We supported the development of a Buy Now, Pay Later (BNPL) service

– on the frontend and backend side.

Learn more about a system that enables deferred payments for Paytree.

About the Buy Now Pay Later schema

We have provided a system that enables deferred payments.

BNP (Buy Now Pay Later) L is a modern form of payment that allows consumers to manage their spending while merchants and banks increase sales and revenue. The right implementation of BNPL in a fintech or bank can be a competitive advantage and attract new customers.

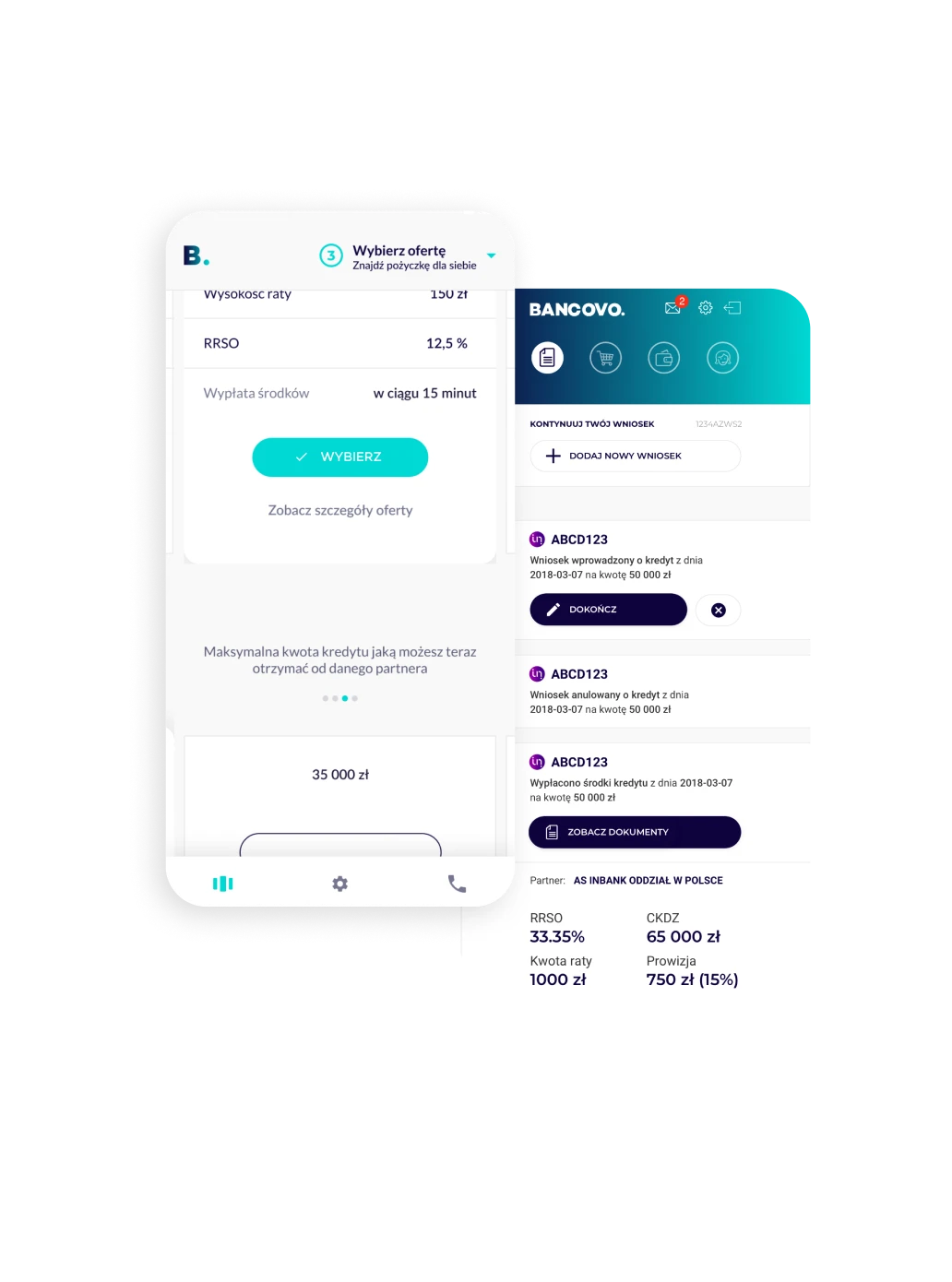

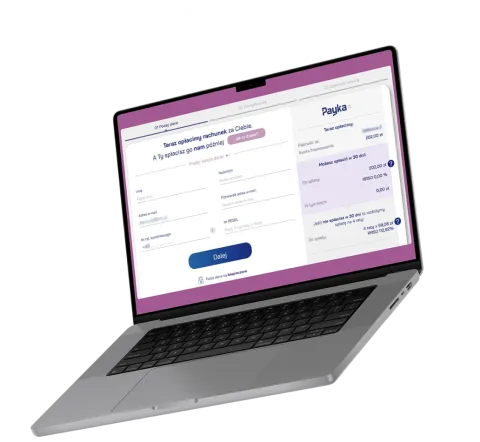

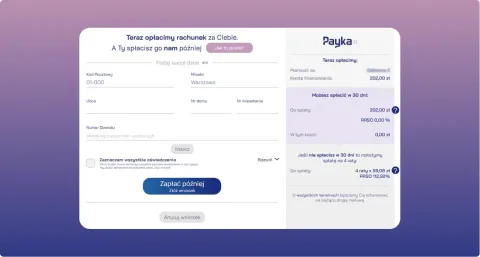

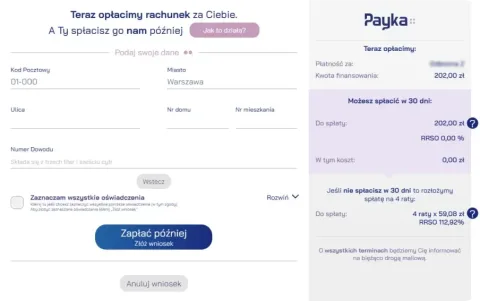

Payka allows users to pay utility bills such as energy, TV, Internet, or telephone (in the Buy Now Pay Later schema). The online payment process is fully automated, quick and simple: after selecting Payka method on the payment gateway, you enter your identification details, if you are recognized, you accept terms with an SMS code. Otherwise or if you use Payka for the first time, you are logging into your bank account to identify yourself through PSD2/AIS.

Payka’s payment process is fully secure. All transactions are encrypted and executed through secure servers and communication channels. The system is integrated with Blue Media’s payment gateway, so there is no need to integrate it with each utility provider separately.

Benefits of implementing BNPL

For the end user (consumer):

- More financial freedom – spread the cost over instalments instead of paying everything upfront.

- Interest-free payments – many BNPL options have 0% interest, making them cheaper than credit cards.

- Easier access to products/services – customers can afford more significant purchases without immediate expenses.

- No complex paperwork – a quick identity and credit check is often all that’s needed, with no lengthy applications.

- Better cash flow management – funds stay available for other expenses instead of being locked into a single purchase.

- Added security – users can check the product before paying using a ‘pay later’ model.

For the bank or fintech:

- More customers and loyalty – flexible payment options attract new users and keep them engaged.

- Valuable consumer insights – transaction data helps understand customer habits and tailor offers.

- Higher transaction volume – BNPL encourages frequent purchases, boosting overall financial activity.

- Competitive advantage – an alternative to credit cards and loans that keeps banks relevant in modern finance.

- Increased e-commerce partnerships – BNPL raises the average transaction value, making it appealing for merchants.

- Upselling opportunities – BNPL users may also be interested in premium accounts, insurance, or other banking products.

How does BNPL work?

The most important information:

Team extension model with 5 backend developers

We collaborate on a team extension model, carrying out tasks together with an external front-end team. During the project, five backend developers were involved in the implementation of new functionalities.

Meet our partner – Paytree

Paytree.pl is a financial company that offers non-banking financing solutions. Its products and solutions include loans, Buy Now Pay Later (BNPL) options, and insurance payment distribution. Paytree.pl operates in financial mediation channels and targets customers looking for non-banking financing options.

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.