A banking app for children: a complete guide to design and features

61% of children aged 10-15 in the UK actively use apps to look after their money. This shows young people are not just ready for modern digital money tools; they actually want them. This guide will talk about the best ways to make banking apps for kids, looking at what users need, how to design them, key features, safety, and what might happen in the future.

Table of contents

Why banks should offer apps for children

Putting money into a banking app for kids is more than just meeting a market need; it’s a smart business choice. Getting a young person as a customer is an investment because they could be very valuable to the bank over their lifetime. If a bank builds loyalty from a young age, it pays off later.

Nearly 45% of young account holders stay with the same bank for at least five years, and 24% never change banks.

On top of this, a children’s app is a great way to cut the cost of getting new customers. Getting a child’s account through their parents is much cheaper than getting a new adult customer, possibly 10 to 25 times cheaper.

This also means more transactions, deposits, and card use, bringing in extra money. Parents might also buy more services like a premium card or insurance, which gives the bank a chance to sell other products.

Looking at the market and what users need

To design good banking apps for children, we first need to really understand the future users. Looking at the market and clearly figuring out what both children and their parents need is the base for any successful project in this area. This takes careful thought and understanding.

What modern young users are like

Children and teenagers are the main group for financial apps, and they have very specific needs and expectations. These are quite different from what adult users of banking systems want.

Not paying attention to these differences will likely lead to a product they won’t be interested in. Generation Z and Alpha expect modern, personalised digital tools, and if traditional banks don’t meet these expectations, young people will happily go for fintech alternatives.

Studies show that one in three Generation Z customers would think about leaving their bank if its digital services were not good enough.

How parents from different generations approach things

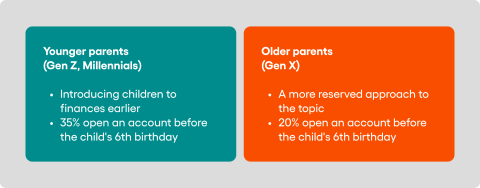

Information about people and their behaviour gives us good clues. It turns out that 63% of parents have opened a bank account for their children, which shows how common this is. However, we see some differences between generations in how they approach this.

Younger parents, from Gen Z and Millennials, tend to introduce their children to money matters earlier. As many as 35% of them open bank accounts for their children before they turn six. This is a clear sign that learning about money is starting earlier and earlier.

Older generations of parents, like Gen X and Baby Boomers, are more hesitant. Among Gen X, 20% open accounts before the child turns six, and for Boomers, it’s 32%. These differences show how the role of early money education is changing.

What parents mainly want

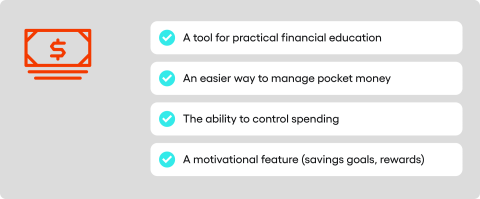

Parents mostly see children’s apps as a tool for practical money education. A recent Bank of America study found that 90% of parents feel responsible for teaching their children about money, and most start talking about it before their child turns 10.

In this way, mobile tools for young children help them learn the value of money and basic budgeting, which helps them in the future.

Apart from learning, parents also like the practical benefits. The app makes it easier to manage pocket money, send money for specific things, and keep track of spending. This gives them more peace of mind and confidence that their child’s money is organised.

The app can also motivate children. Being able to set savings goals, track progress, and get rewards for achievements really encourages children to save money regularly. This builds good money habits for the future.

How social trends play a part

How young people see money is largely shaped by current social and cultural trends. Social media plays a special role here. For many young people, it has become the main place to get information, including about money. We are now seeing the amazing trend of FinTok, which is financial content on TikTok, YouTube, and Instagram. T

hese short, engaging videos explain complicated money ideas in an easy way. They are perfect for Gen Z and their popularity is growing very quickly. These kinds of initiatives really make the often-complicated language of finance simpler, making it easier for young people to understand.

Banks and financial institutions need to see this trend and change how they communicate. Old-fashioned, formal messages might not work at all.

It’s also worth saying that learning about money in general is becoming more popular. It is becoming a more important part of public discussion.

In the United States, which historically found it hard to put financial knowledge into formal education, we are now seeing good changes. More schools, non-profit organisations, and new fintech companies are actively working to promote money education programmes.

This shared effort aims to raise the general level of financial awareness. Mobile apps can really help these efforts.

Good ways to build apps

Just looking nice and being fun to play won’t make an app successful. It needs to have useful features that really meet the needs of both children and their parents. Finding the right balance between freedom and control is key here.

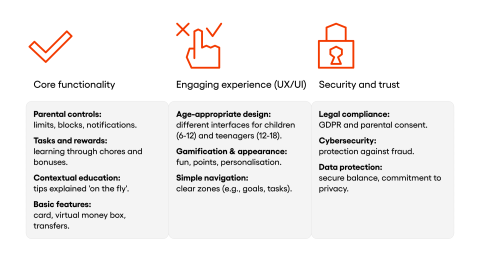

Parental controls – building trust

Parents need to be sure they have full control over their children’s money when they put it in a mobile app. This is absolutely essential for trust. That’s why thorough and easy-to-use tools for watching and managing are a must.

Keeping track and setting limits

The app must let parents fully control the type of transactions and the amounts of transfers. Features like setting spending limits or blocking certain types of purchases are standard things parents expect. Instant notifications about all activity on the child’s account are also very important, so parents can react quickly to anything unusual.

Managing savings goals

Setting savings goals together is a great way to teach planning and patience. The app should let users create virtual piggy banks for specific goals, and also help by setting up automatic, regular transfers from the parent’s account.

Another interesting way to encourage saving is a cashback option, where some of the money from transactions made by the parent goes into the child’s savings account.

Task and reward system

A system of tasks and rewards is a powerful tool for teaching and raising children. Parents should be able to create a list of tasks (like household chores) that the child sees in their app. After the child finishes them and the parent checks them, a set reward, either a transfer or loyalty points, goes into the child’s account.

Learning features

Learning about money in a children’s app should not be a separate, hidden part. The best way is to weave the knowledge into the whole user experience so it comes up at the right time. For example, the first time a child uses a payment card, the app could show a short history of it.

Virtual guides can take the child through more complicated processes, explaining them step by step. Of course, a special “Learn” section is also a good addition, but it can’t be the only way to learn.

Basic banking functions

Despite obvious legal and age limits, the app must offer basic money functions. However, these must be fully suitable for young users. Key features include card payments, usually with small, pre-set limits.

A simple and clear saving system (like a virtual piggy bank) and easy ways to get money from parents or family are also essential. Cash withdrawals from ATMs with limits set by the parent are also a valuable feature.

Designing the user experience (UX/UI)

Designing the interface (UI) and the whole user experience (UX) for banking apps aimed at children is a challenging job. We are making a product for users who see and expect things very differently from adults.

That’s why it’s vital to deeply understand this group to create a solution that is both useful and engaging.

Designing with how children develop in mind

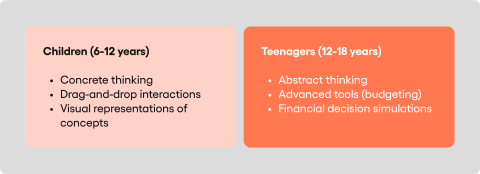

Good design for a children’s app must always consider how children’s thinking develops at different ages. We design differently for a six-year-old than for a teenager. This is a basic rule we can’t ignore.

Age group 6-12 years: Concrete thinking

Children aged 6 to 12 mainly think in a concrete and operational way. This means they learn best through direct, hands-on interactions. That’s why features like “drag-and-drop” and other easy gestures work well in apps for this age group.

Money ideas that are obvious to adults can be confusing for children. Because of this, it’s very important to use pictures to show these ideas. Showing savings goals, spending, or the value of money with images makes them much easier to understand.

Age group 12-18 years: Abstract thinking

Teenagers aged 12 to 18 start to think in a more abstract way. They can already understand more complex money ideas. They expect more advanced tools from apps, such as features for budgeting or planning spending.

For older children and teenagers, we can easily add simulations for making financial decisions. These let them try out different situations in a safe, controlled way. This is a great way to learn about financial responsibility in a practical sense.

Adapting to a child’s physical development

We also need to remember children’s developing motor skills. Especially for younger users, it’s necessary to use bigger buttons, clear icons, and generally larger interface elements. This will make the app comfortable and easy to use.

Easy-to-use navigation, suited to the child’s stage of development, is another very important point. The app’s structure should be simple, logical, and easy to predict. Children need to feel confident moving through the different screens and features, without getting lost or frustrated.

Visuals and gamification

Attractive visuals and cleverly added game-like elements are key to keeping children interested. These often decide whether a young user will like the product and want to use it regularly.

The UXDA Kids Banking App is a very good example of this. Its creators used very colourful backgrounds and 3D icons, which makes it feel more like fun and adventure.

Virtual assistants, like a friendly dog guiding the user through features, are another good idea that builds an emotional connection. What young testers said speaks for itself – they often asked, “Is this a game?”, which shows how successful the app was in making a financial tool that feels like entertainment.

Key visual design practices

Gamification, which is using elements of game mechanics, is absolutely crucial for engaging younger users. Points, badges, levels, virtual rewards – all these things make using the app fun. Learning about money just happens along the way.

Creating consistent themed worlds, for example, about animals or space, is also very effective. Being able to personalise the app’s look based on the child’s age and gender is another important point. Dynamic animations and sounds make it more visually appealing, as long as they are used in moderation.

Information structure and navigation

A banking app for children must have a structure that is easy to understand and fully suited to their stage of development. Even the best features and the prettiest graphics won’t help if a child can’t move around the programme by themselves.

Logical division and personalisation

Looking at solutions available on the market, we can point to some proven methods. A very good approach is to logically divide the app into clear functional areas, such as: Piggy Banks, Transfers, Tasks, or Education.

This helps children know where they are and quickly find the options they need. It’s also worth thinking about letting young users personalise the home screen. Children could choose which functions or information they want to see first. This flexibility makes them feel more in control and makes the product fit their individual needs better.

Safe display of data

It is extremely important to place information about the account balance safely and thoughtfully. In many successful designs, the balance is not shown directly on the main screen for the child. This is to protect privacy and avoid unnecessary stress from seeing the amount, especially if it’s small.

Security and following the rules (Compliance)

Making apps for children comes with special demands for safety and following regulations. These points must be thought about from the very beginning of the design process, because they greatly impact how the product is built and what it does.

Regulatory challenges

The financial sector is tightly regulated, and products for minors have extra, strict rules. These limits affect what features can be offered, for example, when it comes to offering credit or investment products.

We also need to remember the special requirements for protecting children’s personal data (like GDPR), which are much stricter. A key requirement is getting verifiable consent from parents for all data processing and financial actions.

Cybersecurity in mobile finance

Growing online threats mean we need special protection for young users, who are often less aware. Mobile financial systems are at risk from advanced attacks like malware, phishing, and ransomware.

That’s why it’s so important to use modern security, including real-time monitoring systems based on artificial intelligence and machine learning.

Data shows that parents’ worries are real. As many as 65% of them are afraid of online scams, and 62% worry about their children sharing personal data. This highlights the need for not just strong technical security, but also education about online safety built into the app.

In summary

Making a good banking app for children needs a varied approach. The foundation is understanding the market – digitally aware children and their parents, who expect both educational value and complete safety.

The key to success is UX/UI design based on how children develop, combining engaging game-like features with an easy-to-use structure. All of this needs to be completed with thoughtful features that give parents control, and a strong commitment to security and legal rules.

For banks, this is a smart investment in the future. Analysis predicts that banking for children will grow a lot from 2025.

Launching such an app, especially using ready-made “white-label” solutions, which cut the time to market from 10-15 months to 3-5 months, helps secure future customers and makes the bank stronger as a family-friendly bank. With more competition, doing nothing in this area could mean losing a whole generation of customers.

FAQ

1. Why are banking apps for kids becoming so popular?

The popularity of banking apps for kids is surging because younger generations expect sophisticated digital tools for everything, including their finances. A dedicated mobile banking app is no longer a novelty but a necessity for banks wanting to attract young customers.

Statistics show that a majority of children are already using these apps. The trend is amplified by social media, which makes finance more relatable and drives the demand for intuitive kids accounts and the more advanced teen account.

Banks that fail to provide a quality mobile banking experience risk losing an entire generation of future clients.

2. What are the main benefits of opening kids’ accounts with a mobile banking app?

The chief benefit of opening kids’ accounts is the opportunity for practical financial education. A mobile banking app serves as a safe, controlled environment to teach good savings habits and build a child’s money confidence from an early age.

It makes managing pocket money simple and visual, allowing a child to see how their decisions affect their balance in their first current account. By using the app to manage their own savings account, children learn crucial budgeting and planning skills that will serve them for life.

3. How do parental controls work on a kids debit card and account?

Parental controls are a core feature, giving the legal guardian’s ability to oversee all activity from their own parent account. From their app, a parent can set spending limits, including strict daily spending limits, to manage their child’s spending effectively.

These controls can block certain transaction categories and provide instant notifications or spend notifications for every purchase made with the kids debit card. This ensures parents have full visibility and control over the spending account, creating a foundation of trust and security.

4. Can a child use a debit card from their account to pay online or in shops?

Absolutely. A key feature of these bank accounts is providing a child with their own kids debit card or, in some cases, a prepaid debit card. This card empowers them to make online payments and in-store purchases, giving them hands-on experience.

For even greater convenience, the debit card can be added to a mobile wallet, allowing for secure contactless payments using Apple Pay or Google Pay. All transactions, whether made with the physical kids debit or a service like Apple Pay, are tracked within the app for the parent to review.

5. What features help a young adult manage their own savings account?

To help a young adult manage their money, these apps offer more than just a standard account that pays interest. The focus is on visual, goal-oriented savings accounts.

A child can create virtual “piggy banks” for things they want to save for, which is a powerful tool to teach good savings habits. While some savings accounts do earn interest, often displayed as a gross rate or annual equivalent rate, the key motivational feature is the interactive progress tracking.

This visual feedback is more effective for building good savings habits than a simple interest rate alone.

6. How do banking apps for kids use gamification to build money confidence?

Gamification is a technique used to make learning about finance feel like a game, which is highly effective for building money confidence in young users. Instead of lectures, the mobile banking app uses points, badges, and rewards to encourage positive financial behaviour.

A child might complete chores to earn more money for their pocket money or hit a savings goal to unlock a new achievement. This playful approach keeps children engaged and helps them learn key financial concepts almost by accident, making the entire process fun and rewarding.

7. Are these banking apps designed differently for younger children and teenagers?

Yes, the design of the mobile banking experience is carefully tailored to the user’s age and cognitive abilities. An app for a younger child (6-12) will use a simple interface with large, colourful icons and concrete actions, as this is how they learn best.

In contrast, a teen account for an older child (12-18) will feature more advanced tools for budgeting and planning to help the young adult manage their finances more independently. This ensures the app remains relevant and useful as the child grows.

8. What security measures are in place to protect child’s spending account?

Protecting a child’s spending account is the highest priority, involving multiple layers of security. The online banking platform uses modern cybersecurity, including AI-based monitoring, to defend against threats.

A crucial security feature is the legal guardian’s ability to control the account; all financial operations require verifiable parental consent. Should a debit card be lost or stolen, it can be frozen instantly from the parent account.

Additionally, instant notifications for all transactions provide real-time monitoring of the child’s spending.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.