Open banking: a clear guide to new financial services

A new study from Juniper Research forecasts that Open Banking API call volume will surpass 720 billion globally by 2029, increasing 427% from 137 billion in 2025. This surge highlights how open banking transforms financial sectors by granting users enhanced control over their financial data and enabling access to innovative financial products and services.

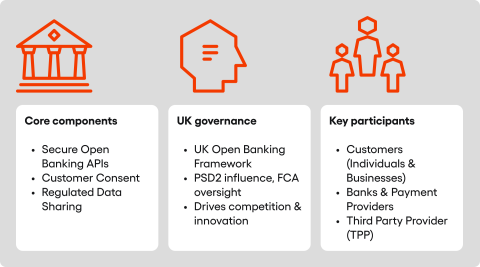

The system’s foundation lies in securely sharing customers’ financial information, always with their consent, with licensed third-party service providers. Regulatory frameworks, significantly influenced by directives from the European Union, which have notably shaped the United Kingdom’s approach to new financial services, are pivotal in guiding these developments.

Table of contents

Understanding open banking and its framework

The essence of open banking involves technological cooperation. This cooperation is made possible by special programming interfaces, known as open banking APIs. These APIs enable secure and controlled communication between financial institutions, like traditional or challenger banks and payment providers, and applications offered by external service providers.

The core of open banking: APIs and consent

In practice, banks, at the customer’s request, provide secure access to specific financial data through these APIs. They can also enable the initiation of payments. To ensure consistency and security, a robust open banking framework and standards, like those developed in the UK, are crucial. These standards ensure different systems can communicate in a unified and secure way.

A fundamental element of the entire system is the customer’s conscious and explicit consent to share their customer data. The consent process must be transparent. Users need to know precisely what data they are sharing, with whom, and for how long. Importantly, they have significantly more control over this process and can withdraw their consent at any time.

A key European directive, the Second Payment Services Directive (PSD2), has been foundational in shaping open banking. PSD2 mandated that banks must allow regulated third-party providers access to customer account information and facilitate payment initiation, always with explicit customer consent. This aimed to spur innovation and competition in financial services.

The United Kingdom transposed PSD2 into its national law and subsequently built a distinctive open banking ecosystem, notably through the work of the Competition and Markets Authority (CMA), making it a prominent example of these new financial services in action.

The UK’s open banking regulation and framework

The UK’s open banking initiatives have been significantly shaped by its specific regulatory environment. This open banking regulation aims to drive competition and innovation within the financial services sector. The framework dictates how data is shared and how payment services are performed.

The ongoing development of the open banking framework ensures that it adapts to new technologies and consumer needs. This includes clarifying roles for financial service providers and technical service providers. It also means addressing emerging security risks effectively.

Key participants: from banks to third-party providers

The open banking ecosystem includes several key groups. Customers, individuals and companies own their data and decide on its use. Banks and payment providers (ASPSPs) manage customers’ bank accounts and are obliged to provide data and services.

Another vital link is the third-party provider (TPP), which is licensed to offer specific services. These include PISPs (Payment Initiation Service Providers), offering payment initiation services, and AISPs (Account Information Service Providers), providing account information and account aggregation services. These TPPs are key to delivering value-added services to consumers and businesses.

Key initiatives shaping the future of payments

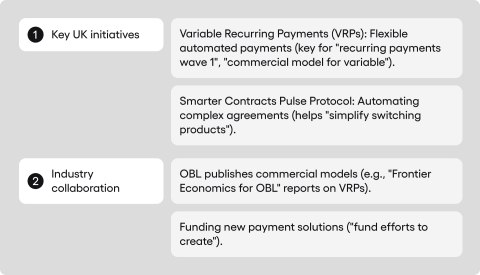

Several key initiatives are pushing the boundaries of what open banking services can offer. These developments focus on creating more flexible and efficient payment solutions. Much work is underway to deliver the initial phase of these innovations.

Variable Recurring Payments (VRPs): a new era for regular payments

Variable Recurring Payments (VRPs) represent a significant step forward for managing regular payments. Unlike traditional direct debits, VRPs allow for payments that can vary in amount and frequency, authorised by the customer upfront. This offers greater flexibility for subscriptions, utility bills, and moving money between savings accounts. Developing Variable Recurring Payments (CVRPs) is a key focus, often called the recurring payments wave 1.

Many firms agree to fund the ongoing development of VRPs. These efforts to create new payment mechanisms aim to benefit both consumers and businesses. The initial phase of work is crucial for establishing a solid foundation.

The commercial model for VRPs and industry collaboration

Establishing a fair commercial model for variable recurring payments is essential for widespread adoption. Open Banking Ltd (OBL), the entity that succeeded the Open Banking Implementation Entity, publishes the commercial model reports. One such key document is the CVRP commercial model report prepared by Frontier Economics for OBL.

This commercial model report, prepared by independent economists, helps define how costs and benefits are shared among participants. The aim is to fund efforts to create a sustainable ecosystem. This often involves collaboration between banks and payment providers and other financial service providers.

Smarter Contracts Pulse Protocol: simplifying complex agreements

The Smarter Contracts Pulse Protocol is another important development. This protocol aims to simplify how complex agreements and automated instructions are handled within the open banking framework. It allows for more sophisticated services with smarter contracts.

The contracts pulse protocol aims to reduce manual intervention and potential errors in executing recurring transactions or other agreement-based financial activities. This technology is particularly relevant for businesses managing complex payment schedules. It should ultimately simplify switching products and services for consumers, too.

The impact of open banking: consumer benefits and adoption

The growth of open banking is having a noticeable impact. OBL’s latest impact report reveals increased consumer adoption of related services. This suggests that more people are comfortable using the financial innovation offered.

Growing adoption: what the reports tell us

Several indicators point to this positive trend. The latest impact report reveals that the number of consumers benefiting from open banking services is growing. The impact report reveals increased trust and utility.

Further evidence, such as April ecosystem highlights and March API performance data, often shows the system maturing. The report reveals increased consumer engagement with tools that help manage their financial data more effectively. This trend means seeing consumer adoption catch up with the technology’s potential.

Practical benefits: savings, switching, and new products

Consumers can make valuable savings using tools that analyse their spending and find better deals on financial products. Open banking also makes switching products and services easier. The goal is to make switching as pain free as possible.

This leads to greater competition among financial providers. It encourages them to offer more attractive financial products and services. These can range from new types of savings accounts to more tailored lending options.

How open banking works in practice

Understanding how open banking services function helps to appreciate their benefits. It relies on secure connections and clear user permissions. This ensures that financial information is handled responsibly.

Accessing financial data and making payments

When a customer wishes to use an open banking service from a TPP, they give explicit consent. This allows the TPP to request specific account information or initiate payments from the customer’s bank account via the bank’s API. This process is designed to be secure and transparent at every step.

Account aggregation is a popular service. It allows users to see all their financial data from different financial institutions in one place. Payment initiation services offer a streamlined way to make online payments directly from a bank account.

The role of security in open banking services

Security is paramount in the open banking framework. Service providers must adhere to strict security protocols to protect customer data. This includes robust authentication methods and encryption to prevent unauthorised access and mitigate security risks.

The framework ensures that customers have a secure way to share their financial information. Regular updates and monitoring of open banking APIs help maintain high security standards. This helps build trust among users of these new financial services.

Challenges and the road ahead for open banking

Despite its successes, open banking still faces challenges. Ensuring consistent service quality across all financial service providers is one such area. Another is continuing to build consumer trust and awareness of the benefits and security measures.

The industry continues to fund efforts to create better user experiences and more innovative value-added services. There is ongoing work to forward the initial phase of new developments. The aim is to make open banking work seamlessly for everyone.

A significant development is the plan to create a new company to deliver the next phase of open banking initiatives. This new company to deliver these services will build on the foundations already laid. You can find the latest news and insights on official open banking channels.

Summary: open banking’s continuing evolution

Open banking has already brought significant changes to financial sectors. It empowers consumers and businesses with greater control over their financial data. It also fosters innovation among financial service providers.

The journey continues with new developments like Commercial Variable Recurring Payments (CVRPs) and the Smarter Contracts Pulse Protocol. The focus remains on delivering secure, user-centric open banking services. The phase of commercial variable recurring payments and other initiatives show the ecosystem is actively evolving.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.