Core banking as an accelerator of product innovation

Build a scalable core banking system that can cut time to market (TTM) for new financial products by up to 70%.

Book a meeting

Measurable benefits of system modernisation

We integrate core banking platforms from leading providers, translating your business strategy into technical solutions compliant with European regulations. Turn the modernisation mandate into a tangible market advantage.

When a legacy system holds your business back

A monolithic legacy system, burdened by technical debt, stifles innovation. In a market where agility and speed of response are decisive, an outdated core banking platform makes it easier for competitors to expand, leading to loss of market share.

See how we can address this.

Schedule a free expert session

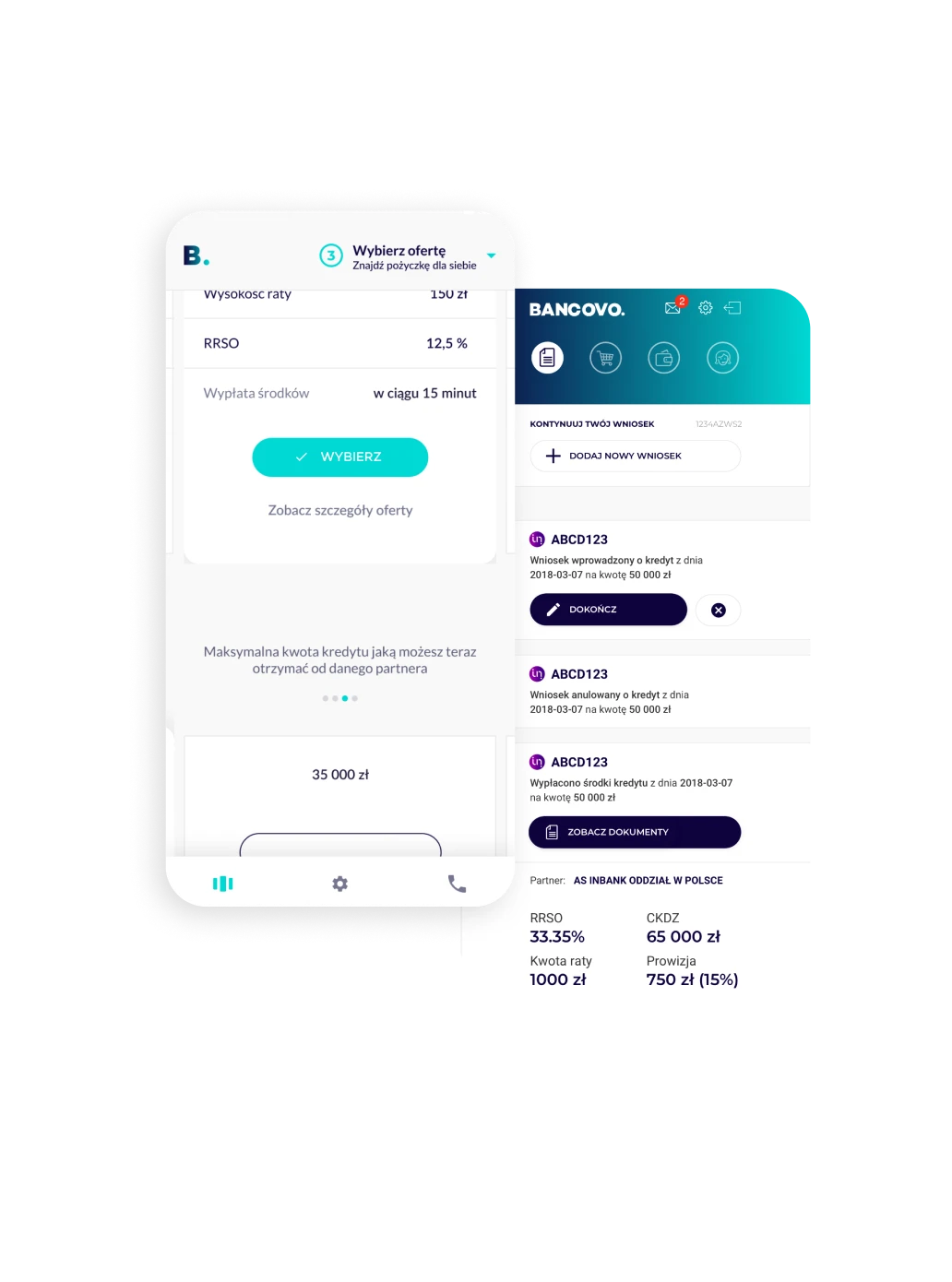

Key elements of a modern system

Implementation process: from strategy to a working system

Get insights about

latest financial sector trends

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.