We are a banking software development company

We help banks modernise legacy environments and scale critical operations. By bridging the gap between traditional infrastructure and modern delivery, we ensure faster time-to-market and full regulatory compliance.

Top challenges of modern banking

As banking technology partner we already delivered:

-

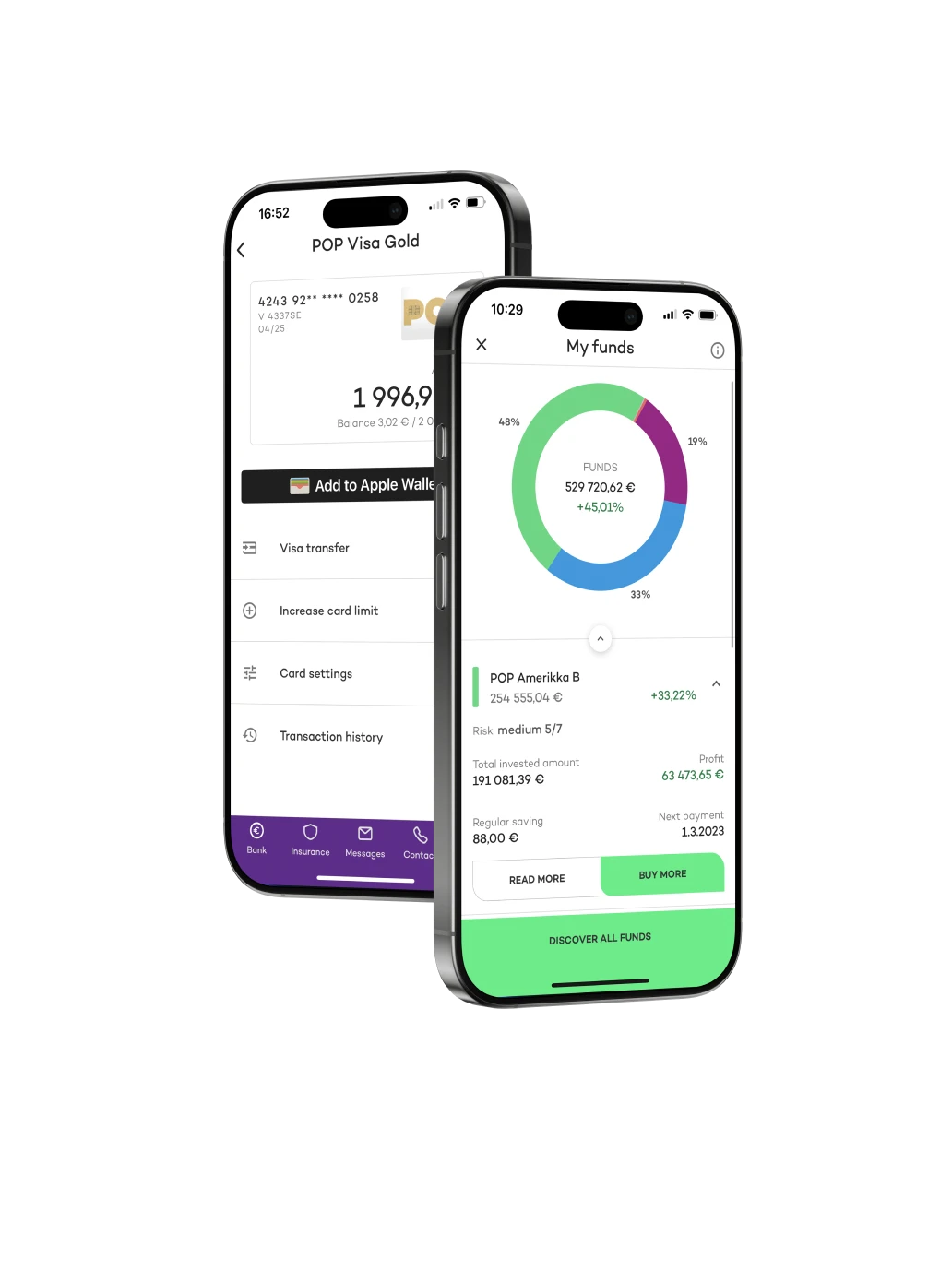

8mobile banking apps

-

40+projects for BFSI

-

4,5xfaster time-to-market

-

+20%customers growth

Research shows that as much as 64% of customers think digital processes such as remote account opening, online banking options or an easy-to-use app are important when deciding who to bank with.

Let's talk about itFill in a short contact form and we’ll get back to you via email within an hour.

Delivery acceleration services

Ready-made digital solutions designed for fast market impact

Our core portfolio brings together proven IP, AI-powered engines, and turnkey frameworks that address most pressing challenges in finance and technology.

Inject speed, flexibility, and engineering excellence directly into your operations

Our services cluster is designed to break down delivery bottlenecks, modernise architectures, and accelerate digital product development.

We usually help the banking industry with:

Digital banking

– Mobile apps: built from scratch

– Internet banking: bespoke web solutions

– VAS: Implementation of Value-Added Services

Financing & wealth

– Lending & mortgages: custom platforms and solutions

– Wealth management: systems for asset management

– Payments: support speed, scale, and regulatory compliance

Corporate & infrastructure

– Corporate banking: comprehensive B2B solutions

– Enterprise platforms: CMS, CRM, and ECM deployment

– Backend & APIs: custom business logic and middleware

Working with Speednet means:

Get insights about technical solutions

for banks and financial institutions

A comprehensive report on the SuperApp trend

- Vision and future directions – embedded banking and SuperApps vs. “light” apps

- Lessons from the market: WeChat, Alipay and more

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.

Frequently asked questions about banking software development

Absolutely! We’re always up to date with the latest banking technology trends. We specialise in helping financial institutions navigate the complexities of digital transformation, whether you’re a traditional bank looking to modernise or a digital-only bank seeking to improve its offerings.

Our team is skilled in implementing the latest banking technologies shaping the future of finance. We understand that each institution has unique needs. This is why we offer custom solutions, both third-party systems and our technology.

Adapt the latest banking technology trends, from mobile banking platforms to AI-driven customer service solutions with our assistance.

Read our guide on Must-Have Features in Today’s Banking Applications.

Although we are not a traditional provider of a ready-made core banking system. Our services include the development and implementation of key banking infrastructure elements. These can be considered core banking development tailored to the individual needs of our clients.

We frequently work hand-in-hand with core banking software companies. Our projects often involve:

- integrating key features of core banking software solutions with existing banking systems,

- API development,

- modernizing legacy systems.

Yes, companies providing core banking solutions might be keen on our following services:

- Integration of new or updated core banking solutions with your clients’ existing banking systems.

- Creation of APIs that facilitate communication between the core banking system and other applications and services.

- Update older, legacy banking systems. Ensure compatibility with modern core banking solutions.

- Testing services. Ensure that implemented core banking solutions function flawlessly. Meet all regulatory requirements.

- Development of advanced security solutions. Protect sensitive financial data processed by core banking systems.

- Development of tools for data analysis and report generation. Decision-making based on data from core banking systems.

- Support and maintenance of implemented systems.

- Mobile interfaces for core banking systems. Enable access to key functions via portable devices.

- Consultations on the latest trends in core banking. Assist in making strategic technological decisions.

- Training programmes for clients’ IT staff. Smooth takeover and management of new core banking systems.

These Speednet services can greatly support firms providing core banking solutions.

We have over 24 years of experience in fintech and banking software development. During this time, we have specialised in providing advanced solutions and a reliable development process. Our clients in the financial industry range from investment banks and private banks to fintech startups and financial organisations.

Get to know challenges and solutions in the banking product development process.

As a financial software development company, we believe there’s no one-size-fits-all answer in programming languages for banking software development. The choice largely depends on the project’s specific requirements, the existing infrastructure, and the long-term goals of the financial institution.

That said, we’ve found several languages particularly well-suited for banking applications:

- Java,

- Python,

- C#,

- Kotlin

- and JavaScript (with Node.js).

Our development team at Speednet is proficient in these languages and more. We adapt our software development process to each project.