Strategies for successful fintech development outsourcing

Outsourcing fintech software development has become a strategic move for companies aiming to enhance product quality, manage development costs, and access a global talent pool. By partnering with external experts, fintech companies can overcome the challenges of building in-house teams, especially when dealing with complex technologies like blockchain, AI, or regulatory compliance. This approach enables organisations to streamline operations, focus on core competencies, and maintain flexibility in scaling their development efforts according to market demands.

A well-executed outsourcing strategy also offers fintech companies the ability to accelerate time-to-market, which is crucial in a fast-moving, competitive landscape. However, success depends on choosing the right outsourcing provider, defining clear objectives, and establishing robust communication channels. In this article, we delve into the key strategies that make fintech software development outsourcing effective, ensuring both technical excellence and alignment with business goals.

Table of contents

What is Fintech Software Outsourcing?

Fintech software outsourcing refers to the practice of delegating the software development tasks of financial technology solutions to external service providers. This approach allows financial institutions to leverage specialised expertise and cutting-edge technologies without the need to build and maintain these capabilities in-house.

The fintech outsourcing market has experienced significant growth in recent years. According to a report by Grand View Research, the global fintech market size was valued at $266.56 billion in 2022. It is predicted to grow at a compound annual growth rate (CAGR) of 17.5% by 2030. This growth is largely driven by the increasing adoption of fintech solutions and the need for the financial industry to modernise operations and adopt emerging technologies.

The COVID-19 pandemic has accelerated the adoption of remote and hybrid work models, which has had a profound impact on fintech outsourcing. This shift has expanded the pool of available talent, allowing fintech firms to access expertise from around the globe. Moreover, it has normalised virtual collaboration, making it easier for organisations to work seamlessly with outsourced development teams.

Why Banks and Fintech Companies Outsource Fintech Software Development

There are several compelling reasons why banks and financial institutions choose to outsource their fintech development. Let’s explore the most common ones:

Specialised Skills and Technology Access

Fintech software development requires a unique blend of financial expertise and technological mastery. By outsourcing, financial institutions can tap into a pool of specialists with deep knowledge in areas such as blockchain, artificial intelligence, and cybersecurity. This access to cutting-edge skills and technologies enables banks to innovate without the need to constantly retrain their in-house teams. Additionally, outsourcing allows organisations to leverage experts in narrow fields, enhancing the quality and specificity of the solutions developed.

Faster Time-to-Market

Speed is often a critical factor in gaining a competitive edge in the financial industry. Outsourcing fintech software development allows companies to accelerate their development processes, leveraging the external expertise and established workflows of experienced development teams. This can significantly reduce the time it takes to bring new products and services to market.

Cost Efficiency

Developing and maintaining an in-house fintech software development team can be extremely costly, especially for smaller financial institutions. Outsourcing provides a more flexible and often more cost-effective alternative. It eliminates significant upfront investments in infrastructure and tooling expenses and allows institutions to scale their development efforts up or down as needed.

Scalability

The demand for fintech solutions can be highly variable, with periods of intense development followed by quieter phases. Working with a third-party fintech software development company means that fintech institutions can respond rapidly to changing market conditions and growing customer requirements without the constraints of a fixed in-house team.

Access to Fresh Perspectives and Proven Methodologies

Partnering with external experts provides access to a “fresh” external perspective that can stimulate innovation and creativity within the organization. These experts bring experience from other projects, allowing for the adoption of proven methodologies that can enhance project outcomes. They also provide support in the modernization of legacy systems and assist in the adoption of new technologies, ensuring that the bank or fintech remains competitive.

Knowledge Transfer and Backup for Internal Teams

Outsourcing not only aids in project execution but also allows for knowledge transfer to the organization, enabling internal teams to learn from the experts they collaborate with. This backup for internal teams ensures continuity and reduces dependency on key employees, thereby mitigating risks associated with turnover or absence.

Focus on Core Banking Activities

By outsourcing fintech software development, banks and financial institutions can free up their internal resources to concentrate on their core competencies. This shift enables them to focus on strategic initiatives, customer relationships, and other critical aspects of their business, while leaving the technical complexities of fintech projects to specialized partners. Moreover, this leads to a better use of internal competencies and allows for the distribution of responsibility, reducing the burden on internal teams.

Key Considerations Before Outsourcing Development of Fintech Software

While there are significant advantages to fintech development outsourcing, it is crucial for fintech businesses to carefully consider several factors before hiring a financial software development outsourcing company.

Understanding Business Objectives and the Scope of the Project

Before engaging a fintech outsourcing company, it is essential to have a clear understanding of the core business functions that need to be covered and the requirements the outsourcing team must meet. This includes defining the specific problems to solve with the final product, the features, and functionalities it must offer, and how the fintech solution fits into the long-term business strategy.

Evaluating ROI from Fintech Software Development Outsourcing

Conducting a thorough cost-benefit analysis is crucial to ensure that fintech outsourcing will deliver a positive return on investment (ROI). This evaluation should consider not only the direct costs of fintech software development services, but also the potential benefits in terms of faster time-to-market, access to tech expertise, specialised skills, and improved quality of the final product.

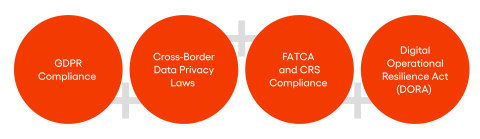

Legal Considerations

Fintech development outsourcing often involves the need to meet complex legal and financial regulations, particularly when handling sensitive financial data or working in international environments. Crucial areas to address include:

- GDPR compliance: Ensuring that the outsourcing vendor adheres to the General Data Protection Regulation, especially when handling EU citizens’ data.

- Cross-border data privacy laws: Understanding and complying with data protection regulations in all relevant jurisdictions.

- FATCA and CRS compliance: Ensuring adherence to the Foreign Account Tax Compliance Act and Common Reporting Standard for financial institutions operating internationally.

- Digital Operational Resilience Act (DORA): Ensuring fintech firms establish business continuity measures for incidents involving subcontractors and external service providers, and implement ICT risk management frameworks, including managing risks from external ICT service providers.

Compliance in an International Context

When outsourcing fintech software development internationally, it is crucial to navigate the regulatory differences between the countries of the client and the outsourcing team. This includes understanding the various audits and certifications required from fintech outsourcing service providers in different jurisdictions. Ensuring compliance across borders is essential to avoid legal issues and maintain the trust of customers and regulators alike.

Cybersecurity and Security Audits

In the fintech industry, security is paramount. It is crucial to ensure that the fintech outsourcing provider adheres to the highest safety standards and uses relevant tools and frameworks to protect sensitive financial data and other information that is integral to business operations. Some example methods and approaches to ask about include:

- Zero Trust Security model: Implementing a security approach that assumes no trust and verifies every access request, regardless of its source.

- Cloud security: Ensuring robust security measures for cloud-based fintech solutions.

- Identity and Access Management (IAM): Implementing strong IAM practices to control access to sensitive systems and data.

- Compliance with industry standards: Ensuring adherence to standards such as PCI DSS for payment card security and ISO 27001 for sensitive data security management.

Regular security audits should be conducted to verify that these measures are effectively implemented and maintained.

Intellectual Property Rights

Clearly defining intellectual property rights is crucial when outsourcing fintech development. The contracts between fintech companies and outsourcing partners must clearly state who owns the intellectual property for the developed software, including any custom algorithms or innovative solutions. This helps prevent future disputes and protects the investment in the developed technology.

Non-Disclosure Agreement (NDA)

Before sharing any sensitive information with potential outsourcing partners, it is essential to have a detailed non-disclosure agreement in place. This legal document helps protect the fintech company’s confidential information and business ideas from being disclosed or misused by the outsourcing company.

How to Choose the Right Fintech Development Outsourcing Partners

The software development process varies for every financial brand, so it is essential to analyse specific requirements before selecting the ideal outsourcing partner. This approach helps financial institutions ensure the success of any fintech development project they pursue.

Domain Expertise

Look for a fintech software outsourcing provider with a strong track record in fintech projects. They should demonstrate a deep understanding of the financial services industry, including data security measures, regulatory requirements, and market trends. Knowledge of financial regulations is crucial, as compliance with relevant laws can make or break a fintech project. A reliable outsourcing partner with industry knowledge can provide valuable insights and help navigate complex financial landscapes, ensuring both compliance and innovation in your projects.

Technical Expertise

Ensure that the potential partner has expertise in financial technology relevant to your project. This might include experience with blockchain, AI/ML, cloud computing, or specific programming languages and frameworks used in fintech software development. Evaluate the technical capabilities of your outsourcing partners through their past projects, certifications, and the qualifications of their fintech developers. Additionally, inquire about their years of presence in the market, as a seasoned partner is likely to have honed their skills and adapted to industry changes. A technically proficient partner can bring cutting-edge solutions and best practices to your fintech initiatives.

Reputation and References

Outsource fintech development to a potential partner with an excellent reputation in the market. Look for case studies, client testimonials, and, if possible, speak directly with their past or current clients. References can provide valuable insights into their reliability, quality of work, project management tools, methodologies, and their ability to deliver results on time and within budget. Pay attention to their track record in handling digital solutions similar to yours and how they have overcome challenges in the past.

Cultural and Time Zone Fit

When outsourcing development to an international provider, consider the cultural fit and time zone differences. Access to a global talent pool with a compatible work culture and overlapping working hours can significantly enhance collaboration and communication. Assess the team’s ability to adapt to your company’s work style and their flexibility in accommodating your schedule. Cultural alignment can lead to smoother project execution and better long-term relationships. It’s also worth considering nearshore and offshore options, as these can offer cost advantages while still providing access to skilled talent.

Communication and Accountability

Effective communication is crucial for successful fintech software development outsourcing. Evaluate the potential partner’s communication processes, including their reporting methods, frequency of updates, and availability for meetings. Transparent reporting can help maintain clarity throughout the project. Additionally, assess their accountability measures and how they handle issues or delays. Look for vendors who prioritise transparency, offer flexible Service Level Agreements (SLAs), and demonstrate a proactive approach to problem-solving.

Scalability and Employee Turnover Rate

Consider the partner’s ability to rapidly expand their team if project demands increase. The possibility of quick team expansion is essential for adapting to changing market conditions. Additionally, inquire about their employee turnover rate, as high turnover may indicate issues with employee satisfaction and can disrupt project continuity.

Pricing Rates and Models

Consider the pricing structure offered by potential partners. Common models include:

- Time and Materials (T&M): In this model, the client pays for the actual time spent on the project. It offers flexibility but requires careful monitoring of hours and costs.

- Fixed Price: A set price for a defined scope of work. This model provides budget certainty, but may be less flexible for changes in project scope.

- Team Augmentation: Hiring dedicated fintech developers who work as an extension of the in-house team. This model allows for greater control and integration with existing processes.

Choosing the model that best aligns with the institution’s project needs and budget constraints is essential to achieving success. Consider factors such as project complexity, timeline, and internal resources when deciding on the most suitable pricing model.

Best Practices for Managing Fintech Software Outsourcing Teams

Effective management is key to success when outsourcing fintech development. Here are our recommended best practices:

Picking a Software Partner

Before engaging with potential partners, it is crucial to establish a clear foundation for your project. This involves defining your business context and problem statement, which will help the team understand your needs. Determine the desired outcomes of the project to ensure alignment with your business goals. Set up a realistic budget and timeline to guide your partner selection process. Additionally, document detailed business requirements to provide clarity. Finally, establish internal responsibilities within your organisation to ensure smooth collaboration with the outsourcing team. This preparation ensures that you have a clear vision of what you want to achieve and can effectively outsource fintech software development.

Defining Project Assumptions and Requirements

A well-defined scope helps prevent misunderstandings and scope creep later in the project. Clearly define both functional and non-functional requirements for your solution. This should include:

- Detailed feature specifications

- Architecture requirements

- Design mock-ups

- Preferred tech stack

- Regulatory requirements

- Expected time-to-market

Moreover, include a clearly defined “definition of done” to ensure all team members have a shared understanding of what constitutes project completion.

Communication and Reporting

Effective communication is crucial for keeping the project on track and addressing issues promptly. Establish clear communication channels and reporting processes for outsourcing development tasks. Work with your vendor to:

- Create a responsibility matrix to clarify roles and responsibilities.

- Set up regular update schedules to keep all stakeholders informed of progress.

- Implement documentation standards to ensure consistency and clarity in all project-related communications.

- Establish a clear problem escalation path for addressing issues that may arise during development.

- Agree upon availability windows that work for all parties involved, despite time zone differences.

Preparing Project Plan

Collaborate with your outsourcing services partner to transform requirements into actionable items. This involves breaking down the project into epics and tasks, establishing the work process and pipeline, and ensuring a solid integration strategy with external systems. Employ agile methodologies with short sprints (2-3 weeks) to foster flexibility and adaptability throughout the project lifecycle. A well-structured project plan provides a roadmap for development and helps track progress effectively, ensuring that all team members understand their tasks and responsibilities.

Establishing Milestones and Deliverables

Outsourcing software development for financial services requires that goals, timelines, and performance indicators are well-documented. Conduct regular status meetings to track progress against these milestones and address any deviations promptly. This practice helps maintain project momentum and allows for timely adjustments if needed.

Controlling Scope Creep

The right outsourcing vendor implements a thorough change management process to evaluate and approve any changes to the project scope. This helps prevent uncontrolled expansion of the project, which can lead to delays and budget overruns. They should also ensure that all stakeholders understand the impact of proposed changes on timelines and resources before approving them. Regular threat identification and technical debt control should be part of this process.

Security Measures

Protecting sensitive data in the fintech sector requires advanced technical expertise. Ask your vendor to implement robust security measures throughout the entire development process. Recommended practices include:

- Regular security audits to identify vulnerabilities

- Continuous Integration/Continuous Deployment (CI/CD) strategy to facilitate frequent code changes and deployments

- Data encryption

- Strong authentication and authorisation mechanisms

- Code security reviews

- Test automation to enhance the efficiency and coverage of the testing process

- Regular penetration testing

- Compliance checks

Risk Management

Define potential risks and develop mitigation strategies with your software development company for both technical and project-related risks. Regularly review and update your risk management plan throughout the project lifecycle. This proactive approach helps minimise disruptions and ensures that the team is prepared to handle challenges as they arise.

QA and Testing

Implement a comprehensive quality assurance process that includes unit testing, integration testing, and user acceptance testing (UAT). A robust testing strategy ensures that the final product meets all requirements and functions as intended—ensuring that financial transactions are fast and secure. Establish rollback procedures to recover quickly from failed deployments, and select the appropriate release strategy (e.g., big bang, feature flags, phased rollout, canary deployment, blue-green deployment) based on your project’s needs.

Feedback Culture

Fostering a culture of continuous improvement by establishing feedback loops and conducting regular lessons-learned sessions should be a priority during business process outsourcing collaborations. Open communication and constructive criticism should be encouraged from all team members. This approach helps refine processes and improve outcomes over time, leading to more efficient and effective project delivery.

Knowledge Management and Technology Transfer

Effective knowledge transfer strategies between teams should be implemented from day one. This includes creating comprehensive documentation, building internal competencies, and providing training to in-house staff. Documenting design decisions ensures that the rationale behind choices is clear. Effective knowledge transfer ensures that your organisation can maintain and evolve the developed solution even after the outsourcing engagement ends, reducing dependency on external partners.

Importance of Soft Skills

Pay attention to cultural aspects and soft skills when managing outsourced teams. This includes effectively managing cross-cultural teams, building trust in outsourcing relationships, and communicating effectively in an international environment. Strong soft skills can significantly enhance collaboration and project outcomes, leading to more successful partnerships.

Metrics and KPIs

Define and monitor key performance indicators (KPIs) to track the success of your outsourcing engagement. Consider using a balanced scorecard approach to manage outsourcing relationships, ensuring a holistic view of performance across various dimensions. Regular monitoring of these metrics helps identify areas for improvement and ensure the overall success of the outsourcing engagement:

- Project delivery time

- Budget adherence

- Code quality metrics

- Customer satisfaction scores

- Team productivity

Other Considerations in the Fintech Industry Development Outsourcing

Beyond core project management practices, there are several other important factors to consider when selecting the ideal outsourcing partner for fintech solutions:

Regulatory Compliance

Working with global talent requires ensuring beforehand that the vendor is well-versed in the regulatory requirements specific to your market and the type of fintech solution being developed. This includes understanding and implementing measures to comply with regulations such as PSD2, MiFID II, and AML directives.

Customer Experience

While focusing on the technical aspects of development, don’t lose sight of the end-user experience. The right outsourcing partner should have a strong understanding of UX/UI best practices in fintech applications and be able to deliver solutions that meet the high expectations of modern financial consumers.

Data Privacy

Given the sensitive nature of financial data, robust data privacy measures are crucial. Ensure that your outsourced team implements strong data protection practices and complies with relevant data privacy regulations in all jurisdictions where your solution will be deployed.

Seamless Integration with Legacy Systems

Many financial institutions still rely on legacy systems for core operations. Your outsourcing partner should have experience in integrating modern fintech solutions with these legacy systems, ensuring continuous operation and data flow.

Contracts and SLAs

Develop comprehensive contracts and Service Level Agreements (SLAs) that clearly define expectations, deliverables, performance metrics, and penalties for non-compliance. These documents serve as the foundation of your outsourcing relationship and can help prevent misunderstandings and disputes.

Automation in Fintech Outsourcing

Consider leveraging automation technologies to improve cost efficiency, increase productivity, and reduce errors in your fintech development process. Example approaches include:

- Robotic Process Automation (RPA) in financial processes: RPA can be used to automate repetitive tasks in areas such as compliance checking, data entry, and reconciliation.

- AI and machine learning in test automation and QA: These technologies can significantly enhance the speed and coverage of testing processes, improving the overall quality of the developed solution.

Challenges in Business Process Outsourcing for Fintech and How to Overcome Them

Outsourcing fintech development offers numerous advantages, but it also comes with its own set of challenges that require careful management to ensure project success. Here are some common challenges and strategies to overcome them:

Unclear Project Objectives

One common issue is unclear project objectives, which can lead to confusion and delays. To overcome this, it is crucial to invest time in clearly defining and documenting project objectives before engaging with an outsourcing partner. A well-defined project scope should include specific goals, deliverables, and timelines. Additionally, establishing a change management process can help handle any necessary adjustments to objectives during the project, ensuring all stakeholders remain aligned.

Inaccurate Project Estimation

Another challenge is inaccurate project estimation, which can result in budget overruns and missed deadlines. To address this, it’s important to consider various factors when estimating the project, such as the time required for delivering the project scope, conducting tests, handling unforeseen issues, deployment, project handover, documentation creation, and training. Involving experienced stakeholders in the estimation process can lead to more accurate assessments.

Communication Gaps

Communication gaps can pose significant challenges in fintech development outsourcing, leading to misunderstandings and project delays. Establishing clear communication channels and schedules can mitigate this risk. Utilising collaboration tools for real-time communication and document sharing, along with regular video conferences, can help reduce misunderstandings. Furthermore, promoting a culture of open dialogue encourages team members to voice concerns promptly.

Managing Customer Expectations

Misaligned expectations between the client and the outsourcing partner can lead to dissatisfaction. Clearly communicating project scope, timelines, and deliverables from the outset, along with providing regular updates and being transparent about any challenges or delays, can help manage expectations effectively. Regular feedback loops ensure that client concerns are addressed in a timely manner.

Data Security and Compliance

Data security and compliance with regulations, such as GDPR, are critical in fintech. Outsourcing partners must demonstrate robust practices for protecting sensitive data, including secure storage and transfer of information. Meeting the requirements of financial regulators is paramount, and it is advisable to conduct regular audits to ensure ongoing compliance.

Integration Challenges

Problems with integrating new solutions with existing infrastructure can block progress. Compatibility with legacy systems is often a significant hurdle. To ensure business continuity during implementations, organisations should develop a comprehensive integration strategy that addresses potential data synchronization issues between systems. Conducting thorough testing and quality control measures can identify and resolve integration issues early.

Scalability and Resource Management

Scalability challenges may arise as the project grows, making it difficult to scale resources effectively. Choosing an outsourcing partner with proven scalability and discussing potential scaling needs upfront can ensure that increased demands are met. Precise definitions of the scope of responsibility in contracts can prevent resource allocation disputes.

Managing a Distributed Team

Managing a distributed team introduces complexities such as time differences between teams and challenges related to remote work. Coordinating work between different locations requires clear guidelines and effective online meeting organisation. Building trust within a distributed team can be challenging; hence, regular check-ins and team-building activities, even in virtual settings, are vital.

Documentation Issues

Incompleteness and outdated technical documentation can interfere with project progress and knowledge transfer. Establishing rigorous documentation practices ensures that all team members have access to up-to-date information, promoting consistency and clarity. This documentation should be easily accessible and continuously updated throughout the project lifecycle.

Incident Management

Effective incident management is essential for addressing issues as they arise. Implementing clear procedures for incident reporting and resolution can minimise disruptions. Regular training sessions can help teams respond promptly to unexpected challenges.

Long Sales Process and Competition

The long sales process in outsourcing can delay project initiation. Companies must be prepared for this by conducting thorough research on potential partners and streamlining their selection process. Additionally, the competitive nature of the fintech market necessitates a focus on innovation and quality to differentiate offerings.

Responding to Changes in Requirements

Implementing a structured but flexible process for managing change requests ensures that adjustments can be made without significant disruption. This includes assessing the impact of changes on timelines and budgets and communicating these effects to all stakeholders.

Onboarding and Team Integration

Effective onboarding and team integration are crucial for the success of outsourcing engagements. Developing a comprehensive onboarding plan can help new team members acclimate quickly. This should include training on company processes, culture, and tools used for collaboration.

Asynchronous Cooperation

Facilitating asynchronous cooperation between teams in different time zones can enhance productivity but requires careful planning. Establishing clear expectations for response times and utilising project management tools can help keep teams aligned despite their geographical differences.

Conclusion

Fintech development outsourcing offers significant benefits for banks and financial institutions, including access to specialised skills, faster time-to-market, and cost-effectiveness. However, successful outsourcing requires careful planning, clear communication, and effective management.

By understanding the key considerations, selecting the perfect partner, and implementing best practices in project management, financial institutions can navigate the challenges of fintech development outsourcing and leverage it as a powerful tool for innovation and growth.

As the fintech landscape continues to evolve, outsourcing will likely play an increasingly important role in helping financial institutions stay competitive and meet the changing needs of their customers. By embracing this approach and implementing the strategies outlined in this article, banks and financial institutions can position themselves for success in the digital age of finance.

Ready to take the next step in your fintech development journey? Learn more about picking the right partner for fintech development outsourcing in our comprehensive guide: How to Choose a Fintech Partner. This resource will provide you with in-depth insights and practical tips to help you make an informed decision and set your fintech project up for success.