Insurance technology partner

We help insurance companies digitise and integrate sales and servicing processes, accelerating time to market and improving operational efficiency.

With Speednet you can:

-

126%profit growth

-

+35%in operation efficiency

-

+20%customers growth

-

4,5 xfaster time to market

We can help you with:

Product Development

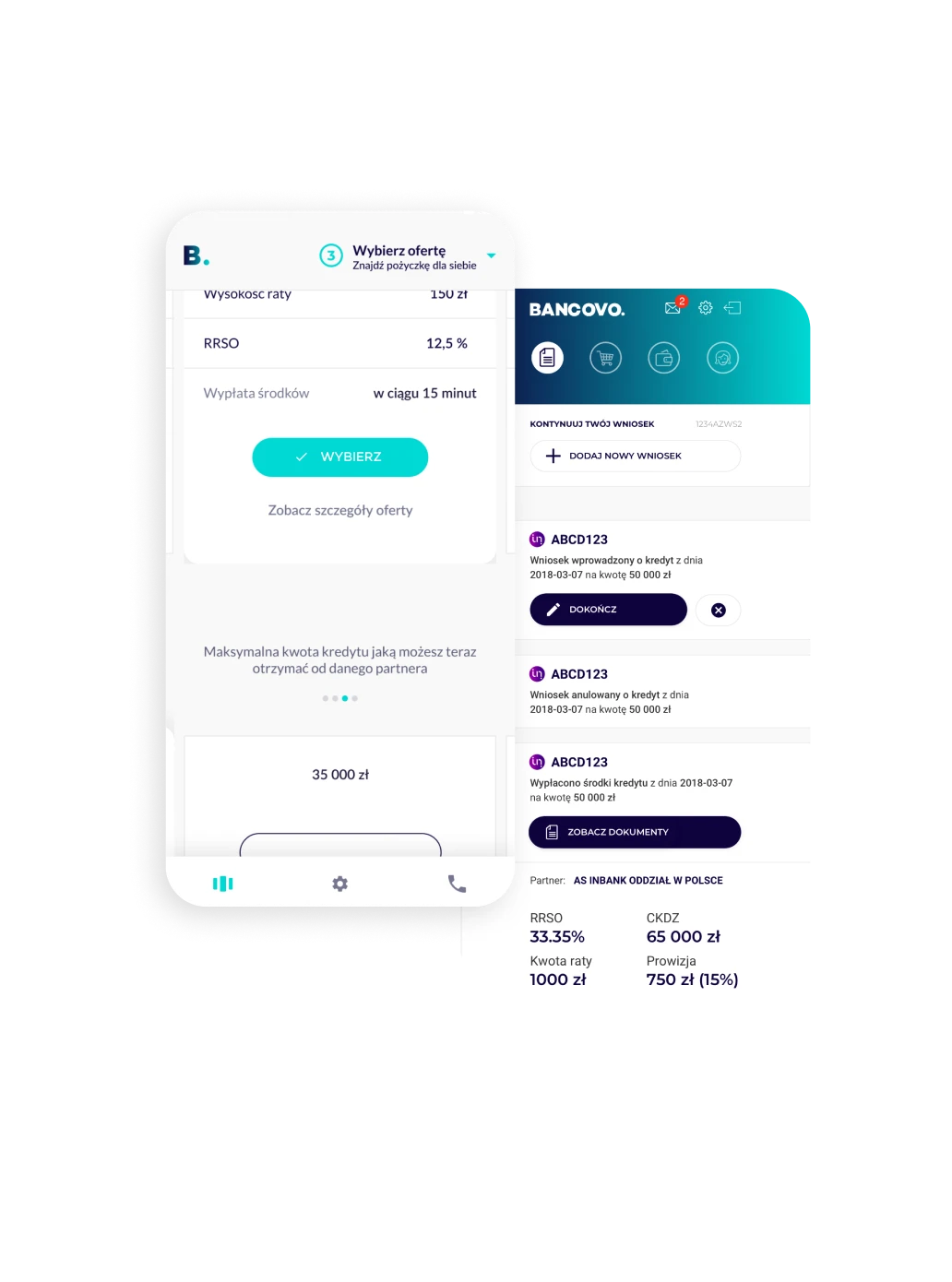

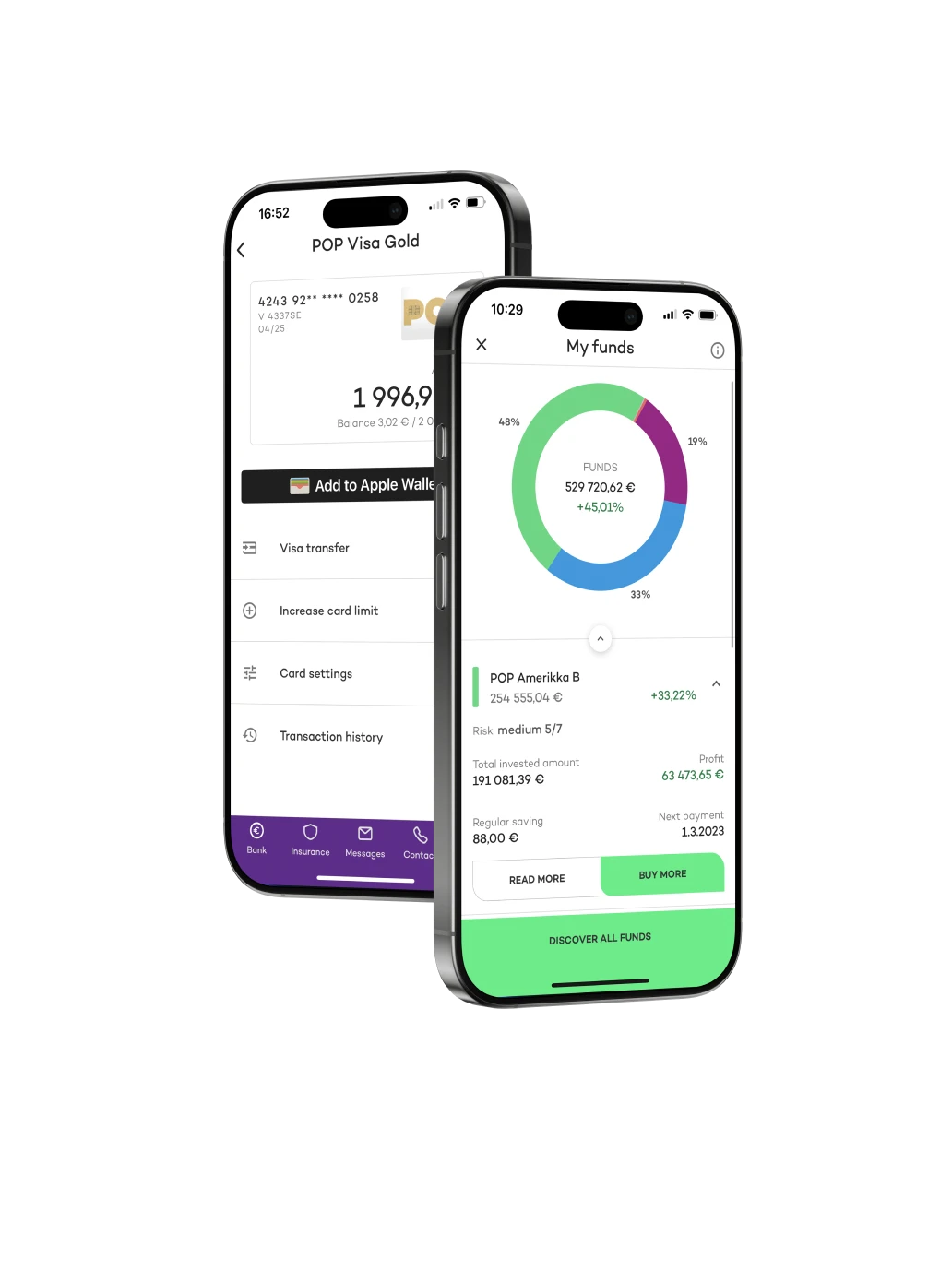

– Custom apps: Tailored web and mobile platforms

– Optimization: Refining systems for peak performance

– UX/UI Design: Audits and design focused on usability

Revenue & Sales

– Smart selling: Built-in cross-selling and upselling tools

– Automation: Digital claims and automated underwriting

Tech & Data

– Analytics: Predictive insights and advanced reporting

– Modern stack: KMP, Scalable Cloud, DevOps, and AI integration

Risk & Compliance

– Security: Robust risk management and data protection

– Regulatory: Full compliance across all digital solutions

Ready-made digital solutions designed for fast market impact

Our core portfolio brings together proven IP, AI-powered engines, and turnkey frameworks that address most pressing challenges in finance and technology.

Working with Speednet means:

The guide for financial and insurance services

- 16 key questions to ask an IT vendor

- Legal considerations

Get insights about technical solutions

for banks and financial institutions

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.

Frequently asked questions about insurance software development

Insurtech refers to the use of innovative technologies to improve and streamline the insurance industry and align with consumer expectations. It includes a wide range of digital solutions and platforms designed to enhance various aspects of insurance operations, including policy management and distribution, claims management, underwriting, customer service and risk assessment.

Insurtech companies aim to make insurance services more accessible, efficient, and user-friendly while also helping traditional insurance companies adapt to the digital age. This technology-driven approach is transforming the insurance sector by offering new products, improving customer experiences, and optimising business operations.

Insurtech has proven particularly valuable across various insurance areas, with some sectors experiencing a more significant impact:

- Auto Insurance sector

- Health Insurance sector

- Property and Casualty Insurance sector

- Life Insurance sector

- Travel Insurance sector

- Cyber Insurance sector

- Small Business Insurance sector

These sectors have seen significant advancements through insurtech solutions, improving efficiency, customer experience, and risk management. The impact varies based on market readiness and regulatory environments, but the trend towards digitalisation continues across all insurance sectors.

Certainly! At Speednet, we specialise in developing custom mobile applications for the insurance industry, which will enhance customer experience as well as the efficiency of insurance agents. Our team has extensive experience in creating robust, user-friendly mobile insurance software solutions from scratch, tailored to the unique needs of traditional insurance companies.