Innovations in mobile banking application development: What's new for 2025 and beyond?

Mobile banking app development in 2024 and beyond will be accelerated by new technologies even more than in previous years. We are witnessing an enormous transformation of money-related brands that are embracing a wide tech stack, supporting banks in delivering mobile apps with advanced features that meet the demands of mobile banking users.

Which innovations are truly desired by their customers, and how can they be introduced via mobile banking development to provide value and achieve business goals? This article is an overview of the emerging trends that will shape the way mobile banking apps will be built in the upcoming years. We will discuss key technologies for banks and other financial institutions and the features that mobile banking services should offer.

Table of contents

Overview of the Mobile Banking Sector

The banking industry has undergone an unprecedented shift in recent years, transitioning from traditional brick-and-mortar operations to a digital-first approach. This transformation has been driven by changing consumer expectations, technological advancements, improving banking app development process, and the need for more efficient, cost-effective banking apps.

In 2024, the banking industry is more dynamic and competitive than ever before. Traditional banks must face fintech startups and neobanks, which usually implement innovations early on. This market situation forces banks to innovate rapidly or risk obsolescence. Investing in robust mobile banking development is often one of the best solutions.

The COVID-19 pandemic has further accelerated this digital shift, with consumers increasingly preferring contactless, mobile banking solutions. Even though lockdowns are no longer in place, many customers have become accustomed to digital-only banking apps and want all their financial solutions to be easily accessible from anywhere in the world.

Key statistics highlight the impact of these changes:

- According to Statista, the number of mobile banking app users worldwide is expected to exceed 2.5 billion by the end of 2024.

- Allied Market Research claims that the global mobile banking app market size is projected to reach $7 billion by 2032, growing at a CAGR of 16.8%.

- Finder.com research found that “86% of UK adults use a form of online banking, which is around 46 million people”. 53% of citizens (28 million people) use a mobile banking app of some kind.

These figures underscore the growing importance of mobile banking applications in the financial services ecosystem and how important developing mobile banking software will be in the upcoming years.

Growing Demand for Advanced Mobile Banking Solutions

The demand for sophisticated mobile banking services is driven by a range of factors, the most crucial being the evolution of consumer behaviour. Millennials and Gen Z, who are digital natives, expect seamless, on-the-go banking experiences. They prefer to use a mobile banking app over traditional methods to pay bills, transfer money, and other financial activities. They also rather use investment apps over other investing options.

Older generations are catching up, changing their habits and embracing the convenience of a mobile banking app. Consumers across the board seek a very specific mobile banking product: a secure mobile banking app that allows personal finance management anytime, anywhere, without needing to visit physical bank branch locations.

Mobile devices have become an essential part of people’s lives worldwide. Exploding Topics estimates that by 2027, over 7.5 billion people will have a smartphone, meaning almost everyone in the world will be equipped with a mobile device. Considering these predictions, mobile banking app development must provide accessible solutions to a wider population.

Reducing Reliance on Physical Bank Branches

Mobile banking apps are increasingly being developed to reduce the reliance on physical bank branch locations. With the convenience of internet banking and advanced mobile banking solutions, customers can now perform tasks such as managing accounts, transferring funds, and even applying for loans without visiting a bank branch.

This shift is particularly prominent in retail banking apps, where users expect full access to their bank accounts and services through a mobile banking product. As banks move towards digital banking app development, the role of brick-and-mortar locations continues to decline, with many institutions focusing on enhancing their mobile offerings.

Mobile Banking Apps’ Role in Financial Inclusion

Mobile banking apps play a crucial role in bringing banking services to underserved populations, particularly in developing countries. The role of mobile banking app development in promoting financial literacy and inclusion cannot be underestimated. Moreover, with the help of advanced tech (e.g. artificial intelligence), financial education and improved money-related decision-making will be within everyone’s reach. Banking app developers will have a chance to improve the future.

Operational Benefits for Financial Institutions

As mentioned earlier, the pandemic accelerated the adoption of banking apps, with many consumers turning to them to avoid in-person interactions. However, mobile banking app development did not only provide benefits for consumers. Mobile apps allow financial organisations to reduce operational costs associated with maintaining physical branches and handling face-to-face operations.

With these factors in mind, banks, fintech companies, and other financial organisations are investing heavily in mobile banking application development to meet the growing demand and become leaders in the market.

Key Technological Advancements in Mobile Banking App Development

The mobile banking app landscape in 2024 is characterised by several groundbreaking technology trends that are reshaping how customers interact with financial services. Let’s explore some of the most significant innovations in the banking app development sector.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML algorithms are revolutionising mobile banking software development by enabling personalised experiences, enhancing security, and improving operational efficiency of mobile apps. Artificial intelligence, including generative AI models, automates many processes in internet banking, speeds up mundane, repetitive tasks, and supports decision-making on all levels.

Some key applications of ML and AI in banking apps include:

- Predictive Analytics: AI algorithms conduct market research, as well as analyse user behaviour and transaction history to offer personalised financial advice, product recommendations, and spending insights via mobile banking application.

- Fraud Detection: ML models can identify unusual patterns in real-time, flagging potentially fraudulent transactions and enhancing security for financial institution to handle.

- Chatbots and Virtual Assistants: AI-powered chatbots provide 24/7 customer support, answering queries and guiding users through various mobile banking app processes.

- Credit Scoring: ML algorithms can assess creditworthiness more accurately by analysing a broader range of data points, potentially expanding access to credit for underserved populations.

- Voice Banking: A modern banking app with AI-enabled voice recognition technology allows users to perform banking tasks using voice commands, enhancing accessibility and convenience.

AI can also assist in the mobile banking app development process, helping engineers craft concise code, fix bugs, and create a mobile banking app with advanced features for an elevated customer experience.

Open Banking

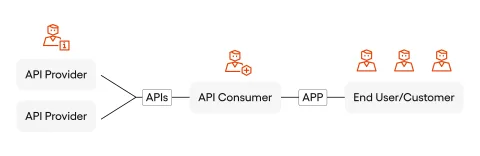

Open banking is a game-changing concept that is gaining traction globally. It involves banks sharing consumer data with third-party providers through secure APIs, with the customer’s consent. This innovation fosters a more convenient and personalised financial services ecosystem, where many solutions can be connected to provide a unique experience for the end user of the mobile banking app.

Key benefits of open banking in mobile banking application development include account aggregation, allowing users to view and manage multiple bank accounts from different institutions within a single banking app. This enhances financial management by integrating data from various sources, providing comprehensive insights and budgeting tools that can cover multiple bank accounts and transactions.

Open banking also enables faster, more secure payments directly from bank accounts, potentially reducing reliance on card networks. Streamlined payments can eliminate the frustration of entering card details during online shopping and facilitate one-click payments, which are highly demanded by consumers within the mobile banking market.

Fintech companies can leverage mobile banking data to create tailored financial products and services. For example, investment apps can access a more comprehensive view of the user’s financial situation, potentially leading to better financial decisions and higher returns.

Banking of Things (BoT)

The Banking of Things (BoT) represents the convergence of the Internet of Things (IoT) and financial services. This innovative concept allows everyday devices to initiate financial transactions autonomously, creating a seamless integration of banking services into people’s daily lives.

Santander, a leading global bank, has been at the forefront of market research regarding BoT applications. They explain that mobile application development that enhances banking solutions with IoT provides numerous advantages to customers. For example, a smart fridge could order groceries based on stock levels (e.g. when a milk bottle is empty), and the user would only need to confirm the payment on their smart device (watch, phone, speaker, etc.).

BoT can reduce fraud by simplifying and automating customer verification, making the process much more convenient for users. Additionally, devices in BoT networks could provide invaluable data for banks, improving credit scoring and offering tailored loan products.

Other potential use cases include connected vehicles automatically paying for fuel, parking, or tolls without driver intervention, and smartwatches or fitness trackers facilitating contactless payments or monitoring spending habits. In B2B contexts, machines could autonomously pay bills based on usage and order supplies or pay for maintenance services.

The implementation of BoT in a mobile banking app opens up new possibilities for convenient, frictionless financial interactions. However, it also raises important considerations around security measures and privacy that developers must address.

Key Features of Advanced Mobile Banking Applications

As online banking services embrace new technologies and emerging trends, they incorporate a wide range of mobile banking app features designed to enhance user experience, security, and functionality. By incorporating these elements, banks and fintech companies create more valuable mobile banking experiences. Let’s explore some of the key features that define state-of-the-art mobile banking apps for 2024 and beyond:

Enhanced Security Measures

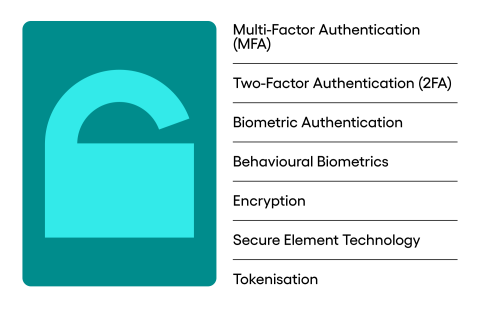

Security remains a top priority in mobile banking application development. Advanced safety protocols are crucial to protecting users’ financial information and maintaining trust in mobile banking software. Some of the most important security measures in mobile app development for banks include:

- Multi-Factor Authentication (MFA): MFA adds layers of security by requiring users to provide two or more verification factors to access their accounts. This might include something the user knows (password), something they have (a mobile device), and something they are (biometric data).

- Two-Factor Authentication (2FA): A subset of MFA, 2FA typically involves a password plus a second factor, such as a one-time code sent via text message or generated by an authenticator app.

- Biometric Authentication: This includes fingerprint scanning, facial recognition, and voice recognition. Biometric authentication offer a high level of security while providing a seamless user experience within a banking app.

- Behavioural Biometrics: Advanced systems can analyse unique patterns in user behaviour, such as typing rhythm or how a device is held, to add an extra layer of continuous authentication.

- Encryption: End-to-end encryption ensures that data transmitted between the user’s device and the bank’s servers remains secure and unreadable to potential interceptors.

- Secure Element Technology: This involves storing sensitive data in a separate, secure chip on the device, isolated from the main operating system.

- Tokenisation: For secure payments with a mobile banking app, tokenisation replaces sensitive card data with unique identification symbols, maintaining security even if the token is intercepted.

Support Service (AI Bots)

AI-powered chatbots, voice bots, and virtual assistants have become integral to modern mobile banking applications. Their capabilities to handle enquiries become more sophisticated every year, meaning the number of cases and complexity levels they can handle also increase.

The benefits of implementing an AI-driven bot into a mobile banking app include:

- 24/7 Availability: Chatbots provide round-the-clock customer support, answering queries and assisting with basic tasks at any time.

- Instant Responses: Users can get immediate answers to common questions without waiting in phone queues or for email responses.

- Personalised Assistance: Advanced chatbots can access user data to provide personalised financial advice and product recommendations.

- Multilingual Support: AI chatbots can communicate in multiple languages, making mobile banking services more accessible to a diverse user base.

- Reduced Operational Costs: By handling routine queries, chatbots allow human customer service representatives to focus on more complex or sensitive issues.

- Guided Processes: Chatbots can walk users through various banking processes, such as setting up a new account or applying for a loan.

Transfers & Payments

It is obvious that every financial application should have payment and transfer options. However, mobile banking apps are continually expanding their payment and transfer capabilities to meet evolving user needs. They introduce innovative methods such as:

- Peer-to-Peer (P2P) Payments: Users can send money directly to friends, family, or other individuals quickly and easily, often using just a mobile number or email address.

- QR Code Payments: QR codes enable contactless payments in retail settings, providing a quick and comfortable payment method.

- Bill Splitting Features: Apps now offer the ability to split bills among multiple users, making it easier to manage shared expenses.

- International Transfers: Many apps now facilitate cross-border money transfers, frequently at more competitive rates than traditional methods.

- Scheduled Payments: Users can set up recurring payments or schedule future transfers for better financial planning.

- Request Money Feature: This allows users to request payments from others, useful for collecting shared expenses or receiving payments for goods and services.

- Integration with Digital Wallets: Many banking apps now integrate with popular digital wallets like Apple Pay, Google Pay, or Samsung Pay for seamless mobile payments.

UX Innovations

User experience (UX) is a critical factor in the success of mobile banking applications in 2024 and beyond. Several innovations are setting new standards in the industry. Key UX design strategies include:

- Intuitive Navigation: Apps are designed with clear, logical navigation structures that allow even new users to find what they need quickly and easily.

- Customisable Dashboards: Users can personalise their app interface, choosing which information and features are displayed prominently.

- Dark Mode: Many apps now offer a dark mode option, reducing eye strain and conserving battery life.

- Voice Commands: The integration of voice recognition technology allows users to perform banking tasks hands-free.

- Gamification: Some apps incorporate game-like elements to make financial management more engaging and rewarding.

- Accessibility Features: Advanced apps include features like screen readers, high-contrast modes, and adjustable text sizes to cater to users with disabilities.

- Contextual Help: In-app tutorials and tooltips guide users through new features or complex processes.

Smooth Onboarding

A frictionless onboarding process is crucial for user adoption and retention. The first impression is vital and can influence the consumer’s decision to stay with the bank long-term. Modern mobile banking apps implement several features to streamline the onboarding process:

- Digital Identity Verification: Users can verify their identity remotely using document scanning and facial recognition technology, saving time and offering convenience.

- Pre-filled Forms: Apps can pull information from official sources or other apps to autofill application forms, reducing manual data entry.

- Progress Saving: Users can save their progress and return to complete the onboarding process later if needed.

- In-App Document Uploading: Necessary documents can be photographed and uploaded directly within the app.

- Real-Time Verification: Advanced systems can verify user information in real-time, potentially allowing instant account opening.

- Step-by-Step Tutorials: Interactive tutorials help new users navigate the app and understand its features.

Personalisation

Personalisation is becoming increasingly sophisticated in mobile banking applications. With the help of artificial intelligence, it is easier to achieve spectacular results and provide exactly what clients are looking for. How do banks tailor their services?

- AI-Driven Insights: Apps analyse spending patterns and financial behaviour to provide personalised financial advice and product recommendations.

- Custom Alerts: Users can set up personalised notifications for account activity, bill payments, or financial goals.

- Tailored User Interfaces: The app interface can adapt based on user preferences and most-used features.

- Personalised Financial Goals: Users can set and track custom financial goals, with the app providing tailored strategies to achieve them.

- Smart Budgeting: Apps can create personalised budget categories based on individual spending habits.

Seamless Integration

Modern mobile banking apps are designed to integrate smoothly with other financial services and third-party apps. This way, they become multi-featured hubs to handle various daily tasks or enhance their internal functionalities with additional options. Several technologies enable such interoperability:

- Open Banking APIs: These allow secure data sharing between banks and authorised third-party providers, enabling a range of innovative services.

- Investment Platform Integrations: Many banking apps now offer direct access to investment platforms or robo-advisors.

- Accounting Software Integrations: Small business banking apps often integrate with popular accounting software for seamless financial management.

- Loyalty Programme Integrations: Apps can connect with retailer loyalty programmes, allowing users to track and redeem points directly through their mobile banking app.

- Social Media Integrations: Some apps allow users to make payments or split bills through social media platforms.

- Financial Aggregation: Users can view and manage accounts from multiple financial institutions within a single app.

Trends in Mobile Banking Development

Considering the top technologies and the most popular features, mobile banking application development trends shape the future of digital financial products and services. They reflect changing consumer preferences, technological advancements, and evolving regulatory landscapes. What are the most interesting directions the industry is following in 2024?

Super Apps

The concept of super apps, which originated in Asia with platforms like WeChat and Alipay, is gaining traction globally. Super apps are all-in-one platforms that offer a wide range of services beyond traditional banking functions. They offer true ecosystem integration where a mobile banking app is connected with other daily-use services like ride-sharing, food delivery, or e-commerce.

Super apps are often considered tools for so-called lifestyle banking, where financial services are seamlessly incorporated into users’ everyday activities and purchasing decisions. They typically operate on a marketplace business model, meaning that consumers can access products and services from various providers.

By offering a broader range of services, super apps can gather more comprehensive user data, enabling better personalisation and risk assessment. The diverse range of services keeps users engaged with the app more frequently, potentially increasing loyalty to the banking brand.

The main challenge for super apps is regulatory compliance. They must navigate complex legal environments, especially when offering services across different sectors. Handling diverse types of user data raises important privacy considerations and a need for stringent data privacy measures. Balancing the broad range of services with a clean, intuitive user interface can also be a challenge.

Neobanking

Neobanks, also known as challenger banks or digital-only banks, continue to disrupt the traditional banking industry. These fintech companies offer account management and other services exclusively through digital channels, such as mobile devices and web platforms, without physical branches. Neobanks are known for their fully digital experiences that offer numerous perks, including lower fees and better interest rates due to the lack of brick-and-mortar locations.

Such banks typically implement new features and services more quickly than traditional banks. Fast innovation and a focus on digital-native customers mean they often meet modern customer demands faster. Additionally, their digital products tend to be designed with attention to detail, which is essential for today’s users. With data-driven insights, neobanks leverage customer data to offer personalised financial advice and product recommendations.

For a detailed comparison between neobanks and traditional banks, refer to our comprehensive report: Neobanks vs. Legacy Banks.

Green Banking

Environmental consciousness is increasingly influencing banking practices, leading to the rise of green banking initiatives in mobile applications. Consumers are interested in features such as calculating the carbon footprint of their spending and investments, as well as sustainable investment options. Integration of ESG (Environmental, Social, and Governance) investment products within banking apps is becoming a must for modern providers.

The green banking trend encourages financial organisations to issue statements and documents in digital form only, significantly reducing paper waste. Moreover, by offering rewards for environmentally friendly financial decisions, they promote eco-awareness among customers. Another option is to offer green lending with preferential rates for projects or purchases that support sustainability. Such organisations can play an integral part in sustainability education, providing information and tips on responsible financial practices.

Ensuring accurate calculation of environmental impact across various spending categories is a challenge green banks face daily to ensure transparency and avoid accusations of greenwashing. They also have to balance their eco-friendly approach with other banking priorities like customer service and profitability.

Value-Added Services (VAS)

Banks are increasingly offering value-added services within their banking applications to differentiate themselves from competitors. They also want to provide more comprehensive financial solutions that align with their customers’ needs and expectations.

By offering a wider range of services, banks can become more integral to their customers’ daily lives and increase customer retention in the long run. Value-added services can also create additional income through partnerships or direct service fees. Offering more services provides banks with a more comprehensive view of their customers’ financial lives.

Ensuring smooth integration of diverse services within a single app can be technically challenging. Integration complexity should be addressed early on to avoid potential issues with user experience. To improve UX further, it’s important to maintain a clean, intuitive interface while offering numerous services at once.

Some examples of VAS in mobile banking include:

- Bill Payments: Integration of utility and other bill payments directly within the mobile banking app.

- Subscription Management: Tracking and managing various subscriptions to help users avoid unwanted charges.

- Transportation Payments: The ability to purchase parking tickets, pay highway fees, and buy bus or train tickets within the app.

- Entertainment Tickets: Access to cinema, theatre, concert, and other event tickets that can be booked in the online banking application.

- Tax Calculation and Filing: Tools to help users calculate and potentially file their taxes.

- Insurance Products: Various insurance products and services that can be compared and purchased within the app.

- Travel Services: Currency exchange, travel insurance, and international usage features for travellers.

- GPT Integrations: Incorporation of generative AI technologies like GPT for enhanced customer service, financial advice, and even assistance with loan applications.

- Financial Education: In-app resources for improving financial literacy.

Case studies of Modern Mobile Banking Application Development

Now that we know what is shaping current mobile banking app development approach and how the above-mentioned trends can change the future of the financial industry, we want to showcase a few real-world examples. The applications discussed below are already introducing the latest innovations into their structures and achieving success in their niches.

POP Pankki: Our Client’s Success Story

POP Pankki is a Finnish cooperative bank that sought to create a modern, user-friendly mobile banking solution to cater to the evolving needs of its customers. They trusted our team to develop a solution that would incorporate new technologies and best practices in UX and UI design.

We worked hard to deliver a mobile banking app with an intuitive interface that allows users to easily navigate through various banking functions, such as current account balances, making transfers and payments, taking loans, and using third-party services.

Following the release of their digital platform, POP Pankki experienced an impressive 126% increase in profit. They also grew their insurance sales by 20%. The banking app received positive reviews and achieved the highest customer satisfaction score among Nordic countries according to the EPSI Rating 2019. The success of the POP Pankki banking app demonstrates the importance of combining cutting-edge technology with user-centric design and multiple functionalities in mobile banking application development process.

mObywatel

The Polish banking sector has been at the forefront of mobile banking innovations, with several noteworthy developments. One of these is integration with mObywatel, the government’s digital identity system. Many Polish banks have integrated their mobile apps with it to enable users to access various public services and verify their identity directly through the mobile banking app, streamlining processes such as applying for government benefits or filing tax returns.

Users can access public services and financial management tools directly through their mobile banking app, creating a more connected and efficient experience. The synergy between mobile banking apps and mObywatel enhances user convenience by eliminating the need to physically visit banks or government offices.

For example, instead of standing in line to submit specific documents, users can simply verify their identity with a few taps within the mobile banking app and handle their case entirely online. This has been especially useful during the pandemic, when reducing in-person interactions became critical. The system’s integration into everyday banking activities also enables a faster, more secure method of authentication that is increasingly demanded by today’s digital-first consumers.

PSD2 Compliance

Polish banks have embraced the European Union’s Payment Services Directive 2 (PSD2), which mandates open banking practices by requiring banks to share customer data with authorised third-party providers (TPPs) via secure APIs. This regulation has enabled fintech companies to access customer account information and initiate payments, leading to the development of innovative services such as account aggregation, personalised financial management tools, and streamlined payment solutions.

By leveraging these APIs, fintechs have introduced highly customisable and efficient banking options, pushing traditional banks to innovate and improve their offerings.

The adoption of PSD2 has significantly increased competition within the financial services sector, allowing both banks and fintechs to offer tailored solutions that enhance the user experience. Polish banks have utilised open banking to integrate features like frictionless payments and personalised financial advice, making banking more accessible and efficient.

However, this innovation also brings challenges related to data privacy and security, requiring robust encryption and authentication measures to maintain consumer trust. Despite these hurdles, open banking continues to drive transformation, positioning Poland as a leader in digital banking innovation.

Selfie Verification

Several banks and financial organisations in Poland have adopted selfie-based identity verification systems as a cutting-edge solution to streamline customer onboarding and ensure robust security for high-risk transactions. This technology employs facial recognition and liveness detection to verify a user’s identity, ensuring that the person interacting with the banking system is indeed the account holder and not an impersonator.

During the account opening process, users can simply take a selfie within the mobile banking app, which is then compared to the photo on their government-issued ID or other official documents. The system’s liveness detection ensures that the selfie is taken in real-time, preventing the use of static images or deepfakes. This process eliminates the need for customers to visit a branch for in-person verification, providing a faster and more convenient way to set up an account.

Beyond onboarding, selfie verification enhances security for transactions such as large fund transfers or loan applications. By requiring biometric confirmation in these cases, banks can reduce the risk of fraud and identity theft, as facial recognition provides an additional layer of authentication. This approach not only increases security but also improves the overall user experience by simplifying traditionally cumbersome processes.

Polish banks that have implemented selfie verification systems have seen positive feedback from customers who appreciate the convenience and enhanced security. As biometric technologies become more advanced, the use of selfie-based verification is expected to expand, becoming a standard feature in mobile banking to enhance both security and ease of use.

BLIK

BLIK has emerged as one of the most popular and innovative mobile payment systems in Poland, transforming how users handle everyday financial transactions. Launched in 2015, BLIK allows users to make instant payments using a six-digit code generated through their mobile banking app, eliminating the need for physical cards or cash.

Whether paying for goods in-store, shopping online, or withdrawing cash from ATMs, BLIK offers significant convenience. The system also supports peer-to-peer (P2P) transfers, enabling users to send money to friends or family instantly, often using just a mobile phone number. With its widespread adoption across Polish banks, BLIK has become a vital tool for millions of users seeking fast, secure, and simple payment options.

BLIK’s success is largely attributed to its focus on security and ease of use. Each transaction is protected by multi-factor authentication, including the user’s mobile banking app login credentials and confirmation of the unique code, making it one of the safest mobile payment methods available.

Additionally, the system’s real-time nature has enhanced its appeal for both consumers and merchants, reducing transaction times and improving the overall shopping experience. BLIK is continually expanding its capabilities, integrating with international payment systems and enabling contactless payments through smartphones.

As a result, BLIK has not only revolutionised mobile payments in Poland but is also positioning itself as a leading force in the broader European market for digital payments. Soon, this groundbreaking mobile banking technology will be introduced to new countries, with Slovenia and Romania being the first adopters outside of Poland.

Conclusion

The mobile banking app development industry continues to evolve in 2024, and we can expect even more innovations and trends in the years to come. Besides technological advancements, the industry must consider constantly reshaping consumer expectations and regulatory developments. Banks and fintech companies that prioritise user-centric design and data security will thrive in this competitive landscape.

Artificial intelligence is already becoming a foundational technology in mobile banking app development, and its adoption will likely continue, automating and personalising major internal and external operations. Other, more niche innovations, such as the Banking of Things and super apps, will undoubtedly redefine how users interact with financial services. The move towards seamless integration, coupled with the growing demand for green and ethical banking options, further highlights the importance of flexibility and adaptability for financial institutions.

To stay ahead, banks must adopt the technologies, trends, and crucial features mentioned in this article and focus on providing an intuitive and personalised user experience. Regulatory compliance, particularly around open banking and data security, will be key in maintaining customer trust. As the mobile banking app development niche moves beyond basic transactions to offer more holistic financial management tools, institutions that can offer meaningful value-added services will see increased customer loyalty. The future of mobile banking will belong to those who can harness the power of technology while meeting constantly changing customer demands, as well as maintaining transparency and security.

Innovate with Speednet

At Speednet, we support financial institutions with quality mobile banking app development that meets modern UX design, security, and functionality standards and best practices. We build money-related digital products that adapt to today’s consumers’ needs. Whether you’re looking to integrate new technologies, develop a feature-rich system, or enhance an existing banking platform, our team of banking app developers can transform your vision into reality.

With years of experience developing advanced mobile banking applications for global clients, we understand the unique challenges and opportunities within the financial services sector. Our portfolio demonstrates our success in delivering high-performance, scalable, and personalised banking solutions that drive user engagement and business growth. Partner with Speednet to stay ahead in your niche. Explore our portfolio today, or reach out to our mobile app development team to discuss how we can help you. Let’s create a banking app together!