Fintech industry trends 2024: Impact on financial services

Over the years, the financial technology (fintech) sector proved to be a successful and demanded alternative to traditional banking services and financial offers. Halfway through 2024 and looking beyond, it’s clear that this industry will continue to transform and shape the way people interact with money. From paying bills to investing, taking loans, and buying goods, modern financial solutions are forecasted to continuously improve and disrupt the market.

In this article, we’ll explore the key fintech trends that could have the most significant impact on this niche in the years to come. The list of potential tendencies is based on years of experience in creating fintech software, various reports delivered by specialists in the field, and our clients’ ambitions to deliver valuable, high-quality services to consumers interested in future-proof financial products, systems, and apps.

Table of contents

Fintech Industry Overview

Before we dive into the thrilling world of the possibilities that the global fintech market can embrace, let’s have a look at what and who shaped the current landscape. Additionally, we want to discuss the potential of the ongoing situation and which areas will probably expand in the future.

Brief History of Fintech

The roots of the fintech industry can be traced back to the mid-20th century, when in 1950 the first credit card was invented. In 1967, the first ATM was introduced. Both these events marked the beginning of technology’s integration into financial services. However, the term “fintech” itself gained prominence with the advent of internet banking in the 1990s. This period saw the first wave of fintech innovation, with banks moving their services online and creating the foundation for online banking as we know it today.

The second wave of fintech came in the early 2000s and was characterized by the rise of mobile banking and alternative lending market (e.g. peer-to-peer). Companies like PayPal emerged during this time, revolutionizing online payments and setting the stage for future inventions in that area.

The 2008 financial crisis proved to be a catalyst for the third wave of fintech. Its aftermath caused mistrust in traditional financial organizations, creating an opportunity for startups to fill the gaps within the banking industry. Bitcoin and blockchain were introduced a year later, causing another boom in the financial market and raising many questions about the future of money. The popularity of smartphones and mobile devices skyrocketed, and the 2020 pandemic caused another market shift caused by a burning need for contactless, mobile-only solutions.

Over the years, fintech industry has experienced rapid growth and diversification. Right now, the biggest technological novelty that changes it is artificial intelligence (AI) and big data analytics that became faster, more accurate, and less prone to errors thanks to advanced algorithms. Fintech offers a wide range of services adjusted to various clients’ requirements, including insurtech and regtech solutions.

Current Market State

Today, the fintech market is characterized by a blend of startups and established financial institutions, all leveraging technology to offer more accessible, efficient, and personalised financial services. Tech innovations are driving the industry forward, so it’s not surprising that the fintech investments and spending are reaching new heights each year. According to the report by Allied Market Research: “The global fintech market was valued at $110.57 billion in 2020 and is projected to reach $698.48 billion by 2030, growing at a CAGR of 20.3% from 2021 to 2030.” That indicates an extremely rapid growth in the upcoming years.

Increased competition is another factor that strongly shapes the fintech space. Traditional financial organizations have to face startups and tech giants entering the financial sector, while the number of fintech brands increases. Currently, there are approximately 30 000 startups that operate within this market worldwide. This number almost tripled since 2019. As the market matures, there’s an increasing fintech trend of mergers and acquisitions, with larger fintech companies acquiring smaller ones to expand their service offerings. Additionally, many financial brands are looking beyond their home markets, expanding internationally to capture new opportunities.

With the growing influence of fintech, regulators are paying closer attention to the sector, leading to the development of new regulatory frameworks. Moreover, there’s a growing fintech trend of collaboration between fintech startups and traditional financial brands, combining innovative approaches with regulatory expertise. Such partnerships also allow involved sides to enhance their capabilities and stay competitive. The market is also seeing a fintech trend towards consolidation, with larger fintech businesses acquiring smaller startups to expand their service offerings and market reach.

The fintech sector is playing a crucial role in bringing payment providers and other services to underserved populations, particularly in developing countries. The landscape is becoming increasingly global, with significant growth in regions such as Asia-Pacific, Latin America, and Africa. These emerging markets are seeing rapid adoption of fintech solutions, often winning with established banking infrastructures. Furthermore, there’s an increasing focus on sustainable and ethical finance, with many fintechs developing products and services that align with ESG (Environmental, Social, and Governance) principles.

What Influences the Fintech Industry?

There are several factors that drive the growth of the fintech niche:

- Increased smartphone usage and internet connectivity, particularly in growing markets, is expanding the potential user base for fintech services.

- Changing consumer expectations, especially among Millennials and Gen Z, who demand digital-first, personalized financial solutions.

- Advancements in technologies such as artificial intelligence, blockchain, and cloud computing, which are enabling more sophisticated and efficient financial capabilities.

- Regulatory changes, such as open banking initiatives, which are fostering innovation and competition in the financial sector.

- The ongoing impact of the COVID-19 pandemic, which has accelerated the shift towards digital financial services.

Major Players in the Industry

Several companies have emerged as leaders in the fintech space, revolutionising various aspects of financial services. These brands, among others, are at the forefront of innovation, setting fintech trends and shaping the future of this growing industry:

- Shopify: A Canadian e-commerce platform that has expanded into fintech landscape, offering payment processing and small business loans.

- Revolut: A UK-based neobank providing digital banking services, including a multi-currency bank account and cryptocurrency trading.

- Checkout.com: A global payment solutions provider offering a unified platform for online payments.

- Ant Group: The Chinese fintech company behind Alipay, offering a wide range of features, from digital payments to wealth management.

- Stripe: A US-based payment processing platform known for its developer-friendly APIs and extensive feature set.

Key Fintech Industry Trends for 2024

Here’s a comprehensive list of the most influential and promising latest fintech trends for 2024 and beyond. We discuss each prediction in detail to underline the important elements to pay attention to when developing innovative solutions.

Regulatory Standards and Security

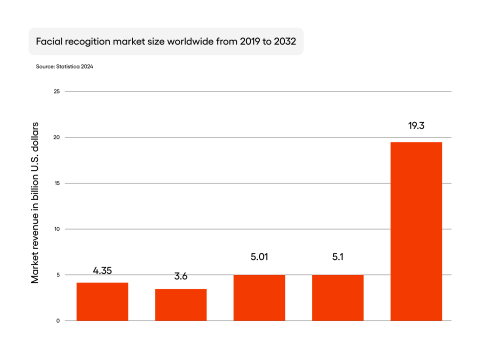

As the fintech realm matures, it’s expected to provide the highest levels of security. Biometric authentication will become increasingly prevalent in 2024 as a more secure alternative to traditional passwords. According to Statista, the global facial recognition market revenue is expected to reach $19.3 billion by 2032. The adoption of passwordless authentication is also on the rise.

Regulatory technology (RegTech) will play a crucial role in helping fintech companies navigate the complex regulatory landscape. AI-powered RegTech solutions will automate compliance processes, reducing costs and improving accuracy. Moreover, in the years to come, we can expect to see a continued focus on developing and implementing robust regulatory frameworks to ensure consumer protection and maintain financial stability. Which acts will matter the most?

eIDAS (Electronic Identification, Authentication and Trust Services)

The European Union’s eIDAS regulation is set to play a crucial role in digital identity verification and electronic signatures. The upcoming eIDAS 2.0 will introduce a European Digital Identity Wallet, allowing citizens to securely store and share their digital identities across the EU.

MiCA (Markets in Crypto-Assets)

The EU’s MiCA regulation, expected to come into force in 2024, will provide comprehensive guidelines for cryptocurrencies and digital assets. This regulation aims to protect investors, prevent market abuse, and ensure financial stability in the crypto space.

EMI (Electronic Money Institution) Regulations

EMI regulations will continue to evolve, focusing on ensuring the stability and security of electronic money issuers. These regulations will likely become more significant, requiring fintech companies to maintain higher levels of capital and implement more robust risk management practices.

KYC (Know Your Customer) and AML (Anti-Money Laundering)

KYC and AML processes will become increasingly sophisticated, leveraging AI and machine learning to enhance efficiency and success rates (e.g. in fraud detection) . Fintechs will need to invest in advanced technologies to stay compliant with evolving regulations while providing a seamless user experience.

ISO 20022

The migration to ISO 20022, a global standard for financial messaging, will gain momentum in 2024. This standard will enable richer, more structured financial data exchange, improving payment processing efficiency and reducing errors. According to EY, the migration to ISO 20022 can significantly enhance payment operating models, leading to improved straight-through processing rates and reduced manual interventions.

AI Act

The AI Act proposed within European Union will have significant implications for fintech companies using AI in their services. This regulation aims to ensure that AI systems used in high-risk areas, including financial services, are safe, transparent, and ethical.

Neobanks and Digital Banking

The rise of neobanks and digital-only banks (often called challenger banks) will continue to disrupt traditional banking models in times of economic downturn. These digital-first brands offer streamlined, convenient, and user-friendly services that appeal to tech-savvy, modern consumers.

For a detailed comparison of neobanks and legacy banks, including their strengths, weaknesses, and future prospects, refer to our report on that subject.

Current fintech trends in neobanking for 2024 include:

- Expansion of services: Neobanks will broaden their offerings to include investment portfolios, insurance, and other financial services traditionally provided by legacy banks.

- Improved AI-driven personalisation: Advanced AI algorithms will enable neobanks to offer highly personalised financial advice and product recommendations.

- Enhanced cross-border capabilities: Neobanks will focus on improving international money transfer services and multi-currency bank accounts to cater to an increasingly global customer base.

- Collaboration with legacy banks: We may see increased partnerships between neobanks and established financial institutions, combining the agility of fintech with the scale and legal expertise of legacy banks.

Digital Money and Payments

The landscape of digital money will go through notable changes. The two key areas of focus include:

Central Bank Digital Currencies (CBDCs)

CBDCs are digital versions of fiat currencies issued and regulated by central banks. As of 2024, several countries are expected to be in advanced stages of CBDC development and implementation. The European Central Bank’s digital euro project, for instance, is making significant progress.

The key challenges of CBDCs at the moment are:

- Improved cross-border payments: CBDCs have the potential to streamline international transactions, reducing costs and processing times.

- Enhanced financial inclusion: CBDCs could provide access to digital financial services for unbanked populations.

- Monetary policy implications: Central banks may gain new tools for implementing monetary policy through programmable money.

- Privacy concerns: Balancing transaction privacy with regulatory oversight will be a crucial issue in CBDC implementation.

Cryptocurrencies

Despite regulatory challenges, cryptocurrencies will continue to play a significant role in the fintech landscape in 2024 and beyond. As regulations like MiCA come into effect, the cryptocurrency market may see increased stability and legitimacy. It’s expected that more traditional financial companies will offer cryptocurrency-related services (e.g. digital wallets, online purchases, etc.) to their clients. Decentralised Finance (DeFi) protocols will become more sophisticated, offering alternatives to traditional financial services, while distributed ledger technology has a chance to shine in security. There will be a growing emphasis on environmentally friendly cryptocurrencies and blockchain technologies to address concerns about energy consumption, too.

Open Banking

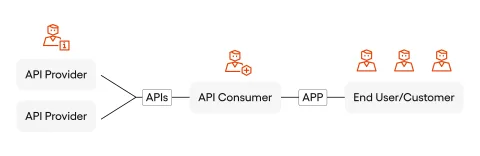

Open banking, which allows third-party financial service providers to access consumer banking data through APIs, is one of the top fintech trends that will continue to evolve and expand in the years to come. The proposed Payment Services Directive 3 (PSD3) regulation will build upon the previous PSD2 version, further enhancing the open banking ecosystem. The key aspects of it include inclusion of more financial products and services beyond payment accounts, enhanced standards for data exchange and API functionality, as well as additional safeguards for data privacy and security.

Open banking adoption will extend beyond early adopters, with more traditional banks embracing the concept. Cross-sector integration will be applied to other financial services, such as insurance and investment management. We can also expect open banking initiatives to gain traction in more countries, leading to increased global data sharing and service offerings.

Generative AI will play a significant role in open banking, enabling advanced financial insights powered by sophisticated data analysis algorithms. It will result in more personalised financial advice and product recommendations. Moreover, AI-driven automation will allow users to optimise their finances based on their banking data and financial goals. More sophisticated AI models will also be harnessed to identify potential fraudsters and accelerate fraud prevention in real-time.

Embedded Finance and API Integration

Integrating financial services into non-financial platforms and applications, will continue to grow in importance throughout 2024 and after. Banks and other financial institutions will need to adapt to the embedded finance trend by developing robust API strategies to enable partnerships with non-financial technology companies, creating modular financial products that can be easily integrated into third-party platforms, and focusing on data security and regulatory compliance in the context of distributed financial services.

According to a report by Globe Newswire, the global embedded finance market is projected to grow with a CAGR of 35.5% by 2028. This rapid expansion underscores the increasing demand for seamless, integrated financial products across various industries. The current fintech trends in this area involve:

- Expansion beyond payments: While embedded payments have been the primary focus, we’ll see growth in embedded lending, insurance, and investment services.

- Industry-specific solutions: Tailored embedded finance offerings for sectors such as healthcare, education, and real estate.

- Enhanced API ecosystems: More sophisticated and standardised APIs will facilitate easier integration of financial services into various platforms.

- White-label solutions: Growth in white-label embedded finance offerings, allowing non-financial companies to quickly launch branded financial products.

Artificial Intelligence and Machine Learning

AI and machine learning will continue to be transformative forces in the fintech industry, with the usage of such models in various aspects of financial services and operations. For example, predictive AI algorithms will be used in credit scoring, fraud detection, market analysis, and customer service. Artificial intelligence proves to be an ally for fintech businesses that want to analyse data from a multitude of data sources to assess creditworthiness of their customers, identify suspicious activities, predict market trends, and handle routine support inquiries.

On the other hand, generative AI, represented by technologies like GPT (Generative Pre-trained Transformer), will see increased adoption in fintech as well. It will enable the creation of AI-generated recommendations tailored to individual financial situations and goals, as well as personalised marketing content and sales strategies. AI systems will also provide detailed financial reports for informed decision-making and assist in designing new financial products and services.

As cyber threats become more sophisticated, AI will play a crucial role in enhancing fintech security. Machine learning models will identify unusual patterns indicative of cyberattacks, provide adaptive security measures, and react to security breaches in real-time.

Despite the potential of AI in fintech, it’s important to be aware of potential challenges of this technology. Many businesses struggle to integrate AI solutions effectively into their existing systems and scale them across their operations. According to a Goldman Sachs report, there’s also growing disappointment from AI projects, with businesses spending significantly on AI without seeing commensurate benefits. To address these challenges and achieve their business objectives, fintech companies will need to focus on developing clear AI strategies aligned with their needs, invest in data infrastructure and talent to support AI initiatives, and implement robust governance frameworks for AI systems.

Buy Now, Pay Later (BNPL)

The Buy Now, Pay Later model has gained significant traction in recent years and is expected to continue its growth trajectory in 2024. What are the hottest fintech trends in that area to watch out for?

- Expansion into new sectors: BNPL services will extend beyond retail into areas such as healthcare, education, and travel.

- Increased regulation: Governments and financial regulators will implement stricter oversight of BNPL providers to protect consumers.

- Integration with traditional credit products: We may see hybrid models combining BNPL with traditional credit cards or personal loans.

- Enhanced risk assessment: BNPL providers will leverage AI and alternative data sources to improve credit decisioning and reduce default rates.

The main challenges to be aware of in the Buy Now, Pay Later realm are:

- Consumer debt concerns: As BNPL usage grows, there are worries about potential over-indebtedness, especially among younger consumers.

- Competition from ordinary banks: Established financial institutions are likely to launch their own BNPL offerings, intensifying competition in the space.

- Data privacy: The collection and use of consumer data for BNPL risk assessment will face increased scrutiny.

For an in-depth discussion on BNPL and its impact on the fintech industry, listen to our podcast episode dedicated to this topic.

Green Fintech

Sustainability and environmental concerns will play a larger role in fintech innovation in 2024, giving a chance for ‘green fintech’ to shine. Consumers highly appreciate fintechs that facilitate investment in environmentally friendly projects and companies. For instance, tools that will allow consumers and businesses to monitor the carbon footprint of their financial transactions will be on the rise. The same goes for specialised loan products for eco-friendly initiatives, such as renewable energy projects or energy-efficient home improvements.

Traditional financial institutions will need to develop new, sustainability-focused products to meet growing consumer demand. Environmental factors will increasingly be incorporated into credit risk models and investment opportunities. It will also be expected of financial institutions to address the growing pressure to disclose climate-related risks and sustainable finance activities.

Fintechs in the B2B Sector

While much of the fintech focus has been on consumer-facing solutions, the B2B sector is predicted to experience significant growth and innovation in that area during the next few years. What can be anticipated?

- SME financial management: Advanced tools for cash flow forecasting, expense management strategies, and financial planning tailored for small and medium-sized enterprises.

- Robotic process automation: AI-powered solutions for automating financial processes such as invoicing, reconciliation, and reporting.

- Supply chain finance: Innovative platforms that optimise working capital and streamline payments across complex supply chains.

- B2B payments: Improved cross-border payment solutions and real-time settlement systems for business transactions.

B2B fintech solutions often need to integrate with legacy systems, presenting technical challenges that will have to be embraced. Navigating complex regulatory environments, especially when dealing with cross-border transactions, will also be a must for brands that will bet on fintech. Protecting sensitive business financial data will be imperative for B2B fintech providers to gain and maintain trust.

Customer Experience and Personalisation

Enhancing customer experience through personalisation will be a key focus for fintech companies in 2024 and beyond. Leveraging advanced technologies to deliver tailored financial services is considered one of the most promising directions to follow. AI models that can predict consumer preferences and behaviours will enable tailored products and services that were not achievable in the past.

The tendency towards mass personalisation will continue as well, with fintechs aiming to provide customised experiences at scale. Financial organizations will have to leverage big data to process vast amounts of customer behavior data in real-time and achieve their ambitious customisation goals. They will also need scalable infrastructures (e.g. cloud-based) that can handle the computational demands of personalisation algorithms.

Financial services industry will increasingly collaborate with businesses from other sectors to provide value-added services (VAS) that enhance the overall customer satisfaction. These may include:

- Partnerships with retail and e-commerce platforms to offer integrated financial services.

- Collaboration with mobility services to provide seamless payment solutions.

- Integration with public services for streamlined tax payments and government transactions.

- Partnerships with entertainment providers to offer specialised financial products for content creators and consumers.

For a comprehensive exploration of value-added services in fintech, check out our e-book on the topic and listen to our dedicated podcast episode.

The Impact of Fintech Trends on the Industry

The hottest fintech trends discussed above will have a profound impact on the financial industry in general. Traditional banks will need to innovate rapidly to compete with agile fintech startups and neobanks. This may lead to increased partnerships and acquisitions, but also to the market movements. Money-related organizations that won’t be able to keep up will experience decrease in customers and revenue.

Financial services will become more accessible and inclusive, especially in emerging markets, through mobile banking and embedded finance solutions. Artificial intelligence will play an important role in that process, enabling personalised financial products and services for all types of clients, no matter their background or history. The functionality of money apps will be broadened thanks to open banking and API integration that foster a more interconnected financial ecosystem, blurring the lines between financial and non-financial platforms.

Cryptocurrencies and CBDCs will challenge traditional monetary systems, potentially reshaping how we think about and use money. They will most certainly play an essential role in speeding up and securing transactions. However, all the controversies regarding increased energy consumption and negative environmental impact will have to be addressed by providers since sustainable finances will gain prominence, influencing consumers’ decisions when picking their preferred tools to manage money.

Considerations Regarding the Future of Fintech

While adopting the fintech trends we’ve discussed in this article means that fintech companies can draw from a pool of various benefits, it’s important to not forget about challenges that have to be proactively conquered. Here are the most burning ones:

- Regulatory compliance: Keeping up with evolving regulatory requirements like GDPR, PSD2, and upcoming AI regulations will be crucial for financial institutions to stay afloat, level up fraud prevention, and increase brand loyalty.

- Cybersecurity: As money-related services become more digital, protecting against cyber threats becomes increasingly important.

- Legacy system integration: Many traditional financial institutions struggle to integrate new technologies with their existing infrastructure.

- Data privacy: Balancing personalization with data protection will be an ongoing challenge.

- Talent acquisition: There’s fierce competition for skilled professionals in advanced software development, data science, AI, blockchain, and other emerging technologies.

- Ethical considerations: The use of AI in financial decision-making raises questions about fairness and transparency that will have to be answered with honest communication and the use of well-designed algorithms.

Conclusion

The fintech industry will grow and thrive in 2024 and beyond. It will probably also go through a few transformations, based on the technological advancements that are yet to come. We’ve listed key latest fintech trends to watch for and provided details to help fintech brands prepare themselves for the upcoming customer demands and be able to face competitors within this complex market.

To achieve success, financial institutions must embrace innovations fast and prioritize customer-centric solutions. Sometimes it will mean large investments, other times it might mean a need for collaboration with traditional banks, other startups, and regulators. If the objective of delivering valuable, trust-worthy products and services is common, there’s no doubt all involved parties will find consensus and provide high-quality digital solutions that will help consumers and businesses with all types of their money operations.

To stay up-to-date with the latest fintech trends and insights, tune in to our Speedtalks podcast. Our expert hosts dive deep into the most exciting topics in the fintech world, offering valuable perspectives and actionable advice for industry professionals. Don’t miss out on these engaging discussions – listen to our latest episodes.