Our fintech ecosystem

Join the fintech partnership ecosystem, expand your customer base and work with us to ensure the success of your current customers. Together we are stronger.

Challenges in today’s financial market

Partner ecosystem

It’s more than just a group of FinTech experts – it’s a collaborative ecosystem offering the chance to boost your revenue by an average of 20–30% through cross-selling and joint marketing efforts, speed up the deployment of your solutions by up to 40%, and cut operational costs.

Our approach to digital transformation

We work with our partners to create Speedboat Solutions – fast-to-deploy, innovative products designed for joint cross-selling and helping you attract new customers.

Together, we’re building the Partner Network – a trusted ecosystem of technology providers, delivering greater value to clients through collaboration.

We combine our products into ready-to-use Value-Added Service (VAS) modules – boosting both your revenue and ours.

AI isn’t everything – we bring deep Industry Expertise in the financial sector, which we share to tackle even the most complex challenges our clients face.

Innovative, quick-to-deploy solutions – Speedboats

These are quick-launch products that help us enter new business relationships effectively.

According to Deloitte, 62% of banks now view co-developing products and services with fintechs as a top priority.

Let's talkThe future is embedded finance

Market value: $392B (expected to reach $629B by 2030)

Examples of services we implement:

- Mobility: Parking, tolls, public transport

- Retail: Shopping, loyalty programmes, exclusive offers

- Entertainment: Cinema tickets, subscriptions, VOD

- Public services: Company registration, healthcare payments

Success Story: Full Pay-by-Bank integration delivered in just 2 weeks!

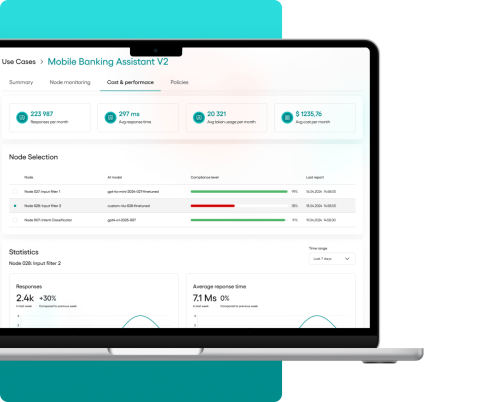

How the partnership works

Learn about the process of joining the partnership ecosystem.

Let’s take the first step

Leave your contact details – I’ll get back to you as soon as possible to explore how we can work together and how you can join our ecosystem.