The insurance chatbots market: an analysis and a strategic guide

Although insurance companies are investing heavily in chatbots, only 26% of customers trust their advice. This deep scepticism from consumers is the key paradox of the AI era in insurance. On the one hand, the technology offers unmatched potential for optimisation and personalisation, driving a multi-billion-dollar market; on the other, its ultimate success depends on winning the most fundamental resource of all: trust.

This blog post looks at how insurers are managing to overcome this barrier, what real-world benefits chatbots are delivering today, and how the new generation of generative AI could both deepen and solve the industry’s trust problem.

Table of contents

Key takeaways

- Rapid market growth: The chatbot sector in insurance is growing at a rate of about 25% a year (CAGR), showing that the technology is being widely adopted as a strategic investment.

- Measurable return on investment (ROI): Market leaders have proven that AI dramatically shortens claim settlement times (sometimes to just a few seconds), reduces costs, and significantly boosts customer satisfaction (NPS).

- Critical implementation barriers: The biggest hurdles to AI adoption are not the technology itself, but outdated core systems (technical debt) and problems with data quality and availability within organisations.

- The expectation gap: Insurers are focusing on using AI to automate customer service, while customers themselves want the technology to deliver hyper-personalised offers, fair prices, and transparency, as shown in a report by IBM.

- The future is GenAI: Generative artificial intelligence will revolutionise every aspect of the industry, from underwriting and risk assessment to fully autonomous, proactive AI agents capable of managing the entire customer relationship.

Insurance chatbots market size

The arguments for using chatbots are backed by hard numbers. These numbers show both the rapid growth of the market and the real, measurable benefits for companies that have invested in the technology.

The global market for chatbots in the insurance sector is experiencing a period of explosive growth. While specific forecasts vary slightly, they all paint a picture of dynamic expansion. This growth is driven by rising customer demand for automated self-service channels and the increasing adoption of AI and NLP by insurers, as confirmed in analysis by Allied Market Research.

Such a high and consistent growth rate (a CAGR of around 25%) clearly shows that investment in conversational technology is seen as a key direction for the entire industry.

The evolution of chatbots in insurance industry

The first generation in insurance

Chatbots started to appear in the insurance world in the 2010s, as online messengers became more popular. These were usually basic, rule-based programs designed to free up consultants from answering the same simple questions over and over again.

The real breakthrough came when insurers started to use platforms where their customers were already spending their time. For example, in 2017, a company called Insurify launched a chatbot on Facebook Messenger for comparing and buying car insurance. In the same year, Progressive introduced its “Flo” chatbot, also on Messenger, which could provide quotes and answer basic questions.

These early versions were an important step. They moved the conversation with the customer to a familiar place and showed the potential for finding new leads and handling simple service requests.

The shift to AI and NLP

A true transformation began when artificial intelligence (AI) and natural language processing (NLP) were added to the mix. This change allowed chatbots to move from simply matching keywords to understanding what a user really meant, the context of the conversation, and even their mood.

Instead of just reacting to “FAQ”, the new generation of bots could understand questions like “What’s the status of my claim?”. This ability to hold an almost human-like conversation in hundreds of languages, a key market driver identified by Allied Market Research, opened the door to automating much more complex business processes.

This history shows a clear shift in how chatbots are viewed and used. At first, they were seen as a marketing novelty, a clever gadget on a website to grab attention and make buying a bit simpler. It was only when AI and NLP technology got better that insurers started to see its potential to change their core business.

A better ability to understand natural language built the trust needed to give bots more responsible jobs, like handling the first notice of a claim or gathering documents. The story of chatbots in insurance is not just about a timeline of events. It’s a map of growing trust and deeper integration of technology into the heart of company operations.

Types of chatbots in insurance

To understand what chatbots can and cannot do, it helps to know the technology behind them. The evolution of the technology is key to understanding their growing capabilities. Matching the right level of tech to the right business task is a critical factor for success.

- Basic level: Rule-based chatbots. This is the simplest form, working from a pre-written script or a decision tree. They are effective in narrow, predictable situations, acting like an interactive FAQ section. Their main weakness is their lack of flexibility; they get lost easily if a question goes off-script, which often leads to user frustration.

- A leap in quality: Conversational AI (NLP and machine learning). This level marks a big step forward, where bots can understand and interpret natural human language. The technology relies on natural language processing (NLP) and machine learning (ML), allowing bots to figure out what a user intends, even if the question is phrased unusually. These systems also learn and improve over time based on past interactions.

- The new frontier: Generative AI and large language models (LLMs). This is the latest and most powerful generation of the technology. These bots can not only understand but also generate new, coherent text that is hard to tell apart from a human’s. They are advanced agents based on large language models (LLMs) that can handle very complex tasks. For business use, a key technique is Retrieval-Augmented Generation (RAG), which grounds the model’s answers in a company’s specific knowledge base to prevent “hallucinations” and make sure replies are factual.

- Expanding the interface: Voicebots and multimodal interactions. The technology isn’t just about how the bot thinks, but also how it communicates. While chatbots suggest text, voicebots, or virtual voice assistants, are becoming common, especially for automating call centres. They use the same AI engines but add advanced speech-to-text and text-to-speech modules. The trend is moving towards an omnichannel strategy, where a single AI engine manages interactions across different channels—chat, phone, and email—to create a smooth customer experience.

Chatbots in insurance: operational and strategic uses

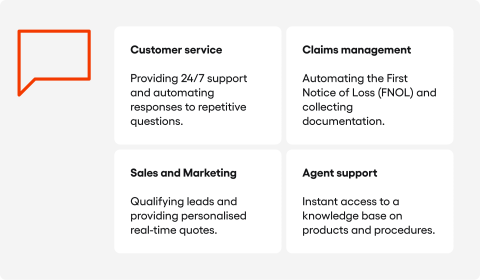

Modern AI chatbots play four key roles in insurance companies:

- Customer Service: This is the most common and mature use. Chatbots provide 24/7 support, which is vital in an industry where unexpected events require an immediate response. They automate answers to frequently asked questions, allowing customers to check policy details, payment status, or find documents. The main goal is to reduce waiting times and free up human agents to focus on more complex cases that need empathy.

- Claims Management: This is an area with huge potential for improvement. Chatbots are changing the claims process, which has traditionally been seen as long and frustrating. They automate the first notice of loss (FNOL), guiding the customer step-by-step through the form, collecting necessary information and photos, and then providing real-time updates on the case status.

- Sales and Marketing: Chatbots are increasingly used not just for service but also to generate revenue. They qualify potential customers by asking targeted questions, provide personalised quotes in real time, and recommend the most suitable products for a user’s profile. They can also send targeted messages about new offers or important policy updates, increasing engagement and sales.

- Agent and Internal Support: The value of chatbots extends beyond customer interactions. They serve as internal knowledge bases for agents and brokers, helping them find instant answers to complex questions about products or procedures. They support the underwriting process by collecting initial data from customers and help with compliance by ensuring consistent and complete data collection.

Real-life examples of chatbots in insurance

This data reveals a pattern of maturity in how AI is adopted. Initial projects tend to focus on operational efficiency and cost cutting, for instance by automating 80% of routine tasks or lowering service costs by 30-40%. This is the first, fundamental stage that builds a business case for the investment.

Once the technology has proven its worth, it is then used in more complex processes like claims handling. At this stage, besides further cost savings, a key benefit is the radical improvement in the customer experience (CX). This directly affects metrics like NPS and customer loyalty.

The most advanced players reach a third level of maturity, turning AI from a defensive tool for cutting costs into a proactive engine for growth. Analysis by McKinsey shows they use technology for hyper-personalisation, processing all quote requests so no lead is lost, and even improving the success rates of new agents.

Understanding this development path is vital for decision-makers. An AI strategy can’t just stop at cutting costs. It must include a plan for evolving towards using the technology to generate revenue and build a lasting competitive advantage.

Chatbots in insurance: key implementation challenges

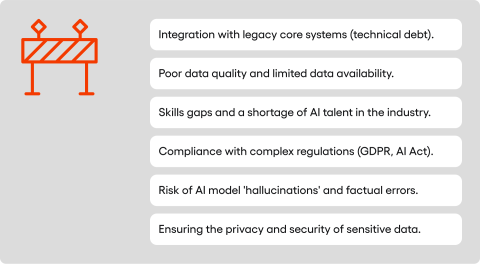

Despite the huge potential, the road to successfully implementing chatbots is full of technological, organisational, regulatory, and ethical challenges.

Technological and organisational challenges

- Integration with legacy systems: This is one of the biggest hurdles. Many insurance companies still rely on outdated, monolithic core systems. As IBM notes, these inflexible systems make integration with modern, API-based AI tools complicated and expensive.

- Data quality and availability: The effectiveness of AI models is directly tied to the quality of the data they are trained on. In a study by IBM, 52% of managers pointed to data limitations as the main factor slowing down innovation.

- Skills gaps: The industry has a shortage of AI talent. According to a study by Accenture, while 92% of employees want to develop their GenAI skills, only 4% of insurers offer the necessary large-scale reskilling programmes.

- Implementation costs: Rolling out an advanced AI chatbot is a big investment. Costs can be over $150,000 for advanced systems, plus ongoing costs for maintenance.

Regulatory and ethical challenges

- Compliance: AI implementation must comply with a complex and evolving legal landscape, including GDPR and the EU’s AI Act, a point highlighted by NAIC. In Poland, legal uncertainty is a significant barrier for 67% of managers.

- Risk of ‘hallucinations’ and inaccuracies: Generative AI models can produce false or made-up answers. This is seen as the main risk by 51% of industry experts. Providing incorrect information to a customer can have disastrous financial and reputational results.

- Algorithmic bias: AI models trained on historical data can reflect and reinforce existing biases. There’s a risk that algorithms could systematically discriminate against certain customer groups, which is a serious ethical and regulatory problem.

- Lack of transparency and explainability: The “black box” nature of some advanced AI models makes it hard to explain why a particular decision was made. This is a problem for an industry that must be able to justify its actions to customers and regulators. This risk is pointed out by 46% of experts.

- Data privacy and security: Chatbots handle huge amounts of sensitive personal and financial data. Protecting this information from cyberattacks is a top priority. The increased risk of data leaks is a concern for 43% of specialists.

These challenges are all connected. They create a kind of vicious cycle that can stop AI projects in their tracks. For example, old systems make it hard to get good data. AI trained on bad data gives poor, biased results. This in turn creates huge regulatory risks.

This means a holistic approach is needed, one that tackles infrastructure modernisation, data governance, and ethical frameworks all at the same time.

Future of chatbots in 5-year horizon

The next five years in the insurance sector will be defined by the faster adoption and growing maturity of artificial intelligence, particularly its generative form (GenAI). This technology will move from being a tool for optimising single processes to becoming the central nervous system of a modern insurer.

The transformative role of generative AI

Generative AI is the driving force behind the next wave of revolution. Forecasts from Accenture point to astronomical growth in this market segment, rising to $14.4 billion by 2032. In the coming years, its impact will be seen in several key areas:

- Hyper-personalisation at scale: GenAI will make it possible to create offers and communications tailored not just to a customer segment, but to an individual’s current needs and behaviour. By analysing data from many sources, AI systems will be able to dynamically adjust premiums and recommend products in real time.

- Autonomous AI agents: The evolution of chatbots will lead to autonomous AI agents capable of carrying out complex tasks on their own. As described by McKinsey, such an agent could not only register a claim but also analyse documents, compare them with policy terms, recommend a decision, and even send a personalised message to the customer.

- A new generation of underwriting and risk assessment: GenAI will revolutionise underwriting by automating the analysis of complex, unstructured documents like engineering reports or medical records. According to Accenture, this will allow for faster, more accurate decisions and the ability to process 100% of incoming enquiries, something that is often not possible today.

The strategic dilemma: costs versus growth

Market analysis, including research by Accenture, shows that companies will face a strategic choice. There are two possible scenarios: aggressive automation focused on maximum cost reduction, or a strategic growth approach where AI is used to enhance employee skills. There is a worrying trend towards seeing AI mainly as a cost-cutting tool, while global leaders treat it as a chance for strategic growth.

Overcoming the expectation gap

A key challenge in the coming years will be to close the gap between what insurers are prioritising and what customers expect. As a report from IBM showed, companies are investing mainly in customer service chatbots, while consumers primarily want AI to deliver personalised prices and tailored products.

Only 29% of customers feel comfortable being served by a virtual agent, and just 26% trust its advice. Companies that understand this disconnect and direct their AI investments towards creating real, personalised value for the customer will win the market’s trust and loyalty.

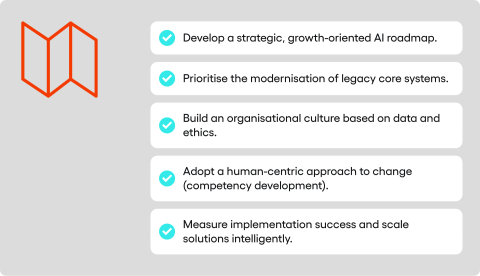

Recommendations for insurers

To navigate the complex technological environment effectively, insurers should take a strategic, multi-faceted approach to implementing artificial intelligence. The following recommendations provide a roadmap for companies wanting to turn technology into a lasting competitive advantage.

Develop a strategic AI oadmap

AI implementation should be seen as a business transformation, not an IT project. Companies need to move away from thinking solely about cost reduction and adopt a perspective of strategic growth. As experts from McKinsey advise, the roadmap should focus on transforming entire domains, like claims handling, rather than implementing isolated use cases.

Prioritise modernising core systems

Technical debt is the biggest brake on innovation. It is essential to invest in a modular, API-based, cloud-native architecture that allows for easy integration with external AI tools and flexible scaling, a point emphasised by Accenture. Paradoxically, AI itself can help in this process by, for example, automating the analysis and refactoring of old code.

Build a culture based on data and ethics

Technology is only a tool; its effectiveness depends on the organisational foundation. Rigorous data governance is a must. In line with recommendations from EY, companies should also develop and communicate clear ethical principles for AI use to proactively address risks and build trust.

Adopt a human-centric approach to change

The biggest risk in a digital transformation is not the technology, but people’s resistance to it. Companies must invest heavily in upskilling and reskilling programmes, teaching employees how to work effectively with AI. Involving employees in the design and implementation process builds trust and a sense of shared ownership.

Measure success and scale intelligently

A “big bang” approach is risky; an evolutionary strategy yields better results. Start by defining key performance indicators (KPIs) to objectively assess the effectiveness of an implementation. Once a pilot project has proven its value, scale the solution while making sure there is a consistent experience across all customer contact channels (omnichannel).

Summary

The digital transformation in insurance has entered a decisive phase. Chatbots and artificial intelligence are no longer optional innovations but have become the foundation of operational efficiency and a key battleground for winning over customers. The analysis clearly shows that the future market leaders will not be the companies that cut costs the fastest, but those that strategically invest in technology as an engine for growth.

Success will be decided by the ability to overcome internal barriers—modernising systems and building a data-driven culture—and to place people at the centre of the changes. This applies both to the customer who expects personalisation and the employee whose skills should be developed, not replaced.

FAQ – insurance chatbots

How is an AI insurance chatbot delivering a measurable return on investment?

Across the insurance industry, market leaders and insurance providers have proven that AI tools like insurance chatbots dramatically shorten claim settlement times, sometimes to just a few seconds, reduce costs, and significantly boost customer satisfaction. Initial projects, which often include live chat functions, tend to focus on operational efficiency and cost savings.

How does an AI chatbot improve the claims processing experience?

Advanced insurance chatbots are changing the entire claims processing system, which has traditionally been seen as long and frustrating for insurance customers. The best insurance chatbots automate the first notice of loss (FNOL). This process of automating claims processing involves guiding the customer step-by-step, helping collect essential information like photos, and then providing real-time updates on the case status. This directly leads to increased customer satisfaction.

Beyond basic service, how can AI-powered technology enhance customer engagement?

AI-powered insurance chatbots are increasingly used not just for service but also to generate revenue for the insurance business. They handle customer inquiries, qualify potential customers by asking targeted questions, provide personalised quotes, and recommend the most suitable insurance plan based on customer preferences. They can also send targeted messages about new offers or important policy updates, leading to improved customer engagement. This shows how insurance chatbots enhance customer interactions.

How does a chatbot for insurance support a human customer service team?

A chatbot for insurance provides 24/7 customer support, automating answers to frequent customer questions. This allows a human customer service team, including customer support agents, to be freed up for more complex cases that need empathy and human assistance via phone calls or live chat. Many insurance firms find that while insurance chatbots handle routine customer queries, complex issues are escalated to human agents on a live chat platform. These human agents are essential for a good customer experience.

What is the future of the autonomous AI agent in the insurance sector?

The evolution of today’s insurance chatbots will lead to the autonomous AI agent, a key part of the future insurance industry. Such an AI agent could not only register a claim but also analyse documents, compare them with policy details, recommend a decision, and even send a personalised message. This AI solution will become the central nervous system for many leading insurance providers and will redefine the insurance business.

Are cost savings the only reason for insurers to adopt an AI agent?

No. While initial insurance chatbot projects focus on cost savings and efficiency, advanced players turn their AI agent from a defensive tool for cutting costs into a proactive engine for growth. Global leaders treat it as a chance for strategic growth, using their AI agent and live chat data for hyper-personalisation and processing 100% of quote requests so no potential customers are lost.

What is the biggest barrier to improving the customer experience with AI?

A key challenge for the insurance industry is closing the gap between what insurers prioritise and what customers expect. Many insurance agencies invest in customer service insurance chatbots, while consumers primarily want AI to deliver personalised prices and tailored products. For a seamless customer experience, companies must direct investments towards creating real, personalised value for the customer, which builds trust and improves the overall customer experience.

What are the different types of AI-powered chatbots available to insurers?

There are three main levels of AI-powered insurance chatbots:

- Basic level: Rule-based chatbots that work from a script, acting like an interactive FAQ. These simple insurance bots lack flexibility.

- A leap in quality: Conversational insurance chatbots using Natural Language Processing (NLP) and Machine Learning. This AI agent can understand user intent and provide human-like interactions.

- The new frontier: The Generative AI virtual assistant and AI agent. Based on Large Language Models, these insurance chatbots can generate new text and handle very complex tasks, including account management.

What are the main challenges when implementing a chatbot for insurance?

The biggest hurdles for insurance providers are often technological and organisational. Many companies rely on outdated core systems, which complicates integration. Another key factor is handling customer data; the effectiveness of an AI agent is tied to data quality. Furthermore, ensuring data security and preventing fraud detection algorithm bias are critical compliance challenges when dealing with sensitive customer data.

How does an AI agent provide around-the-clock customer support?

An AI agent or virtual assistant is vital for providing instant support 24/7, something crucial in an industry where unexpected events require an immediate response. They automate answers, allowing customers to check policy details or payment status outside of business hours. This round the clock support, whether via an AI chatbot or a live chat interface, ensures customers have instant access to help, which is key to improving customer satisfaction.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.