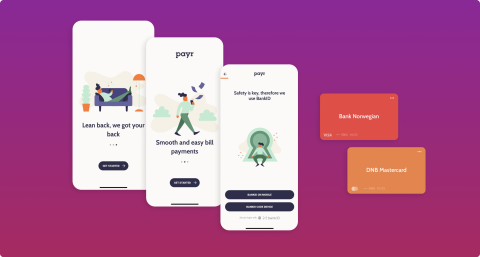

A mobile app with bill payments

in the Scandinavian countries through a UX-friendly interface.

Learn more about the app and our client.

About the service

Payr is a fintech company featured as Startup of the Year and Best Fintech Startup in the national finale of the Nordic Startup Awards, and ranked among the 100 best innovators in the world by H2 Ventures and KPMG. Recently, the company entered the stock exchange.

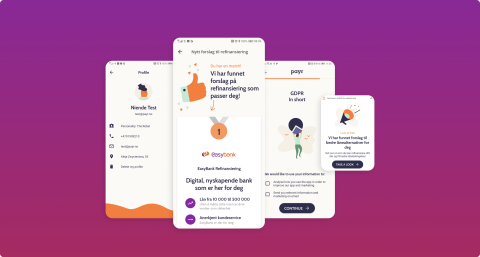

The company needed support from programmers who would help to finalize the work on the financial services aggregation application and help integrate its functionalities into a coherent solution.

Benefits of a mobile app for bill aggregation and cost analysis

A mobile app aggregating daily payments helps customers pay their bills and analyses service costs, bringing significant benefits for both end users (customers) and the fintech company developing it.

Benefits for end users (Customers)

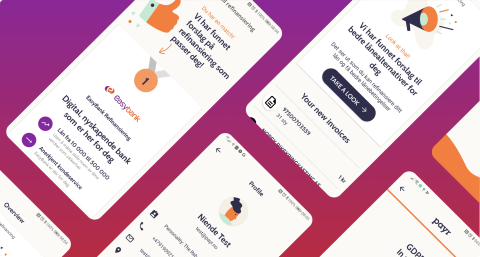

- Easier Payment Management: the app reminds users about due payments, helps them avoid late fees, and allows all bills to be paid in one place, saving time and effort.

- Better Control Over Finances: users can track spending across different services (utilities, subscriptions, insurance, etc.). Moreover, the app can suggest cheaper alternatives based on spending patterns.

- Convenience and Automation: users can set up automatic payments to avoid missing deadlines. Multiple payment options are available (bank transfer, card, digital wallets).

- Time Savings: no need to log in to multiple portals or remember different due dates.

- Improved Credit Score: consistently paying bills on time can positively impact the user’s credit rating.

- Financial Security: users can set spending limits and monitor unexpected cost increases.

Benefits for the fintech company

- Monetising Financial Data: the app can analyse user spending patterns and offer personalised financial products (e.g. better insurance and credit cards).

- Multiple Revenue Streams: subscription fees for premium features (advanced financial insights, automation), commissions from financial service providers, advertising and partnerships – recommend alternative providers based on user spending habits and transaction fees.

- Higher Customer Engagement: users will interact with the app regularly, increasing brand loyalty.

- Opportunity to Expand Services: the app can introduce additional services (loans, savings, investment tools).

- Stronger Market Positioning: a well-designed app enhances brand reputation and makes the fintech more competitive.

- Valuable Market Insights: analysing payment trends helps the company refine its services and develop better financial products.

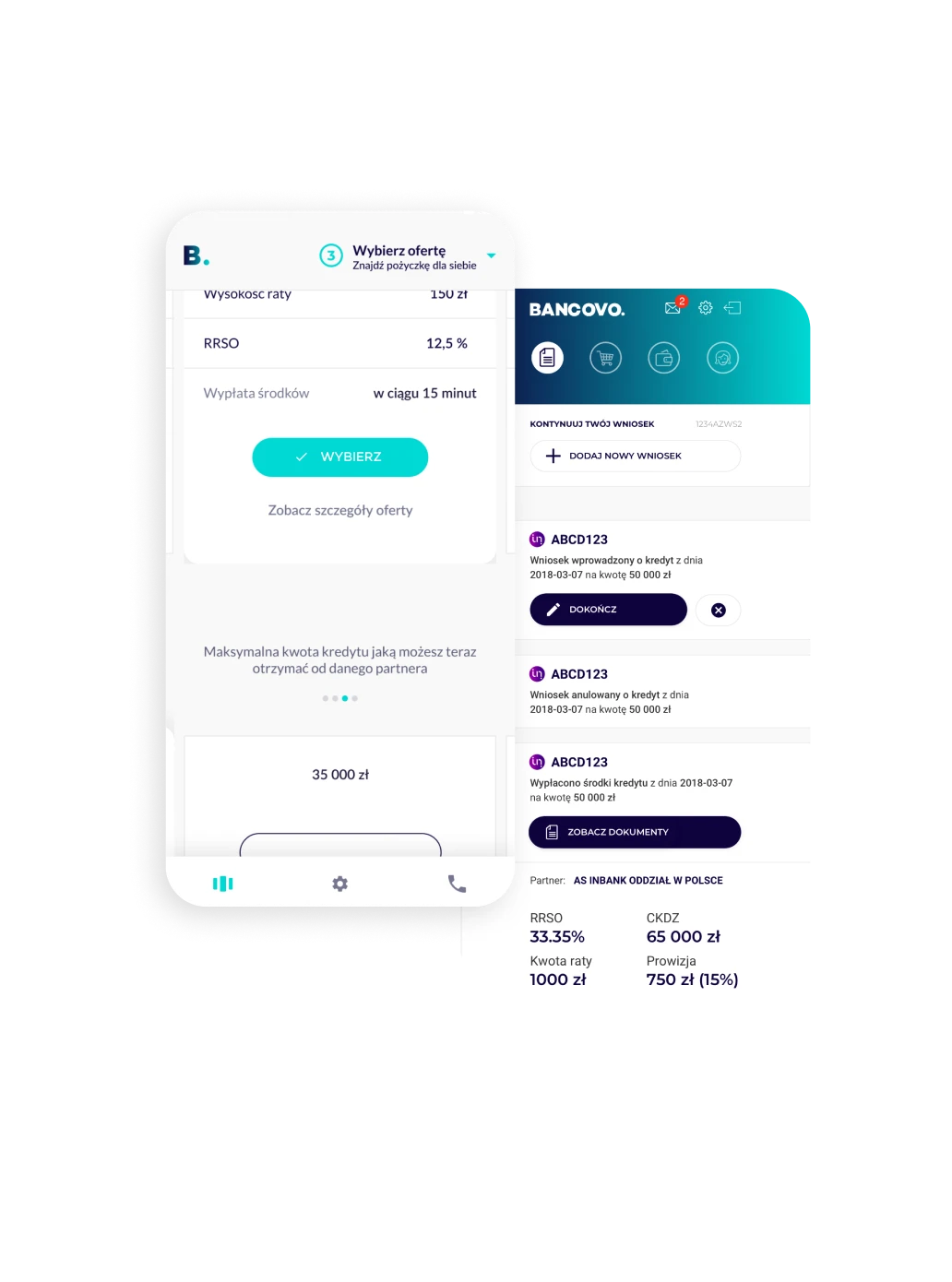

We have built a mobile app that aggregates payments due on a given day, helps the customer pay the bills and provides, as an additional functionality, cost analysis of used services.

A variety of services was assessed using invoices so the customer not only paid bills but also received suggestions for switching to a better-value mobile or banking operator.

The most important information:

What was included in this service

Our Android and iOS development specialists adapted well to the dynamic conditions typical for startups. They created a few prototypes in line with Payr founders’ vision.

This type of app benefits both customers and the fintech company. Customers enjoy greater financial control, convenience, and security, while the fintech gains multiple revenue opportunities, strong user engagement, and valuable market insights. Success will depend on secure integrations with banks, a seamless user experience, and clear value for customers.

Meet our partner – Payr

PAYR (payr.no) is a Norwegian fintech platform that offers seamless and secure payment solutions for businesses and consumers. It provides a user-friendly interface for quick and transparent transactions, integrating various modern payment methods. The service focuses on improving the efficiency of online payments, emphasizing speed, security, and ease-of-use for all parties involved.

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.