New Digital Products in Banking: What is blocking speed?

Developing new digital banking products currently feels like running a gauntlet. Technology, which should act as an engine for growth, frequently serves as a heavy anchor instead. One brutal fact illustrates the scale of this paralysis: according to Gartner, 59% of IT systems in organizations fail to support strategic business goals. Such a deep disconnect means product teams waste resources fighting technical debt rather than building value for customers. This analysis pinpoints the systemic barriers—from hidden infrastructure costs and data chaos to mounting legal pressure—that financial institutions and credit unions must overcome to regain their market footing.

Key takeaways

- Mobile banking apps are no longer enough. While mobile banking has become the market standard, it does not guarantee retention. As Accenture reports, nearly six out of ten customers (58%) now actively look for better deals from competitors.

- IT costs are spiralling out of control. Actual maintenance spending is proving to be 3.4 times higher than original budget estimates, impacting financial stability.

- Decisions are made in the dark. A massive 90% of business users report they lack quick access to strategic information needed for decision-making regarding digital banking services.

- Strategy and technology operate in silos. Most digital banking systems (59%) simply do not deliver on business goals, effectively blocking growth.

- Cybersecurity is the absolute priority. For 75% of chief risk officers, defending against attacks now outweighs geopolitical or financial risks.

- Capital is flooding into regulatory technology. Investors poured $5.3 billion into RegTech solutions in just the first half of 2024 to support regulatory compliance.

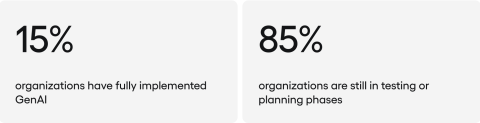

- AI remains in the testing phase. Despite the market hype, only 15% of organizations have implemented Generative AI at a full, company-wide scale.

The end of safe experiments

The financial sector is undergoing a severe value test. The era of safe experiments in isolated innovation labs is over. Leading research from Gartner, McKinsey, and Deloitte reveals a ruthless reality for the 2024–2025 market. Survival for banks now depends on three factors: technical scalability, complete operational resilience, and the ability to turn data into profit quickly. Legacy banks that still view technology merely as a cost centre are ceding ground to players who use digital transformation to drive their business model.

The 9 elements holding the bank back

Why are banks still losing ground to faster rivals, despite throwing record amounts of money at IT? It is not for a lack of ideas. The real issue is the pace of delivery. Digital transformation is a complex reality where every new innovation sits layered on top of decades of legacy infrastructure. Below, we look at the nine biggest hurdles, from creaking systems to isolated teams, that are simply getting in the way of progress.

1. The trap of technical debt. Modernising core systems

Traditional banks are blocked by monolithic Core Banking Systems. These were built in a time that did not foresee real-time digital banking, open APIs, or artificial intelligence. Although decision-makers know the problem exists, they systematically underestimate the cost of keeping this heritage alive. McKinsey analysis shows that banks underestimate the total cost of ownership (TCO) for old technologies by as much as 70–80%.

Such a miscalculation results from ignoring hidden costs. These include astronomical rates for specialists in dying programming languages like COBOL and unacceptably long testing times for even the smallest changes to banking software. The most painful cost, however, is lost profit due to slow product launches. In reality, actual IT costs can exceed the modernization budget by more than three times.

Yet the issue extends far beyond the balance sheet; it paralyses the entire organizational strategy. Gartner warns that nearly 60% of applications do not fit current business goals. Technology, instead of supporting the delivery of banking services, forces employees to use inefficient manual workarounds, dragging down the bank’s overall operational efficiency.

How to break the deadlock? Evolution over revolution

The market is moving away from risky “Big Bang” system replacements. They pose too great a threat to business continuity. Iterative methods are becoming the new standard, allowing digital banking solutions to be delivered faster and more safely.

Risk is best limited by phased replacement, which involves moving functionalities module by module—migrating deposits first, for example, then credits. This approach yields savings of 38% over 18 months and speeds up implementation by 62%. A clean architecture is guaranteed by parallel implementation, building a new digital banking system alongside the old one and gradually migrating clients. The price for this comfort is double maintenance costs during the transition. A quick entry into new niches is made possible by the Banking-as-a-Service model. New products are launched on external cloud based platforms, leaving the old system only to service current processes in maintenance mode.

Modern digital banking platforms act as a key enabler here. They function as an intelligent connector between the rigid central system and dynamic online banking services, allowing data and processes to be freed without the risky exchange of the entire core.

2. Data architecture

Banks face a paradox where they drown in data yet suffer from a severe shortage of useful information. A massive 90% of business employees lack quick access to the data needed for key decisions regarding financial management. Worse still, 81% of respondents cite poor data quality as the main block in their daily operational work.

Thoughtless “lift-and-shift” cloud migration has made things worse. Moving disordered data to virtual servers does not magically improve its quality; it simply changes where the mess is stored. Deloitte warns that cloud data often remains just as isolated in silos as it was in local banking software, effectively preventing its use by advanced artificial intelligence algorithms.

Are you ready for AI? The maturity test

The year 2025 marks a turning point. “AI-readiness” is becoming a hard, measurable indicator of a banking institution’s maturity. Organizations that have organised their data for machine learning report business results that are 26% better. Unfortunately, 65% of firms still lack such resources or cannot reliably assess their quality.

Meeting this standard is vital given the incoming wave of Autonomous AI Agents. These digital banking systems require not only access to information but, above all, certainty about its origin and a precise description. Without this background, autonomous software becomes unpredictable. It can generate false information—hallucinations—or break regulations, which is unacceptable in digital banking.

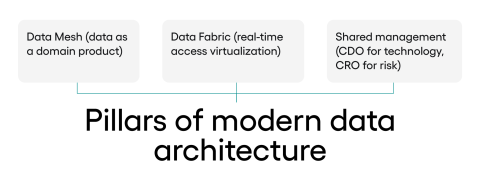

Data Mesh is not technology, it is a power shift

Technology leaders are tidying up data architecture by implementing the Data Mesh model. In theory, it sounds simple: data stops being the property of central IT and becomes a product managed by specific business departments, such as credit.

Implementing it, however, requires a major political and cultural shift. It forces the business side, which was previously just a consumer of reports, to take full responsibility for the quality and maintenance of source data. Without breaking down resistance inside the organisation, even the best digital banking software—like the data virtualization layer known as Data Fabric—will remain an empty shell. Joint Stewardship ensures security, where the CDO handles the technical side, and the CRO sets the safety boundaries for risk management.

3. A thicket of regulations. Global legal fragmentation

The dynamic shifts in the 2025 regulatory environment force banks to adapt constantly. Financial institutions must simultaneously meet new, strict resilience requirements, such as the EU’s DORA act, and operate under political uncertainty stemming from administrative changes in the US and Europe.

A lack of legal consistency holds back global expansion. The CCAF and WEF report confirms that complex licensing processes are the main barrier to growth in international markets. The need to obtain separate licenses in each country and varying data privacy rules cause legal and regulatory compliance costs to snowball.

New rules of the game for artificial intelligence

The entry into force of the EU AI Act fundamentally changes the rules. Authorities now require full transparency. A banking institution must be able to explain precisely why an algorithm made a specific credit or operational decision.

Compliance demands the ability to document every element of data used to train the model. Close, unprecedented cooperation between IT staff and lawyers becomes essential, often lengthening implementation processes for new digital banking services.

RegTech, or automated compliance

The response to these growing challenges is a sharp rise in RegTech investment. This sector attracted $5.3 billion in capital in the first half of 2024. Banks are deploying artificial intelligence here en masse to verify identity precisely (KYC) and detect money laundering attempts (AML). They are also monitoring millions of live transactions to find financial crime and sanctions violations, as well as tracking legal changes worldwide to provide automated regulatory support and adjust internal procedures automatically.

4. Cybersecurity. An asymmetrical arms race

Hacker attacks have definitely ceased to be an IT department problem. They have become a threat to the company’s physical existence. Global losses from this source now exceed $6 trillion annually. For three-quarters of chief risk officers, cybersecurity is now more important and urgent than political instability or traditional risk management concerns.

The insurance industry confirms this view. In the “Insurance Banana Skins 2025” report, cybercrime was ranked as the number one risk for the third time in a row, with record impact strength affecting financial stability.

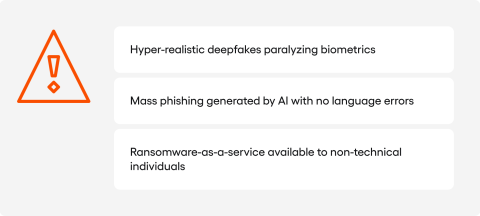

How AI changes attack methods

Criminals use AI to create much more effective attack methods. Authorization processes are paralysed by hyper-realistic deepfakes, which worries more than half of security chiefs who see it as a threat to biometrics. Mass phishing campaigns are now generated by AI, meaning they contain none of the language errors that used to give fraudsters away. The Ransomware-as-a-Service model has drastically lowered the entry threshold, allowing people without deep technical knowledge to carry out attacks on banks.

Digital resilience and the board’s role

Defensive strategy is changing. Instead of just building walls, the focus is on “digital resilience”—the assumption that a breach is inevitable, and the measure of success is the speed of recovery. But speed is impossible without embedded security. Banks must adopt Security by Design and DevSecOps, involving security experts at the concept stage rather than at the final audit, to prevent safety checks from becoming a bottleneck for technological innovation.

Boards are getting directly involved in these issues. A special committee overseeing security operates in 95% of organizations, and the CISO reports risk status directly to the company authorities. Almost half of the largest firms regularly conduct attack simulations to check their procedures in practice.

5. The war for talent

It is not a lack of tools, but a shortage of qualified experts that holds back digitisation the most. Nearly 90% of managers point out that there is simply no one to implement cloud based solutions. Similar acute shortages are visible in cybersecurity and data engineering.

Half of organizations admit bluntly: we lack knowledge about AI, which makes it hard to guarantee the quality of new digital banking software.

Business Technologist. Asset or liability?

To bridge this gap, banks are promoting the role of Business Technologists—business employees who create simple applications using low-code tools. Gartner points to this trend as a key strategic element for driving technological innovation.

Personnel strategy for 2025 rests on three pillars: intensive retraining (reskilling) for the current workforce; offering real flexibility and remote work as a bargaining chip in the fight for talent; and building a strong culture of innovation that attracts people from the tech sector to banking. However, without proper oversight (governance), amateur applications created by the business side can become uncontrollable “Shadow IT,” generating security holes and data inconsistencies in banking software.

6. Integration nightmare

For many financial institutions, connecting systems remains a technical nightmare. More than 70% of banks struggle to integrate data from external providers. The root cause is a lack of standards and the difficulty of connecting the modern cloud with old banking software lacking proper interfaces. Seamless integration remains an elusive goal for many.

In mergers and acquisitions, technology poses the greatest risk. Complex integration can destroy any assumed synergies and profits from the transaction.

Fintechs: The procurement bottleneck

The relationship with fintechs has matured, moving from competition to cooperation. A full 84% of fintechs work with banks, supplying them with technology or white label solutions.

For banks, this is the fastest path to innovation. Success depends, however, on how well they can seamlessly integrate a partner into their systems, which requires investment in open banking and API management. Yet the problem often lies in bureaucracy, not code. Even if technical integration takes days, purchasing processes, compliance, and partner onboarding in a large bank can take 6 to 12 months. Success requires implementing a fast-track procurement path for innovation suppliers to avoid decision paralysis.

7. Customer experience. A conflict of interest

Digitisation provided convenience but took away the relationship. Interactions via online channels are fast but impersonal — what Accenture describes as “functionally correct, but emotionally empty.”

Customers stop seeing differences between banks. Good apps are a standard today, not a differentiator. As a result, 58% of customers buy financial products from competitors, and most use multiple banks simultaneously to satisfy their banking needs.

Looking after the client’s interest versus the business model

Clients expect the bank to “know and understand” their customer needs. The answer is a strategy of looking after the client’s interest to improve customer engagement and customer experience. Banks that genuinely advise, rather than just selling, grow faster.

Digital methods to achieve this focus on features that go beyond the basic delivery channel of a physical branch:

- Recurring payments and bill payment automation to simplify life.

- Budgeting tools that help customers manage cash flow effectively.

- Manage subscriptions features to cut unnecessary costs.

- AI that proactively warns about a lack of funds to cover recurring payments.

- Seamless digital wallet integration with services like Google Pay for instant digital payments.

- Frictionless fund transfers and the ability to transfer money globally.

- Simplified account opening and customer onboarding processes.

- Building trust through financial education (knowledge gaps affect 40% of consumers).

- Combining bots with humans during difficult emotional moments.

Here, however, banks collide with a conflict of interest. If AI advises a client to pay off a credit card faster or move funds to high-yield savings accounts, the bank loses short-term interest income. True digital transformation requires a bold change in success metrics (KPIs)—moving away from rewarding product sales alone to rewarding long-term customer value (LTV) and customer experience.

8. Generative AI

Despite the enthusiasm, broad implementation of Generative AI is going slowly. Only 15% of firms use it across their entire structure, and more than 40% are stuck at the testing stage. Main brakes include difficult integration, privacy concerns, and the risk of errors (so-called hallucinations).

Projects are often run chaotically. Without organising data, most will not bring profit by 2026, as Gartner forecasts. Banks are struggling to integrate these new features into their core product offerings.

Autonomous Agents are coming

The next step is Autonomous AI Agents. Unlike chatbots, they can independently plan and execute complex banking activities on the user’s behalf, such as managing a calendar or financial services. Implementing them requires granting programs appropriate permissions while maintaining strict control. These are becoming key features for any leading provider of banking software.

Necessary oversight

Safe AI development requires supervision. Banks are creating special oversight units responsible for ethics, monitoring errors, and coordinating cooperation between business and IT.

9. Cloud as a product

Treating the cloud just as a “new server room” is a mistake. In the AI era, the cloud must be — as HFS Research indicates — managed like software, meaning fully automated and flexible. Any modern platform offers must be cloud based.

How not to burn the budget

Growing cloud usage means higher bills. The FinOps methodology allows these expenses to be controlled and linked to business benefits, maximizing value from every dollar spent.

Quiet revolution in B2B

Banking for companies is catching up. Corporate clients expect the convenience known from online stores. Main problems include costly invoice processing and payment processing delays. Modern platforms offering instant digital payments and accounting integration act as the solution. Banks must adapt their product offerings to these evolving needs of the past decade.

Synthesis. The end of superficial transformation

An analysis of technological and operational barriers leads to one conclusion: the model of skin-deep digitisation, which involves attaching modern digital banking solutions to an outdated core, has exhausted its potential. The divergence between business goals and IT capabilities (a 59% gap) proves that banks face a hard development barrier in the form of their own infrastructure. Four facts about the sector’s condition emerge from the 2024–2025 data.

First, technology has become a brake. The complexity of old systems and underestimated maintenance costs mean every new project carries a technical debt tax; instead of building an advantage by allowing customers to do more, IT departments consume resources to maintain the current state. Second, data is a cost, not an asset. Despite the narrative about data value, banks struggle with its quality. A lack of access to reliable information hinders decisions, and without tidying up the architecture (often politically painful), implementing AI will remain in the realm of expensive experiments rather than providing banking services efficiently.

Third, security has displaced innovation. The rise in cyber threats forced a change in priorities, making resilience to failure more important than short-term cost optimisation. Finally, people are the bottleneck. The main block is not a lack of technology, but a lack of people capable of implementing it safely, making the competence gap between business and IT a critical risk for various banking services. The growing demand for talent in the new forms of banking remains unmet.

FAQ

What is new digital banking?

New digital banking represents a fundamental shift where the bank evolves from a transactional utility into an invisible, intelligent life partner. It moves beyond simple online banking services to offer hyper-personalised experiences powered by artificial intelligence and real-time data. In 2025, this means banking that is proactive — anticipating a customer’s cash flow issues before they happen — and deeply integrated into non-banking apps through embedded finance, allowing users to pay bills, manage subscriptions, and secure loans instantly at the point of need without ever opening a traditional banking app.

What is the latest technology in banking?

The technological landscape is currently defined by four transformative forces that are reshaping financial institutions:

- Generative & Agentic AI: Moving beyond basic chatbots to autonomous agents capable of complex decision-making and executing multi-step banking activities on behalf of the customer.

- Cloud-Native Infrastructure: Banks are treating the cloud as software — fully automated and scalable—to support the heavy computational load of AI and ensure financial stability.

- Data Mesh & Fabric: Advanced architectures that organize data into accessible products, solving the quality crisis that has plagued legacy banking software.

- RegTech: Automated solutions for regulatory compliance and risk management that use real-time monitoring to detect financial crime and adapt to changing global laws instantly.

- Shutterstock

What are the 5 types of digital banking?

The modern digital banking ecosystem has diversified into five distinct models to meet evolving customer needs:

- Online & Mobile Banking: The digital extension of traditional banks, offering core services like fund transfers and bill payment via web and mobile apps.

- Neobanks: Digital-only fintechs without physical branches that focus on user experience and specific niches (e.g., freelancers, travelers), often operating on top of a partner bank’s license.

- Challenger Banks: Fully licensed digital banks that compete directly with legacy institutions, offering full banking services from savings accounts to mortgages, but with a leaner, technology-first cost structure.

- Banking-as-a-Service (BaaS): A model where licensed banks open their digital banking platforms to third parties, allowing non-banks (like retailers or tech companies) to embed financial products into their own user journeys.

- Crypto & Blockchain Banking: Emerging hybrid platforms that bridge traditional fiat banking with digital assets, facilitating digital payments and settlements using distributed ledger technology.

What is the new technology in banking 2025?

In 2025, the frontier of technological innovation is dominated by Agentic AI — autonomous systems that don’t just chat but take action. Unlike previous digital banking solutions, these agents can plan and execute complex workflows, such as optimizing an investment portfolio, switching utility providers to save money, or managing end-to-end customer onboarding. Additionally, Zero Trust Architectures are becoming the standard for security, ensuring that open banking ecosystems remain secure by continuously validating every user and device, regardless of their location.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.