Digital transformation

Process of going paperless and digitising the credit approval process to improve its efficiency.

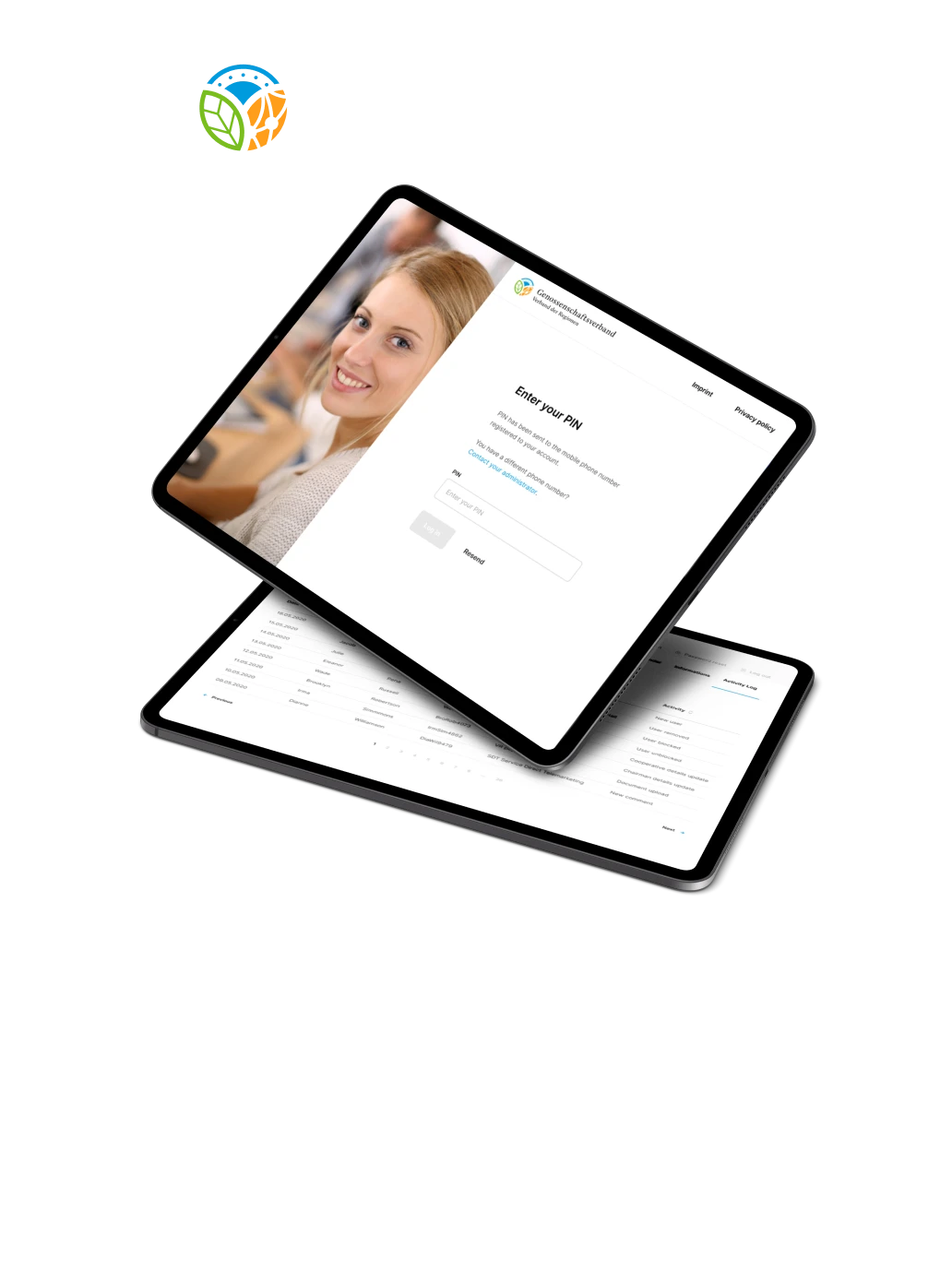

Digitisation of an entirely paper-based B2B-loan application

Team Speednet worked with a large investment bank in Germany to digitise their credit approval process to improve efficiency.

The vision? To create a digital customer interaction platform as a digital face to the customer and scale it to integrate the bank into the customers’ ecosystem.

About the digital transformation

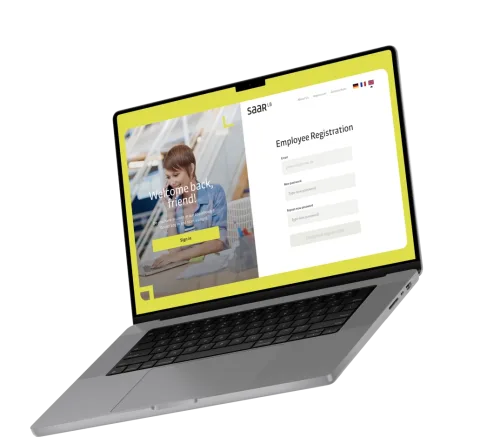

Landesbank Saar is a large German investment bank. The bank provides loans between EUR 20 million and 50 million and operates in Germany and France.

The process of processing a loan application generates a huge amount of documentation. When it was traditionally paper-based, both the client-bank exchanges and the internal circulation of documents were very laborious and time-consuming.

The situation fully revealed its disadvantages when COVID-19 hit. Hence, fast and efficient digital transformation of the key process became absolutely essential.

The most important info

Transforming credit approval for a leading investment bank

During the project, we worked with Horn&Company, a well-known consulting firm.

Speednet’s team of 11 professionals—including frontend and backend developers, business analysts, UX designers, DevOps specialists, testers, and project managers—designed and implemented the new system. It took the team 3 months to reach the MVP stage.

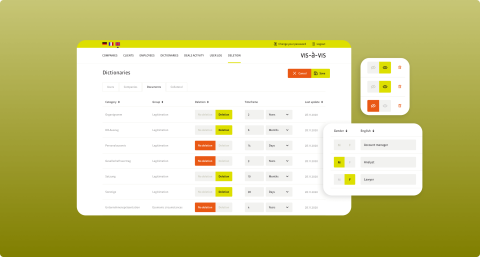

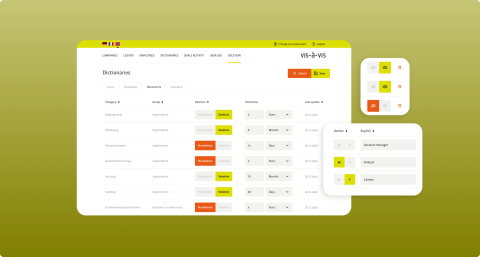

We took care of UX, developing and maintaining a system that enabled three stakeholders: clients, bank employees and top management to participate in a transparent, well-organised and effective process of assessing investment loan applications.

Our solution is fully compatible with the Landesbank Saar core IT system.

The need for digital transformation in banking

Nowadays, traditional banks face unprecedented competition from digital-native neobanks and fintechs. The rise of digital-only banks, such as Revolut, which has amassed 30 million account holders globally in under a decade, underscores a significant shift in customer expectations.

To stay competitive, banks need to modernise their services, improve efficiency, and enhance the digital experience for their clients. Investing in digital transformation is not just about keeping up with trends—it’s a strategic move that allows traditional banks to streamline operations, meet regulatory requirements, and offer the convenience and flexibility that modern customers demand.

Discover the strategies and insights that can help legacy banks thrive and innovate in our new report.

Download for free

Picking the right technology

Meet our partner – Landesbank Saar

Landesbank Saar, or SaarLB, is a Franco-German regional bank headquartered in Saarbrücken, Germany. Established in 1941, it is the largest credit and mortgage bond institution in the Saarland region, with a balance sheet total of approximately €14 billion as of 2017. SaarLB focuses on the Franco-German market, offering services to small and medium-sized enterprises, particularly in corporate and real estate sectors, and project financing in renewable energies.

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.