The core components of a successful banking UX strategy

For almost a third (29%) of banking customers in Europe, the mobile app is their only contact with the bank. This single fact, from a 2024 Forrester report, shows a new reality in the financial sector. Winning customers has shifted from a competition based on the number of features to one based on the quality of the digital experience (user experience, or UX).

In a saturated market, it is now the simplicity, reliability, and ease of use of a service that determines customer loyalty and a bank’s profitability. This article looks at why UX has become the key battleground for customers, what challenges designers face, and which rules will decide success in digital banking.

Table of contents

Key findings

- The rules of competition have changed: Success in banking no longer depends on the number of products offered. It now depends on the quality and simplicity of the user experience (UX), which has become a key factor in building customer loyalty.

- The rise of the “mobile-only” customer: For a large and growing number of customers in Europe (29%), the app is the bank. Neglecting the mobile experience means losing your main connection with your customers.

- UX has a measurable effect on money: A good experience directly improves business results. It lowers the cost of finding and serving customers, increases the number of customers who stay, and helps sell extra products.

- Future strategic challenges: Success in the years ahead will depend on four things: deep personalisation using AI, making digital services accessible to everyone, finding the right balance between security and convenience, and fitting into the world of Open Banking.

The architecture of trust: the strategic importance of UX in the future of banking

The European market: a new competitive era

The situation across the European market is at a turning point. Widespread internet access, which now reaches 94% of all households in the EU, has created the foundation for a major shift in banking. The competition is no longer just about adding new functions to an app; it is about improving the quality of the entire digital journey.

This strategic change is confirmed by a 2024 study from Deloitte, which looked at 349 banks across 44 countries. It found that the most advanced banks, or “Digital Champions,” are deliberately moving their focus from developing new features to investing in a personalised and smooth customer experience. For these leaders, quality has clearly become more important than quantity.

This focus on UX is a direct response to a market where most banks now offer a similar set of basic digital services. The real difference lies in how these services are delivered.

How a great user experience affects a bank’s business

The importance of the user experience comes from its direct and measurable effect on a bank’s main business goals. As competition from agile financial technology (fintech) companies grows, a positive customer experience has become essential for growth. A close look at how UX affects business numbers shows it is an investment that provides a high and measurable return.

How UX builds loyalty and keeps customers

Keeping customers happy is a top priority in a business built on trust. According to the company Temenos, it can cost five times more to get a new customer than to keep an existing one. A high-quality user experience is the best way to build loyalty and stop customers from leaving (often called the ‘churn rate’).

Studies of what consumers expect confirm this. Data from a Salesforce report shows that 80% of them believe a company’s digital experience is as important as its products and services. This means a bad experience feels like a problem with the bank’s core service, not just a technical glitch.

Using UX to attract customers and build a brand

A high-quality user experience is a powerful way to get new customers. Financial products that are easy and pleasant to use naturally get good reviews in app stores. This has a direct effect on the decisions of potential new users.

Happy customers also become the most effective brand ambassadors. Good experiences lead to natural growth through word-of-mouth recommendations. In this way, investing in UX lowers the cost of getting new customers (Customer Acquisition Cost, or CAC), because the experience itself, not expensive advertising, becomes the main draw.

The measurable effect of UX on financial results and ROI

The link between UX and profitability is clear and can be measured in several ways. Firstly, a well-designed UX gets customers more involved and makes it easier to sell them other products, which shows up as a higher ‘conversion rate’ on product applications. Secondly, making interfaces and processes simpler directly leads to lower operational costs.

This can be measured by a drop in calls to the contact centre after a complicated feature is redesigned. An analysis by Capgemini and Efma is worrying: 44% of customers face difficulties, and 70% of abandoned digital journeys are caused by them. Every failed process is lost income that could have been avoided, which directly improves the return on investment in UX.

Strategic challenges for UX in banking in the coming years

Over the next few years, the role of UX teams will change from simply doing tasks to thinking strategically. Their job will no longer be just about designing nice-looking interfaces. It will become a key part of making the bank’s business strategy a reality.

Hyper-personalisation and proactive financial advice

The biggest job is to move from simply showing data to actively helping customers manage their money. As Deloitte‘s report shows, digital leaders are already using tools for personal finance management (PFM). The goal for UX designers is to use data and AI to give users real value.

Inclusive design and digital accessibility for all

A second important job is to make sure banking services are available to everyone. Designing for inclusion and digital accessibility is now a basic requirement, for ethical, legal, and business reasons. UX teams must make the Web Content Accessibility Guidelines (WCAG) a standard part of every design stage.

The growth of conversational interfaces and AI assistants

Artificial intelligence, especially generative AI (GenAI), is changing how customers interact with banks. The task for UX is to design a new generation of virtual assistants that can understand the situation and have a natural conversation. As a report from the agency Edisonda points out, the challenge won’t be the technology itself, but making it more human.

The key challenge: balancing security and convenience

In banking, UX is about finding a balance between strict security rules and customers’ desire for simplicity and speed. This tension is one of the biggest design challenges. On one hand, rules like the PSD2 directive require Strong Customer Authentication (SCA), but on the other, people want to log in with a single tap.

A designer’s job is to create processes, like logging in or authorising payments, that follow the law but feel smooth and almost invisible to the user. This can be done by cleverly using biometrics and behavioural analysis.

10 golden rules for designing UX in banking apps

The financial industry places a special responsibility on designers. The following ten points are a set of universal rules that should be the foundation for any product team in the banking sector.

- Be radically transparent. All costs, fees, and conditions must be communicated clearly and upfront.

- Design for security. Security features, like two-factor authentication (2FA), must be a smooth and integral part of the experience.

- Engineer simplicity. The role of UX is to make the complex nature of banking radically simpler and reduce the mental effort for the user.

- Give instant feedback. Every action a user takes must get an immediate and clear response from the system.

- Use context and personalisation. The app should intelligently adapt its interface and communication to the user’s situation.

- Design for error. A good UX expects mistakes and designs easy, stress-free ways to fix them.

- Provide a sense of control. The user must always feel they are in full control of their finances.

- Make accessibility a standard. Designing according to WCAG standards is a fundamental duty.

- Educate in context. Financial knowledge should be woven into the daily use of the app through short, relevant tips (known as micro-learning).

- Be consistent across all channels. The customer’s experience must be smooth and consistent, no matter how they interact with the bank.

From strategy to action: the UX process and structure in a bank

A great user experience doesn’t happen by accident. It is the result of a disciplined process and the right company culture. Understanding “how” and “who” creates these experiences is just as important as knowing the design rules.

How is a good UX created? The design process

Modern product teams in banking use user-focused methods like Design Thinking or Lean UX. This process is cyclical and has several key stages:

- Research and discovery: It all starts with in-depth user research (interviews, surveys, data analysis) to understand their needs, goals, and frustrations.

- Prototyping: Instead of building the final product straight away, teams create interactive mock-ups and prototypes. These allow for quick visualisation of ideas and early feedback.

- Usability testing: Prototypes are regularly tested with real users. Watching how they behave helps identify problems and areas for improvement before any code is written.

- Iteration: The product is improved in cycles based on test results. This approach reduces the risk of creating a feature that no one wants or knows how to use.

Who is responsible for UX? The team’s place in the bank’s structure

An organisation’s digital maturity depends on where the UX team sits and what its role is. The most effective banks have strong in-house UX or Product Design departments that are more than just providers of nice-looking interfaces. They act as strategic partners for the business, IT, marketing, and, importantly, the legal and compliance departments.

This close, cross-departmental collaboration is essential to balance innovation with regulatory and security requirements. It makes sure the customer’s perspective is considered at every stage of a product’s life, from strategy to launch and beyond.

Designing for different generations: kids vs. adults in the banking world

Launching banking apps for children is one of the most interesting and demanding trends in fintech. It requires banks to fundamentally change how they think about a financial product. Designing for children and adults are two separate disciplines with completely different rules, goals, and measures of success.

Designing for adults: a focus on efficiency and control

Designing for adult users of digital banking is all about maximising efficiency and giving them a sense of full control. An adult user’s goals are practical and task-oriented: they want to manage their finances quickly and securely. The key needs an app must meet are instant access to their balance and transaction history, easy payments and transfers, and simple card management.

The interface for adults should be minimalist, with a clear information structure and navigation designed to reduce the number of steps needed for key tasks. Success is measured by things like how long it takes to complete a task, the task success rate, and usability scores.

Designing for children: a focus on education and engagement

The world of banking for children is completely different. The main goal is not managing money itself, but financial education, learning the value of money, and building good habits like saving. At the same time, the app must meet the needs of the parent, who uses it as a tool to teach their child and safely oversee their first steps in the world of finance.

The interface and features of an app for children must be built on different foundations:

- Gamification: This is a key element. Game-like mechanics—earning points, badges, levelling up, and completing challenges—are used to make abstract financial concepts tangible and exciting.

- A system of tasks and rewards: Apps for children often include a system where parents can set tasks (like chores) and assign a monetary value to them. This teaches the basic principle that work leads to earnings.

- Visual savings goals: Instead of abstract savings accounts, children can create virtual, personalised ‘piggy banks’ for specific goals, like a new bike or a game console. The app shows their progress visually, which makes saving feel real and motivating.

- Adapting to age: The interface must be flexible and suited to the child’s developmental stage. Simple, direct interactions work best for younger children, while teenagers can be introduced to more advanced budgeting tools.

- Solid parental controls: This is an absolute must. The app must give parents full control, allowing them to set spending limits, block certain types of purchases, and get real-time notifications about their child’s activity.

A banking app for a child is really a B2B2C (Business-to-Business-to-Consumer) product. The bank sells the product to the parent, who makes the purchasing decision, and the parent then provides it to the child. Its success depends on meeting the needs of both groups at the same time.

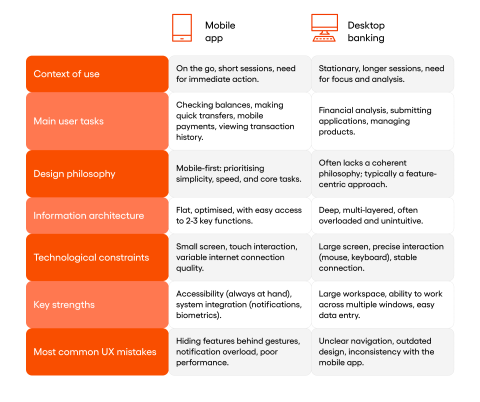

Two worlds, one customer: UX on mobile and desktop platforms

Even though the bank’s customer is the same person, their needs, situation, and expectations are completely different depending on whether they are using a mobile app or a banking website on a computer. Ignoring these differences is a common strategic mistake that leads to frustrated users and lost income.

Differences in context: the mobile app vs. the desktop site

Mobile apps are for daily, quick interactions with the bank. People use them much more often, sometimes several times a week, to do routine tasks: check their balance, view recent transactions, make a quick payment, or transfer money to a friend. The context is dynamic—on the go, on public transport, in a shop. The interaction has to be instant.

Desktop banking is used less often, perhaps a few times a month, for more complex, analytical tasks. These require a bigger screen, more focus, and often involve working with a lot of data. Typical desktop tasks include analysing detailed spending history, applying for complex products like a mortgage, or managing an investment portfolio.

The problem of a quality gap: neglected UX on desktop platforms

Unfortunately, there is often a big gap in the quality of the user experience between these two channels. Banks have invested huge amounts of money in developing their mobile apps, which are often rated as excellent.

At the same time, desktop websites are often neglected and seen as outdated technology. Users regularly criticise them for being cluttered, clumsy, and old-fashioned. The main problem is information overload and navigation that makes it hard to find less-used but important functions.

Design strategy: why the “mobile-first” approach wins

This quality gap often comes from the wrong strategic approach to multi-channel design. Many banks still use an outdated model called Responsive Web Design (RWD). This involves squeezing a big, complex desktop website to fit on a smaller smartphone screen.

A much more effective strategy is Mobile-First Design, which turns the process around. Design begins with a deep understanding of the mobile user’s needs and limitations. The interface is planned from the ground up for a small screen, with simple navigation and content. Only after a solid mobile experience is created is a desktop version developed as a smart extension of it.

Horizon 2030: the future of UX in banking apps

Looking ahead 5-10 years, the role and form of the user experience in banking will continue to change deeply. This evolution will be driven by three key forces: the spread of Open Banking, advances in artificial intelligence, and the expansion of financial services beyond the smartphone screen.

Open banking and the role of UX in managing data

Open Banking, which allows customers to safely share their financial data with third-party providers (TPPs), is fundamentally changing the competitive landscape. It opens the door for banks and fintechs to create ‘super-apps’ and advanced PFM platforms that bring together data from many financial institutions in one place. For the first time, this gives customers a truly complete picture of their financial situation.

Artificial intelligence and the move towards “invisible banking”

Artificial intelligence, especially GenAI, is already being widely used in the financial sector. In the coming years, its role will grow, leading to the development of fully automated interfaces. We will see a shift from the current reactive chatbots to fully proactive, predictive AI assistants. The ultimate goal could be ‘interface-free banking’, where most daily financial tasks are fully automated by AI working in the background.

The expansion of financial services: UX beyond the smartphone screen

The idea of banking being limited to a mobile app and a desktop website is coming to an end. Financial services will need to become part of the smart environment around us, available on demand in different situations and on different devices. UX designers will need to create experiences for a wide range of new touchpoints: wearable devices (like smartwatches), smart speakers, and augmented or virtual reality (AR/VR) systems. This will force a move away from designing graphical user interfaces (GUIs) towards voice user interfaces (VUIs) and gesture-based interactions.

Summary

This article shows that the quality of the user experience (UX) has become a central part of modern banking strategy. The key driver of this change is the dominance of ‘mobile-only’ customers, for whom the mobile app is the sole channel of contact with their bank. This makes the app’s usability and reliability an absolute priority.

The analysis also shows the direct, measurable impact of UX on financial results—from customer retention and loyalty to operational costs and revenue. In the future, success will depend on a bank’s ability to implement advanced personalisation using AI, ensure full digital accessibility, and adapt to the Open Banking ecosystem, where the quality of the experience will be the main point of difference.

Frequently Asked Questions (FAQ)

What defines a superior banking UX, and how does it affect the user experience?

A superior UX is central to any mobile banking strategy and a key trend in online banking. It fundamentally shapes the entire user experience because for ‘mobile-only’ customers, banking apps are their only point of contact. A positive banking UX, as the cornerstone of modern mobile banking, is essential for both customer satisfaction and user satisfaction, which in turn helps customers remain loyal.

Why are high-quality banking apps a matter of survival for the banking sector?

High-quality banking apps are critical because a poor user experience on any of these mobile banking apps can result in losing a customer permanently. For the ‘mobile-only’ user, the banking app represents the entire service. Therefore, the quality of all financial apps and banking apps directly impacts customer loyalty, making excellence in designing banking apps a matter of survival for traditional banks and new entrants alike.

How can financial institutions use UX design to improve results?

Financial institutions can leverage expert UX design to achieve better financial results. A positive digital banking user experience fosters customer loyalty and leads directly to increased customer retention. Better UX design also improves customer engagement with digital products and banking apps, boosting conversion rates across all digital banking services.

How is customer satisfaction in digital banking linked to the user interface?

In digital banking, customer satisfaction is directly linked to the quality of the user interface. For 80% of users, the digital banking user experience is a critical factor. A problem with the banking interface—a core part of the mobile banking experience—feels like a fundamental service failure, which damages both user satisfaction and user trust.

Why is a strong mobile banking UX crucial for driving user engagement?

A strong mobile banking UX is essential for driving user engagement. The primary goal is to create a smooth user experience, which is the key to user satisfaction. When mobile apps are intuitive, it naturally boosts user engagement because the customer enjoys interacting with the bank’s digital services. This strong user engagement is a key focus of the entire software development process.

What key features are essential for delivering intuitive digital banking platforms?

Several key features are vital for delivering intuitive digital banking platforms. Among the most important are tools that offer helpful spending insights, which can actively help customers with saving money. The primary goal of modern digital banking platforms is to provide intuitive experiences that make solving complex tasks feel easy.

How do modern banking apps handle transaction details and bank accounts?

Modern banking apps provide users with full control over their bank accounts. Users can view detailed transaction details for all their financial transactions. A key aspect of the mobile banking UX is providing clear transaction details, which allows users to check account balances and securely authorize the action of transferring money. Access to these transaction details is a fundamental user need.

How does the design process accommodate diverse user needs?

The design process must address diverse user needs, going beyond the average user. This process starts with thorough user research and the creation of user personas to understand different groups. Acknowledging these diverse user needs helps create a product with a low learning curve. Continuous user feedback is vital to ensure all banking processes are easy to use.

What are the main customer expectations for a modern banking experience?

Modern customer expectations dictate that the digital banking user experience must be seamless. On their mobile phones and other apps, users expect every user interface to be simple, fast, and secure, with both security and convenience in mind. These high customer expectations mean the quality of the banking app is as important as the products offered by leading banks.

What core principles make up a successful digital banking user experience?

A successful digital banking user experience is built on several core principles. The design process must prioritize transparency with all financial data and engineer simplicity into the user interface. Giving users control and building user trust are key factors, which are achieved through user research, in-depth analysis of user behaviour, and rigorous testing of all banking apps.

What role does biometric authentication play in mobile banking?

Biometric authentication is a critical digital technology for mobile banking. It is a key part of the UX design solution for balancing security and convenience. Features like facial recognition allow mobile banking apps to offer secure, one-tap logins, creating a smooth user experience for all financial transactions.

How can banking apps drive higher customer engagement?

Banking apps can drive higher customer engagement through superior UX design. An intuitive banking interface that provides actionable insights and helpful spending insights makes the user experience more valuable. This increased customer engagement is crucial to foster customer loyalty and is a primary goal for many digital services.

What is the ‘Mobile-First’ strategy for mobile apps?

The ‘Mobile-First’ strategy is a UX design approach that is critical for all mobile apps in the mobile banking sector. It involves planning the user interface for mobile phones from the ground up, focusing on the core functionality and user habits that define how users spend most of their time. This is more effective for mobile banking apps than simply shrinking a desktop site.

What are the key strategic challenges for the future of digital banking?

The future of digital banking faces challenges that require advanced UX design and new technologies. The biggest tasks for digital banking services are moving to hyper-personalisation by analysing user behaviour, ensuring digital technology is accessible, and designing conversational AI assistants to make the digital banking user experience more human.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.