Insurtech Technology Partner Insurtech software development

We are an insurance software development company

We help the insurance sector decrease time-to-market, stay on top of insurance software development costs, improve back office operations, boost insurance sales and enhance the customer experience.

All that via relevant consulting and custom insurance software development services.

We can help you with:

- Developing web and mobile insurance applications tailored to clients’ needs

- Constructing and refining insurance solutions to enhance performance

- Implementing insurance cross-selling and upselling solutions to boost sales and revenue

- Digitising and automating claims and underwriting processes

- Conducting UX/UI audits and design to improve usability

- Leveraging predictive analytics, data, and reporting tools to provide insights

- Utilising Cloud, DevOps, and AI technologies to enhance scalability and efficiency

- Ensuring security, risk management, and regulatory compliance across insurance solutions

With Speednet, you can:

-

126%profit growth

-

+35%in operation efficiency

-

+20%customers growth

-

4,5 xfaster time to market

Why the insurance industry should go digital

Research suggests that in some markets, as much as nearly half of all new home insurance sales and more than two-thirds of car insurance sales are conducted online.

Insurance business understands the need for change and are adopting newer ways of working, but this isn’t always as easy as it sounds.

The combination of understanding the insurance domain with 24+ years of technical expertise allows us to give you extremely precise time and cost estimates for your project.

Estimate your projectFill in a short contact form and we’ll get back to you via email within an hour.

Our services

We provide a comprehensive solution for insurance software, from ideation to maintenance, including everything in between.

-

Technical Consultancy

Technical ConsultancyWe provide advisory services helping businesses leverage technology effectively to unlock and demonstrate value to their customers.

-

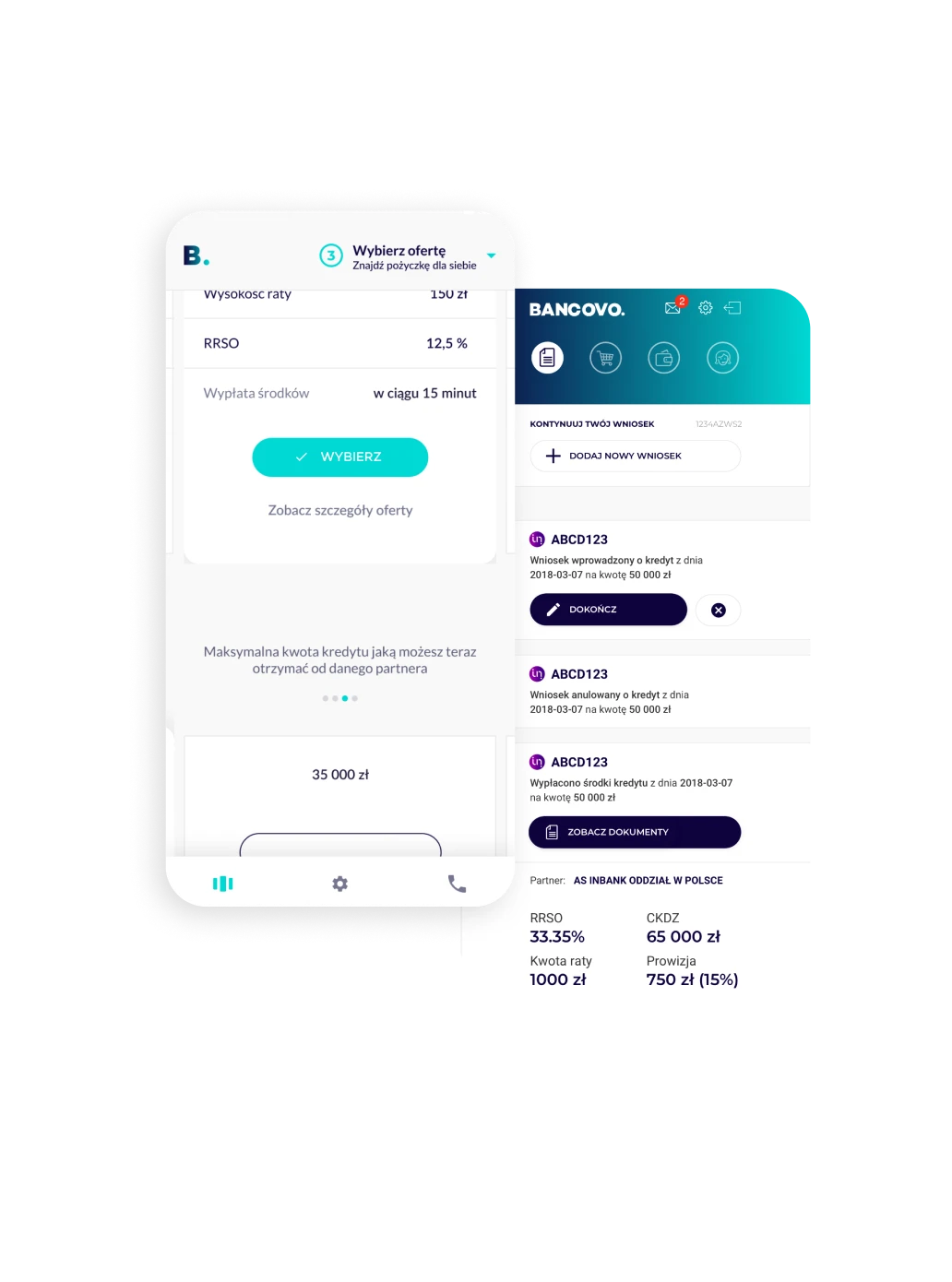

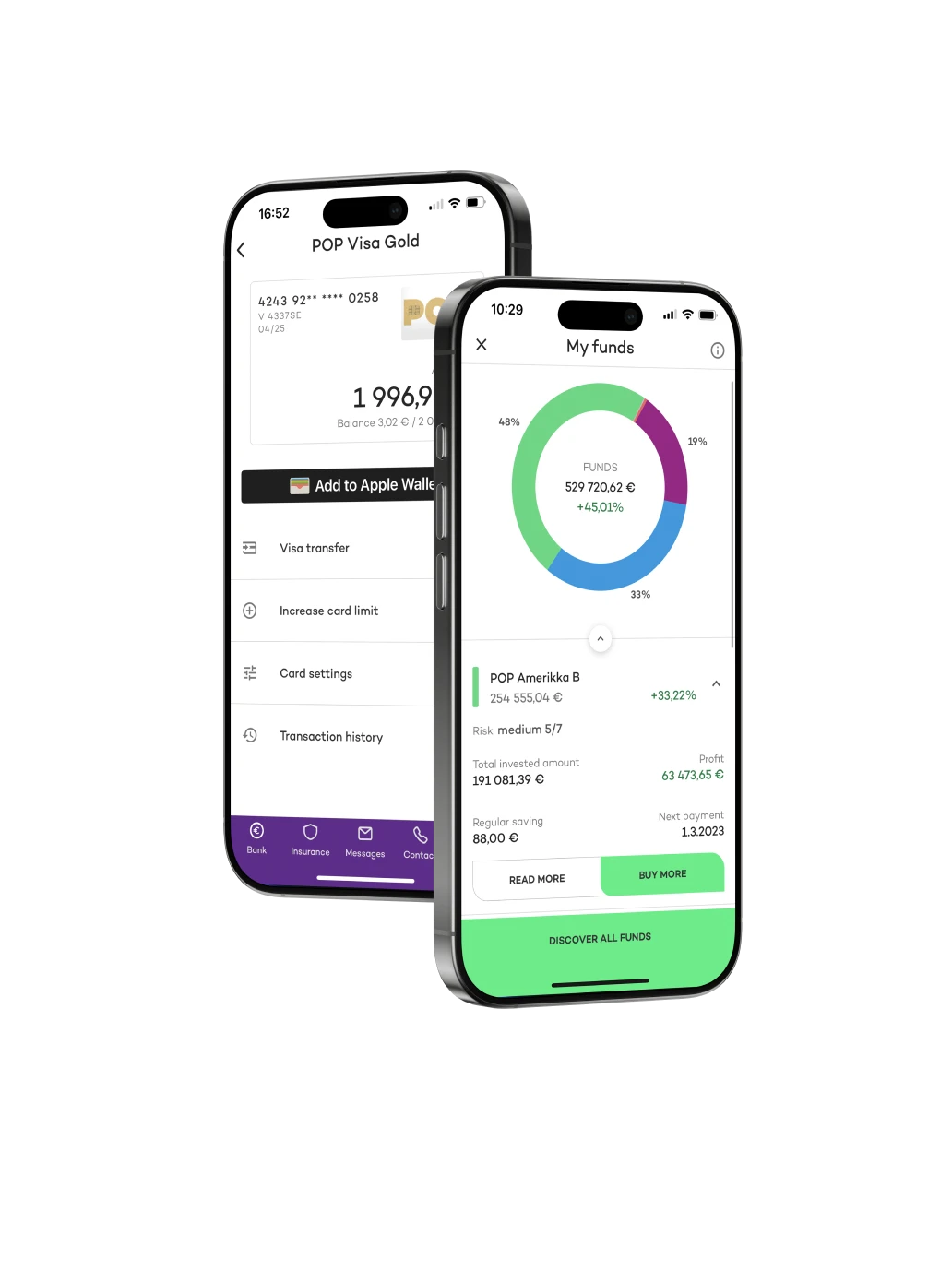

Mobile App Development

Mobile App DevelopmentWe design, develop and maintain mobile apps that are user-friendly, efficient, and aligned with business objectives.

-

Web Development

Web DevelopmentWe offer tailored end-to-end web development services, covering everything from initial design to implementation and maintenance.

-

Product Design

Product DesignWe specialize in crafting digital products with a focus on seamless user experiences, driving customer satisfaction and retention.

We can also help you with

Our process of collaboration with insurers

We use a proven methodology of reliable and predictable software delivery.

Reviews

Industry recognition

At our company, we always strive to deliver solutions of the highest calibre. We value collaboration with every client, whether they are international giants or burgeoning insurtech startups. Each accolade or award nomination brings us great joy, as it reaffirms that our work is consistently of the highest standard.

We’re tech specialists

We provide a comprehensive solution, from ideation to maintenance, including everything in between.

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.

Frequently asked questions about insurance software development

Insurtech refers to the use of innovative technologies to improve and streamline the insurance industry and align with consumer expectations. It includes a wide range of digital solutions and platforms designed to enhance various aspects of insurance operations, including policy management and distribution, claims management, underwriting, customer service and risk assessment.

Insurtech companies aim to make insurance services more accessible, efficient, and user-friendly while also helping traditional insurance companies adapt to the digital age. This technology-driven approach is transforming the insurance sector by offering new products, improving customer experiences, and optimising business operations.

Insurtech has proven particularly valuable across various insurance areas, with some sectors experiencing a more significant impact:

- Auto Insurance sector

- Health Insurance sector

- Property and Casualty Insurance sector

- Life Insurance sector

- Travel Insurance sector

- Cyber Insurance sector

- Small Business Insurance sector

These sectors have seen significant advancements through insurtech solutions, improving efficiency, customer experience, and risk management. The impact varies based on market readiness and regulatory environments, but the trend towards digitalisation continues across all insurance sectors.

Certainly! At Speednet, we specialise in developing custom mobile applications for the insurance industry, which will enhance customer experience as well as the efficiency of insurance agents. Our team has extensive experience in creating robust, user-friendly mobile insurance software solutions from scratch, tailored to the unique needs of traditional insurance companies.