative and productive partnership.

- Language Proficiency: Check if the specialists hired via the outsourcing company have no language barriers, especially when working with offshore outsourcing vendors. This way, you can avoid potential misunderstandings.

- Communication Styles: Ensure that the team you will work with is on the same page when it comes to communication guidelines, meetings, and information exchange procedures. Cultural compatibility in that area can minimise conflicts and problems.

Benefits of Outsourcing Fintech Development

Development outsourcing offers numerous benefits that can help financial companies achieve their business goals and optimise all types of financial processes. Let’s have a closer look at the advantages that make working with an external team an attractive option for all money-related organisations:

Access to Specialised Expertise

Outsourcing is the best way to tap into a global talent pool of experts with specific skills and knowledge in fintech development. Working with software development agencies enables companies to leverage cutting-edge technologies without a need to search for specialists in their local markets. Instead, they can find a vendor that incorporates best practices and delivers solutions of high quality.

Cost Reduction

Outsourcing can significantly decrease operational costs associated with human resources: hiring, training, and maintaining an in-house team. It also eliminates the need for investing in expensive infrastructure and technology. It’s especially beneficial for brands that don’t need an entire IT department on a daily basis. Also, it’s the best choice for businesses that want to develop projects with very specific requirements and are certain that niche skills won’t be needed on board when the project is over.

Faster Time-to-Market

Experienced outsourcing partners can accelerate the development process, enabling many fintech companies to launch their products faster. This is particularly crucial in the highly competitive financial industry, where being first to market can be a significant advantage. Finding the right team to create the solution can be time-consuming, while an outsourced crew can be quickly onboarded and start working on the spot.

Focus on Core Business Activities

By outsourcing development tasks, fintech brands can focus on their core business initiatives, such as strategy, marketing, and customer engagement – instead of spending time on recruiting and managing IT teams. This allows them to allocate resources more effectively and drive business growth. Vendors that handle account and project management are particularly useful in freeing their clients’ time and handling software development end-to-end.

Flexibility and Scalability

Working with outsourced developers offers the flexibility to scale IT resources in both directions, based on project requirements. This adaptability ensures that companies can respond to changing market conditions and evolving business needs efficiently. It’s crucial when brands experience sudden client base growth or when their digital product moves to a different phase and doesn’t require constant care anymore.

Risk Mitigation

Experienced outsourcing agencies bring established business processes and frameworks that can lower risks associated with software development, project management, and maintenance. Their expertise in building complex solutions (especially the ones able to handle banking transactions) ensures smoother execution and higher chances of success. While creating an IT department from scratch requires building such workflows from the ground up, fintech businesses that bet on outsourcing can trust their partners in proven methods of delivering expected results.

Common Challenges in Fintech Development Outsourcing

Outsourcing offers numerous benefits when executed the right way – with company needs and expectations in mind. Nevertheless, it also comes with its own set of challenges to be aware of. Approaching them with an open mind and preparing the business beforehand allows organisations to eliminate potential disruptions and increase their gains when working with external teams.

Here are our picks of the most often considered difficulties and how to transform them to your advantage:

Finding a Suitable Vendor

There are many outsourcing agencies on the market. Many of them have impressive portfolios, a proven track record of successful client stories, and skilled talent on board. That’s why finding the most perfect match is often hard and can lead to working with multiple partners before finding the right one.

Our advice:

- Conduct thorough research based on the guidelines from this article.

- Meet with the company representatives and talk about your expectations and doubts. Test them and analyse how thoroughly they answer your questions before hiring.

- Make sure that the company has experience in similar software products you want to make.

Communication Barriers

Effective communication is crucial for successful fintech outsourcing partnerships. Language barriers, time zone differences, and cultural differences can hinder communication and collaboration. It is essential to establish clear communication channels and protocols to address these challenges.

Our advice:

- Outsource to countries that have a high level of English proficiency and are known for delivering high-quality services (e.g. Poland). An outsourcing service provider from Central and Eastern Europe is a great choice for US, UK, and West European fintech sector brands.

- If you’re an offshore outsourcing client, make sure time differences work to your advantage – your outsourced team can work while you sleep. For onshore outsourcing or nearshore outsourcing, time differences won’t make such a difference.

- Be present in the channels used by the team and make sure they have ways to contact you when it’s necessary.

Quality Control

Ensuring high-quality deliverables is a common concern in outsourcing. Fintech companies need to work with vendors that have implemented robust quality control processes, including regular code reviews, testing, and performance evaluations, to maintain high standards.

Our advice:

- Work with a fintech business process outsourcing agency that handles every aspect of fintech solutions but also allows the client to be an active participant. This way, you will have control but won’t have to be in charge of everything.

- Strategic planning can accelerate business process outsourcing for fintech firms and software engineers, helping both sides constantly monitor progress and report results.

Data Security

Data security is a top priority in fintech development. Companies must ensure that their outsourcing partner adheres to strict security protocols to protect sensitive financial data from breaches and cyber threats. They should also have strong ethics when it comes to handling their client’s intellectual property and documentation.

Our advice:

- Seek partners that have certificates and ISO standards in place. They prove that the infrastructure and internal processes are prepared for handling important data.

- Establish safety measures at the very beginning of collaboration.

- Inform the outsourcing provider about specific requirements and legal regulations that have to be met by the team and the final product.

Managing Expectations

Clear and realistic expectations are essential for successful outsourcing relationships. Fintech startups and companies should establish well-defined project scopes, timelines, and deliverables together with their software partners to avoid mishaps and ensure alignment with business objectives.

Our advice:

- When your company wants to outsource fintech development, provide insights, expertise, and knowledge about its core business functions and clients. This way, the team will be prepared to meet your needs.

Conclusion

Finding the right partner for a fintech company that will meet all the software development needs involves thorough evaluation across multiple criteria. It’s not always easy, but with the help of this article, it can become possible to get a perfect match the first time around. Each aspect mentioned in this guide plays a critical role in ensuring the success of a digital project for the financial industry, while also reducing cost inefficiency and creating an ideal environment for financial transactions of all types.

Working with a competent outsourcing provider means that money-related businesses can hand the wheel to experienced, seasoned specialists that will take responsibility for the outcome, share business advice regarding tech, and create a product that truly corresponds with company objectives and its clients’ demands.

If you want to work with a reliable outsourcing partner that has a portfolio full of successful fintech software outsourcing results, Speednet should be your number one choice.

Contact us today, and we will discuss your ideas, expectations, and business goals. Our team of experts is ready to help you navigate the complexities of fintech software development and deliver solutions that drive your business domains forward.