Bespoke fintech mobile app development: What works and what doesn’t

Fintech app development innovation is no longer just about the technology itself, but about how well it can be adapted to fit the specific needs of each business and its customers. As financial services become more digital, off-the-shelf solutions are often too rigid to keep up with the nuanced demands of modern users. That’s where working with a fintech app development company to create a bespoke banking app comes into play. By tailoring every aspect of the software development process — from data security features and seamless onboarding process to user experience and compliance — financial institutions can use advanced technology to create platforms that not only meet but exceed expectations, aligning precisely with their business objectives and the distinct preferences of their users.

This article will delve into the details of fintech development, exploring what it takes to create a financial app that is fully customised to meet the needs of both businesses and users. We’ll examine when and why custom fintech application development services are preferable over premade alternatives, highlight best practices for building secure, scalable, and compliant fintech apps, and explore case studies that demonstrate both success and failure in this domain.

Table of contents

Introduction to Bespoke Fintech App Development

The term “bespoke” in the world of fintech app development services refers to custom-built solutions tailored to meet the specific needs of an organisation. Unlike ready-made products, such tailored apps are personalised and built from the ground up to ensure full alignment with a company’s unique business goals, customer demands, and operational requirements. The software development process in that case involves designing, developing, and deploying a banking app that focuses on individual requirements of the company, whether that be in terms of user interface, security protocols, or integration with specific third-party services.

According to market research, 45% of consumer use financial mobile apps at least once per day and 48% have 3 or more money-related mobile applications installed on their phones. In today’s competitive fintech industry, customers are seeking more than just a basic mobile banking app. They desire seamless, intuitive, and, above all, personalised mobile experiences. Digital wallets and other financial management apps have to deliver innovative functionalities, for example a possibility to make an instant money transfer. Fintech development has to be able to deliver these promises and enable better financial management for banking customers. This increasing demand for personalised services, from tailored investment advice to real-time transaction analysis, has led many fintech firms to turn to bespoke software development as a solution.

When and Why To Invest in Bespoke Fintech App Development

Choosing to invest in custom fintech app development is a strategic decision that goes beyond standard functionality. It’s about crafting fintech solutions tailored to each company’s specific market, regulatory environment, and user expectations. In this section, we’ll explore the key reasons and scenarios where bespoke software development delivers unmatched value and long-term flexibility for all companies that want to build an investment app, a financial management app, or other mobile banking solutions.

Market Research

The fintech industry is constantly growing, and with an influx of mobile-first users, the competition to provide superior customer experience is fierce. An off-the-shelf mobile banking app can only take business so far, often failing to meet specific needs like regional compliance or niche customer preferences. Bespoke fintech app development services enable the financial industry to access sophisticated market data analytics, and then differentiate themselves by offering unique services that align with trends and customer expectations. Every fintech app idea should begin with thorough market data research and then continue with finding the right fintech app development company that uses advanced technologies to deliver exquisite Android and iOS apps.

Personalisation

One of the key advantages of tailor-made fintech app development solutions is the ability to personalise every aspect of the user experience in mobile apps. From branding elements to individual product offerings based on user data (e.g. transaction history), the flexibility of a bespoke solution allows companies to offer a truly personalised customer journey. Hyper-personalisation is a serious trend that should not be overlooked — 18% of fintech investments went towards such efforts last year. Consumers that want to use an investing app or improve their wealth management will definitely search for a fintech application that will have high personalisation capabilities.

Scalability and Flexibility

Every fintech company’s needs will grow and evolve over time. Sometimes this growth can be unexpected and requires quick decision-making. Bespoke fintech app development process is designed with scalability in mind, enabling businesses to easily add new features, expand user capacity, or integrate with new services as they scale. The flexibility of a custom-built fintech application allows the company to pivot and adjust its offering without significant rework.

Regulatory Compliance

A fintech company that has a revolutionary app idea has to navigate complex regulatory frameworks, and a lot of them. Adhering to GDPR, PSD2, local policies, and specific anti-money laundering (AML) rules means staying compliant is non-negotiable in banking app development. A tailored fintech app can be built to meet all relevant regulatory requirements from the outset, ensuring a smoother process of obtaining approvals and maintaining ongoing compliance. Premade solutions don’t always have such an option.

Sustainability and ESG

In an era of increasing focus on responsibility for our planet’s condition, a bespoke fintech app can incorporate features like carbon footprint tracking for transactions, helping companies align their services with environmental, social, and governance (ESG) goals. These features demonstrate a commitment to sustainability, which resonates well with today’s conscious consumers. Partnering with a fintech mobile app development that also cares about these causes means they can help banks and financial organizations reach these objectives.

Best Practices in Fintech App Development

Each decision made during banking app development — whether it’s about security protocols, user experience, or integration — can make or break the success of the final product. In this section, we’ll explore essential best practices in fintech app development process, helping you understand what works and how to avoid common pitfalls. Also, working with a fintech app development company that can update the financial app to keep pace with evolving technology and regulatory requirements is a smart decision to make early on.

Secure Solutions

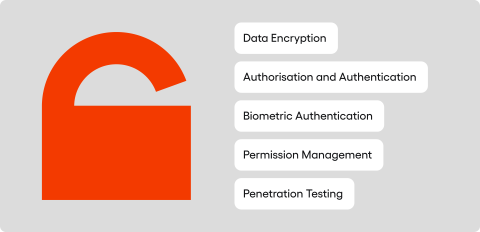

A fintech app has to handle sensitive data, from personal information to transaction details, making it a prime target for cyberattacks. Security in bespoke fintech app development is not just an add-on, but a fundamental feature, woven into the very fabric of the fintech application. Robust security measures should be integrated at every level, ensuring a seamless balance between user convenience and data protection.

- Data Encryption: Implementing strong encryption protocols, such as AES (Advanced Encryption Standard) and SSL/TLS (Secure Socket Layer/Transport Layer Security), ensures that sensitive information remains encrypted both in transit and at rest. This is particularly important for protecting data like credit card information and personal identification numbers (PINs).

- Authorisation and Authentication: Two-factor authentication (2FA) and multifactor authentication (MFA) add layers of security, ensuring that only legitimate users gain access to their accounts. These features have become standard in fintech app development, preventing fraudulent access even if user credentials are compromised.

- Biometric Authentication: As fintech app development services evolve, biometric solutions like facial recognition, fingerprint scanning, and even behavioural biometrics (e.g., analysing typing patterns) offer enhanced security. These methods reduce the reliance on passwords, which are often weak or reused across multiple platforms.

- Permission Management: By implementing fine-grained permission management, fintech apps can control which users have access to different features based on their roles. This ensures that sensitive actions, such as authorising high-value transactions, are only available to trusted users.

- Penetration Testing: Regular penetration testing helps identify vulnerabilities before they can be exploited by malicious actors. By simulating real-world attack scenarios, developers can patch weaknesses early in the development cycle.

When it comes to security, the most common mistake to avoid by the fintech app development team is relying on outdated security libraries or frameworks, which may have known vulnerabilities. Additionally, failing to enforce strong password policies or implementing overly simplistic password reset procedures within the financial app can leave it vulnerable to brute force or social engineering attacks.

Compliance with Regulations

Compliance is an integral part of fintech app development. With a growing number of global and regional regulations governing data privacy, anti-money laundering (AML), and user authentication, a fintech mobile app must be designed to meet these standards from day one. This ensures both legal compliance and customer loyalty, as users are increasingly aware of their digital rights and their want their mobile banking apps to respect them.

- KYC (Know Your Customer): KYC processes are essential for verifying the identities of users, especially in a financial app that deals with various transactions. Properly implemented KYC mechanisms help prevent fraud and comply with AML requirements by ensuring that only legitimate users gain access to financial services.

- AML (Anti-Money Laundering): Tailor-made fintech app development must include features that detect and prevent money laundering activities, like monitoring transaction patterns and reporting suspicious activities to relevant authorities.

- PSD2 (EU Directive for Open Banking): Compliance with PSD2 ensures that a mobile banking app can securely share customer data with third-party providers, encouraging innovation in the financial services industry. The directive mandates strong customer authentication (SCA) and secure access for third-party payment providers.

- GDPR (General Data Protection Regulation): Fintech apps operating in the European Union must comply with GDPR regulations to protect users’ personal data. This includes obtaining explicit consent from users before processing their data, providing the right to be forgotten, and safeguarding against data breaches.

- WCAG (Web Content Accessibility Guidelines): Ensuring that apps are accessible to users with disabilities is not just a regulatory requirement, but also an ethical one. By adhering to WCAG, a fintech app can reach a wider audience and ensure inclusivity in their services.

The major problem when it comes to compliance in banking app development is the lack of ongoing monitoring of regulatory changes that can lead to non-compliance. Moreover, poor storage of user consent data for GDPR compliance can result in heavy fines and reputational damage.

Architecture and Scalability

A robust architecture is the backbone of a successful fintech app. Given the dynamic nature of financial services, a mobile app must be designed to scale as the business grows and user demands evolve. Digital solutions with poorly designed architectures may struggle to handle increasing volumes of data and transactions, leading to poor performance and, ultimately, a negative user experience.

- Microservices: Microservices architecture breaks the app into smaller, independent components that can be developed, deployed, and scaled separately. This allows fintech app development to remain flexible, with each service handling a specific function, such as payments or user authentication.

- Cloud-based Infrastructure: Fintech app development consulting companies often leverage cloud services because they enable a mobile app to scale quickly and handle fluctuating workloads. Cloud infrastructure provides the flexibility to add resources as needed, ensuring that the mobile app can handle increased traffic during peak times without performance degradation.

- Containerisation: Containerisation technologies, like Docker, ensure that a mobile app can be deployed consistently across different environments. Containers package the app’s code and dependencies, making it easier to deploy updates and scale horizontally when necessary.

As for challenges in software development for financial companies, relying on monolithic architecture, where the entire mobile app is built as a single, interdependent block, can hinder scalability and make updates more complicated. A poorly optimised database can also slow down the app’s performance, especially as the user base grows.

User Experience (UX)

User experience plays a critical role in fintech app development solutions, where ease of use, simplicity, and personalisation are essential to attracting and retaining users. A custom fintech app offers the opportunity to create a smooth, intuitive interface that aligns with the brand’s identity and meets the specific needs of its users.

- Usability and Simplicity: A clear, simple interface makes it easy for users to navigate and complete tasks without confusion. Reducing unnecessary steps in financial processes like user registration and transactions ensures that customers can focus on the core functions of the mobile app without frustration.

- Responsiveness: A bespoke fintech app should be responsive, providing a seamless experience across various devices, from smartphones to laptops. Given the variety of devices in use today, ensuring responsiveness improves user satisfaction and engagement.

- Personalisation: Offering tailored services and content based on user data, such as spending habits or financial goals, enhances the customer experience. For example, a fintech app could recommend personalised investment options based on the history of user transactions.

- Accessibility: Compliance with accessibility guidelines such as the EU Directive 2019/882 ensures that apps are usable by people with disabilities. This not only widens the app’s reach but also helps businesses avoid potential legal issues.

Adding too many advanced features in the software development process is considered a potential mistake that can clutter the mobile app and confuse users, driving them away. Lengthy verification processes can also frustrate users, causing them to abandon the app before completing registration.

Integration with External Systems

Integration with external systems is crucial for fintech app development, which often rely on third-party services for contactless payments, data sharing, and more. A well-integrated app can offer a seamless experience to users, allowing them to access multiple services from a single platform. This trend will grow in popularity in the years to come due to the increasing adoption of super apps and value-added services (VAS).

- ISO 20022: This global standard for financial messaging ensures that fintech applications can communicate with other financial institutions using a unified format. Compliance with ISO 20022 allows for smoother integration with banks and other payment systems.

- Open API: Open APIs allow third-party developers to integrate with digital banking services, increasing a specific financial app’s functionality. For example, integrating with a popular payment gateway through an open API can make it easier for users to complete financial transactions.

- Payment Provider Partnerships: Partnering with multiple payment providers gives users more flexibility in how they make transactions. However, it’s important to balance this with app performance and security considerations.

Failure to comply with API standards or integrating with too many payment providers can overwhelm the app’s infrastructure and slow down performance. It’s essential to ensure that each integration is secure and necessary for the app’s core functionality.

Performance and Optimisation

A high-performing fintech app is essential to maintaining user trust and satisfaction. Performance optimisation ensures that the app remains responsive, reliable, and capable of handling large volumes of traffic without crashing. A fintech app development company of your choice should be able to not only build a digital product that works splendidly, but also to fix performance issues when they occur.

- Testing: Regular testing, including manual, automated, and load testing, ensures that the app can handle real-world conditions. Load testing, in particular, simulates heavy traffic to identify potential bottlenecks.

- Code Optimisation: Clean, optimised code reduces app size and improves load times, particularly on iOS and Android devices. Reducing latency and improving responsiveness is crucial for retaining users in a fast-paced fintech environment.

- Continuous Integration/Continuous Delivery (CI/CD): Implementing CI/CD pipelines allows for faster updates and bug fixes, ensuring that the app stays relevant and secure without long downtimes.

Ignoring load testing can lead to unexpected crashes during peak times. Furthermore, poor optimisation for mobile devices, where the majority of fintech app usage occurs, can result in slow performance and frustrated users.

What about the eternal dilemma: Progressive Web Apps (PWA) vs. Native Apps? PWAs offer the advantage of cross-platform compatibility, while native apps tend to provide better performance and deeper integration with device features. The choice between the two depends on the company’s specific needs, fintech app requirements, and target audience.

Monitoring and Data Analytics

Monitoring app performance, user behaviour, and other statistics is essential for continuous improvement. By collecting financial data and analysing user interactions, developers can identify areas for enhancement and fix issues before they escalate.

- Collecting Analytics: Analytics provide insights into how users interact with the app, helping developers optimise features and improve the overall experience.

- User Feedback Monitoring: Monitoring user reviews and feedback in app stores helps identify common pain points and areas for improvement.

- Automatic Alerts: Setting up real-time notifications for anomalies or errors ensures that issues are addressed before they affect a large portion of the user base.

Collecting too much data without a clear strategy for analysis can create information overload, making it difficult to derive actionable insights. On the other hand, ignoring user feedback whatsoever can lead to frustration and attrition over time.

Case Studies of Bespoke Fintech App Development Services

Bespoke fintech app development is not just about building a functional product — it’s about creating a solution that aligns with the unique business needs of the market, users, and regulatory landscape. The following case studies highlight how a custom fintech app development project can transform business. Each offers insights into what works in the world of bespoke app development, as well as lessons learned from both successes and failures.

POP Pankki

POP Pankki, a group of 18 cooperative banks in Finland, embarked on a digital transformation by developing a bespoke mobile banking app. Designed to handle core banking operations like payments, account management, savings, and loans, the app also supports insurance services such as generating quotes and paying premiums. Built with strong security protocols like the TUPAS authentication system, the app passed Finland’s F-Secure security audit, ensuring the highest level of protection for users.

A key feature of the app was its ability to drive cross-selling, particularly for insurance and mortgage products. In the year following its launch, the number of insurance customers grew by nearly 20%, showcasing the app’s impact on the bank’s business. The app also integrates with external APIs, offering customers seamless access to various financial services and insurance services within one platform.

POP Pankki’s mobile app became a critical part of the bank’s broader digital strategy, contributing to a 126% profit increase in 2019, the best result in the bank’s history. Made by a 17-member mobile app development team from Speednet over nine months, the app’s modern UX/UI enhanced daily banking convenience while supporting long-term growth. Former CEO Pekka Lemettinen praised our fintech app developers for commitment to delivering high-quality software that aligned with POP Pankki’s strategic goals.

Payka

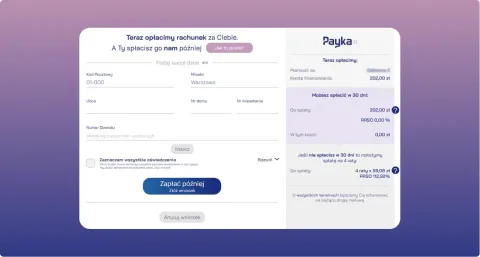

Payka, a Buy Now Pay Later (BNPL) service, focuses on helping users manage utility payments such as energy, TV, internet, and telephone bills. The app simplifies the payment process, allowing customers to defer payments in a fully automated, secure, and efficient way. After selecting the Payka option on the payment gateway, returning users can complete transactions with an SMS code, while new users or those unrecognized by the system can authenticate through their bank account using PSD2/AIS. This streamlined process, integrated with the Blue Media payment gateway, ensures there’s no need to connect directly with individual utility providers.

The security of Payka’s payment system is a top priority, with all transactions encrypted and processed via secure servers and communication channels. This provides peace of mind to users and utility companies alike, enhancing trust and reliability. By integrating with multiple utility providers through a single gateway, Payka offers a convenient solution for both customers and businesses, contributing to its recognition as the “Innovation of the Year” at the Loan Magazine Awards in 2022.

The Payka development team we’ve provided extended its resources through a collaboration model involving five backend developers, working closely with an external front-end team to introduce new functionalities. By offering a flexible payment solution, Payka has tapped into a growing market, attracting a wide range of customers — including those waiting for their next pay cheque — and enabling users to complete higher-value purchases. The success of the BNPL model continues to rise, particularly among millennials and Gen Z, making Payka an essential tool for both users and businesses looking to boost customer satisfaction and sales.

Wonga

Wonga, once a prominent player in the UK payday loan market, offers a cautionary tale for fintech companies about the importance of compliance and sustainable business models. Founded in 2007, Wonga rose to prominence by offering short-term loans with a fast approval process, facilitated by its bespoke digital platform. The app provided quick and easy access to loans, with approval decisions made in minutes — appealing to users who needed immediate financial support.

However, despite its technological success and user-friendly interface, Wonga failed to adequately address the growing regulatory scrutiny in the payday loan industry. The company was criticised for its high-interest rates and lack of transparency in loan terms, which led to significant regulatory action from the UK Financial Conduct Authority (FCA). In 2014, Wonga was forced to write off £220 million in debts for over 330,000 customers due to non-compliance with affordability checks. By 2018, the company collapsed into administration, unable to adapt to new regulatory frameworks and public backlash.

The downfall of Wonga underscores a critical lesson for fintech companies: compliance with regulations is just as important as technological innovation. While Wonga’s bespoke app excelled in user experience and speed, the company’s failure to align with evolving regulations led to its demise. For fintech startups and established businesses alike, ensuring that regulatory compliance is built into the DNA of the app from the outset is crucial for long-term survival.

Conclusion

Bespoke fintech app development services offer a tailored approach that goes beyond standard off-the-shelf solutions, allowing the fintech sector to meet the evolving needs of their users while maintaining flexibility, scalability, and compliance with complex regulations. By focusing on security, regulatory adherence, and user experience, bespoke apps can offer financial services that are both innovative and sustainable. The success stories of fintech mobile app development for POP Pankki and Payka demonstrate the power of custom-built fintech solutions in driving growth and enhancing user satisfaction. On the other hand, Wonga’s downfall serves as a reminder of the importance of maintaining regulatory compliance.

Investing in a partnership with a fintech app development company is not just about technological innovation — it’s about building a long-term, scalable, and secure foundation that aligns with business goals and user expectations. By following best practices and learning from both successes and failures in the industry, fintech companies can create mobile applications that offer a competitive edge in today’s rapidly evolving financial landscape.

If you’re ready to take your fintech app to the next level, explore Speednet’s fintech software development services and discover how our expertise can help you build secure, scalable, and high-performing applications tailored to your business needs.