New fintech innovation in 2025? Speednet’s predictions on the next big thing

Imagine waking up in the morning and, before checking your phone, your AI-powered financial assistant has already reviewed your bank accounts, analysed your financial behaviour, and estimated when your next pay cheque will arrive. It not only suggests a budget for the week but also identifies an alternative financing option that optimises your liquidity without burdening you with excessive interest. This isn’t science fiction—it’s the direction fintech is heading in 2025.

Over the past decade, fintech has undergone an enormous transformation. It started as a disruptor and evolved into a dominant player in the financial sector. From AI-driven online banking to blockchain-based assets, technology has reshaped how individuals and businesses manage money. The rise of embedded finance, decentralised financial services, and hyper-personalised banking has shifted control away from traditional banks, empowering consumers and tech-driven platforms. Now, in 2025, another wave of this transformation is underway. Let’s examine how 2024 set the stage for what’s next and which trends are predicted to be the most promising for 2025.

Table of contents

2024: The Year That Redefined Fintech

The fintech industry saw remarkable expansion in 2024. According to Boston Consulting Group (BCG), revenues increased by 14% year-on-year, with non-crypto, non-China-based sectors growing by over 21%. This growth was largely fuelled by AI’s widespread adoption, embedded finance, and advancements in regulatory technology (RegTech).

As the World Economic Forum states: “With more than $350 billion of venture capital (VC) funding invested since 2015, fintech has become an industry with global net revenue exceeding $150 billion in 2023 and is expected to grow to $400 billion by 2028”. It’s probably safe to assume that AI-driven financial services attracted a significant portion of these investments in 2024, especially in risk control, automated credit scoring, and algorithm-powered investment advisory platforms. Meanwhile, traditional banks increasingly partnered with fintech startups, leveraging API-driven integrations, digital wallets, and financial literacy tools.

Regulatory changes also played a defining role. In Europe, updates to PSD2 and the introduction of PSD3 strengthened compliance requirements for online banking, while the AI Act introduced new regulations for AI-driven financial management. In the US, stricter anti-money laundering (AML) policies pushed financial institutions to scale AI-powered fraud detection systems.

Beyond the numbers, the most significant transformation in 2024 was how AI became integral to financial technology. It was no longer just an enhancement—it became the engine driving financial automation and personalised banking experiences. Fintech firms harnessed deep data analytics, embedding predictive intelligence into everything from banking apps to investment platforms.

Key Trends in 2024 and Their Influence

The past year brought a series of breakthroughs that redefined the financial sector. Fintech brands and traditional financial institutions adopted innovative solutions to meet the changing expectations of consumers. Let’s explore the key shifts that shaped the landscape.

AI’s Expanding Role in Financial Services

Artificial intelligence was at the forefront of fintech’s transformation, evolving beyond process automation to support financial education, provide better risk management, and enable personalised banking with sophisticated financial apps.

One of the most impactful applications was in credit scoring. Traditional models often excluded individuals with limited credit history, but AI-driven systems used behavioural data, transaction history, and machine learning to create more dynamic assessments and increase financial inclusion. This approach expanded access to credit for millions worldwide, particularly in underserved markets.

AI-powered investment platforms also gained traction, with robo-advisors outperforming human wealth managers in various areas. By analysing real-time data, these tools crafted customised investment strategies that minimised risk while optimising returns, enabling users to increase their returns.

On the regulatory side, AI streamlined compliance processes, reducing human error and helping financial institutions stay aligned with emerging requirements like PSD3 and DORA.

Embedded Finance: A Seamless Experience

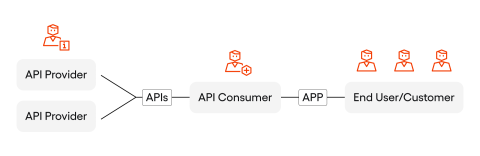

Embedded finance became a defining feature of 2024’s fintech landscape, with banks increasingly collaborating with external platforms to integrate financial services into e-commerce, the insurance industry, and payment ecosystems. Through the use of APIs, financial institutions were able to seamlessly connect with third-party providers, allowing consumers to access banking features without leaving their preferred platforms.

For instance, BNPL (Buy Now, Pay Later) solutions became fully integrated into major retail platforms, eliminating the need for external credit applications. Similarly, online wallets partnered with insurance providers, allowing users to purchase personalised financial products within their apps. These integrations marked a shift towards a financial experience that was not only digital-first, but also deeply embedded into everyday transactions.

Elevating Digital Banking Experiences

With consumers expecting faster, more intuitive interactions, fintech firms prioritised improving digital banking experiences. AI-powered virtual assistants evolved from answering simple queries to providing real-time financial advice, transaction insights, and budgeting recommendations.

Banks also streamlined mobile experiences, introducing instant digital identity verification, one-click account openings, and real-time money transfers. Personalised financial dashboards became common, giving users a clearer picture of their personal finances, including savings, investments, and spending habits. This shift wasn’t just about convenience—it empowered consumers with greater financial literacy and control.

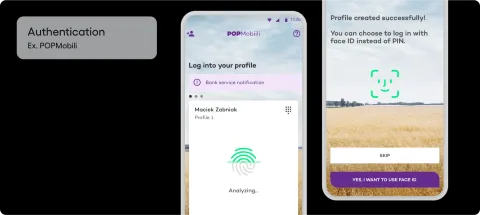

Strengthening Security with Biometrics

As digital transactions grew, so did the sophistication of cyber threats. In response, financial companies expanded their use of biometric security. Fingerprint scanning, facial recognition, and behavioural biometrics became standard in payment apps and platforms.

AI fraud detection systems analysed transaction patterns in real time, flagging anomalies before financial losses occurred. Many banks also implemented AI-driven anti-money laundering (AML) measures, reducing investigation times and improving fraud prevention.

Speednet’s Predictions for Fintech Innovation in 2025

2025 is expected to bring a wave of new fintech innovations that will redefine financial services, regulatory frameworks, and customer expectations. From AI-powered financial automation to sustainability-focused fintech, these trends will shape the next era of digital banking, compliance, and embedded finance. Below, we explore Speednet’s eight key predictions for fintech in 2025 and how they will impact the industry.

Advanced Automation and AI

Artificial intelligence has already revolutionised customer experience, compliance, and risk prediction, but in 2025, AI will go even further, becoming an autonomous decision-maker in financial processes. This means that the upcoming year might bring a shift from AI as an assistant to AI as an independent financial strategist capable of handling transactions, optimising savings, and dynamically managing investments.

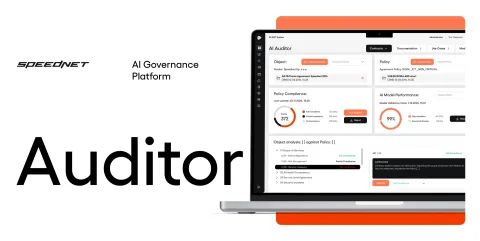

AI Governance

With AI taking on a more significant role in financial services, governance and ethical AI deployment will be crucial. Regulators and the fintech sector will focus on ensuring AI-powered financial decision-making is fair, transparent, and unbiased. Algorithm-based lending, alternative credit scoring, and risk assessments will need to comply with new AI ethics standards to prevent discrimination and algorithmic bias.

AI Wallets

The rise of AI online wallets will change how people manage and optimise their finances. They will be smarter than ever, analysing spending patterns, transaction histories, and personal financial goals in real time. By providing automated budgeting insights, savings recommendations, and investment strategies, such wallets will empower users to make better financial decisions with minimal manual effort.

AI-Powered Compliance

Regulatory compliance is often a complex, costly, and time-consuming process for financial organisations. In 2025, AI will take on an even greater role in automating compliance. Regulatory reporting tools that use algorithms (e.g. machine learning) will help financial firms analyse vast amounts of transaction data, detect anomalies, and ensure adherence to financial regulations such as GDPR, CCPA, and AI governance laws (e.g. the AI Act in the EU).

Decentralised Autonomous Chatbots

Customer support in financial services will shift towards decentralised, AI-based chatbots that operate autonomously. Unlike traditional chatbots, these systems will leverage machine learning, predictive analytics, and real-time regulatory updates to provide hyper-personalised financial guidance. They will be capable of advising customers on long-term and short-term loans, insurance, investments, and risk prevention with accuracy comparable to human advisors.

Greater Product Differentiation with AI

Artificial intelligence will enable established financial institutions to create highly customised financial products, adjusting features in real time based on customer preferences and market conditions. Financial offers such as loan terms, interest rates, and insurance policies will be dynamically optimised based on AI risk assessment and financial forecasting for specific clients.

Regulatory Development & Security

As fintech continues to integrate AI and cloud-based financial services, the regulatory landscape will adapt to address compliance challenges and emerging security risks. 2025 will see increased regulatory enforcement around AI decision-making, cybersecurity, and identity verification.

Compliance and Risk Management (AI Act, PSD2, PSD3, DORA, and NIS2)

Regulators worldwide are tightening oversight of financial technology firms. Europe’s AI Act, PSD3, and DORA frameworks will introduce more stringent requirements for AI governance, data security, and financial stability. Similarly, NIS2 (Network and Information Security Directive) will enforce tougher cybersecurity standards on financial services companies and mobile banking apps.

Proof of Personhood (Digital Identity Verification)

As AI deepfakes and identity fraud become more sophisticated, financial brands will implement “proof of personhood” technologies to ensure the authenticity of users. Biometric authentication, AI behavioural analysis, and blockchain-based identity verification will become the norm, enhancing security in banking, digital payments, and peer-to-peer lending.

System Modernisation

Legacy banking systems continue to be a major bottleneck for fintech innovation. In 2025, the finance industry will abandon outdated infrastructure in favour of modern cloud services that support real-time financial data analytics, AI-powered mobile banking, and advanced automation.

Replacing Legacy Systems with Modern Technologies

Traditional banking infrastructure often struggles to handle the real-time, data-heavy demands of modern fintech companies. As a result, many banks will invest in cloud computing, smart contracts, and distributed ledger technology to improve efficiency, increase cost savings, and accelerate fintech innovation even further.

Greater Utilisation of Financial Data with AI

Big data analytics will enable fintech companies to extract deeper insights from customer behaviour, market trends, and transaction histories. By leveraging real-time data, banks, and fintech companies will offer more precise risk assessments, fraud detection, and customer-centric financial solutions.

Sustainable and Green Fintech

The fintech industry is moving towards sustainability-focused financial services, as both consumers and businesses demand eco-friendly banking options and financial products. In 2025, we will see increased investment in green fintech, with a focus on carbon tracking, green loans, and sustainable online wallets.

The financial industry will introduce climate-conscious lending programmes, where large and small businesses receive preferential financing rates based on their carbon footprint reduction efforts. Meanwhile, green investment platforms will gain traction, allowing individuals to invest in ESG-compliant assets while tracking their environmental impact.

Central Bank Digital Currencies (CBDCs)

Governments worldwide are moving closer to full-scale adoption of Central Bank Digital Currencies (CBDCs). In 2025, several major economies are expected to launch CBDC pilots or full implementations, transforming cross-border payments, monetary policies, and financial inclusion efforts. Central banks in countries such as China, the European Union, and the United States are actively researching or testing digital currency frameworks, aiming to modernise the financial ecosystem while maintaining regulatory control.

CBDCs will offer faster transactions, lower costs, and improved transparency, reducing the need for intermediaries in global trade and digital asset management. Thanks to blockchain and distributed ledger technology, such currencies will enhance security and efficiency in payments, preventing fraud and ensuring real-time settlement of transactions.

Additionally, they will provide greater financial access to underbanked populations, allowing individuals in regions with limited banking infrastructure to participate in the formal economy through cyber wallets and mobile banking solutions. As regulatory concerns around privacy, security, and monetary stability continue to evolve, central banks will need to carefully balance innovation with risk prevention, ensuring that CBDCs complement rather than disrupt existing financial systems.

Open Banking

Open banking will continue to expand, allowing consumers greater control over their financial data and broader access to personalised banking services. In 2025, we can expect to see more advanced API integrations, enabling seamless financial experiences across multiple platforms such as payment apps and banking platforms.

As traditional banks increasingly collaborate with fintech companies, the industry will move towards a fully interoperable financial ecosystem, where users can access real-time financial insights, automated budgeting tools, and AI investment recommendations through a single interface. This level of integration will also drive more competitive financial products, as banks and fintech firms leverage customer data to offer hyper-personalised lending rates, savings plans, and financial incentives.

Super Apps

Super apps—comprehensive financial ecosystems that merge banking, payments, insurance, and e-commerce—will reshape the fintech landscape in 2025. These next-generation platforms will leverage AI-driven insights, streamline investment management, and expand embedded finance capabilities, offering users a seamless, all-in-one financial experience. As demand for convenience and hyper-personalisation increases, these solutions will become the go-to choice for handling both daily transactions and long-term wealth planning.

Companies like PayPal, Revolut, and WeChat are already evolving into fully integrated financial platforms, setting the stage for widespread global adoption. In regions such as Asia and Latin America, where digital-first financial services dominate, these multi-functional apps will accelerate financial inclusion by providing access to a diverse range of products tailored to personal and business finance needs. Meanwhile, in Western markets, regulatory hurdles may slow adoption, but the increasing demand for streamlined financial services will push banks and fintech firms to consolidate offerings within unified, AI-powered platforms.

Banking as a Service (BaaS)

Banking-as-a-Service (BaaS) will play a pivotal role in the fintech revolution, enabling non-banking companies to provide financial services without navigating the complexities of full banking licences. By leveraging BaaS platforms, businesses will be able to launch digital wallets, lending solutions, and investment services effortlessly, fostering competition and improving financial accessibility across multiple industries. This plug-and-play approach will empower companies in e-commerce, the gig economy, and retail to embed financial tools directly within their platforms, unlocking new revenue streams and strengthening customer engagement.

As this model gains traction, more brands will incorporate embedded financial solutions—such as automated savings accounts, alternative lending options, and AI-driven wealth management—directly into their ecosystems. This evolution will blur the lines between traditional banking and fintech, allowing marketplaces, social platforms, and digital service providers to act as financial enablers. Consequently, consumers will enjoy greater financial accessibility, seamlessly managing their money wherever they shop, work, or interact online, while fintech firms and non-financial businesses benefit from expanded monetisation opportunities.

Final Word

The financial services sector will undergo another major transformation. 2025 will be a defining year for fintech innovation. As traditional banking models continue to evolve, financial institutions, fintech startups, and digital-first businesses must be ready to embrace these new business models, regulatory challenges, and customer expectations.

We are moving into an era where AI decision-making, embedded finance, decentralised digital services, and sustainability-driven fintech will reshape how money moves, how customers interact with financial institutions, and how regulatory frameworks adapt to the rapid pace of change. Companies that embrace these changes with an open mind will be the pioneers of the next wave of financial transformation.

For more insights on financial technology and how to develop future-proof solutions in today’s digital world, check out other articles on the Speednet blog.