What is FinOps and its importance today

By the end of 2025, companies are expected to shift over half of their IT budgets to the public cloud. For financial institutions, this massive change demands a new kind of financial discipline. Boards must now get to grips with a completely different cost structure. In this report, we explain why a firm grasp of FinOps is no longer optional but necessary for survival. We will examine the specific challenges the financial sector faces and provide a step-by-step guide to building a system that manages cloud spending effectively.

Key takeways

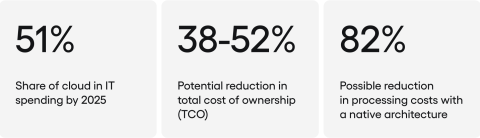

- By 2025, companies will have moved 51% of their IT spending in key areas to the public cloud.

- Organisations that adopt FinOps can cut their cloud costs by 20-30%, freeing up money for innovation.

- System modernisation can lower the total cost of ownership by up to 52%.

- An architecture designed for the cloud can reduce data processing costs by as much as 82%.

- A well-developed FinOps system allows for over 90% of cloud spending to be allocated, providing full transparency.

- Companies can bring new products to market 18 days faster.

What is FinOps?

FinOps, or Cloud Financial Management, is a response to the new financial reality created by the cloud. The old approach of centralising control over IT costs is no longer effective. Instead, FinOps introduces a completely new organisational culture and way of working, bringing together finance, technology, and business teams.

The main idea is a complete change of perspective: organisations stop just reacting and cutting expenses and start consciously creating value. In practice, every pound spent on cloud technology must be linked to a specific business goal, such as keeping systems running, reacting quickly to market changes, or building a lasting competitive advantage.

The shift from a model of fixed capital expenditure (CAPEX) to a variable, consumption-based cloud model (OPEX) completely changes how financial control works. It decentralises purchasing and gives responsibility to individual engineering teams.

While this speeds up innovation, it also creates the risk of spiralling costs that are hard to manage. Without new rules and control tools, this freedom can lead to budget chaos. That is exactly why companies are adopting FinOps: to bring in the necessary order and management processes to control a new situation where spending is distributed.

FinOps is not just about cutting costs; it is a process that creates the financial capacity to drive innovation. By optimising spending, institutions can allocate capital to high-value initiatives like AI implementations, banking system upgrades, or new digital products. In this way, FinOps turns the cloud budget from a cost centre into a self-funding engine for growth.

The FinOps model: three pillars of cloud management

So how does this idea work in practice? The FinOps Framework, developed by the FinOps Foundation, is based on a cycle of three interconnected pillars: Inform, Optimize, and Operate. For the implementation to succeed, companies must develop each of these areas at the same time, making sure they are consistent. Together, they create a self-reinforcing loop of continuous improvement.

Pillar 1: Inform – Gaining Visibility

This is the foundation of FinOps. The goal is to provide full, real-time transparency, offering insight into resource use, costs, and how they are allocated to specific departments. Companies must have access to detailed, up-to-date data that offers much more than a standard monthly bill from a provider. The most important actions include:

- Rigorous tagging of resources to correctly attribute costs.

- Developing metrics that show the real business value.

- Introducing internal accounting mechanisms (known as showback/chargeback) that show teams how much the resources they use actually cost.

The ultimate goal of the Inform phase is to answer not just the question “how much did we spend?” but, more importantly, “what business value did we get in return for that spending?”.

Pillar 2: Optimize – Taking Action

Armed with clear visibility from the Inform phase, the next pillar involves a continuous cycle of optimisation. This covers both rates (for example, by using reserved instances and savings plans) and resource consumption itself. Basic techniques include:

- ‘Right-sizing’, which means matching the size of resources to actual demand.

- Getting rid of unused instances and orphaned disks.

- Moving archival data to cheaper storage.

By 2025, technology will play a decisive role. Reports highlight the growing importance of AI-based predictive models and automated scaling systems as essential tools for managing the dynamic and complex workloads typical of financial services.

Pillar 3: Operate – Aligning with Business Value

The final pillar focuses on integrating FinOps practices into the daily rhythm of the organisation, ensuring continuous improvement and business alignment. This is where a deep cultural shift happens. Teams need to be made aware of costs, and consistent methods for managing cloud finances must be put in place. Engineering teams must build cost awareness into their processes, software development and deployment cycles (CI/CD), and system architecture reviews. Key actions include:

- Breaking down organisational silos and creating management teams that include specialists from technology, finance, and risk.

- Ensuring solid support from the top, with a champion at the CEO, CTO, or CFO level.

- Shifting the conversation within the organisation from asking “is this service expensive?” to “does the value this service generates justify its cost?“.

The three pillars do not work in isolation; they form a cycle where each element strengthens the next. Better visibility (Inform) leads to more effective optimisation (Optimize). The savings and efficiency gains free up resources and build internal support, which reinforces the culture and governance of the Operate phase, leading back to better data and improved visibility.

Market data on the cloud transformation

The scale of the transformation and the financial consequences of implementing FinOps are best illustrated by hard data. Forecasts from leading analytical firms for 2025 show that companies will shift 51% of their IT spending in the most important categories from traditional solutions to the public cloud.

At the same time, analysis from Accenture proves that modernising outdated systems can reduce the total cost of ownership (TCO) by 38-52%, and implementing a cloud-native architecture can lower processing costs by 82%. These initiatives have a direct impact on the ability to respond faster to market needs, illustrated by the example of reducing the time-to-market for new products by 18 days. The table below provides a condensed view of the situation.

The benefits of FinOps: real savings from market leaders

So much for theory. But how do these principles work in practice? Proven FinOps methods deliver direct, measurable financial and operational benefits. Market data analysis provides concrete evidence of this model’s effectiveness.

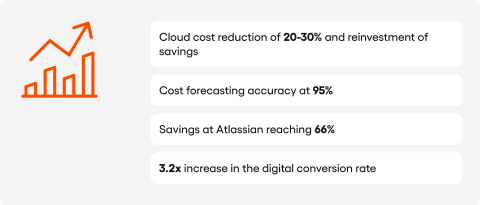

McKinsey estimates that organisations effectively implementing FinOps can reduce their cloud costs by 20% to 30%. These savings are often reinvested in further innovation, creating a self-reinforcing growth cycle.

- In the insurance sector, Nationwide Insurance achieved annual cloud cost savings of over $1 million after implementing FinOps practices.

- In the technology sector, Atlassian managed to reduce its cloud costs by as much as 66%, showing the optimisation potential even in technologically advanced organisations.

- As part of its managed services, Accenture regularly achieves 95% accuracy in cloud cost forecasting for its clients, along with an average 15% reduction in annual cloud spending.

- Even simple changes can have a big impact. A large retail chain automated the process of shutting down servers at night and on weekends, which reduced its cloud costs by about 6%.

- Modernisation initiatives, a key part of FinOps, bring even deeper benefits. Analyses show a 47% reduction in total cost of ownership, a 3.2-fold increase in digital sales effectiveness, and a reduction in time-to-market for new products by 18 days.

- For any board, the message is clear: the ability to achieve double-digit savings while improving forecasting accuracy makes implementing FinOps a strategic priority.

Challenges of implementing FinOps

The financial sector faces specific barriers when adopting the cloud and FinOps. To develop an effective strategy, it is important to understand these challenges.

Regulatory complexity and GDPR

Financial institutions operate in an exceptionally demanding regulatory environment. Conflicting data location requirements in different jurisdictions (such as GDPR in Europe and CCPA in the US) significantly complicate operations and increase compliance costs.

This often forces organisations to design region-specific cloud architectures, which prevents them from fully benefiting from economies of scale and global optimisation. Maintaining compliance is further complicated by the dynamic nature of the cloud.

To ensure system resilience, data may be automatically replicated between data centres in different countries, making oversight difficult without strict controls like geofencing or advanced data classification policies.

Cybersecurity and risk management

To effectively protect sensitive financial data in the cloud, an approach that goes beyond traditional cybersecurity measures is needed. Reports show that companies must implement a Zero Trust security model and data-centric security mechanisms, where protections like end-to-end encryption and tokenisation travel with the data, regardless of its location.

Another key issue is the shared responsibility model. In practice, this means the cloud provider is responsible for the security of the infrastructure itself (such as the data centres), while the customer is responsible for everything they put on it – their data, applications, and configurations.

A misconfiguration or misunderstanding in this area can lead to catastrophic security breaches. In addition, Deloitte highlights the systemic risk associated with vendor lock-in, which threatens the entire company and pushes institutions to adopt multi-cloud strategies to diversify risk.

Organisational barriers and technical debt

It might seem that the toughest barriers are technological or regulatory. Nothing could be further from the truth. The biggest challenge is often the organisation itself. According to analysis by BCG, only 30% of digital transformation initiatives succeed, mainly due to difficulties in implementing large-scale organisational and cultural changes.

Employees may resist new tools and processes, preferring familiar, though inefficient, systems. Outdated systems, often over 30 years old, are a huge financial and operational burden. Companies systematically underestimate their hidden costs by an average of 70-80%.

This accumulated technical debt makes cloud migration complex and expensive. Boards, seeing the scale of the investment and the risks involved, often postpone the decision, which only makes the problem worse. As a result, companies tend to stick with old, proven solutions and avoid change.

AI ethics and sustainable development (ESG)

Implementing FinOps, especially in combination with AI-based automation, introduces new categories of risk. First, there is the risk of algorithmic bias. AI models trained to optimise costs might make decisions that unintentionally discriminate against certain groups of customers or favour lower-quality services if they are cheaper. This can lead to reputational and legal problems.

The “black box” problem in AI further complicates auditing and explaining why a particular optimisation decision was made, which conflicts with regulatory requirements for transparency in the financial sector.

Second, there is growing pressure to comply with Environmental, Social, and Governance (ESG) goals. Cloud computing, although often more energy-efficient than traditional data centres, has a significant carbon footprint. Data centres account for about 1% of global electricity consumption.

Financial institutions must include this impact in their ESG reports. FinOps practices can directly help achieve environmental goals by optimising resource consumption, which leads to lower energy use and reduced CO₂ emissions. An important part of a “green IT” strategy is choosing cloud providers that power their data centres with renewable energy.

These three main challenges – regulation, security, and cost – present financial institutions with a difficult strategic choice. Maximising one goal often comes at the expense of others. For example, to meet strict data sovereignty requirements, a bank might have to use a more expensive, local cloud provider, forgoing cost optimisation.

Similarly, implementing an advanced Zero Trust architecture requires investment in specialised tools and skills, which also raises costs. Saving money at the expense of security or compliance always carries too much risk.

In this context, a mature FinOps system, integrated with risk and compliance departments, provides the data and analysis needed to make informed decisions that balance different goals. This shifts the discussion from simple cost comparison to an advanced analysis of risk and benefit – the language of the board.

A 3-step strategy for implementing FinOps

Reports from leading advisory firms point to three main courses of action. These will allow financial institutions not only to meet the challenges but also to take advantage of the opportunities created by the cloud transformation. They form a logical sequence: from building the foundations, through defining the direction, to execution based on technology.

Step 1: build a FinOps team (CoE)

The first and most important step is to formally establish a cross-functional team or FinOps Centre of Excellence (CoE). This team must combine knowledge from technology, finance, and risk management. It should develop and oversee the FinOps strategy, provide centralised tools and expertise to the entire organisation, and support the cultural change throughout the company. This is consistent with the observation that successful transformations require dedicated leadership at the board level. Establishing a CoE is a prerequisite for the successful implementation of the next steps.

Step 2: choose a multi-cloud (cloud-right) strategy

Analysis from Deloitte clearly shows that companies need to move away from the simplistic “cloud-first” mantra to a more thoughtful “cloud-right” strategy. This means that every decision to move a system to the cloud must be linked to a specific business objective and preceded by an analysis of whether the cloud is the optimal solution in that case.

This approach also involves consciously adopting a multi-cloud or vendor-agnostic model in procurement processes. The goal is to minimise the risk of dependency on a single provider and to optimise for performance, functionality, and cost, depending on the specifics of the system. Research shows that as many as 81% of IT decision-makers in the financial sector already describe their preferences as “agnostic,” meaning independent of a specific provider.

Step 3: modernise systems and automate

Institutions must develop a clear, phased strategy for modernising outdated systems. Analyses point to several proven approaches, such as gradually replacing components by business function or implementing a new core system in parallel while maintaining the old one. A key element of this strategy is investment in automation.

Both Accenture and Gartner identify AI/GenAI and automation as the most important trends for 2025. This includes automating infrastructure management, security monitoring, and using AI for cost forecasting. Industry reports emphasise that the primary goal should be to have machines take over tasks related to service quality assurance wherever possible, thus freeing up people.

A roadmap for implementing FinOps

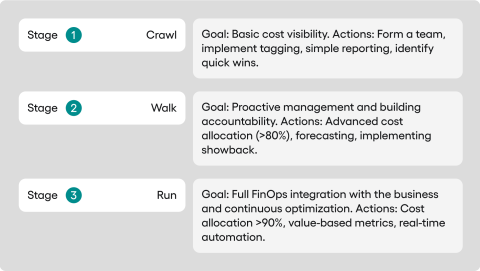

Implementing FinOps is an evolutionary process, not a one-off project. The “Crawl, Walk, Run” maturity model, developed by the FinOps Foundation, helps to structure this process and gradually build skills, while ensuring that benefits are achieved quickly at each stage.

Phase 1 (crawl): the basics and quick wins

The goal is to gain basic cost visibility and start building a culture of financial awareness. In this initial phase, actions are often reactive, and the main task is to understand where and why the company is spending money in the cloud.

Key actions include creating a small, cross-functional FinOps team to lead the initiative, implementing basic resource tagging mechanisms to allocate at least 50-60% of costs to the appropriate departments or projects, creating simple dashboards and reports that show spending trends and identify the largest cost items, and focusing on simple optimisations, such as removing unused resources.

Phase 2 (walk): scaling up and building accountability

The goal is to move from reactive to proactive cost management and build accountability within engineering teams. At this stage, the organisation develops its processes and tools to enable more advanced optimisation and forecasting.

Key actions include aiming to allocate over 80% of cloud costs by implementing showback or chargeback mechanisms, which increases team accountability. It also involves actively managing commitments (reserved instances, savings plans) to cover 60-70% of steady workloads and lower unit rates, implementing budgeting processes for teams and improving forecasting accuracy to aim for a variance below 15%, and using tools to automatically generate optimisation recommendations (e.g., for right-sizing).

Phase 3 (run): automation and value management

The goal is to fully integrate FinOps with the application development and maintenance process and to make decisions based on business metrics. In the “Run” phase, FinOps is an integral part of the organisational culture, and processes are highly automated. Key features of a mature system include the automatic implementation of optimisation recommendations, for instance through CI/CD pipelines, and automatic management of the resource lifecycle.

It also involves measuring cloud costs against business metrics (e.g., cost per transaction, cost per customer), which allows for ROI-based decisions, a continuous dialogue between finance, technology, and business teams about the value generated by the cloud, not just its cost, and regular reviews and audits of FinOps practices to identify new optimisation opportunities and adapt to changing business needs.

| Phase | Months 1-3 (Q1) | Months 4-6 (Q2) | Months 7-9 (Q3) | Months 10-12 (Q4) |

|---|---|---|---|---|

| Crawl | Establish CoE team. Implement tagging policy. Basic reporting. Identify waste. | Tagging audit. First FinOps workshops for teams. | Begin cost allocation (showback). | Analyse initial results and plan for Walk phase. |

| Walk | Implement optimisation tools. Purchase first reservations/savings plans. | Expand showback/chargeback. Implement team budgeting. | Automate right-sizing recommendations. Improve forecast accuracy. | |

| Run | Begin defining unit economics metrics. Pilot CI/CD optimisation integration. |

FinOps and DevOps: synergy and differences

Are FinOps and DevOps two competing approaches? Quite the opposite. To fully integrate cloud financial management with the software lifecycle, it is important to understand their synergy. Although the two disciplines have different goals, their combination is necessary to get the maximum value from cloud investments.

A comparison of goals and metrics

DevOps is a culture and a set of practices that bring together software development and IT operations. Its main goal is to shorten the software development lifecycle, from development to deployment, while maintaining high quality and reliability.

DevOps focuses on automation, continuous integration, and continuous delivery (CI/CD) to speed up innovation. FinOps, a name derived from “Finance” and “DevOps,” is a cultural practice that brings financial accountability to the variable spending model of the cloud. FinOps aims to maximise business benefits. It does so by enabling engineering, finance, and business teams to make informed, data-driven decisions about the trade-offs between speed, cost, and quality.

| Aspect | FinOps | DevOps |

|---|---|---|

| Main Goal | To optimise costs and maximise business benefits in the cloud | To speed up software delivery and improve its reliability |

| Teams Involved | Finance, Engineering/Operations, Business | Developers, Operations |

| Key Metrics | Cost efficiency, ROI, forecasting accuracy | Deployment frequency, lead time for changes, change failure rate |

| Scope | Broader, covering the entire organisation, including finance and procurement | Focused on the software development lifecycle (SDLC) |

How to combine FinOps and DevOps

FinOps and DevOps form a coherent system. DevOps was born out of the need to break down silos between developers and operations, to avoid situations where development teams finished their work and passed it on without collaborating with the department responsible for maintaining the systems.

FinOps solves a similar problem that has arisen in the cloud era: engineering teams generate costs, and simply pass the bill to the finance department without taking responsibility for it. Combining FinOps and DevOps creates a powerful mechanism where:

Financial accountability is built into the development process. DevOps teams, equipped with FinOps data and tools, are aware of the costs of their architectural and deployment decisions in real time.

Optimisation is part of the CI/CD process. FinOps principles can be codified and automated within DevOps pipelines (FinOps as Code), which ensures that only optimised and cost-effective resources are deployed.

Decisions are made based on the full picture. FinOps provides guardrails and financial context for the fast iterative cycles of DevOps. Teams can consciously decide when to invest more to speed up innovation and when the priority is cost optimisation.

The combination of FinOps and DevOps transforms cost management from a reactive accounting exercise into a proactive, engineering-led approach, leading to better visibility, greater efficiency, and better alignment of technology spending with business goals.

Summary: FinOps is not a cost, but an extra return on efficiency

The move to the cloud is clearly dividing the financial sector into two groups of companies. The first treats its cloud spending as an investment in the future. The second sees it only as a cost that is spiralling out of control. The approach a company chooses will determine its ability to compete effectively in the market in the coming years.

While one institution wastes its budget on inefficient infrastructure and unused resources, another, thanks to advanced and proven FinOps methods, operates at much lower costs. The difference is not just about the numbers on a spreadsheet.

It is about the extra financial resources the company gains from operating more efficiently. This is the money that will fund the next generation of AI-based products, enable faster development of digital services, and provide an edge in the competition for customers.

Over a few years, this creates an advantage that grows over time and becomes impossible to catch up with. Leading companies will innovate faster and cheaper, gaining more market share. At the same time, their competitors will be stuck in a vicious circle, trying to fix mistakes and pay off the costs of past neglect in the cloud, with no money for real development.

Therefore, implementing FinOps is more than just a decision about the IT budget. It is a strategic choice for the board that will determine whether, in the coming decade, the company wants to set trends in the market or merely try to keep up with them.

FinOps: frequently asked questions (FAQ)

What are the three pillars of FinOps?

The standard finops framework is based on three core principles that form a continuous cycle: Inform, Optimize, and Operate. The Inform phase focuses on gaining cost visibility into cloud spending. Optimize is about finding efficiencies to reduce cloud costs, while the Operate phase focuses on continuous improvement and aligning cloud operations with business objectives.

What does a FinOps person do?

A FinOps professional’s role is central to cloud financial operations. They work at the intersection of finance and technology, with a primary goal of managing cloud costs effectively. Their daily tasks involve analyzing spend data, forecasting future cloud spend, and promoting a culture of cost awareness to maximize the business value of cloud.

What is FinOps vs DevOps?

Cloud FinOps is a cultural practice focused on bringing financial accountability to the cloud’s variable spend model. In contrast, DevOps aims to improve software delivery speed. While DevOps helps a company move faster, FinOps ensures it moves faster with greater efficiency and financial control over cloud expenses.

What problem does FinOps solve?

FinOps solves the problem of uncontrolled cloud spending that arises from the cloud’s consumption-based model. It provides the framework, finops tools, and culture needed to bring financial control and predictability to this decentralized way of spending, enabling organizations to effectively control cloud spending and align it with their goals.

How should an organization begin its FinOps?

The FinOps journey typically begins with establishing the FinOps Foundation by creating a small, cross-functional team. The initial focus is on gaining basic cost visibility by implementing resource tagging to allocate costs. This first phase focuses on quick wins, like removing unused resources, and starting to build a culture of financial awareness.

What are some cost optimization techniques in FinOps?

Practical cost optimization involves a continuous cycle to optimize cloud usage and find cost savings opportunities. Key techniques include ‘right-sizing’ to match cloud resources to actual demand, eliminating unused cloud infrastructure like instances and disks, and moving data to cheaper storage to lower overall cloud costs.

Who are the key FinOps practitioners within an organization?

FinOps practitioners form a cross-functional team combining specialists from technology, finance, and business teams. A key cultural shift involves creating collaboration between business and engineering teams, empowering them with data and tools to make cost-conscious decisions and take ownership of their cloud spend.

How does FinOps ensure that cloud spend provides value?

FinOps ensures the value of cloud is maximized by connecting cloud spend directly to business value. A core practice is to align cloud spending with specific business goals, shifting the internal conversation from “is it expensive?” to “does the value this service generates justify its cost?”, treating technology as an investment.

What is the role of data in cloud financial management?

Data is foundational to effective cloud financial management. By analyzing detailed cloud billing data, organizations can achieve full transparency. This enables data-driven decision making, helping teams understand resource use, identify optimization potential, and implement internal accounting mechanisms like showback to create financial accountability.

What does the implementation roadmap for FinOps look like?

Implementing FinOps practices is an evolutionary process structured by the “Crawl, Walk, Run” model. The “Crawl” phase focuses on basic visibility. “Walk” scales up processes and accountability. “Run” fully integrates cloud financial optimization into business operations through automation and continuous improvement, making it a core part of the culture.

What are the strategic benefits of FinOps beyond cost savings?

Beyond direct cost savings, FinOps turns the cloud budget into a self-funding engine for growth. The savings achieved through cloud optimization can be reinvested in high-value initiatives like AI implementations or new digital products. This allows a company to maximize business value and innovate faster than competitors.

This blog post was created by our team of experts specialising in AI Governance, Web Development, Mobile Development, Technical Consultancy, and Digital Product Design. Our goal is to provide educational value and insights without marketing intent.