An innovative fintech platform

– that enabled users to choose from more than 25 financial, banking and non-banking institutions.

Learn more about this innovative platform.

An innovative fintech platform

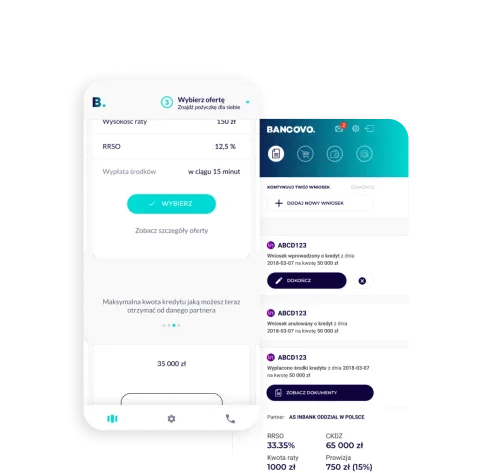

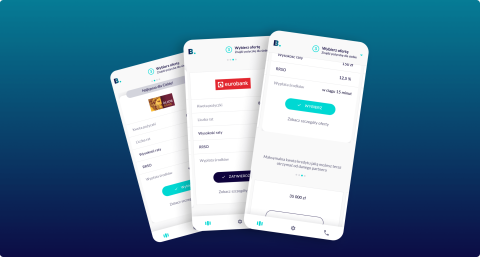

Bancovo, a fintech platform launched in Poland in 2018, set out to transform the lending market by giving consumers direct access to loan and credit offers. The platform connects users with a broad network of financial institutions — including banks and non-banking lenders — offering loans.

The Challenges

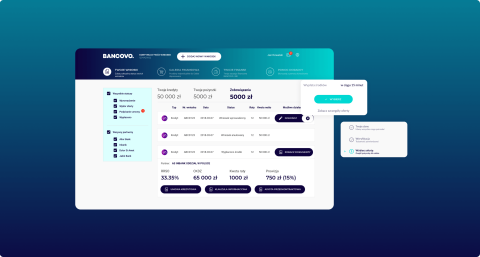

Bancovo needed a platform that could integrate with multiple financial institutions, each with its own technical framework and regulatory requirements. With over 100 microservices, the architecture had to be built to support a growing user base.

The most important numbers

Solution Approach

The project spanned multiple years, from 2017 to 2024, with a strong focus on integration with financial institutions. Our solution includes a system for communication with many financial institutions as well as a reporting system and an extensive back office.

A key priority was designing an intuitive user interface. Despite the platform’s complex architecture, we ensured a smooth and user-friendly experience.

To support long-term operational independence, we provided structured training programmes and detailed documentation, equipping Bancovo’s internal team with the knowledge needed to manage the platform efficiently. The transition was carefully planned to ensure a seamless handover without disruptions.

To tackle all those challenges, we assembled a team of UX designers, backend and frontend developers, and business analysts, all with deep experience in financial IT projects. We built the platform using a technology stack that included Java, .NET, and JavaScript, chosen for its reliability and scalability.

Results

The collaboration led to the successful launch of the Bancovo platform. From the start, users gained access to a wide range of loan offers from over 25 financial institutions, simplifying the borrowing process for Polish consumers. With over 100 microservices, the system is modular and scalable, allowing it to adapt to future growth and changing market needs

Picking the right technology

Meet our partner – Alior Bank

A new service called Bancovo was launched on December 20th – through family and friends tests. The Bancovo brand was owned by a daughter company of the Polish bank – Alior Bank. Its goal was to implement the bank’s current strategy of being a digital rebel.

The Bancovo project is being implemented by a team led by Monika Charamsa, who has been involved with the consumer finance sector since 2001.

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.