Trends in insurance in 2025: the era of prediction and prevention

A fundamental shift is reshaping the insurance industry. The sector is moving from a traditional, reactive model of compensating for loss to a proactive approach based on the principle of “predict and prevent”. Though investment in artificial intelligence is growing rapidly – Gartner’s report, The 2025 Insurance CIO Agenda, shows that 89% of CIOs plan to spend more on generative AI in 2025 – the real benefits won’t be seen right away.

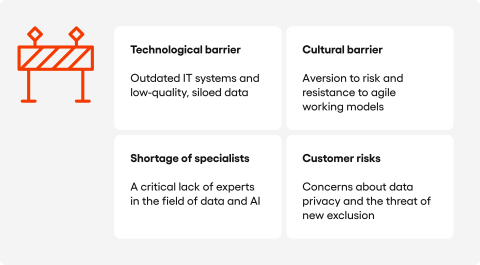

According to Forrester, fewer than 5% of insurers will see clear financial gains from AI in the next year. This situation is caused by deep-seated problems like old IT systems and a serious shortage of skilled people. This report analyses which product innovations are creating real growth, what ethical and cultural problems the industry faces, and what steps leaders can take to turn technology’s promise into real success.

Table of contents

Key information

- The AI investment paradox: Even though 89% of CIOs are increasing their budgets for generative AI, fewer than 5% of companies will see clear profits from it in 2025 because of system-wide barriers and a lack of specialists.

- The growth of embedded insurance: Embedded insurance is expected to grow by 30% in 2025, making it the most promising area for short-term growth in the industry.

- Risks for the customer: Highly personalised insurance creates a danger of a new type of insurance exclusion. At the same time, studies show that 86% of consumers are worried about their data privacy, which makes it harder for new products to be adopted.

- The key to success: A leadership model where IT and business leaders create strategy together greatly increases the success rate of transformation, rising to 71% compared to 48% in traditional models.

A new era for insurance – from reaction to prevention

The insurance sector has for decades been based on a “react and repair” model and is now entering a new era defined by a fundamental change in its way of working. It is moving from the passive role of a loss compensator to an active partner in risk management. Driving the transformation are three powerful and interconnected trends.

The first is what customers now expect. Today’s consumer is used to smooth and personalised digital experiences in other areas, and they bring these same expectations to insurance. The second trend is a new and unstable risk landscape, as growing threats from climate change and advanced cyber-attacks are a huge challenge for old actuarial models.

To meet these new challenges, the tools are provided by the rapid development of AI and the Internet of Things (IoT). It is worth noting, however, that market pressure from a growing “trust deficit” is just as important as new technology. Analyses by Bain & Company show that investors are losing confidence in insurers’ growth plans, making new, transparent products a strategic necessity.

AI as the fundamental engine of transformation

Artificial intelligence has become the basic technology that supports the entire next generation of insurance products and business models.

Generative & agentic AI: redefining product possibilities

We are seeing a key change in approach as we move from AI that automates tasks to AI that can act on its own. The Accenture Technology Vision 2025 report describes the birth of “agentic systems” that can understand complex business logic. The arrival of agentic systems opens up revolutionary possibilities for product development, as an AI agent can dynamically update underwriting guidelines, create personalised policy documents on demand, or even handle complex claims negotiations.

Hyper-personalisation and dynamic underwriting in real time

Personalisation is no longer an optional extra; it has become a basic customer expectation. Using advanced machine learning (ML) models, AI is the engine driving this hyper-personalisation. It allows for sophisticated customer segmentation based on real needs and behaviours, rather than broad demographic categories.

Challenges in scaling AI: the gap between investment and real returns

Despite great enthusiasm, putting AI into practice on a large scale faces serious obstacles. The industry is spending huge amounts on AI, and data from Gartner shows that 89% of CIOs in the insurance sector plan to increase their budgets for generative AI in 2025. But the forecasts in Forrester’s Predictions 2025 report are clear: fewer than 5% of insurers will see direct, tangible profits from AI in 2025. That this gap exists is due to deep-rooted barriers, which include not only outdated IT systems and a critical shortage of specialists with data and AI skills, but also the lack of a clear strategy for connecting technology with business goals.

Product innovations driven by technology

New product categories are redefining the value of the insurance industry, changing the way insurance is designed, distributed, and used.

Embedded insurance: integration into the customer’s ecosystem

Imagine buying a plane ticket, and travel insurance is already included in the price without you having to ask. That’s the basic idea behind embedded insurance. Analysts at Forrester call it a “bright spot” in innovation, with an impressive projected growth of 30% in 2025. The model, however, carries a fundamental risk, as insurers could be reduced to the role of a simple capital provider for powerful platform players who control the customer relationship and data.

Usage-based insurance (UBI) and parametric insurance: data as the core of risk assessment

These products represent the shift towards real-time risk management. Usage-Based Insurance (UBI) uses telematics data to directly link the premium amount to a person’s driving style, allowing for more accurate risk assessment and price personalisation. Parametric insurance works based on an objective measure, such as wind speed, and a payout is made automatically when a pre-agreed threshold is passed, which gets rid of the complicated claims process.

New horizons: protection for digital and sustainability risks

The risk landscape is constantly changing, creating a need for new forms of protection. The market for cyber risk insurance still has huge growth potential, especially in the small and medium-sized enterprise sector. At the same time, the spread of AI creates an emerging market for new types of liability, which according to Deloitte, is set to grow at a rate of ~80% CAGR.

It is also worth highlighting the role of reinsurance as a quiet engine of innovation. Global reinsurers play a key part in absorbing and pricing new, complex threats like climate disasters or systemic cyber-attacks. They often provide the financial backing that allows Insurtechs and insurers to bring bold, new products to the market.

Market examples: the pioneers of innovation

The following examples of Insurtech companies show how these trends are being put into practice.

Lemonade built its model on AI and data from the start, changing the claims process with a chatbot that can pay out simple claims in seconds. About 30-40% of all claims are handled this way.

Root Insurance came to the market with a radical idea: insurance premiums should be based mainly on how you drive, not who you are. Using telematics in smartphones, Root monitors the real behaviour of drivers to accurately assess risk.

Tractable specialises in using AI to automatically assess vehicle damage from photos. Their computer vision technology can analyse pictures and generate a repair estimate within minutes.

Challenges on the road to digital transformation

The path to transformation is full of barriers that go beyond purely technological issues. Success depends on overcoming deep-seated operational, cultural, and ethical challenges.

Data quality and interoperability: the hidden barrier

The problem of outdated IT systems is only part of the challenge. An equally serious, and often overlooked, barrier is the low quality and lack of interoperability of the data itself. Many companies struggle with data locked in incompatible, departmental silos, where it is often inconsistent, incomplete, and full of errors, following the principle of garbage in, garbage out.

The cultural barrier: a clash of tradition and innovation

Perhaps the biggest, though often underestimated, challenge is the cultural barrier. Insurance organisations, being by nature conservative and risk-averse, find that shifting to an agile, experiment-based operating model represents a fundamental shock to their very identity. The digital culture requires an appetite for risk and a test and learn mentality, and making such a cultural change is much harder than putting new technology in place.

Risks for the customer: the ethical side of transformation

The technological revolution has serious consequences for customers. Hyper-personalisation creates the risk of a new class of “uninsurable” customers, as algorithms may assign prohibitively high premiums to people with higher risk profiles. Trust in data privacy is also key, as studies show that 86% of consumers are worried about the privacy of their data. Equally important is the risk of dehumanising the claims process, where the drive for maximum automation can lead to a loss of empathy when customers need it most.

Strategic tasks for 2025 and beyond

Success is not guaranteed just by investing in technology. It requires a holistic transformation covering architecture, people, and governance.

- Modernising the technology architecture. It is necessary to move away from monolithic systems towards modular, flexible platforms based on APIs, with data at the centre.

- Developing people and a culture for the AI era. The skills crisis requires aggressive upskilling and reskilling programmes. It also needs an evolution of the leadership model, where IT and business leaders work together.

- Navigating the regulatory and ethical landscape. As AI becomes more powerful, responsible innovation becomes a key business requirement. Insurers must build solid governance frameworks to make sure their AI models are fair and transparent.

Leaders face the challenge of a “bimodal transformation”. The challenge means simultaneously optimising the existing, profitable business while aggressively investing in building a completely new, agile model for the future. Managing this duality is the greatest strategic challenge for the coming decade.

Conclusion: the future of insurance in the AI era

The shift to a technologically advanced, proactive insurance model is not a question of “if”, but “when and how”. Success in this transformation will be achieved by those organisations that can move from experiments to scale. They will need to effectively modernise their core technology, team skills, and culture of responsible innovation.

The coming years will see a widening gap between the digital leaders and those who fall behind. What will be key to success is not the blind following of technological novelties, but rather the strategic determination to build the foundations from which their true potential can be released. The insurance industry has a historic opportunity to redefine its role in society – from a simple payer of claims to an essential partner in building resilience and security in an increasingly uncertain world.

FAQ

What is the main role of artificial intelligence in insurance?

AI is the fundamental engine for the next generation of insurance products. Its applications range from enhancing fraud detection systems to powering “agentic systems” that can handle complex tasks like dynamic underwriting. This innovation allows leading insurers to create hyper-personalized products for each customer.

How are climate change and extreme weather impacting the insurance market?

Climate change presents a huge challenge to the insurance market, as growing threats like natural disasters strain traditional models. This, combined with factors like social inflation, creates an unstable risk landscape, driving insurers toward new products, like parametric coverage, for modern risk management.

How are evolving customer needs shaping the insurance sector?

Understanding the modern customer is paramount. Today’s customer expects seamless digital experiences, pushing the entire sector to evolve. Meeting these specific consumer needs requires a deep analysis of the customer journey, making hyper-personalization a basic requirement for insurers aiming for growth.

Beyond natural disasters, what are some key emerging risks?

The sector faces several emerging risks beyond traditional threats. These include advanced cyber-attacks, geopolitical tensions, and entirely new types of liability created by AI. The market for insuring these digital risks shows significant growth potential for insurers.

What are the main data and cultural barriers for insurers?

Many insurers face significant internal barriers. A major challenge is handling complex data that is often trapped in incompatible silos, making effective information governance critical. Additionally, the conservative, risk-averse culture of the sector often clashes with the agile, experiment-based model needed for digital innovation.

How are digital tools changing claims handling?

Digital tools, particularly generative AI, are revolutionizing claims handling and creating operational efficiencies. For instance, some Insurtechs use chatbots that can pay out simple claims in seconds. More advanced systems are also being developed by insurers to improve the entire claims process.

What gives insurers a competitive advantage in their digital transformation?

A significant competitive advantage for insurers comes from their leadership model. The success rate of transformation jumps to 71% when IT and business leaders collaborate on strategy. This integrated approach is key to achieving profitable growth and realizing the full benefits of innovation.

What should be the primary focus for insurance leaders to drive profitable growth?

The primary focus for insurance leaders must be a “bimodal transformation.” This means insurers should simultaneously optimize their existing, profitable business while building a new model for future growth. This requires a focus on modernizing operations and building solid governance frameworks for risk mitigation.

What is the role of the global insurance market in innovation?

The global insurance market, particularly global reinsurers, acts as an engine of innovation. The global insurance ecosystem is critical for absorbing complex threats like systemic cyber-attacks. This financial backing from the global insurance market allows both Insurtechs and traditional insurers to bring bold new products to the insurance market.

What are commercial lines and how do they relate to the protection gap?

Commercial lines insurance refers to policies designed for businesses, covering risks like property damage and liability. The protection gap is the shortfall between the total economic cost of a loss and the amount covered by these commercial lines, representing a significant uninsured risk for a business.

What are the key trends in regions like the Middle East and Latin America?

Key trends in insurance within the Middle East and Latin America markets include rapid digitalization. There is also increasing demand for health and life insurance, driven by a growing middle class. These regions still present major growth opportunities for the global insurance community.

How do interest rates affect the financial performance of insurers?

Changing interest rates directly impact the financial performance of insurers. Most insurers invest the premiums they collect in bonds. When rates are low, investment income decreases, putting pressure on profitability. This creates a complex challenge that all insurers must manage.

What are key priorities for insurers in the coming year?

Looking ahead, many insurers are setting priorities for the first quarter. Key agenda items include developing strategies to counter social inflation, investing in AI for more sophisticated fraud detection, and refining the digital customer experience to better meet consumer needs.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.