The strategic integration of PIS and AIS in banking

Reducing account verification time from 48 hours to a few seconds is no longer an innovation; it is a baseline requirement. With 68% of customers abandoning digital applications mid-stream, manual processing acts as a brake on sales. The following analysis demonstrates how Payment Initiation Services (PIS) and Account Information Services (AIS) eliminate this friction, cutting corporate onboarding times by 90% and turning a costly regulatory burden into a market advantage.

Key takaways

- Verification speed: Modern account verification via the PIS API takes just 2–5 seconds (Zwitch).

- Time reduction: Market leaders have shortened corporate client onboarding by 90% – from months to minutes (Deloitte).

- Customer churn: Fully 40% of SME merchants plan to switch payment providers due to slow onboarding (Capgemini).

- Precision: Integrating AIS data with biometrics cuts false positives by 66% (McKinsey).

- Emerging threats: Video-based methods are increasingly ineffective against a 118% rise in deepfake attacks (Trustpair).

- Cost savings: Consolidating identity tools saves $1.2 million over three years (Forrester).

The new market reality

The financial landscape shifted sharply between 2024 and 2025. After a decade of cheap money fuelling expansion at any cost, the market is now demanding proof of value. Boston Consulting Group describes this period as a “FinTech spring,” but one defined by strict profitability. With public company EBITDA margins hitting 16%, investors want evidence that institutions can generate returns on every client.

Two variables dictate success in this environment: the cost of acquisition and the cost of service. Identity verification (KYC), once viewed as a tiresome obligation, has become the primary battleground. Despite strong results in the banking sector, structural problems persist. Boston Consulting Group points to pressure on margins and competition from non-bank players as significant threats. Traditional business models remain vulnerable to shocks, necessitating technology that tightens the system and cuts waste.

The compliance cost crisis

Compliance departments, particularly in AML and CFT, consume the lion’s share of operational budgets. This spending stems primarily from hiring armies of experts rather than investing in technology, yet systems remain porous. Market pressure forces a move away from manual, labour-intensive verification. Traditional KYC, relying on physical documents and declarations, is an expensive anachronism that creates barriers and drives revenue loss.

Regulators and banks are responding by turning to Open Banking. PIS and AIS have evolved from niche concepts into powerful tools that drastically shorten onboarding and eliminate KYC errors.

The architecture of modern onboarding

To understand the scale of this change, we must examine how PIS and AIS function in risk assessment and identity verification. By 2025, open banking adoption reached critical mass, with EY reporting implementation in over 65 countries. Capgemini predicts that global cashless transaction volumes will surge from 1.685 trillion in 2024 to over 3.5 trillion by 2029.

The potential of AIS

AIS, which allows secure access to a client’s finances, became the market standard for due diligence in 2025. Institutions no longer trust static PDFs or scanned IDs because generative AI has made forgery accessible and precise, a threat highlighted by Trustpair. Instead, banks use AIS to pull verified data directly from the source systems of other institutions.

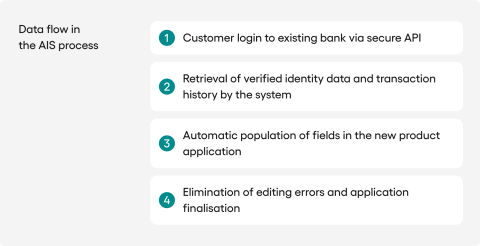

Traditional onboarding relied on the client manually filling out forms, a major source of errors and frustration. AIS technology automates this stage entirely, allowing banks to build a transparent, connected service environment. In practice, a client logs into their existing bank via a secure API. The system retrieves verified identity data and transaction history, then automatically populates the new product application. This reduces error risk to zero and accelerates processing. McKinsey experts note that the best compliance systems remove barriers at these friction points, immediately boosting customer experience and conversion rates.

Establishing the source of funds and creditworthiness is the foundation of KYC. Previously, this required gathering physical employer certificates or paper statements. Now, algorithms analyse real-time transfers to spot regular income, fixed obligations, and spending patterns. This allows for far more precise risk assessment than models based solely on static historical data.

Verification through PIS

While AIS provides knowledge, PIS verifies identity through action. Originally associated with e-commerce, payment initiation now serves as an advanced authentication mechanism in KYC processes.

For years, the industry relied on “micro-transfers,” forcing clients to wait one or two business days. In 2024 and 2025, immediate API verifications integrated with PIS replaced this method. Zwitch and Perfios calculate that modern account verification takes between two and five seconds. By requiring the client to log into online banking and authorise a transaction, PIS meets strict Strong Customer Authentication (SCA) requirements. Unlike the manual approach—slow, prone to error, and expensive due to refund handling—PIS is instant, secure, and boasts a process effectiveness exceeding 91%.

Adopting PIS also protects against fraud. Even if a criminal possesses a victim’s personal data, they rarely hold simultaneous access to the victim’s online banking and trusted device. Trustpair reports that payment fraud cost firms millions in 2024 because 70% of organisations still relied on manual account checks. In this light, PIS becomes a central element of “defensive banking.”

The effects of transformation

Data from 2024 and 2025 provides hard evidence that integrating PIS and AIS works. The benefits fall into three main categories: faster revenue generation, cost optimisation, and error elimination.

The most spectacular results appear in corporate and institutional banking. Until recently, onboarding a corporate client was an ordeal averaging 100 days. McKinsey estimates that KYC and due diligence consumed over 40% of that time. By 2025, cloud platforms integrated with AIS and public API registries changed the equation. Deloitte describes a case where a standardised cloud “front office” reduced the timeline from months to minutes. For SMEs, speed is survival. Capgemini warns that 40% of merchants will switch providers if onboarding drags on.

Regarding errors, false positives plague traditional AML systems, generating massive costs as humans must manually check every flag. Using AIS data combined with advanced AI analytics brings a breakthrough. McKinsey cites a bank using behavioural biometrics to cut false alarms by 66% while boosting fraud detection to over 90%. The system understands context—recognising, for instance, that a large inflow is a property sale rather than money laundering. Financially, Forrester calculates that consolidating tools and automating these processes saves a mid-sized organisation $1.2 million over three years.

The role of Agentic AI

We are entering the era of Agentic AI, where systems act rather than just analyse. In onboarding, autonomous agents are the ideal partner for the structured data flowing from PIS and AIS channels. McKinsey defines these agents as systems capable of planning, executing multi-step tasks, and adapting to variables.

In practice, an autonomous agent intercepts an account application the moment it arrives. It independently calls the AIS API to retrieve transaction history and uses OCR and NLP to read corporate documents against public registers. Crucially, if the agent detects a discrepancy, it does not reject the application. Instead, it corrects the error using trusted PIS transaction data, solving 90–95% of simple quality issues without human intervention.

This technology is vital because threats are escalating. Deepfake-based attacks rose by 118% in 2024, rendering video interviews and selfie checks obsolete. PIS and AIS act as a shield here. Breaking cryptographic bank authorization is vastly harder than faking a video. Consequently, leading identity providers like Entrust and Persona are making behavioural verification mandatory.

Sector analysis

The impact of combining PIS and AIS solutions is not distributed evenly across the financial landscape. Different market segments derive specific, distinct benefits from these technologies:

- Retail Banking: In this sector, user experience is the governing factor. Customers now demand an immediate response. The prevailing solution is the “flash registration” model using AIS, where a single consent allows the bank to download a complete data set. Neobanks such as Revolut and Monzo have leveraged these mechanisms effectively, recording a 23% increase in deposit revenue in 2024 (Boston Consulting Group).

- Wealth Management: The challenge here has traditionally been the difficulty in estimating the true financial potential of a client whose assets are scattered across multiple institutions. AIS aggregation solves this by creating a holistic picture of the client’s wealth in seconds. This capability allows firms to offer highly individualised advisory services from the very first day (Capgemini).

- The SME Sector: This area faces the strongest competitive pressure from FinTech. The main barrier to servicing SMEs remains their complex ownership structures and the difficulty of assessing credit risk for entities without a long history. The market response is to assess capacity based on current financial liquidity using AIS data rather than historical reports. This shift has shortened credit decision times to just a few hours.

Market best practices

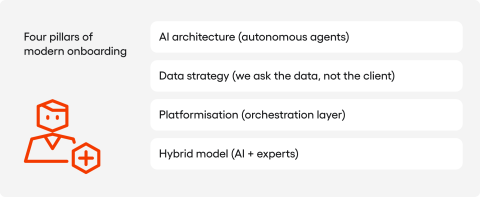

A thorough analysis of market leaders’ strategies in 2024–2025 allows us to define modern standards in onboarding. The most effective organisations apply an integrated approach built on four pillars:

- AI Architecture: Innovative entities are moving away from simple RPA solutions towards autonomous AI agents. These agents independently verify inconsistencies using transaction data. They allow for dynamic configuration, automatically selecting limits and account types based on real-time risk assessment. furthermore, they orchestrate workflows between CRM, Core Banking, and AML modules to ensure full transparency.

- Data Strategy: The key differentiator for top implementations is a fundamental change in philosophy: stop asking the client, start asking the data. Institutions aggregate information directly from trusted databases, limiting the client’s role to mere confirmation. This enables “perpetual KYC,” where traditional periodic reviews are replaced by continuous monitoring. If AIS data detects a sudden change, the system automatically triggers re-verification.

- Platformisation: System fragmentation is the main obstacle to efficiency. The solution is an orchestration layer that binds multiple verification providers into a single whole. This allows banks to flexibly select verification methods depending on risk levels and costs. Companies that have consolidated their identity tools report savings of $1.2 million over three years (Forrester).

- The Hybrid Model: Market leaders understand the limitations of artificial intelligence. They implement models where AI handles 100% of repetitive processes, freeing experts to focus on complex cases and building high-value relationships. It is also becoming standard practice to deploy independent QA systems to verify decisions made by AI agents.

Regional context

Europe remains the incubator for these solutions, driven by PSD3 and the European Digital Identity Wallet. Member states must provide these wallets by 2026, creating new infrastructure where PIS and AIS verify financial attributes. Meanwhile, emerging markets in Latin America and Southeast Asia often adapt faster due to a lack of legacy technology, using alternative data to verify clients excluded from the traditional system.

Conclusion

PIS and AIS technologies are the foundation of modern banking architecture; treating them as optional invites obsolescence. Automating KYC is the only viable path to managing compliance costs that are becoming globally untenable. For decision-makers, this transformation transcends technology. It requires shifting from a gatekeeper mentality to a partnership model, where security is an invisible process that builds trust. The synergy of PIS and AIS provides the tools to make that vision a reality.

FAQ

What are PIS and AIS?

PIS (Payment Initiation Services) and AIS (Account Information Services) are the two core services defined under Open Banking regulations (such as PSD2 in Europe). They allow licensed third-party providers (TPPs) to access banking data or functionality, but only with the user’s explicit consent.

What is the main difference between AIS and PIS?

The primary difference lies in their function: AIS is for reading data, while PIS is for making payments. AIS provides read-only access to account details, involving no money movement. In contrast, PIS allows a provider to initiate direct account-to-account (A2A) transfers on your behalf.

What is Account Information Services (AIS) used for?

AIS allows third-party providers (AISPs) to view your bank account data, such as balances and transactions. This technology powers:

- Budgeting apps: Aggregating accounts to show all spending in one place.

- Personal finance management: Innovative tools for tracking finances.

- Lending checks: Instant credit scoring and loan affordability assessments.

How does Payment Initiation Services (PIS) work?

PIS enables third-party providers (PISPs) to initiate a payment directly from your bank account. It acts as an alternative to card networks. Common uses include:

- E-commerce: “Pay by Bank” options at checkout.

- Automation: Setting up recurring payments.

- Savings: Moving money automatically to savings accounts.

Do these services require Strong Customer Authentication (SCA)?

Yes. Both AIS and PIS are strictly regulated and require Strong Customer Authentication (SCA). This ensures that no data is shared and no payment is made without secure identity verification from the account holder.

Why are PIS and AIS considered beneficial?

These services empower consumers by offering streamlined financial processes and better tools. By enabling direct payments and unified data views, they foster significant innovation across the fintech sector.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.