New mobile banking app from scratch

that has achieved the best user rating on the market.

The application is used daily by approximately 30,000 Android users and 11,000 iPhone users.

How did our partnership start?

The usability and quality of mobile services are at the heart of any successful banking strategy.

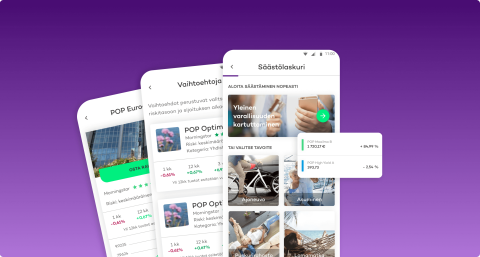

Moving towards modern banking, POP Pankki began the process of deep digital transformation. One of the steps in the process was to build mobile banking from scratch. The goal was not only to increase customer satisfaction but also to open up new opportunities for financial and insurance product sales.

Our solution was one of the foundations of POP Pankki’s digital transformation.

Challenges

- Digital transformation of the bank cooperatives (diverse stakeholders and digital debt).

- New UX/UI supporting users in day-to-day operations.

- Create secure and scalable software for future upgrades.

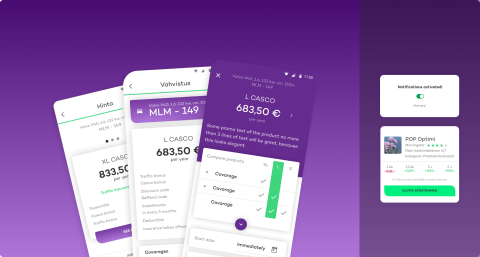

- Cross-sell functions for insurance and mortgages within the app.

- New functionalities enhancing the convenience of the clients.

Creating the new POP Pankki mobile application

Picking the right technology

The most important numbers

Secure authentication

Created for a group of cooperative banks and insurers, the POP Pankki app identifies users using the TUPAS protocol (the Finnish Online Bank Identification Strong Customer Authentication platform). It has also passed the Finnish F-secure security audit.

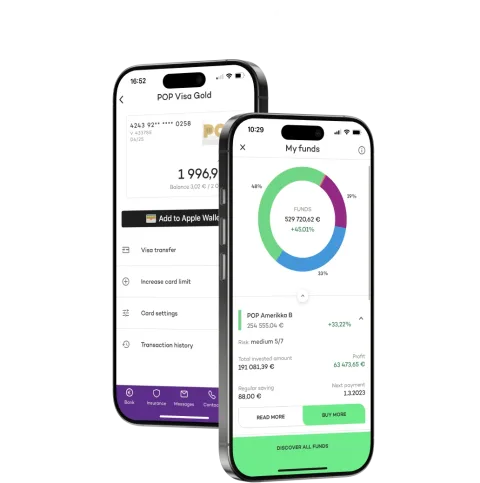

New cross-selling channel

The application not only provides functionalities for the bank’s customers but has also created an entirely new channel for cross-selling. In the year the application was launched, the number of insurance clients increased by nearly 20%. The app communicates with external APIs to complete banking operations (payments, accounts management, savings accounts, loans), servicing insurance (generating quotes, purchasing policies, paying premiums) and external services (e.g. selling investment funds).

Discover the secrets to maximising the success of your banking software with our ebook on value-added services.

Learn more

Enhancing the banking experience

Value-added services refer to features within banking software that enhance main financial products and services. Unlike traditional banking functionalities, such as saving accounts, money transfers, or loans, VAS extend beyond basic functions, which makes banking apps more convenient and universal. Solutions proposed by banks may vary to meet diverse customer needs.

Benefits of implementing VAS

For the end user (consumer):

- Improved overall banking experience

- Stronger customer engagement

- Increased customer loyalty

- Perks and discounts

- Fewer apps to install and use

- One account to rule them all

For the bank or fintech:

- Competitive edge

- Better customer acquisition and retention

- Additional revenue streams

- Higher profit

- Boost for brand reputation

- Future-proofing

Success afterwards

- A new app has increased insurance sales by 20%

- 28-31k active daily users on Android

- 10-11k active daily users on iOS

- In 2019, it achieved the best results in its history, recording a profit increase of 126%

- Enjoyed the highest customer satisfaction in the Scandinavian countries (EPSI Rating 2019)

Learn more about how to create a better mobile app

Read more

After the implementation

Thanks to the current mobile application, the POP Bank Group has been able to position itself larger than its competitors and build an ever-evolving sales channel.

After implementing it and completing other transformation processes in 2019, the bank achieved the best results in its history, recording a profit increase of 126% and enjoying the highest customer satisfaction in the Scandinavian countries (EPSI Rating 2019).

Meet our partner – POP Pankki

POP Pankki is a group of 18 local cooperative banks all over Finland. The group offers retail banking services to private customers, small and medium-sized companies, agricultural and forestry companies, and non-life insurance services to private customers. POP Bank Group’s history dates to 1997.

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.