Launch your microloan product three times faster and cheaper

Reduce your operational costs by up to 60% by implementing a ready-to-use lending engine in just two to four months.

Schedule a free consultation

See the measurable results of implementation

Are traditional processes slowing your growth?

High costs, the risk of errors, and long waits for a decision are all consequences of handling applications manually with outdated systems. This discourages customers and often causes them to abandon the process altogether.

Find out how you can fix this

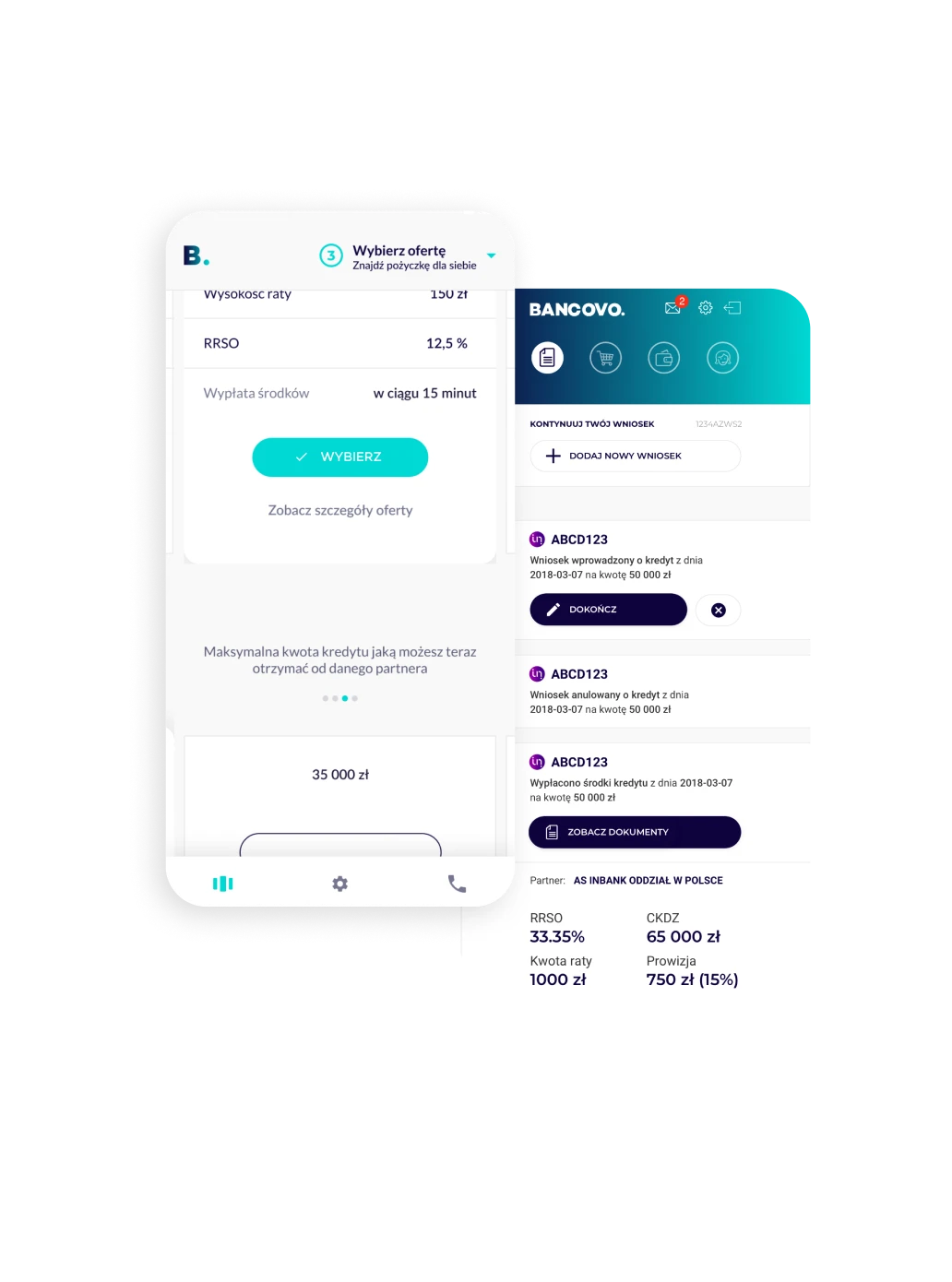

A single solution with benefits for your business

Launch your product in 3 simple steps

Do you want to reduce costs and increase conversion?

Let’s talk about how this ready-made microloan solution can increase your company’s revenue.