An M&A transaction between banks

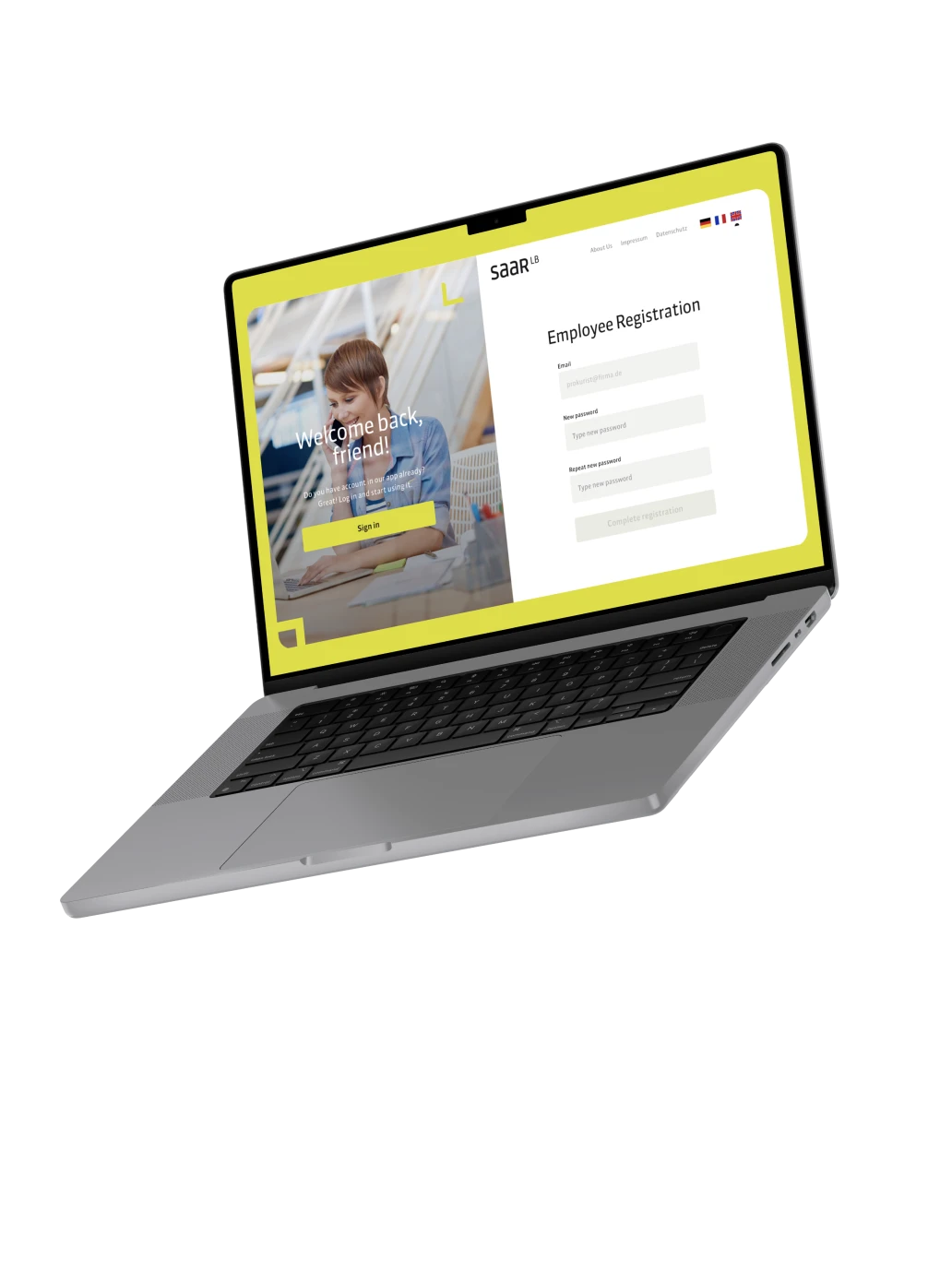

A highly secure online platform for servicing mortgage loans used by customers and bank employees.

Learn more about the solution and our client.

Facilitating an M&A transaction between banks

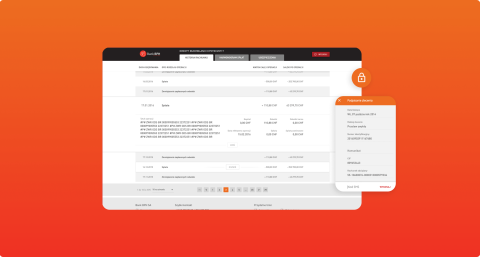

It is a highly secure online platform for servicing mortgage loans used by customers and bank employees. It gives borrowers user-friendly access to key information on their financial products and enables them to track currency exchange rates and easily contact the bank.

What was the challenge?

Our client was in a complex M&A process with another large bank. The Polish Financial Supervision Authority (a regulator of the Polish financial market) set a condition: customers with Swiss franc mortgages had to be provided with a dedicated web application that would let them manage their credit obligations.

1. The platform had to fit the new condition of The Polish Financial Supervision Authority

2. The timing of the project was crucial. We had only 3 months to complete the complex M&A process.

Our solution

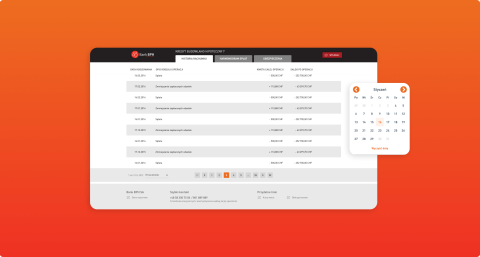

The recipe for success was a mix of SCRUM methodology and complete transparency. Our programmers worked closely with the bank’s senior IT experts at every platform development stage. The system, which is A-rated for security, was delivered on time and budget. The merger process could smoothly continue to a trouble-free completion. As a result, the bank’s employees use the platform to communicate effectively with customers and generate reports and statistics.

What is Scrum?

Scrum is a flexible way to manage tricky projects, primarily used in making software, by working together and improving step by step. It splits tasks into short periods called sprints, which usually last two to four weeks, where teams finish small, working parts of the project. Teams pick Scrum because it lets them change plans quickly if needed and encourages everyone to share ideas in daily meetings, with clear jobs like Scrum Master and Product Owner. This method makes things clear, improves the work, and lets teams organise themselves, which is great for busy, fast-moving projects!

The most important information:

Our Team

Our objective was to design, develop, and test a solution within a three-month timeframe, successfully executed by a dedicated team of nine members. We deployed our frontend and backend developers, testers, DevOps specialists, UX designers, and a project manager to drive the initiative. The team delivered a fully functional website on schedule, meeting all project deadlines.

Meet our partner – Bank BPH

Bank BPH (Bank Przemysłowo-Handlowy) is a Polish universal bank established in 1989. It became part of the General Electric Group in 2009. The bank focuses on servicing existing mortgage loans. Its primary task is to ensure the highest quality of customer service and to implement its business strategy socially responsibly.

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.