We support fintech companies with our experience

Scaling fintech products without the chaos. We combine product thinking with growth-ready, compliant architecture to future-proof your financial technology.

Fintechs work with us to:

As fintech technology partner we already delivered:

-

200+experts on board

-

30+BFSI clients

-

4,5xfaster time-to-market

-

+20%customers growth

The combination of understanding the financial domain with 25+ years of technical expertise allows us to give you extremely precise time and cost estimates for your project.

Estimate your projectFill in a short contact form and we’ll get back to you via email within an hour

Delivery acceleration services

Ready-made digital solutions designed for fast market impact

Our core portfolio brings together proven IP, AI-powered engines, and turnkey frameworks that address most pressing challenges in finance and technology.

Inject speed, flexibility, and engineering excellence directly into your operations

Our services cluster is designed to break down delivery bottlenecks, modernise architectures, and accelerate digital product development.

Our approach to building world-class fintech software development solutions

We’re dedicated to creating exceptional fintech development solutions.

We do it by prioritising a few critical factors during the cooperation process.

The guide for financial and insurance services

- 16 key questions to ask an IT vendor

- Legal considerations

Working with Speednet means:

Get insights about technical solutions

for banks and financial institutions

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.

Frequently asked questions about fintech software development

Many fintech companies still rely on legacy software. It remains critical to their operations, costly to replace and deeply integrated within their processes. Our approach to integrating existing financial systems and legacy software centres on an API-first and microservices architecture. We prioritise creating modular, reusable components through an API-first strategy. This improves interoperability and reduces project timelines. Microservices architecture fosters a more agile and adaptable IT infrastructure. As a result, your software will be capable of supporting future growth.

Our fintech software developers focus on easing data exchange and improving application functionality. We aim to modernise IT infrastructure and provide seamless integration with existing financial systems.

We specialise in seamless communication with third-party services. We know how to enable data exchange and automate actions to enhance application functionality. This ensures smooth interoperability, whether building from scratch or integrating with existing APIs.

We provide fintech firms with platform integrations, secure data exchange, and the ability to add new functionalities.

Fintech software development companies focus on advanced financial technology. This includes security when dealing with sensitive financial data, regulatory compliance for banking software and scalability. They are highly specialised fintech developers with a deep understanding of the financial sector and the ability to navigate through financial systems. In contrast, general software development companies serve a broader range of industries. They don’t have the same focus on the specific needs of the financial sector.

Read on How to Choose the Right Partner for Fintech Development Outsourcing

The development services we provide for our clients, which include fintech companies, are:

- web development,

- mobile banking development,

- product design,

- and technical consultancy.

In financial software development, a significant portion of our vast services focuses on:

- digital payment solutions,

- international money transfer implementations,

- transaction security and data encryption,

- big data analytics,

- implementing emerging technologies and innovative solutions.

Our fintech projects help businesses to stay ahead of financial trends by leveraging new technologies.

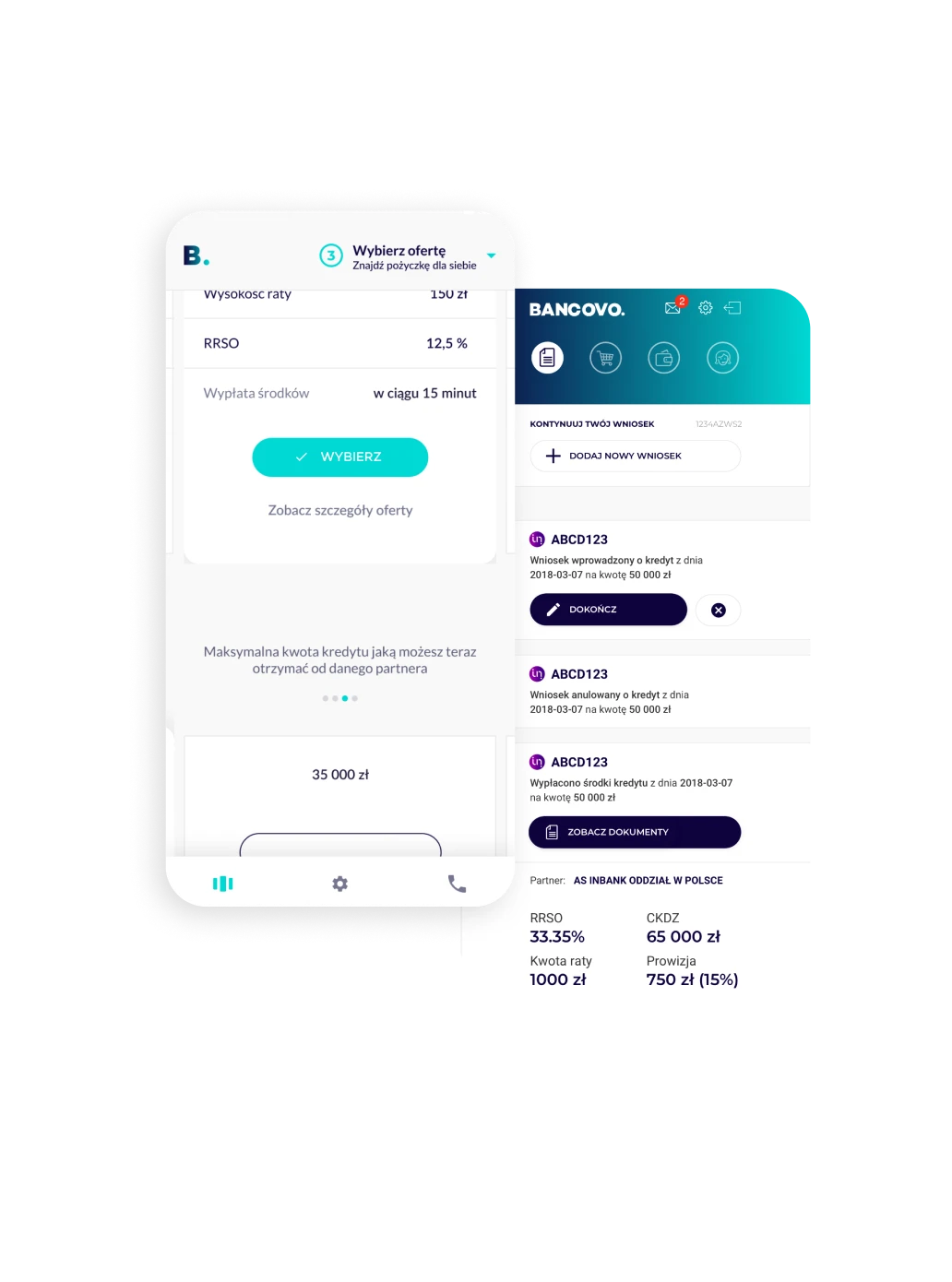

Fintech software development refers to the design and creation of digital solutions and applications for financial institutions and digital banks. This may be:

- fintech applications for mobile devices,

- lending platforms,

- payment apps,

- investment platforms,

- trading systems,

- and other online financial products.

Fintech software development is crucial for creating new business models. It changes traditional financial services and improves customer experiences in the digital age. Embedded finance, which integrates financial services into non-financial platforms, further accelerates this change. It enables businesses to offer custom financial solutions directly in their products.