KYC and AML

Ensure your company’s security, regulatory compliance, and higher conversion rates. Our solution minimises the risk of fraud by providing clients with a fast and intuitive verification process. This can increase the number of successfully completed onboarding processes by up to 223%.

Book a meeting

Turn regulatory obligations into a real business advantage

We work with leading technology providers to deliver a solution that transforms regulatory requirements into a tangible competitive edge.

Ineffective verification harms trust and business

A slow, unclear, or unreliable KYC process leads to customer frustration and abandoned registrations. At the same time, in an era of growing threats – with face-swap attacks increasing by 704% – ineffective verification opens the door to fraudsters, generating financial losses and eroding trust in your brand. See how we can help.

Schedule a free expert session

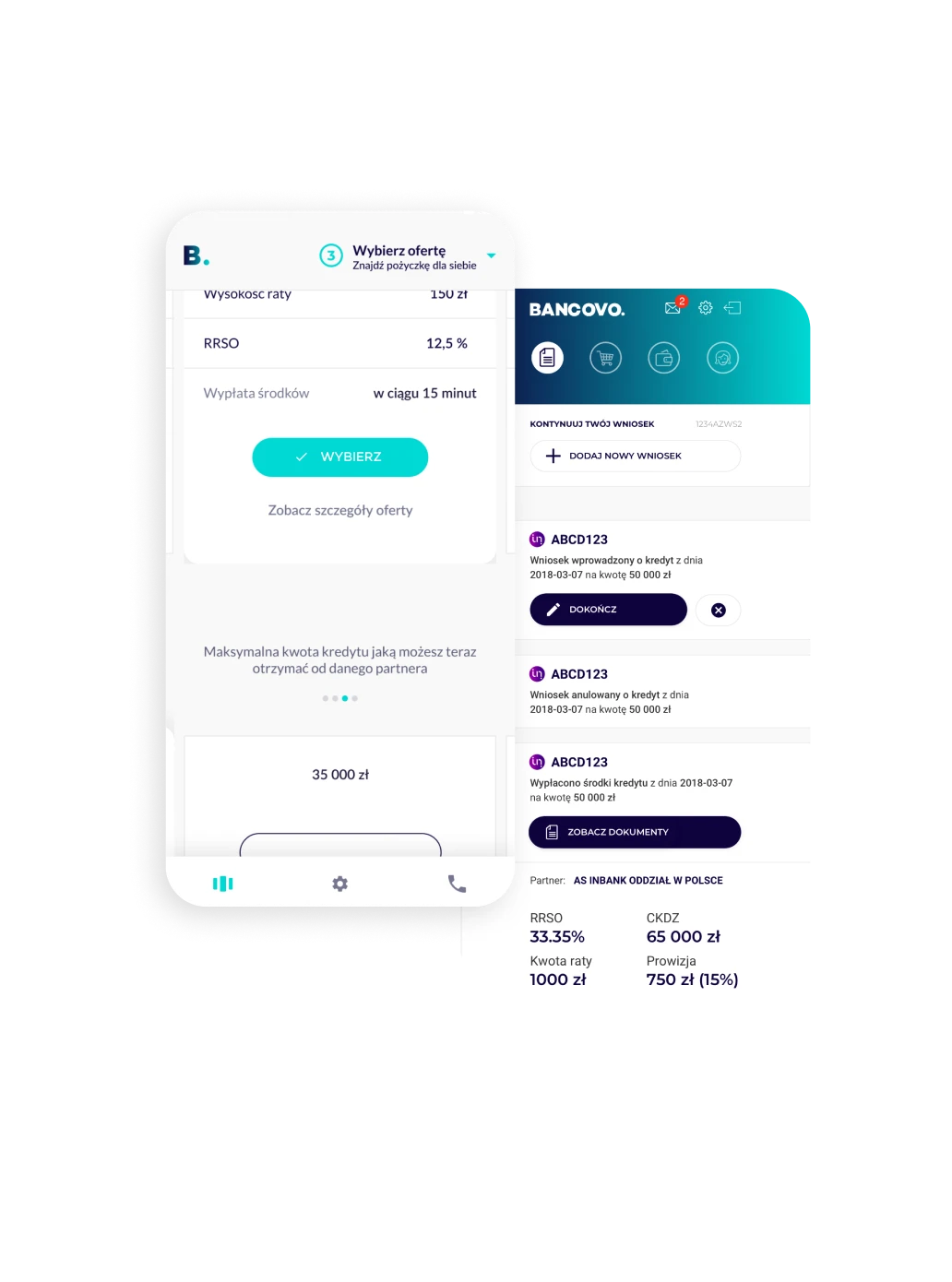

Provide clients with security and convenience

From verification to trusted client

Get insights about

latest financial sector trends

Schedule a free project estimate

If you want to discuss a requirement with technical experts, schedule a free consultation to see if we’re a good fit to help.