Strategic management in mobile banking

Data shows that a mid-sized bank can grow its revenue by €50–100 million a year simply by matching offers more closely to what customers actually need. Yet the numbers tell a troubling story: customer churn in some regions hits 69%, and most institutions still fall short of any advanced personalisation. The root cause is not marketing. It is technical debt. We examine how banks manage customer communications, the challenges of technical debt, and the architectural solutions that help retain customers. The analysis considers three key perspectives: Head of Mobile Banking, Chief IT Architect, and Chief Risk Officer

Table of contents

Key findings

- Event-driven hyperpersonalisation: applying the “Netflix effect” to generate offers within milliseconds of a trigger event, lifting revenue by 10–20%.

- Relevance score filtering: running every notification through an algorithmic relevance filter so that customers do not start ignoring the security alerts that truly matter.

- Communication orchestration: a central decision engine that keeps channels consistent and blocks marketing offers during crisis situations.

- DORA compliance and offline-first design: giving users access to balances and transaction history without a server connection, meeting digital-resilience requirements head-on.

- Digital early-stage collections: shifting repayment processes into self-service channels, raising recovery rates by 40–60% while reducing customer discomfort.

- Dual-layer interface architecture: a modular UI that adapts in real time, meeting the mobile-first expectations of Gen Z while preserving the stability preferred by Boomers.

The mobile banking context in 2026

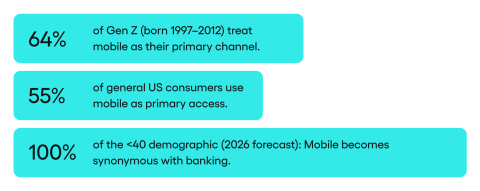

The year 2026 marks the point where treating a mobile app as an add-on to online banking or a branch network is no longer viable. The analytics paint a clear picture. By 2024, mobile was already the primary channel for 55% of US consumers, and among Gen Z (born 1997–2012) that figure stood at 64%, as the American Bankers Association consumer survey confirms. Within two years, for anyone under forty, the phone will simply be banking. Desktops and branches will linger at the margins, used occasionally for complex operations or those requiring a physical presence.

This goes well beyond swapping one screen for another. It is a shift in the very nature of interaction and the philosophy behind the customer relationship. Users under thirty expect the app to do far more than display a balance. They want a “Financial Cockpit,” an integrated interface that bundles payment features with life-management modules: digital subscription management, carbon-footprint visualisation for spending, bite-sized financial-literacy lessons, and automated savings driven by behavioural economics, a trend highlighted in Bankrate‘s overview of digital banking trends. Banks that stick to plain transactional services risk becoming invisible, reduced to background infrastructure, a “dumb pipe,” while fintechs and super-apps take over the direct customer relationship, as analysts at Retail Banker International have warned.

The “Zero-UI” paradox and invisible banking

The dominant tech trend for 2026 is “Zero-UI,” sometimes called Invisible Banking. The idea is straightforward: the best banking experience is the one that demands no attention at all. Payments execute automatically based on situational context. AI algorithms analyse cash flows in real time, spot surplus funds, and sweep them into a savings account. An investment portfolio rebalances dynamically in line with market conditions, with no manual slider adjustments needed. The OCC’s Semiannual Risk Perspective captures the scale of this shift.

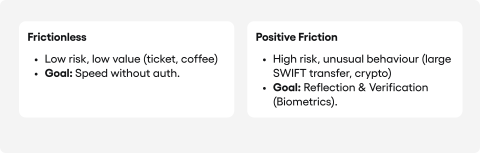

Behavioural economics, though, flags real cognitive risks behind this minimalism. When all friction is stripped out of spending, it triggers what researchers call the “payment depreciation effect.” Without physical contact with cash and a visible dip in the wallet, budget control weakens. People make impulsive decisions because the natural “pain of paying,” the self-control mechanism that cash provides, simply disappears, a phenomenon explored in depth by Glance in their analysis of financial user behaviour.

A bank has to walk a fine line between convenience and responsibility for the customer’s finances:

Frictionless (maximum fluidity) applies to routine, low-value transactions. A bus ticket, a morning coffee, or access to online content should go through instantly. Every extra second of delay or additional verification step breeds frustration.

Positive friction (deliberate slowdown) applies to high-risk transactions. A €10,000 SWIFT transfer to a brand-new overseas recipient should require additional biometric verification or an SMS code. An inexperienced customer trying to put their entire savings into cryptocurrency ought to see an educational warning and a delayed confirmation. This is a critical element in preventing Authorised Push Payment (APP) fraud, where a manipulated victim willingly authorises the transfer themselves, a risk the Bank Policy Institute has examined closely.

Demographic divergence: the two-speed challenge

By 2026, the notion of “one app for everyone” has become an operational myth, and clinging to it risks losing strategically important customer segments. Session data reveals a functional gulf between generations. Serving both groups with a static interface guarantees frustration on both sides.

Table 1.1: Generational behaviour comparison in digital channels

| Area of analysis | Gen Z | Baby Boomers | Strategic implication |

|---|---|---|---|

| Primary channel | 64% mobile app | 41% online (PC), 13% branch | A dual front-end architecture is unavoidable. |

| P2P payments | 41% use weekly | Negligible use | Infrastructure must support real-time micropayments. |

| Digital wallets | 35% use daily | 69% have never used one | Apple Pay / Google Pay integration is baseline hygiene for younger users. |

| Loyalty | Low; ready to switch | High; driven by inertia | Customer experience is the only retention tool for Gen Z. |

Sources: American Bankers Association, Drive Research, Alkami Technology

For a Head of Mobile, this means deploying a modular presentation layer. The interface adapts dynamically to the user profile: a twenty-year-old student sees a dashboard dominated by quick P2P payments, QR codes, and digital-wallet integrations, while a sixty-year-old in the same system gets large domestic-transfer buttons, a tabular transaction history, and a visible helpline number. One system, one intelligent presentation layer, adjusting the view on the basis of CRM data.

For an Enterprise Architect, the back-end infrastructure must handle two very different communication patterns at once. On one side, the system processes ultra-fast micropayments (RESTful API) where a transaction completes in under 100 milliseconds. On the other, it supports stable, session-based processes for older demographics: cross-bank transfers with long session timeouts (30 minutes) and full audit logging. These two technical philosophies have to coexist within a microservices architecture, delivering performance on both paths without compromise.

Hyperpersonalisation as an economic necessity

In 2026, personalisation is no longer a nice-to-have feature. It has become a baseline economic requirement, one that determines whether a financial institution survives in the market. Banks that deploy advanced personalisation see satisfaction and retention rates three to five times higher than their competitors, with revenue growing by 10–20% over the same period, as a Medium analysis of hyper-personalisation in digital finance details. In concrete terms, a mid-sized bank generating €500 million in annual revenue can add an extra €50–100 million purely by aligning its offer more closely with customer needs.

Despite this, the vast majority of the banking sector still operates at a basic level. Research published by TSYS indicates that 94% of financial institutions cannot deliver hyperpersonalisation to the degree the market now expects. The consequences of falling behind are severe: in some regions, annual churn rates reach 69%. Nearly seven out of ten customers walk away within twelve months. That churn does not just mean lost revenue. It also forces the bank to spend heavily on acquiring replacements, at a cost of between €200 and €500 per person in retail banking.

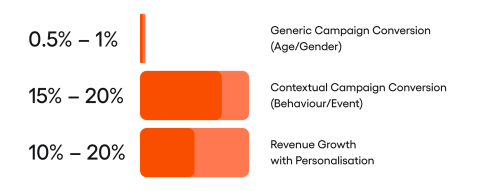

Many managers still believe that demographic segmentation is enough for effective personalisation. Reality sets a much higher bar. Today’s customers expect the “Netflix effect,” recommendations built on real-time behavioural analysis rather than static data collected at account opening. Age, gender, or postcode are now almost worthless as predictors of financial needs.

The traditional approach sends a mortgage offer to every customer who turns 30 and has no mortgage history. Conversion rates for that kind of campaign hover around 0.5–1%. A modern system works differently. It identifies life moments through behavioural analysis: regular visits to furniture shops, deposit payments, or property-related searches within the online banking platform. Experts at SBS note that the system responds contextually, only after detecting such a pattern, and offers a mortgage at the moment the customer is actually planning to buy a property. Conversion then jumps to 15–20%. That is the difference between spam and genuine help, between irritation and real added value.

Notification fatigue and the battle for attention

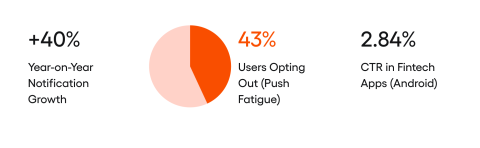

One of the greatest threats to mobile-channel effectiveness in 2026 is user overload. Data from Latinia shows that the volume of push notifications is growing by more than 40% a year, and this has reached a tipping point. The communication channel is beginning to destroy itself: as many as 43% of users choose to disable notifications once they consider them irrelevant. Nearly half of all potential recipients simply stop reacting to banking messages.

Losing the push channel carries risks that stretch far beyond marketing statistics. The problem is not just lower campaign conversion. It is the severing of a defensive line when fraud is detected. Consider a specific scenario: a customer has turned off notifications because of constant promotions and credit offers. When the anti-fraud system flags a suspicious card transaction, there is no way to reach the account holder in real time. The bank must fall back on more expensive channels (SMS, phone calls) or accept the risk that the customer only discovers the fraud when checking a statement. The result is higher financial losses and serious reputational damage.

Platform-level data reveals clear differences in user behaviour. Android historically showed higher opt-in rates because permissions were granted by default at installation. That advantage is eroding in newer OS versions, which introduce stricter rules. Currently, click-through rates in fintech apps on Android sit at around 2.84%, according to Pushwoosh‘s benchmark data. Out of a thousand notifications sent, just 28 people will tap the message and take action.

iOS presents a different picture altogether. Apple’s system requires explicit user consent before any notifications can be delivered. Opt-in rates here are structurally lower, hovering between 51% and 56%, as Business of Apps reports. Every send also carries a higher risk of consent being revoked: iPhone users tend to be more aware of their communication controls and block notifications from specific apps more readily. A single poorly targeted message can mean permanently losing the channel.

The way out of this trap is the introduction of a “Relevance Score.” This mechanism requires every message to be assessed by an algorithm before it is sent. The system examines the likelihood that a specific user will interact, given the current time, location, and financial context. Messages with a low score, those judged unlikely to trigger a reaction, land in the in-app inbox rather than interrupting the user’s attention as a push notification. CleverTap‘s fintech engagement study explores this approach in detail. This protects the most valuable asset of all: the user’s consent to receive future messages that genuinely matter.

Super-apps and ecosystems

Global tech players are forcing banks in 2026 to make a decision that will define their market position for the next decade. Financial institutions must choose one of two paths: build their own super-app that integrates finance with lifestyle, or accept the role of a background service provider through embedded finance.

Neobanks like Revolut and NuBank have proved that adding services beyond traditional banking (travel, shopping, crypto, stock trading) directly boosts daily active users and builds long-term loyalty. Data cited by Business of Apps demonstrates that customers who use at least three non-banking features are 60% less likely to switch providers. The relationship is proportional: the more aspects of life a single app covers, the higher the switching costs and the stronger the brand attachment.

Traditional banks should pursue full integration of third-party APIs, allowing the bank to serve key life moments directly within its own app. A system detecting a card transaction at an airport, for example, could display a contextual travel-insurance proposal covering the exact duration of the trip. That kind of functionality, though, requires an open architecture and the ability to exchange data with external providers in real time.

Ethical design: fighting “dark patterns”

Close cooperation between mobile product teams and Compliance is essential for eliminating so-called “dark patterns,” interfaces deliberately designed to manipulate user decisions. Regulatory bodies in the European Union (Digital Fairness Act) and the United States (Consumer Financial Protection Bureau) are actively penalising practices that exploit cognitive biases, as Osano‘s overview of dark pattern enforcement illustrates.

Prohibited practices include making subscription cancellation difficult, hiding total costs, using misleading consent buttons, creating artificial urgency through countdown timers, and exploiting user inattention, for instance by displaying contract terms for a fraction of a second.

Managing a mobile channel now requires regular UX audits focused on digital fairness. Transparency must characterise every conversion path: account opening, taking out a loan, changing a tariff, and cancelling a service. Deliberately complicating the process of leaving, known as “sludge,” is both unethical and legally risky. Fines for violations can reach 4% of an institution’s annual turnover, as the Deceptive Patterns enforcement tracker documents. For a mid-sized commercial bank, that translates into a potential loss of hundreds of millions of euros. The economic calculation leaves no room for doubt: short-term gains from conversion optimisation do not justify regulatory risk of that scale.

Communication orchestration: the operational brain

What orchestration means and why it matters

Communication orchestration in 2026 banking is far more than the technical distribution of messages. It is an advanced decision-making system that manages the consistency of interactions across every contact channel: push, SMS, email, in-app, and the call centre.

Without central coordination, communication descends into chaos, burdening both the customer and the institution. Picture a scenario where a customer is a week late on a loan instalment. Almost simultaneously, they receive an SMS from the collections department and an email promoting a new personal loan. Moments later, an agent rings with a satisfaction survey. These messages flatly contradict one another: collections signals a financial problem, marketing tries to sell more debt, and the quality team ignores the situation entirely. That kind of dissonance undermines the bank’s credibility and accelerates churn, a pattern the Smart Communications guide to omnichannel orchestration examines in detail. The customer gets a clear signal that the bank does not view their situation as a whole, that individual departments simply operate in isolation.

The “Central Brain” mechanism

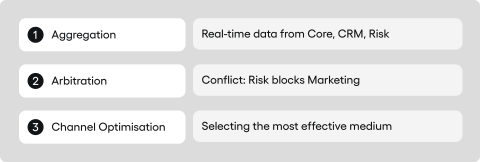

The foundation of effective orchestration is a central decision engine, referred to in the literature as the “Central Brain.” It sits as a logic layer between domain systems (core banking, CRM, risk management) and content-distribution channels. Its job is to make real-time decisions based on the full picture.

The process starts with event aggregation. The engine monitors signals from the bank’s operational systems: app logins, completed transactions, credit-score changes, helpline contacts, branch visits. Each event is logged and analysed as it happens.

The next stage is priority arbitration. When departmental interests clash, the system automatically ranks messages by weight. A suspected card-fraud detection immediately blocks any marketing sends. In their place, the system generates a push notification about the security threat, while call-centre agents receive an alert with the case context.

The final phase is channel selection. The decision about how to reach the customer depends on four factors: the user’s stated preferences, the urgency of the message, the technical availability of the channel, and the cost of delivery. SMS, as an expensive medium, is reserved for critical alerts, used only when a cheaper push notification cannot be delivered, a principle reinforced by the American Bankers Association‘s findings on channel preferences. This lets the orchestrator optimise customer experience while keeping the communication budget under control.

Context and real-time delivery

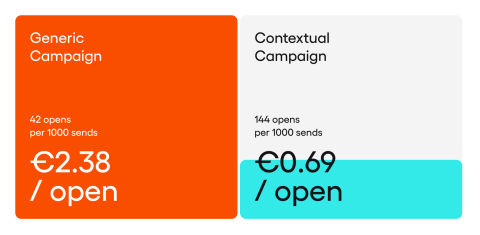

Contextuality, the ability to judge whether a given message makes sense at a particular moment in a customer’s life, is the bedrock of effective orchestration. The Batch mobile engagement benchmark shows that context-aware notifications achieve an open rate of 14.4%, while generic mass campaigns sent without any analysis of the recipient’s situation generate just 4.19%. That is more than a threefold improvement in effectiveness at the same delivery cost. In ROI terms the gap is even starker: if sending a thousand messages costs €100, a generic campaign produces 42 opens (€2.38 each), whereas a contextual one delivers 144 (€0.69 each).

By 2026, context stretches well beyond geolocation. It encompasses financial status (balance, debt, transaction history), emotional state (financial crisis versus planning a major purchase), product lifecycle stage, and in-app behaviour patterns.

A lack of context leads to strategic blunders. If the scoring system rejects a mortgage application due to insufficient creditworthiness, and the very next day the same customer receives a holiday-loan offer, the bank embarrasses itself. A customer who has just learned they cannot afford a property gets a proposal to take on consumer debt. The likelihood of conversion is near zero, while reputational risk and customer frustration spike sharply.

Contextual communication rests on prediction. The system spots an upcoming subscription payment and cross-references it with a low account balance. The customer receives a proactive alert: “In two days your Netflix fee (€11) will be charged, but your balance may not cover it. Would you like to top up from savings or defer the payment?” A message like that positions the bank as a partner preventing problems, not a pushy salesperson. Interaction rates with these alerts often exceed 40%, because they carry genuine value at the moment of receipt.

The Enterprise Architect’s perspective: technology foundations

Why event-driven architecture is unavoidable

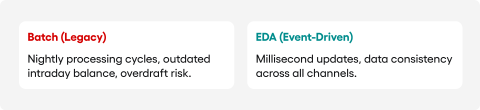

An Enterprise Architect surveying the 2026 landscape reaches one clear conclusion: monolithic architectures built on batch processing have run their course. These systems, proven through decades of overnight runs, no longer meet the demands of today’s market or regulators.

Customers now expect real-time notifications, instant payment posting, and dynamic risk assessment at the point of transaction. This forces a move away from the traditional batch model towards Event-Driven Architecture (EDA). It is not a technology option; it is a business necessity.

The limitations of legacy core banking systems show up most clearly in day-to-day operations. As RST Software highlights in their analysis, because these systems process data in overnight cycles, they work from a frozen snapshot of reality. A transfer ordered at 10:00 in the morning will only update the central balance overnight. Throughout the entire day the mobile app displays outdated data, which can lead customers into poor financial decisions such as accidentally going into overdraft.

The event-driven model changes the philosophy of data processing entirely. In EDA, every action (a payment, an address change, a click on an offer) is treated as an “event” published to an event broker such as Kafka or Solace. Subscribers, including the anti-fraud system, the accounting ledger, and the notification engine, consume these events immediately and independently of one another, a pattern that IBM‘s architecture documentation describes in depth. Components react in real time, so the customer sees an updated balance within seconds.

Investing in EDA delivers measurable returns, confirmed by real-world deployments in financial institutions. A report published via PR Newswire details that development teams report a 23% productivity increase, new-customer acquisition effectiveness rises by 22%, and revenue grows by 18%, driven by the ability to bring new financial products to market faster. New components can subscribe to existing events without rebuilding the entire system, cutting time-to-market from months to weeks.

The “Hollow Core” strategy

Replacing a core banking system ranks among the riskiest operations in the industry. With budgets running into hundreds of millions of euros and multi-year timelines, the failure rate can reach several dozen percent. Many financial institutions find themselves in a kind of technological paralysis, aware that their current systems are outdated yet afraid of an operational catastrophe. The recommended alternative for 2026 is the “Hollow Core” strategy, outlined by Infosys in their design patterns for core banking innovation.

This approach keeps the mainframe as the ultimate system of record, responsible for correct end-of-day closing and transaction posting. A modern architecture is built in parallel as an “around-the-core” layer, using event-driven architecture to feed an Operational Data Store that takes over all read traffic: balance checks and transaction history in digital channels.

The critical element is decoupling the application layer from the legacy core. The mobile app pulls data exclusively from a fast, cloud-based operational layer, bypassing direct mainframe queries. This reduces costly MIPS consumption and cuts response times from hundreds of milliseconds to roughly a dozen. The bank avoids the risk of a big-bang migration, gradually moving business logic out of the expensive core instead.

Offline-first: reliability in the mobile channel

A banking app must work reliably regardless of network quality. A user in the underground or a lift expects the same smooth experience as on fast Wi-Fi. In an “offline-first” architecture, reliability becomes a fundamental parameter for building trust, as DashDevs explores in their guide to offline-first design challenges.

The technical challenge lies in keeping the device’s local database consistent with the central server. Rather than blocking operations when there is no signal, the app employs an Optimistic UI approach: the interface immediately reflects the requested transaction (reducing the visible balance, for example) while actual synchronisation with the back end happens in the background once connectivity returns.

This model demands sophisticated management of data-inconsistency risk, for instance when an account lacks sufficient funds at the moment of actual posting. Implementing a Saga Pattern for automatic compensation and rollback of failed operations becomes necessary. The risk-management team must define strict transactional limits for offline mode to prevent double-spending of the same funds.

DORA: operational resilience as the new standard

The Digital Operational Resilience Act (DORA) establishes a new model for technology risk management across the European Union. For the Chief Risk Officer and the Enterprise Architect alike, this regulation forces a shift from sealed-off cybersecurity towards a broader concept of operational resilience. Where cybersecurity focuses on defending against external attacks, operational resilience accounts for the full spectrum of disruptions, from infrastructure failures and botched software updates to the collapse of a third-party supplier.

DORA obliges banks to fundamentally rework their processes and map out every dependency. An institution must identify all technology providers supporting its critical business functions, from global cloud operators (AWS, Azure) to API providers for credit scoring and firms supplying niche system components. Every technological dependency, no matter how small, requires an inventory and a risk assessment of what happens if it disappears.

The regulator places particular emphasis on third-party risk, holding banks fully accountable for continuity of service. A financial institution cannot shelter behind a subcontractor’s failure. The CrowdStrike incident of July 2024 proved exactly why this approach matters: a faulty software update paralysed 8.5 million Windows systems, blocking infrastructure for hours in critical sectors including banking and air transport, as Juniper Research documented in their impact assessment. Dependence on a single security vendor left many institutions unable to serve their customers at all. This demands diversification strategies and contingency plans that allow an immediate switchover to alternative solutions.

The third pillar of the regulation, substitutability, strikes directly at the practice of vendor lock-in. System architecture must, by design, allow the replacement of a key component provider within an acceptable timeframe. Using proprietary technology that makes migration difficult now generates regulatory risk on its own, forcing the adoption of open standards and APIs that prevent long-term ties to any single technology partner.

AI regulation and algorithmic risk

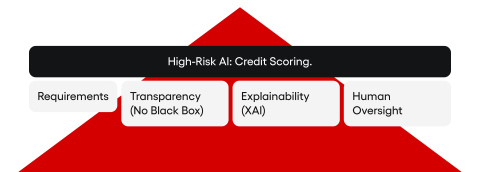

The European AI Act classifies AI systems according to the threats they pose to fundamental rights. Algorithms used for credit scoring have been placed in the high-risk category. The legislator has recognised that an automated credit decision affects a citizen’s life to a degree that warrants special oversight.

This classification imposes strict requirements on models used in banking. A model cannot operate as a “black box”: full transparency and explainability of decisions are mandatory. Customers are entitled to a clear justification for a rejection that goes beyond a vague reference to a numerical score. The elimination of bias is an absolute requirement as well, ensuring that the algorithm does not discriminate against applicants on the basis of protected characteristics such as gender or ethnic background.

The most far-reaching obligation is the implementation of human oversight, a Human-in-the-Loop requirement. Fully autonomous decision-making in credit, with no option for human review, may be ruled unlawful. This requires the CRO to establish an AI Ethics Board: an interdisciplinary team responsible for auditing algorithms for bias and defining protocols for human intervention in automated processes.

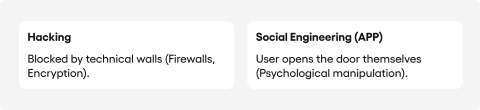

The new face of fraud: Authorised Push Payment

Years of investment in banking security, covering strong customer authentication, tokenisation, and biometrics, have forced criminals to change their attack vector. Instead of breaking through technical barriers, fraudsters now use social engineering, targeting the user directly. In the Authorised Push Payment (APP) model, the manipulated customer authorises the transfer to the criminal’s account themselves.

A typical spoofing scenario works as follows: a call from a fake bank security officer warns the victim that their funds are at risk. The conversation ends with the victim willingly transferring money to a “technical account.” Because the victim logs in correctly and approves the operation using an SMS code or mobile authorisation, transaction-monitoring systems often do not flag it as an anomaly.

Financial liability for these incidents, however, is shifting towards the institutions. The UK’s Payment Systems Regulator has introduced precedent-setting rules requiring banks to refund APP fraud losses, on the grounds that a financial institution has better tools for detecting unusual patterns than a consumer does.

The mobile app becomes a critical checkpoint in this context. It must analyse the broader circumstances of a transaction in real time. Detecting correlated events (an ongoing phone call during a large transfer, unusual behavioural biometrics, or a payment to a brand-new recipient) should activate “Smart Friction” mechanisms, as the EBA‘s guidance on strong customer authentication reinforces. Instead of a smooth transaction, the system forces an additional verification step, displays a personalised warning, or temporarily freezes the funds, giving the user time to pause, reflect, and verify the situation through a different channel.

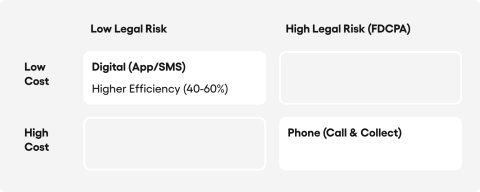

Digital collections: transformation and regulatory risk

Traditional phone-based debt collection is losing its effectiveness while generating growing legal risks. Aggressive contact models that rely on multiple calls per day increasingly collide with tightening consumer-protection regulations. In the United States the FDCPA, and in Europe unfair-commercial-practices directives, penalise conduct that amounts to harassment, as the Consumer Financial Protection Bureau makes clear in its enforcement guidance. Breaching these rules carries not just financial sanctions but reputational damage as well.

Shifting communication preferences among Millennials and Gen Z are forcing a transformation of collection processes. Younger demographics avoid synchronous voice communication from unknown numbers and prefer asynchronous channels instead. In early-stage collections (up to 30 days overdue), digital channels (SMS, email, push notifications) achieve recovery rates 40–60% higher than telephone contact, as Resolve Pay‘s channel-performance statistics demonstrate.

The higher recovery rates stem from eliminating psychological discomfort. A customer with temporary cash-flow problems is far more likely to use a self-service portal within the app to set up a repayment schedule on their own terms than to pick up a call from a debt collector. Automating this process frees up human resources for complex cases that require negotiation and a personal touch, leaving standard overdue accounts to algorithms and mobile interfaces.

Economic analysis and strategic recommendations

The cost of doing nothing

The largest drain on a bank’s balance sheet in 2026 is not IT infrastructure. It is customer loss. The churn rate directly erodes the value of a financial institution.

A report by Alkami Technology indicates that 50% of digital banking users are willing to switch providers if a competitor offers something better. Half the customer base sits in a permanent state of readiness to migrate. A single process failure or a string of poorly targeted notifications is enough to push a user into actively searching for alternatives.

The cost of acquiring a new customer exceeds the cost of retaining an existing one by a factor of five to twenty-five, as MiaRec‘s analysis of churn economics shows. This gap exists because acquisition demands heavy spending on marketing campaigns and sales processes, while retention relies on the quality of service. Every departure generates a double loss: future revenue disappears, and the bank must pay the acquisition cost all over again.

For an institution with a portfolio of one million mobile users and an annual churn rate of 10%, the losses are concrete. With a Customer Lifetime Value estimated at €3,500, the bank loses roughly €350 million in potential value each year. These are funds withdrawn from deposits and margins lost on credit products.

An investment of €20–50 million in modernising event-driven architecture and communication orchestration has a hard economic justification in this context. The return comes through churn reduction alone. Cutting churn by just two percentage points (from 10% to 8%) preserves around €70 million a year, guaranteeing a return on investment within twelve to eighteen months.

ROI from hyperpersonalisation and EDA

Deploying event-driven architecture and personalisation engines is a strategic growth mechanism that goes well beyond a technology expense.

Banks that apply real-time personalisation report revenue increases of 10–20%, as the Medium study on hyper-personalisation in digital finance confirms. This stems from higher cross-sell effectiveness: precise behavioural analysis allows the bank to offer a product, whether a premium card or travel insurance, at the exact moment a purchasing need arises. Replacing mass campaigns with event-driven messages lifts conversion rates sharply.

Automating collections and service processes reduces operating costs by up to 40%, according to data from Resolve Pay. Traditional call-centre-based models give way to intelligent notifications and chatbots in digital channels. Shifting enquiry handling to self-service portals eliminates costly human intervention. With the cost of a single agent call sitting between €5 and €15, the annual savings run into millions of euros.

Business agility and shorter time-to-market allow the bank to respond effectively to competitive moves. A report via PR Newswire on EDA adoption confirms that launching a new product in a monolithic architecture takes months, while systems built on EDA can deliver the same result in weeks by simply adding a new microservice. The speed of adaptation determines whether a bank holds its market share against fintech offerings.

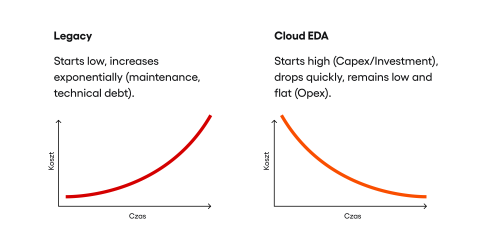

TCO: legacy versus modern architecture

Maintaining legacy systems generates technical debt that compounds every year and places a disproportionate burden on IT budgets. COBOL developer rates are rising by 15–20% annually, reflecting a generational gap and a shortage of new talent trained in the technology. Financial institutions are forced to pay a premium for maintaining code written decades ago.

The risk of failure grows exponentially. Every modification in a monolithic architecture carries unpredictable side effects in distant parts of the system. Integrating legacy platforms with modern APIs requires expensive workarounds and middleware layers. As CIO reports, each additional layer increases architectural complexity and total cost of ownership. Over a longer time horizon, maintaining the status quo becomes financially unsustainable.

Migrating to cloud-based, event-driven architecture involves high initial capital expenditure, a significant one-off hit to financial results covering new infrastructure, licences, and the need to assemble specialist project teams. Despite the barriers to entry, long-term TCO falls thanks to two factors: auto-scalability in a pay-as-you-go model, which allows computing power to adjust dynamically to current load, and CI/CD automation of maintenance (monitoring, backups), which removes the need for manual administrator intervention. Over a five-year horizon, modern architecture generates lower operating costs.

Cost and benefit comparison of collection channels

| Channel | Interaction cost | Response rate | Regulatory risk | Application |

|---|---|---|---|---|

| SMS | Very low | 60–80% | Low (with consent) | Early collections (1–30 days) |

| Negligible | 15–25% | Very low | Reminders, education | |

| Phone (voice) | High (€5–15 per call) | 40–60% (if answered) | High (contact intrusiveness) | Late-stage / complex collections |

| In-app push | Negligible | High (context-dependent) | Low | Instant reminders |

| Self-service portal | Low (maintenance only) | 20–35% | None | All stages |

Source: Resolve Pay

Strategic recommendations

For the Head of Mobile

The priority is evolving the app towards a “Financial Cockpit,” an intelligent tool supporting personal finance management. The system should proactively anticipate user needs and suggest solutions before the customer even identifies a problem, taking on the role of an active financial adviser.

This requires deploying a modular, segment-based UI. A universal strategy proves ineffective with a diversified customer base: Gen Z expects gamification and gesture-based interactions, while older segments need clarity, large buttons with visible labels, and no hidden functionality. Ignoring these differences degrades satisfaction for both groups and produces mediocrity.

The primary success metric becomes the “Relevance Score,” measuring push notification conversion into desired actions. A result above 40% indicates high targeting precision. Equally important is minimising the opt-out rate. Users typically disable notifications because of low relevance or excessive frequency. Every percentage-point drop in opt-out means preserving a direct communication channel with thousands of users.

The ethical dimension of design is gaining weight as consumer-protection requirements tighten. A UX audit eliminating dark patterns is essential, covering techniques that make subscription cancellation difficult or use misleading visual hierarchy on buttons. Compliance with the planned Digital Fairness Act is not just a regulatory box to tick; it is the foundation for building long-term trust.

For the Enterprise Architect

In a banking environment that operates around the clock, the architect’s top priority is systemic resilience. Service downtime is not just lost revenue; it is lasting erosion of trust. A mobile-app outage during peak transaction hours generates reputational damage out of all proportion to the duration of the incident.

The technological backbone becomes Event-Driven Architecture. This model enforces asynchronous communication: one module emits an event (for example, “salary received”) and others react to it independently, updating the credit score or selecting a deposit offer. Loose coupling means the failure of one component does not paralyse the whole. The system keeps running while the damaged element is repaired in isolation.

Legacy-system modernisation requires the “Hollow Core” strategy. Rather than a risky big-bang rewrite, which ends in failure in 70% of projects, the bank gradually retires monolith functions. It replaces them with microservices while maintaining a stable façade for the user. This allows iterative testing of new solutions on a small volume of traffic without risking the stability of the entire organisation.

Resilience means engineering that assumes failure is inevitable. Circuit Breaker mechanisms automatically isolate malfunctioning modules, protecting the infrastructure from cascading errors. This directly fulfils DORA requirements. The mobile app must also maintain offline functionality, providing access to cached data (balance, history) without an active network connection.

For the Chief Risk Officer

Risk management is evolving from static audits towards continuous monitoring. In a reality where a cyberattack lasts minutes and the regulator demands immediate reporting, risk is a dynamic variable, not a quarterly checkbox.

The central challenge is fully mapping the ICT supply chain in line with DORA. The bank must identify dependencies on cloud providers and SaaS platforms, define scenarios for their unavailability, and establish recovery time objectives. In parallel, the AI Act mandates strict oversight of algorithmic models: algorithms must be free from discriminatory bias, and their decisions must be fully explainable to both the customer and the supervisor.

In collections, early-stage processes (delays of 1–30 days) are migrating to digital channels. Automated contact cuts costs and legal risk simultaneously. A push notification or SMS costs a fraction of a cent, while a phone call runs to several euros. Less intrusive text-based communication also minimises the risk of harassment complaints.

Combating APP fraud demands advanced contextual analysis. Security systems must identify behavioural anomalies: an unusual login time, a new recipient account, or chaotic navigation patterns. Detecting such signals must automatically block the transaction and force additional authentication. This is the only effective barrier against social engineering that bypasses traditional technical defences.

Conclusion

The year 2026 will determine the balance of power in the sector for the coming decade. Institutions that build their strategy around the mobile app and event-driven orchestration will gain a lasting competitive edge, translating into faster product launches and more effective customer retention at reduced operating costs.

Leaving siloed legacy systems and mass communication in place leads to marginalisation. Customers will leave for providers offering better UX (often fintechs), and regulators will impose sanctions for non-compliance with DORA and the AI Act.

The costs of transformation are high, covering technology investment and migration risk. The cost of inaction, however, is existential: losing the ability to compete and a slow bleeding of the customer base. Rebuilding the architecture is not a strategic option. It is a condition for remaining profitable.

Frequently Asked Questions (FAQ)

How should a modern mobile banking strategy address diverse customer experience needs?

Leading banks optimize customer experience by deploying a dual-layer interface. This mobile banking strategy adopts a mobile first approach for Gen Z while ensuring stability for older generations. By not relying solely on one method, a company ensures the mobile banking app serves as the primary channel for everyone, preventing churn in a competitive world.

Why is hyper personalization crucial for financial institutions today?

Real-time hyper personalization is essential for growth, potentially increasing revenue by 10–20%. Financial institutions must use behavioral data to offer specific money management tools instantly. Without this innovation, a company risks losing customers to competitors who better understand their needs through advanced mobile banking capabilities.

How are mobile banking apps reshaping the landscape of digital banking?

Mobile banking apps are transforming into “Financial Cockpits” for everyday banking. They integrate life-management modules and automated bill payments, meeting rising consumer expectations for “Invisible Banking.” This shift in digital banking prevents banks from becoming background infrastructure and ensures they maintain direct relationships in the financial industry.

Why are banking apps evolving to include lifestyle and financial products?

To build deeper customer loyalty, banking apps are bundling travel and shopping features with traditional financial products. A company must invest in this integration to create a competitive advantage. It transforms the app into a comprehensive ecosystem, which is crucial for retaining users in the evolving mobile banking sector.

How can actionable insights improve customer engagement and reduce fatigue?

Mobile banking apps use actionable insights to assign a “Relevance Score” to notifications, optimizing customer engagement. Intelligent routing ensures low-priority messages go to an in-app inbox rather than disturbing users. This protects customer satisfaction and preserves the push channel for critical alerts, a key aspect of effective mobile banking communication.

What risks and benefits does artificial intelligence bring to automation?

Artificial intelligence enables seamless automation but requires strict risk management under the AI Act. Algorithms must be explainable and subject to human oversight to prevent bias. While AI drives innovation in mobile banking, banks must ensure transparency to maintain trust and regulatory compliance regarding automated decisions.

What are the technical requirements for successful digital transformation?

Successful digital transformation demands financial institutions invest in Event-Driven Architecture (EDA) and a “Hollow Core” strategy. These technological advancements decouple the app from legacy systems, allowing real-time processing. This boosts operational efficiency, enables faster new offerings, and ensures mobile banking resilience in line with DORA regulations.

How do digital tools foster financial empowerment in collections?

Financial empowerment tools in mobile banking apps move collections to self-service portals. This innovation respects private user journeys, allowing customers to manage money repayment plans without uncomfortable phone calls. It reduces operational costs for credit unions and banks in developing markets, improving recovery rates significantly.

Will physical branches remain relevant as mobile wallets gain popularity?

Physical branches will linger at the margins, used primarily for complex operations requiring a physical presence. Latest insights confirm that for younger generations, mobile wallets and apps are the standard. Leading banks must treat digital integration as baseline hygiene rather than relying on physical locations for daily interactions.

How do advanced analytics and predictive analytics enhance customer onboarding?

Advanced analytics allow banks to replace static demographic segmentation with real-time behavioral data. Using predictive analytics, a company can identify specific needs during customer onboarding, streamlining user journeys by offering relevant products instantly. This shifts the focus from mass marketing to genuine value creation, avoiding generic spam.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.