A loan sales and management system

Upgrading of the legacy solution with new functionalities and reducing the technical debt

Learn more about a system for our fintech client

About the service

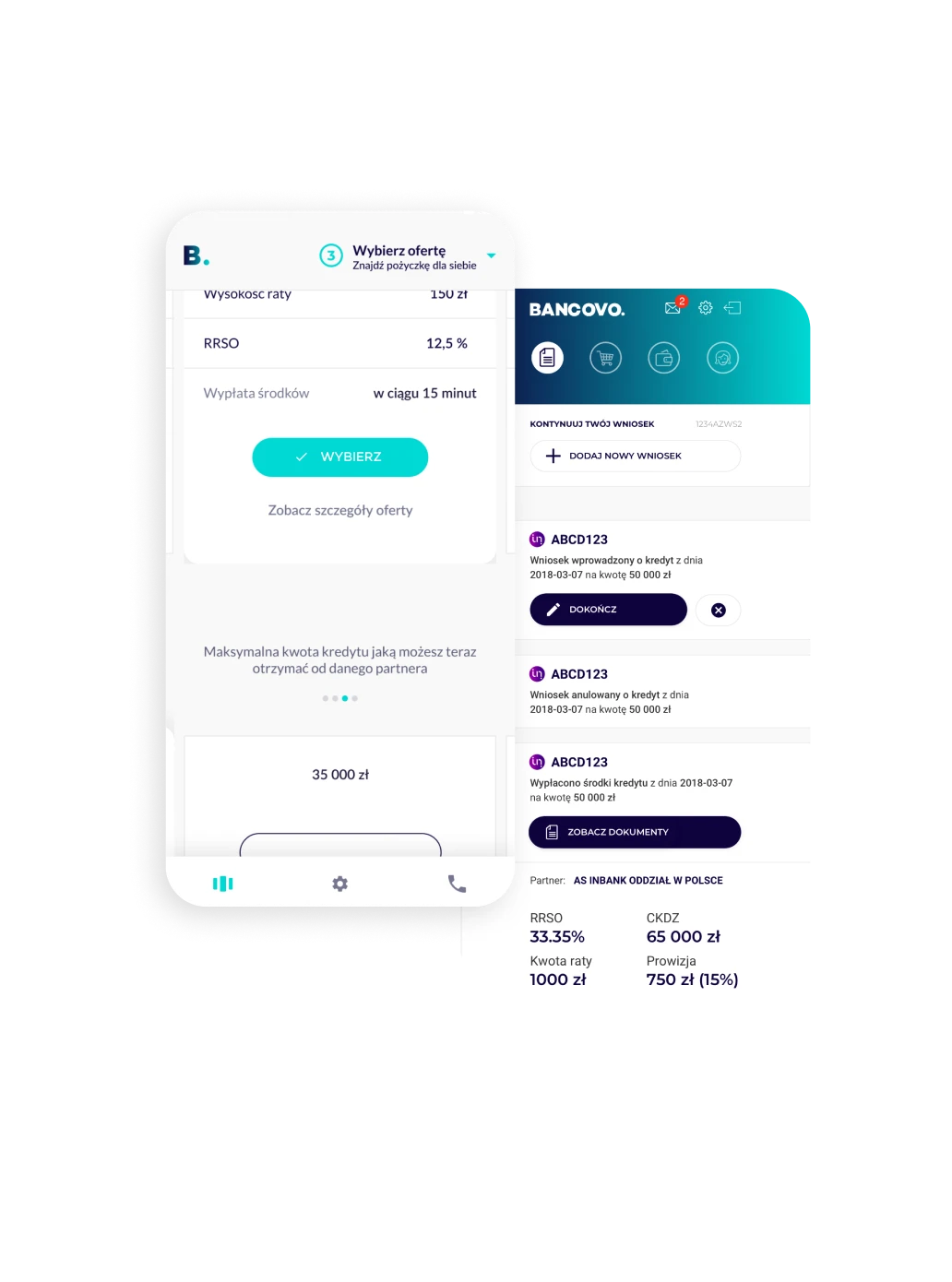

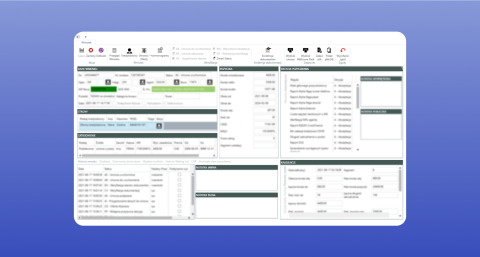

Our team entered the project running and got down to work on two platforms, one of them dealing with the processing of loan applications (scoring and risk assessment, blacklist checking), and the other used for handling existing loans (monitoring the repayment schedules, verifying bank payments).

We upgraded the legacy solution with new functionalities and reduced the technical debt in the process. We were working together with the Client for 2 years.

Disclaimer: All the information relating to the client is protected by an NDA agreement, therefore we have avoided using names that could identify them. For this case study, we’ll refer to them as ‘the Client.

The Client is one of Poland-based, fintech companies. It specializes in real-time payments that are accessible thanks to non-banking solutions.

The most important information:

What was included in this service

Our people quickly took over the running and development of the two platforms. At the peak, six Speednet specialists were involved in the project.

The technical debt

Eliminating technical debt in the financial sector is not just an IT decision—it’s a strategic business move. The risks of delaying modernization (cyber threats, compliance issues, operational inefficiencies) far outweigh the challenges of upgrading. Financial institutions that successfully manage technical debt gain a competitive edge, reduce costs, and enhance customer trust.

Benefits of reducing technical debt

- Better security & compliance – Modern systems reduce the risk of cyberattacks and help meet financial regulations.

- More stable operations – Fewer system failures and downtime, ensuring smooth banking services.

- Faster innovation – Easier adopting new technologies like AI, cloud, and open banking.

- Lower costs – New systems reduce maintenance costs and improve efficiency.

- Improved customer experience – Faster transactions and better digital banking services.

Challenges of reducing technical debt

- Risk of service disruptions – System migrations can cause temporary issues or failures.

- High upfront costs – Upgrading IT systems requires a significant initial investment.

- Resistance to change – Employees may struggle to adapt to new technologies.

- Long transition period – Replacing old systems can take months or years.

- Integration issues – Connecting new systems with existing ones can be complex.

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.