Must-have features in today's banking applications: A comprehensive guide

In recent years, mobile banking apps have evolved to become multifaceted hubs for money-related operations and other services. In 2024 and beyond, it’s imperative for financial institutions to listen to modern consumers and respond to their demands. The way users interact with their mobile apps is highly focused on convenience, accessibility, and security. Moreover, since clients no longer want to visit a bank branch, they expect digital solutions that allow them to access their savings accounts, transfer money, pay bills, and handle their digital wallets with just a few taps on their mobile devices.

To enable numerous digital banking tasks from anywhere in the world and provide robust banking application features, finance companies have to revolutionise their approach to software development. Working with partners that can create such versatile online tools is crucial. However, the initial step is to plan which functionalities to include in the final product.

This article is a comprehensive guide that explores the must-have additions for banking apps to remain competitive and future-proof. It discusses which features are worth incorporating to meet and exceed customer expectations. We will look closely at why these banking app features are anticipated and when introducing them is a good business move.

Table of contents

Mobile Banking Market Overview

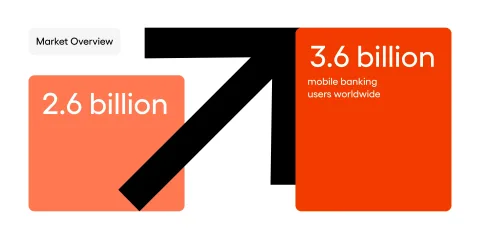

Before we proceed, it’s important to understand the current state of the mobile banking market. It’s undeniable that the sector has seen exponential growth that has remained fairly consistent over the past decade. In 2020, the number of mobile banking users worldwide reached 2.6 billion, and in 2024, it’s expected to exceed 3.6 billion. With a CAGR of over 23% and an expected market reach of over $80 billion, the sector is growing rapidly due to a plethora of factors. One of them is the post-pandemic reliance on smartphones and demand for remote services. Others include improved internet connectivity and a preference for online banking over traditional banking.

Financial institutions are investing heavily in fintech and bank apps to capture the market’s potential and meet customers’ needs. The competition is fierce, so neglecting an online presence is not an option. Continous innovation leads to the best user experience and completely new mobile banking features that go beyond general money-related operations. However, even the most sophisticated functionalities won’t catch the user’s attention if the overall experience is mediocre.

Importance of Improving Customer Experience in Mobile Banking

In times of digital natives, customer experience has become the heart of every mobile banking app. Consumers pay attention to mobile apps offering seamless navigation, intuitive interfaces, and personalised interactions with banks. Financial companies that base their core banking offer on these details can enhance customer retention and loyalty.

That’s why it’s essential to understand new and existing customers’ needs, preferences, and behaviours when creating digital solutions. Leveraging advanced technologies allows banks to deliver individually crafted services oriented towards user engagement. Personalisation drives profitability and competitiveness, making it necessary for financial brands to utilise data analytics and gain insights into their customers to tailor their offers accordingly.

For instance, digitally enabled features like personalised financial advice, targeted product recommendations, and customised alerts can be incorporated into their apps to answer ongoing needs and provide support for decision-making processes. With an easy-to-use, well-designed structure where information flow and every activity can be performed in a few simple steps, the software proposed by banks should quickly display information and perform transactions without any hassle. Continuous usability testing and incorporating customer feedback can help refine the bank’s mobile app design and functionality in the long run.

Best Modern Banking App Features

To stay ahead in the competitive, highly-saturated mobile banking market, financial institutions must offer a comprehensive suite of mobile banking app features that cater to diverse customer needs. Here are our picks of what to include in today’s banking applications:

Security Measures

Security in a mobile banking app is an absolute priority in times when cybercrime is expected to increase year-on-year. Current and new customers need assurance that their financial data is protected against various types of threats. Key security measures to include in a mobile app are:

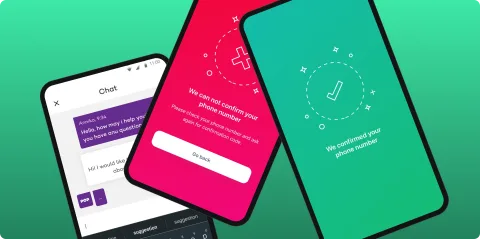

Two-Factor Authentication (2FA): Adds an extra layer of security by requiring users to provide two forms of identification before accessing their bank accounts. This could be a combination of something the user knows (a password), something the user has (a mobile device), or something the user is (biometrics).

Multi-Factor Authentication (MFA): Enhances security risks prevention by combining multiple verification methods, such as passwords, biometrics, and one-time codes. MFA provides a more robust defence against unauthorised access, even if one factor is compromised.

Biometric Logins: Utilises fingerprint, facial recognition, or voice recognition technology to secure access. Biometric authentication offers a convenient and secure way for users to log in, reducing reliance on passwords which can be forgotten or stolen.

Encryption Protocols: Ensures data is encrypted during transmission and storage, protecting it from unauthorised access. Besides standard safeguarding protocols like advanced encryption standards (AES) and secure socket layer (SSL), banks should come up with their own, advanced measures to ensure the highest level of security.

Fraud Detection: Thanks to AI advancement, transactions monitoring for suspicious activity can be automated to provide instant notifications for unusual login attempts or other atypical events. Additionally, incorporating Play Integrity API enables improved app integrity by detecting potentially harmful and unverified versions. Implementing root and jailbreak detections further secures the application by identifying devices that have been tampered with.

Certificate Pinning: A security measure necessary to ensure that the app only communicates with trusted servers.

Data Confidentiality Features: There are several methods that can be combined to protect sensitive information, like Keychain Secure Storage and Symmetric Cryptography.

Request Signing: Verifies the authenticity of requests to prevent tampering and replay attacks.

Bank Account Management

Effective bank account management features in an online banking app are crucial for providing users with easy access to their financial information, credit and debit cards, as well as budgeting tools. There are several essential functionalities like account opening with online customer authentication, account balance checking before and after login, and real-time updates to ensure that users have accurate information about their financial status, helping them make informed decisions.

Comprehensive and searchable records of past transactions should be available via the history feature. An easily navigable transaction history with advanced search and filtering allows users to track their spending, verify transactions, and detect any unauthorised activity. Essential features such as categorisation of transactions, visual representations of spending patterns, and downloadable statements in various formats (PDF, CSV) can further enhance the customer experience when using a banking app.

Transfers and Payments

Modern mobile banking apps should make sending money without bank account numbers and other inconvenient requirements easy. To do that, they offer the following options:

Peer-to-Peer Payments: Users can send money instantly to a friend’s mobile number. Peer-to-peer payments are convenient for splitting bills, sending gifts, or paying back loans. The examples are Polish BLIK and Swedish Swish – solutions that took P2P payments to the next level of convenience.

QR Code Payments: Another feature for instant payments that enables users to quickly perform transfers within seconds. QR code payments can be used for paying bills and transferring funds.

Digital Wallet Integration: Secure storage and management of multiple payment methods. They can store credit and debit card information, loyalty cards, and even tickets, providing a single point of access for various payment needs. Integration with digital wallet providers like Google Pay and Apple Pay is also appreciated by customers.

Near Field Communication (NFC) Payments: Contactless payments are increasingly popular for their speed and convenience. Users can make transactions by simply tapping their mobile devices.

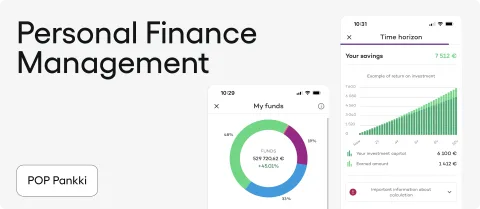

Personal Finance Management

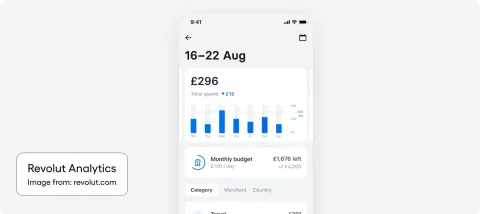

Personal finance management tools help users take control of their financial well-being via a mobile banking app. For example, budget tracking is essential for monitoring income and expenses, setting spending limits, and alerting users when they are close to exceeding their assumed budget. Other banking app features, such as integration with third-party budgeting apps, automated savings based on spending patterns, and personalised financial tips, can further enhance the customer experience.

Spending analysis in the bank app provides insights into spending habits. Such tools can categorise expenses, providing users with a clear picture of where their money is going and helping them identify areas where they can save. Together with goal-setting functionalities, they can be helpful in achieving financial goals like saving for a holiday, a new car, or an emergency fund.

Customer Support

Robust customer support options are vital for resolving issues quickly and efficiently. Important features include:

Chatbots: AI-powered chatbots that provide instant support 24/7 and answer common queries. They can handle a wide range of tasks, from answering frequently asked questions to assisting with transactions.

Live Chat: For more complicated customer service tasks where human support is necessary is a core banking feature. Access via a mobile app is convenient and enables users to quickly resolve potential problems.

In-app Appointment Scheduling: Some cases require in-person presence. Scheduling a meeting with a bank representative makes it easier to find a suitable date.

Omnichannel Support: Providing consistent support across multiple traditional digital channels, including chat, phone, social media, and email lets users choose the method that is most comfortable for them.

Personalisation: Tailored support based on user profiles and past interactions is a great way to make users feel valued and understood, enhancing their overall customer experience.

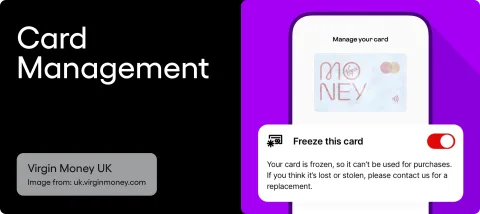

Card Management

Card management features enhance user convenience and security. For instance, if users can instantly report a lost or stolen card via a mobile banking app, they can prevent unauthorised transactions. The same goes for temporary suspension of all ATM card transactions, which is useful if a card is misplaced but not necessarily lost, providing a security measure for a set period of time.

Users should also be able to order a new or replacement card through the app to reduce downtime. Additional functionalities such as an ATM locator feature, setting spending limits, enabling or disabling international transactions, and viewing PIN codes can make card management truly advantageous.

Loan and Credit Services

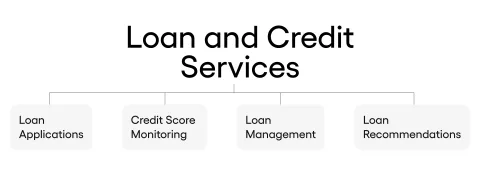

Integrating loan and credit services into mobile banking apps is a great addition besides classic core banking offers. A successful banking app can provide:

Loan Applications: Streamlining the loan application process can reduce the time and effort required to apply for a loan, enhancing the user experience.

Credit Score Monitoring: Regular updates on credit scores and tips to improve them can help users understand their credit health and take steps to fix it.

Loan Management: Payment schedules and payoff projections displayed in mobile apps support keeping track of loan repayments and adequate financial planning.

Loan Recommendations: Pre-approved loan offers based on real-time credit score updates can be a great way to find suitable proposals and make informed decisions.

Bill Payments

Convenient bill payments are a must-have among mobile banking app features. Examples are recurring automatic payments for regular spending that help customers never miss a due date and reduce the risk of late fees. Additionally, notifications and reminders support users in staying on top of their financial obligations and avoiding missed payments.

For one-off bills, mobile banking apps can offer one-time payments for easy and quick processing. With the integration with multiple entities and categorisation of bills, users stay informed about their transaction history by checking their cash app.

Notifications and Alerts

Timely notifications and alerts keep users informed and engaged at all times. Important features include:

Transaction Alerts: Real-time alerts for account activity can be utilised by users to monitor their account activity and detect any unauthorised transactions.

Balance Updates: Notifications when account balances reach certain thresholds are crucial for financial management.

Promotional Offers: Alerts about the bank’s new products, services, and promotional offers inform users about new opportunities and enhance their overall banking experience.

Customisation: In-app notifications settings should be fully customisable to provide tailor-made information users are interested in.

Integration with Smart Devices: Notifications displayed on smartwatches keep users constantly on top of their accounts.

Multi-Currency Support

For users who deal with multiple currencies in their banking transactions, multi-currency support is essential. The features of a successful banking app in that area include:

Currency Conversion: Real-time currency conversion rates ensure that users have accurate information about currency values, helping them make informed decisions about currency exchange.

Multi-Currency Accounts: They provide the ability to hold and manage multiple currencies within a single account, simplifying the management of different currencies and providing a single point of access for various currencies.

International Transfers: Easy and cost-effective international money transfers are imperative to transfer funds abroad conveniently. Support for rare currencies is an additional plus.

Trading Platforms: By providing real-time currency rate alerts and allowing users to perform exchange transactions, mobile banking apps can support investment efforts.

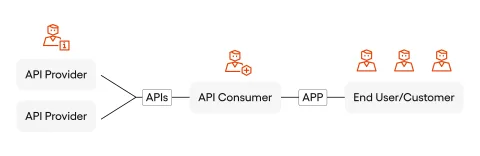

Open Banking Integration

API support is important for gaining seamless access with a wide range of external solutions to extend the functionality of a mobile banking app. Customisable API settings, real-time data sharing, and support for multiple API standards are also nice to have.

Value-added services are an integral part of modern financial applications, and they go far beyond standard money-related operations like investments, insurance, or fintech services. They provide users with additional resources to manage various parts of their lives, like transport, entertainment, and shopping.

Another great addition to mobile banking apps is seamless integration with popular third-party services and financial software, like budget planning or bill-splitting solutions. They provide access to a wider range of tools, making banking applications powerful hubs for all financial operations.

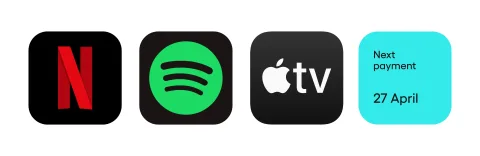

Subscription Management

A mobile banking app can integrate directly with subscription providers to let users monitor and manage such services in one place. Subscription tracking can help users stay on top of their recurring payments and avoid unnecessary charges.

Easy options to cancel unwanted subscriptions is another great benefit that increases convenience and reduces costs. Notifications for upcoming subscription payments can help users avoid missed payments and manage their finances more effectively.

Crypto Exchange & Payment

With the growing popularity of cryptocurrencies, integrating crypto features can attract a tech-savvy audience to mobile banking apps. Which ones are worth exploring?

Currency Exchange: In-app cryptocurrency trading and exchange services provide a comfortable and secure way to trade cryptocurrencies, enhancing user satisfaction and engagement. Thanks to real-time crypto price alerts, customers can make better investment decisions.

Crypto Payments: Ability to make payments using cryptocurrencies is a flexible option for users that want to explore alternative transaction processing.

Crypto Wallets: The best way to securely store and manage various crypto coins, accessing them only when necessary. Support for a wider range of currencies is highly appreciated.

Pressure to Stay Competitive

The banking industry is considered highly competitive. New fintech startups constantly challenge traditional banks, changing the status quo and making them embrace innovation. To stay ahead of competitors, banks must continuously invest in tech advancements and adapt to changing market demands by introducing high-quality features mentioned above.

Providing an exquisite mobile banking experience with all the offered services is also a must. Banks are obliged to leverage data analytics and browse through customer feedback to truly refine their offerings and meet evolving expectations. By doing so, they can build long-lasting customer relationships without worrying about competitors. It’s also essential to foster collaboration with fintech companies and outsourcing vendors that can support banks with access to top-notch technologies and help them introduce solutions that stay ahead of the curve.

Explore Banking Case Studies

To truly understand the impact of all the features mentioned in this article and how they can transform banking experiences, exploring real-world case studies is essential. At Speednet, we’ve helped several financial institutions reach and exceed their business goals by developing robust software solutions with powerful functionalities on board.

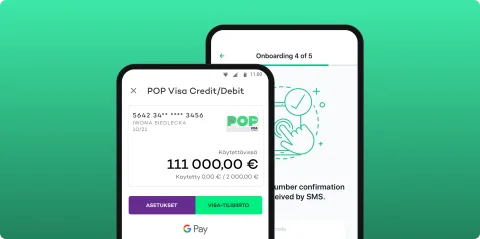

Examples from real life showcase valuable insights into the challenges, solutions, and outcomes of implementing advanced features into various banking environments. For instance, our client Pop Pankki, a Finnish banking app, increased their profit by 126% and scored the highest customer satisfaction rate in Nordic countries.

They outsourced software development to us and digitally transformed their operations to meet the unique needs of their customers. The brand was strongly focused on usability, convenient features, and additional offers for customers, increasing insurance sales via the app by 20%. It’s a spectacular success story, proving that betting on a modern approach is the best way for banking apps to thrive.

Delve into other case studies of our clients to gain a deeper understanding of what makes banking applications successful.

Final Word

As the mobile banking market continues to transform, it’s important to find a software development partner that can integrate the necessary must-have features into a successful banking app. Financial institutions should invest in outsourcing to constantly deliver high quality and simultaneously optimise the budget. Speednet is at your service – let us help you achieve long-term success with user-centric financial solutions.