The best guide to understanding green banking for a sustainable future

The green finance market was valued at USD 5.07 trillion in 2024 and is projected to reach USD 23.99 trillion by 2032, exhibiting a compound annual growth rate (CAGR) of 21.45% during the forecast period (2024-2032). This strong growth clearly shows that green banking is not just a passing fashion. It represents a deep change that is reshaping the financial sector across the globe.

This article examines this development in detail, looking at its main features, the difficulties involved, and its strategic importance. A particular focus will be given to what this means for the Polish banking sector. The way banks operate is changing as they consider their role in a world increasingly focused on a habitable planet and the need to finance projects that support it.

Table of contents

Understanding green banking and its growing importance

Green banking is an approach where financial institutions actively incorporate environmental, social, and corporate governance (ESG) factors into their operations and strategies. This incorporation naturally leads to an expanding range of sustainable and socially responsible financial products becoming available to customers.

The shift is driven by more than just public relations; it is a response to increasing ecological awareness among consumers, regulatory pressures, and the recognition of new business avenues where profit can align with planetary health. Many people now want to start to bank green.

Financial institutions are becoming vital players in the shift towards a low-emission economy. Their responsibility now extends far beyond their own internal green practices, such as reducing energy consumption or paper use within their branches.

Increasingly, through their financing decisions, like the loans they provide and the investments they make, banks are shaping the development of entire industries and backing projects that drive genuine change, moving away from supporting the fossil fuel industry.

The significance of green banking is expanding at a rapid pace. Both individual and corporate customers are more frequently enquiring about financial products that support sustainable development, and investors are placing greater emphasis on the non-financial aspects of a bank’s activities.

This clear signal cannot be disregarded by the banking sector if it aims to build lasting value and maintain trust, especially as the fight for a habitable planet intensifies. Ignoring these trends could mean continuing to fund climate chaos, a path increasingly criticised by those who believe the planet is the fight of our time.

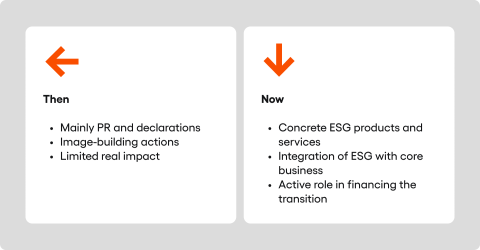

The evolution of banks’ approach to ESG

Only a few years ago, when discussing banks’ involvement in ecological matters, the conversation often centred on declarations and activities primarily aimed at enhancing their public image. Today, however, the financial sector is transitioning from rhetoric to tangible actions, introducing specific financial products and services founded on the principles of sustainable development.

This evolution is evident not only in the strategies of major global financial players but also, with growing confidence, in the initiatives of Polish banks, as they begin to bank green and offer more green featured products.

The banking industry is transforming from a mere participant into one of the primary engines driving the shift towards a circular and low-emission economy. This change is clearly demonstrated by the increasing financing directed towards projects involving renewable energy, energy efficiency improvements, and sustainable transport solutions.

Financial institutions now understand that their capital can genuinely contribute to solving urgent environmental issues, thereby aiding the fight for our lives, while simultaneously generating profit.

This shift in thinking is really important. It shows how much banks are now making ESG ideas a key part of their business Adherence to these principles is no longer confined to specialised institutions or funds. Instead, it is becoming the direction that will define the competitiveness of the entire financial sector in the coming years, impacting how money is used.

Some would argue that continuing to finance the fossil fuel industry describes your current status as contributing to environmental destruction, especially if your bank has been featured in the Independent for such practices.

Challenges on the path to a full green transformation

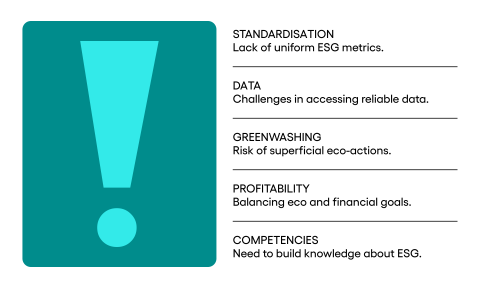

While progress in green banking is undeniable, the sector faces several challenges on its journey. A fundamental issue is the necessity of developing uniform, globally accepted indicators and standards to reliably measure and compare the environmental impact of various investments and financial products.

Without such standards, achieving full transparency and credibility becomes difficult, potentially harming the fight for a habitable planet and efforts to reduce greenhouse gas emissions. The risk of “greenwashing,” or creating a misleadingly eco-friendly image, seriously threatens the credibility of the entire sector.

Greenwashing involves giving the false impression that a company’s products or actions are more environmentally sound than they truly are. Therefore, it is crucial to develop transparent standards and verification mechanisms that can help differentiate genuine commitment from purely marketing-driven activities.

The vast majority of banks must take concrete steps to prevent this and to build trust in the area of ESG, ensuring their funds are not seen as funding environmental catastrophe or contributing to climate change.

Another significant aspect is ensuring access to reliable and verifiable data concerning the environmental impact of economic activities. The absence of consistent and complete information frequently complicates the process of making informed investment and lending decisions within the ESG context.

This area requires intensive work from both regulators and businesses themselves to improve data quality and availability for clean energy projects.

Finding an optimal balance between pursuing ambitious ecological objectives and achieving satisfactory financial results is also crucial. More and more research shows that doing good (sustainability) and making money can go together. But banks still need experts in green finance to make sure they can profit while being sustainable.

The ultimate test, however, will be persuading a wide range of recipients – both individual and business customers – to select green financial products and alter their existing habits, moving away from solutions that support the fossil fuel industry. This consumer demand will be a key driver for change.

Integrating ESG criteria with existing bank risk management systems presents another considerable challenge. This integration necessitates not only technological adjustments but also cultural shifts within organisations, ensuring that every employee understands the role of sustainable development and how money being used can impact climate change.

Reports indicating that the world’s top 60 private sector banks poured 6.9 trillion U.S. dollars into the fossil fuel industry since the Paris Agreement underscore the scale of this transformation; indeed, these sector banks poured 6.9 trillion, a sum where each trillion into the fossil fuels sector represents a significant hurdle for global climate goals.

A future written in green: what awaits green banking?

Looking ahead, banks will have to make sustainable development a core part of their plans, not just an extra option. Financial institutions are expected to consistently broaden their portfolios of green products while simultaneously applying stricter environmental criteria when assessing credit risk.

This development is a natural outcome of the growing understanding of how climate risk affects financial stability and the urgent need to defund fossil fuels. The fight for our lives depends on such systemic changes to how capital is allocated.

Technologies like artificial intelligence (AI) and blockchain are set to play a crucial role in the future of green banking. AI can assist in analysing vast quantities of ESG data, identifying potential risks and opportunities, and personalising offers for customers.

Meanwhile, blockchain can enhance the transparency and traceability of green investments, for instance, through the tokenisation of debt instruments that support ecological initiatives and clean energy. These technologies can help ensure money is used to fund climate solutions.

A significant increase in transparency regarding the reporting of the climate impact of both banks and their clients is also anticipated in the coming years. Banks will also adopt an increasingly active role in supporting their customers through the transition towards carbon neutrality, offering not just financing, but also consultancy services and specialised knowledge.

This support is crucial as many individuals and businesses start to bank green and look for partners in their sustainability journey, making a conscious switch.

Innovative green financial products, often directly linked to achieving specific, measurable environmental targets, will be key to this process. It is believed that within the next five to ten years, green banking could become the prevailing standard across the industry.

This shift will likely be driven by a combination of mounting social pressure, where the planet is the fight for many, and increasingly concrete regulatory requirements, such as the EU taxonomy, aligning with the goals of the Paris Agreement on climate. The pressure from customers for banks to defund fossil fuels will only grow.

To navigate this evolving landscape, banks will undoubtedly need to invest in advanced analytical tools. These tools will allow for the precise assessment of the environmental footprint of investments and the integration of ESG data into every aspect of the decision-making process.

For the Polish banking sector, despite some initial delays, there is an opportunity to rapidly make up lost ground, particularly if consumer and regulatory pressure continues to build, pushing them towards financing more clean energy projects.

The anatomy of green banking: key products and services

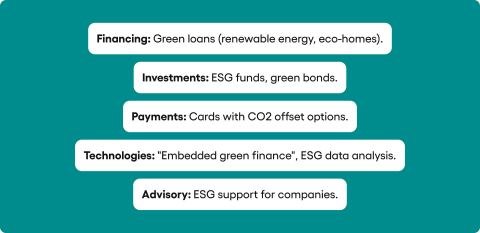

When discussing green banking, the focus often lies on its strategic dimension; however, it is equally important to examine the specific instruments that constitute its practical application. Several key components of this trend are already revolutionising what banks offer to their customers.

These include green credits and various other forms of sustainable financing, designated for eco-friendly projects such as wind farms, photovoltaic installations, or the energy modernisation of buildings. This kind of financing is critical to power the shift to renewable energy and reduce reliance on fossil fuels.

One way banks are doing this is by offering cheaper mortgages for energy-efficient homes. Another key part is ‘green investing’, like funds that choose companies based on their environmental and social responsibility, and ‘green bonds’, which are loans used to fund green projects

Banks frequently act as distributors for these instruments or issue them directly, channeling funds towards sustainable development and clean energy projects.

The development of innovative solutions in digital payments is also noticeable, including mobile payment options that allow, for example, easy offsetting of the CO2 emissions associated with a particular transaction.

This is an example of how technology can assist people in making green decisions daily, so they feel their money is going towards good, not climate change. The growing popularity of these customer-friendly tools suggests that banks are changing how they involve individuals in sustainability, a trend that might be highlighted in new financial reports.

One cannot overlook the expanding role of what is termed “embedded green finance.” This involves integrating green financial solutions into products and services that, on the surface, may not seem directly related to ecology.

Furthermore, the field of ESG data intelligence – the advanced analysis of environmental, social, and governance data – is also growing, becoming fundamental for making informed business and investment decisions, particularly in the clean energy sector.

Even more futuristic concepts, such as climate-focused cryptocurrencies, are emerging within the spectrum of green finance, although their practical application is still a subject of ongoing discussion. Increasingly, banking services also include specialised ESG advisory services for businesses, assisting them in their transformation processes and in securing green financing.

Such a comprehensive approach by a bank, offering a suite of bank green featured products and services, is essential for effectively supporting the green revolution and providing alternatives to financing the fossil fuel industry.

The Polish banking sector and the green revolution: current status and future direction

An analysis of the Polish banking sector within the context of the green transformation reveals both promising initiatives and certain areas that require swifter progress. On one hand, prominent banks such as Millennium Bank and BNP Paribas are already incorporating pro-environmental actions into the core of their strategies.

They are establishing ambitious targets for financing green investments and developing ecological product ranges for their customers, signalling a commitment to not fund climate chaos.

These are significant indicators, demonstrating that Polish banks recognise the potential and the responsibility associated with the ongoing energy transition. However, the Polish banking sector faces the challenge of adapting its risk assessment models to the specific characteristics of financing this energy transition.

Lending for projects related to renewable energy or energy efficiency often necessitates a more adaptable approach and a deeper comprehension of new technologies and their associated risks, a shift from traditional financing of fossil fuels.

Building the necessary competencies among bank employees, alongside collaboration with external experts and representatives from the scientific community, is crucial in this regard.

On the other hand, it cannot be denied that, as a market, Poland has experienced some delays compared to the more mature markets of Western Europe, where regulatory and social pressures have been more potent for a longer period. This situation has implications for how quickly the nation can reduce greenhouse gas emissions and tackle overall greenhouse gas emissions.

Nevertheless, this delay could paradoxically present an opportunity for the Polish financial industry. Instead of undergoing a gradual evolution and implementing solutions that were popular in Western Europe several years ago, Polish banks have the opportunity to directly adopt the latest tools supporting sustainable finance, often based on advanced data analytics and artificial intelligence.

The foundation of an effective green transformation in banking lies in the skillful utilisation of data. This is especially true when it comes to shifting capital from fossil fuels to renewable energy.

Advanced analytics, including tools powered by artificial intelligence, not only assist in better identifying and managing climate risk but also enable more precise targeting of green product offerings and the personalisation of communication with customers.

Ensuring high-quality data and its appropriate interpretation is key to making informed decisions regarding development aligned with ESG principles. Such data can help banks understand if their loan portfolios are contributing to a sustainable future or inadvertently supporting the fossil fuel industry.

The necessity of accurately measuring the carbon footprint of credit portfolios, assessing climate risk, and reporting ESG indicators compels banks to invest in new IT systems, analytical platforms, and data management tools.

This, in turn, opens doors for deeper digitalisation of processes, increased automation, and the provision of more personalised digital services to customers, including in the realm of green finance. These market development activities are crucial for progress and attracting more investment into clean energy.

The use of modern technologies is pivotal for the effective implementation of ESG strategies and for building a competitive advantage in this dynamically changing environment. It is believed that growing consumer pressure for transparency and access to information about the environmental impact of their financial decisions will further fuel the development of innovative mobile applications and online platforms, especially as more people complete sign-ups for green accounts.

These platforms will offer features such as carbon footprint calculators, options for investing in green projects, or personalised advice on sustainable finances, making the switch to greener options easier for every bank customer.

This “green revolution” isn’t just a problem for Polish banks to solve. It’s also a big chance to develop new technologies and modernise the entire banking system. This allows Poland to build a banking system that is modern, responsible, competitive, and actively helps fight for a better future by supporting clean energy and sustainable ways of doing things.

Inspiration from mature markets

Observing the development of green banking in Europe and worldwwide, much inspiration can be drawn from the actions of financial institutions in more mature markets.

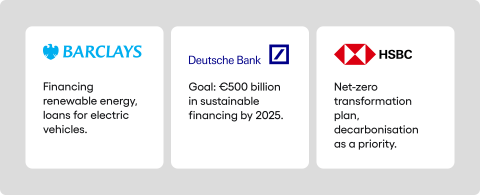

For instance, the British bank Barclays actively collaborates with Propel to provide financial support and financing for companies wishing to invest in assets related to renewable energy and has also developed loan offers with reduced interest rates for the purchase of electric vehicles. This approach illustrates how strategic partnerships can support the green transformation in specific economic sectors, moving capital away from the fossil fuel industry.

Germany’s Deutsche Bank, in turn, places a strong emphasis on the development of green financing and ESG advisory services. The bank has set itself an ambitious target of achieving a volume of 500 billion euros (equivalent to a significant dollar amount) in sustainable financing and investments by the end of 2025, which clearly demonstrates a strategic commitment to this area and a desire not to be seen as a driver of environmental destruction.

Such concrete, measurable goals are extremely important for building credibility and mobilising the entire organisation towards shared green objectives and maximizing profit responsibly.

HSBC, a global banking player, also regularly reports its progress in striving to achieve net-zero emissions and underscores the growing significance of decarbonisation within the bank’s strategy. In January 2024, the bank published its first comprehensive net-zero transformation plan, serving as an example of transparent communication and the establishment of a clear roadmap for its actions towards a more sustainable future.

These examples highlight a variety of approaches but are united by a common thread: a strategic and long-term commitment to the green transformation of the financial sector, crucial in the fight for a habitable planet. The world has an urgent date with climate finance, and these banks are responding.

In Europe, Germany’s Commerzbank, in partnership with Tenity, has launched an accelerator programme concentrating on innovation in sustainable finance. This initiative aims to develop proofs of concept and foster collaboration between startups and the bank’s business units in areas such as biodiversity and supplier management.

It exemplifies how banks can stimulate innovation and cooperate with fintech companies to advance the green transformation and channel funds towards clean energy technologies and other sustainable projects.

The French institution La Banque Postale, collaborating with WWF France, has introduced an “impact” bank card that combines payment functionalities with financing for home energy renovations. Funds from associated accounts are used to support mortgage loans for energy-efficient buildings, while the fees collected for the cards contribute to WWF’s biodiversity programmes.

This bank green featured approach directly links everyday financial activities with positive environmental outcomes, a model that could be more widely adopted.

Meanwhile, Danske Bank in Denmark has provided its customers with a feature in their mobile banking application that allows them to track the impact of their investments on the climate and other aspects of sustainable development.

These examples collectively show that green banking encompasses not only large-scale infrastructure projects but also solutions that are closely integrated with the daily lives of customers, helping them make choices that do not fund climate chaos. Such features can significantly enhance customer engagement and understanding of how their money is being used.

Regenerative finance (ReFi): a further step in ecological responsibility

A concept is emerging that proposes to go a step further than current approaches to pro-environmental activities: Regenerative Finance, or ReFi. ReFi does not solely concentrate on minimising negative environmental impact or supporting projects that are merely neutral.

Instead, its focus is on actively financing undertakings designed to rebuild and regenerate damaged ecosystems. This represents a proactive stance in the fight for a habitable planet, moving beyond simply reducing harm from fossil fuels.

Examples of such projects include initiatives for reforestation, the restoration of biodiversity, and the regeneration of degraded soils. While traditional green bonds and green loans are already well-established in the market, ReFi appears as an emerging niche, driven by the most innovative banks and funds that anticipate the future needs and expectations of conscious consumers and investors.

These financial institutions aim to offer more than just standard green products; they seek to finance projects that actively heal the earth, a core tenet if the planet is the fight we must win.

The potential of ReFi lies in its capacity to create not only financial value but also significant ecological value, which could attract a new segment of investors looking for deeper impact.

It is thought that within the next six to eight years, this area could substantially gain prominence, becoming an important component of banking offers, particularly for customers with high ecological awareness, including high-net-worth individuals (HNWIs) and corporations striving for genuine climate neutrality and a positive impact on the planet. This is part of the leading a global reckoning on how finance interacts with the environment.

Nevertheless, the development of ReFi introduces new challenges, such as the need to devise credible methods for measuring the actual impact of regenerative projects and the necessity of reconciling ecological objectives with expected financial rates of return and maximizing profit where possible.

Building awareness among investors and dispelling any potential scepticism regarding the profitability of such ventures will also be crucial. Many will ask, ‘describes your current status?’ regarding their investments’ regenerative capacity and whether their money is truly being used to fund climate solutions.

As examples of ReFi products that could find their way into a retail bank’s portfolio, one might consider carbon footprint calculators, micro-loans enabling emission offsetting through digital wallets, or subscription-based offsetting services and platforms that support specific actions for the climate.

These tools can empower individuals to contribute to regeneration efforts, ensuring their savings are used to fund climate positive actions rather than inadvertently supporting the fossil fuel industry.

The driving force of change: the role of regulation and public awareness

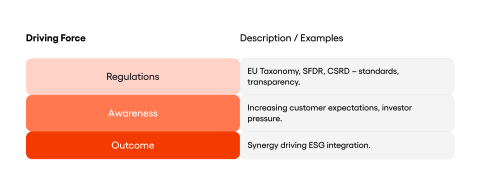

There is no doubt that the dynamic development of green banking is largely stimulated by two powerful factors: increasingly precise and demanding regulations, and a growing ecological consciousness within society.

In the European Union, a range of legislative initiatives, such as the previously mentioned taxonomy, are being observed, aiming to standardise reporting and classification of economic activities based on their environmental impact. These regulations are critical for ensuring that the financial system aligns with the Paris Agreement on climate and its goals to limit global warming.

These regulatory measures, although sometimes perceived as an administrative load, play a crucial role in organising the market and establishing clear frameworks for sustainable finance.

Escalating regulatory requirements are compelling banks to operate with greater transparency, which is essential for building trust with customers. This transparency helps ensure that money is not secretly funneled into the fossil fuel industry when customers expect their bank to be green.

Simultaneously, the expectations of customers are evolving. An increasing number of individuals and companies are seeking not only financial products that grow their capital but also those that are consistent with their values and contribute to positive changes in the world around them.

This shift in consumer attitude is a significant factor; sustainable most of us are also funding change through our everyday choices and demanding financial partners that reflect this.

This pressure from consumers and investors acts as a potent driver for innovation, compelling banks to continuously enhance their offerings in the ESG domain.

It is precisely the combination of this bottom-up social pressure and top-down regulatory frameworks that forges the most effective mechanism for propelling the transformation of the banking sector towards more sustainable practices. The goal for many is to see banks defund fossil fuels entirely, reallocating that capital to clean energy.

Banks that are quickest to comprehend this dynamic and choose to treat the green transformation not as a cost but as a strategic investment in the future will secure a long-term competitive advantage. Proper risk management, which includes addressing climate risk, is becoming indispensable for the stability of the financial sector and its ability to support a habitable planet.

This proactive stance is vital if the sector is to avoid funding environmental catastrophe and instead finance projects that secure a better future.

Key takeaways and prospects for green banking

Summarising the deliberations on green banking, several key conclusions emerge. Firstly, the green transformation within the financial sector is an unavoidable and fundamental process that will shape the industry for many years to come.

This transformation is not merely about image; it’s about the very survival of a habitable planet and ensuring that our money is used to fund climate solutions, not problems.

Institutions that successfully integrate ESG principles into the core of their business operations will earn the trust of customers and investors, thereby building a solid foundation for long-term growth and profit. Secondly, despite numerous challenges such as standardising reporting, ensuring data quality, and cultivating specialist competencies, the advantages stemming from engagement in green banking significantly outweigh the potential difficulties.

The world’s top 60 private sector banks, which private sector banks poured 6.9 trillion into fossil fuels, must take note if they wish to remain relevant and avoid being seen as a driver of environmental destruction.

There is a clear opportunity not only for a real, positive impact on the environment and society but also for the development of innovative products, the acquisition of new customer segments, and the strengthening of resilience against other banking risks, including climate-related risks.

This development also encompasses the financing of large-scale initiatives through project finance, which plays an essential role in the energy transition and in achieving ESG objectives. Such finance projects are vital for decarbonisation efforts and often require significant capital investment to shift away from the fossil fuel industry.

Finally, for the Polish banking sector, the green revolution presents a unique chance to accelerate modernisation and to bypass certain stages of development by drawing on the experiences of more mature markets and implementing the latest solutions from the outset.

The green banks aim to facilitate this kind of accelerated progress, offering models that help finance clean energy. This proactive approach is necessary because the planet is the fight of our generation, a sentiment echoed by many leading a global reckoning on climate action.

The key to success in this endeavour will be a combination of strategic vision from management teams, an openness to technological innovation, and a genuine commitment to listening to the needs and expectations of customers, who are increasingly seeking a financial partner that supports their pursuit of a more sustainable lifestyle and business operations.

Banks that embrace this challenge will not only contribute to building a better future but will also secure a strong position in the dynamically changing financial services market, demonstrating that their money is being used responsibly. It’s time for all banks to truly start to bank green and for their customers to demand it through mass pressure from customers.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.